benedek/E+ via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on July 1st.

Real Estate Weekly Outlook

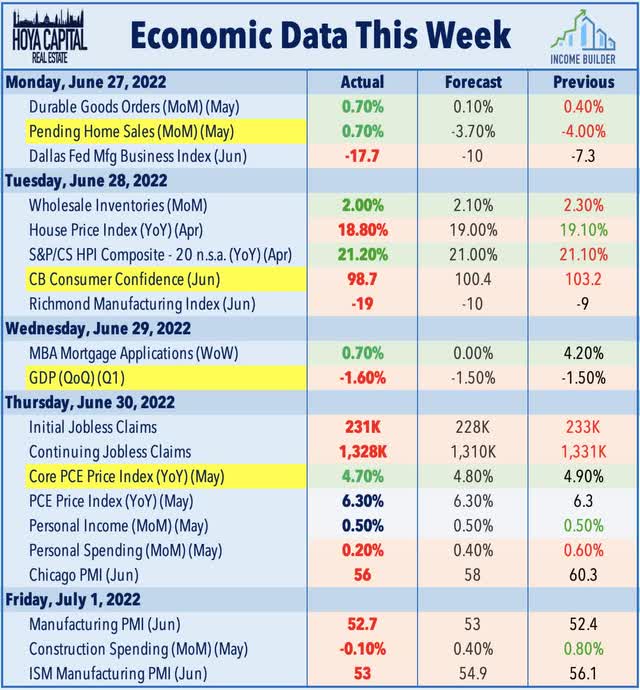

Following their best week of the year, U.S. equity markets were again under pressure this week while global benchmark interest rates retreated sharply as recession concerns and signs of peaking inflation sparked a bid for bonds. The downbeat economic data continued throughout the week – with the notable exception of surprisingly solid housing data – as softening spending, consumer confidence, and manufacturing data dragged the Citi Economic Surprise Index to the lowest level since April 2020. Signs of peaking domestic inflation, however, sparked optimism that this potential “soft landing” could cool inflationary pressure without the need for more aggressive Fed actions.

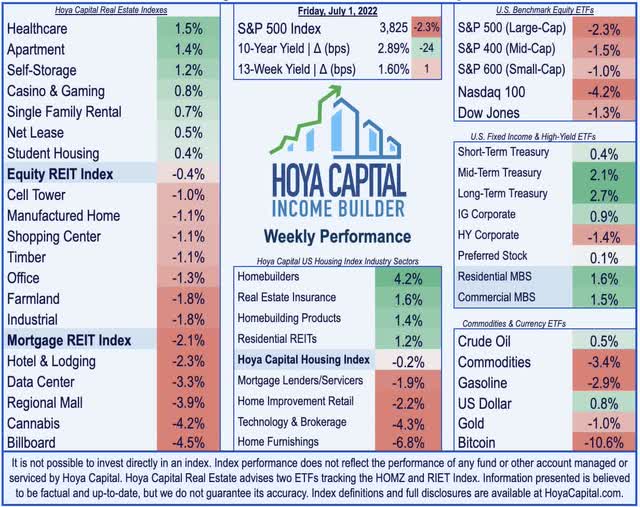

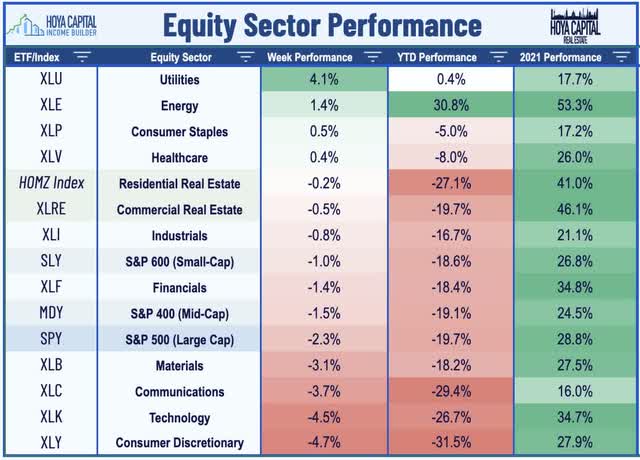

Capping off its worst first-half performance since 1970, the S&P 500 retreated 2.3% following gains of nearly 7% last week – pushing its rough stretch of declines to 11 of the past 13 weeks. Expectations of U.S. economic leadership amid the global cooldown buoyed the Mid-Cap 400 and Small-Cap 600 – which posted more modest weekly declines – but punished the tech-heavy Nasdaq 100, which slipped more than 4%. Real estate equities were among the leaders of the week, benefiting from the retreat in global interest rates and the rotation into domestic-focused sectors. Strong performance from residential REITs offset declines from technology and retail REITs as the Equity REIT Index finished lower by 0.4% on the week with 7-of-19 property sectors in positive territory while the Mortgage REIT Index finished lower by about 2% following double-digit gains in the prior week.

Global benchmark interest rates have taken a “U-turn” over the past three weeks – mirroring the notable weakness in recent economic data – as the 10-Year Treasury Yield closed the week at 2.89%, down 24 basis points on the week and more than 60 basis points below its high of 3.50% in early June. The recent bid for bonds has helped to soften the blow from the historically rough year across fixed income securities as the Bloomberg Aggregate Bond Index rallied nearly 2% to trim its drawdown to under 10%. Commodities, Bitcoin, and Gold were notably weak while the U.S. Dollar rallied to the cusp of 20-year highs. Homebuilders and the broader Hoya Capital Housing Index were a notable bright spot for the second-straight week following another slate of surprisingly solid sales data and on hopes of some long-awaited relief from the year-long surge in mortgage rates.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

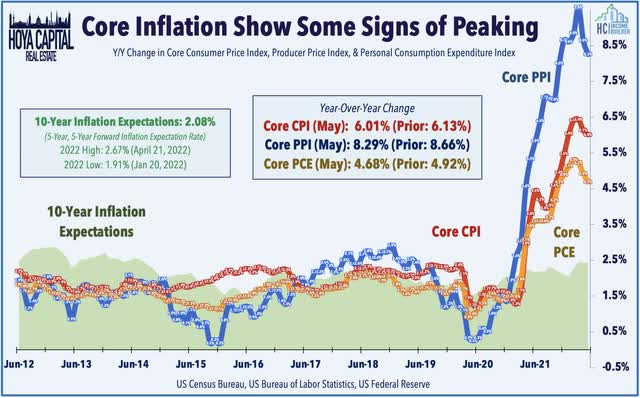

Data released from the Conference Board this week showed that consumer sentiment dipped to the lowest point in nearly a decade in June, consistent with data last week from the University of Michigan showing a historic decline in sentiment fueled by concerns over inflation. Signs of cooling price pressures have become more frequent over the past month, however, including in the Core PCE Price Index this week – the Federal Reserve’s preferred gauge of inflation. A slowdown in consumer spending helped to cool the Core PCE for the third-straight month in May to an annual rate of 4.7%. Notably, the last four months have posted annualized inflation rates averaging just 3.9%. The PEC Index is aided by its relatively low weighting towards shelter compared to the CPI Index, and we expect rents to increasingly drive total inflation over the next year even as broader inflationary pressures moderate.

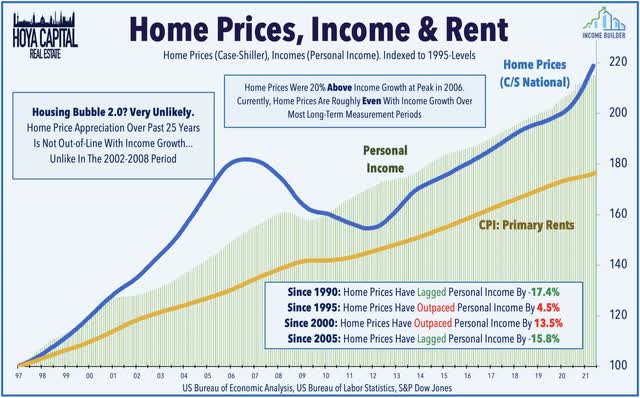

Reminiscent of early in the pandemic, housing data has been a surprising bright spot in recent weeks while other economic indicators have surprised to the downside. Pending Home Sales snapped a six-month skid of declines in May while mortgage applications to purchase a home climbed for a third-straight week. A much-needed cooldown in the rate of home price appreciation – which began to be reflected in the lagged Case Shiller Index data this week – and a modest uptick in supply levels have appeared to pull some potential buyers back into the market in early summer. A Redfin report – which showed that asking prices have declined 1.5% from their record-highs this Spring – noted that “buyers homebuyers have noticed the shift in power and are no longer leaving the market.” Notably, Redfin reported that 6.5% of homes for sale in June had a price drop – the highest since at least 2015. The “catch-up” in rent growth has also pushed some households back towards ownership markets as Yardi reported that rents rose 14% year-over-year in May and revised higher its full-year rent growth projections.

Equity REIT Week In Review

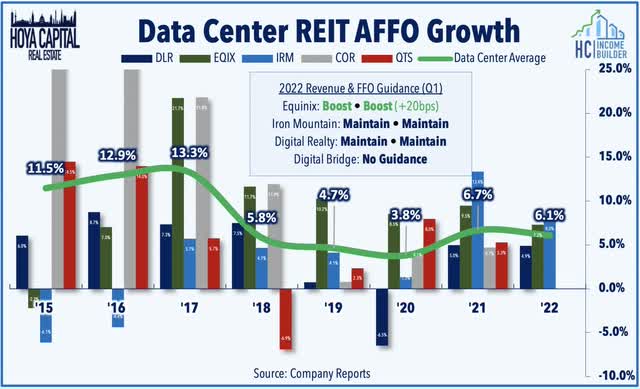

Data Center: Technology REITs have become “battleground” stocks in recent weeks after short-selling firm Chanos & Company launched a $200m fund that will bet against US-listed REITs with a particular focus on data centers. In a Financial Times interview, Jim Chanos described the position as the firm’s “big short” based on the thesis that “value is accruing to cloud companies, not the bricks and mortar legacy data centers.” Consistent with the focus of our analysis on the sector for several years, the companies synonymous with cloud computing – Amazon (AMZN), Microsoft (MSFT), and Google (GOOG) (GOOGL) – are among the largest and most critical tenants of these data center operators, and have become even more critical tenants in recent years as a growing share of leasing activity has accrued to these “hyperscale” tenants which have increasingly dictated the terms of leasing agreements and pricing. While growth has indeed slowed from the mid-2010s, we’re quite a bit more bullish on the sector than Chanos, noting that the data center operators, too, have aggressively consolidated and believe that there’s more than enough value to be shared in the cloud for data center REITs and hyperscalers to coexist.

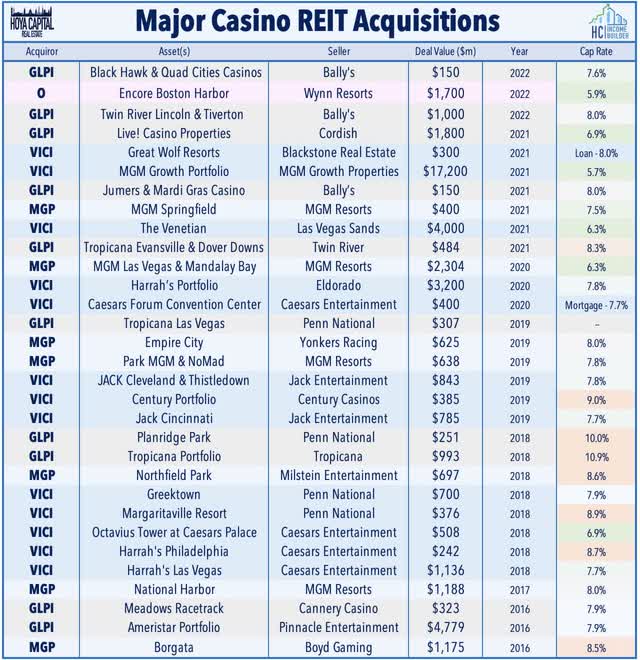

Casino: Gaming and Leisure Properties (GLPI) was among the better-performers this week after announcing that it reached a $1.0 billion deal with Bally’s Corporation (BALY) to acquire the real property assets of Bally’s two Rhode Island casino properties – Bally’s Twin River Lincoln Casino Resort (“Lincoln”) and Bally’s Tiverton Casino & Hotel. Bally’s will immediately lease back both properties and continue to own, control, and manage all the gaming operations of the facilities on an uninterrupted basis. GLPI expects the transaction to be accretive to earnings upon closing in late 2022 and launched a secondary offering to sell 6.9M shares of common stock for total gross proceeds of ~$308.8 million to fund much of the acquisition. Both properties are expected to be added to the existing Bally’s Master Lease between GLPI and Bally’s, with incremental rent of $76.3 million.

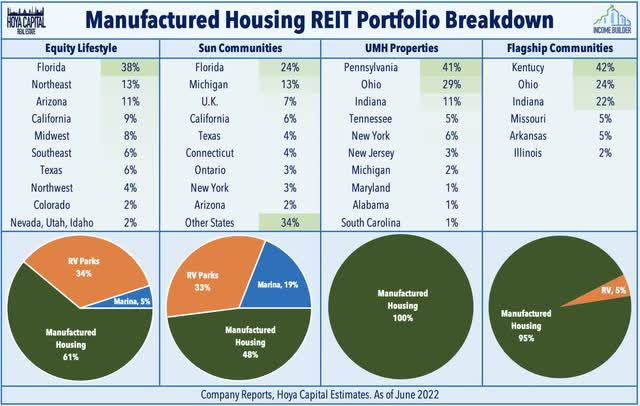

Manufactured Housing: Residential REITs were again among the upside standouts this week with notable upside from UMH Properties (UMH), which we recently added to our REIT Focused Income portfolio. This week, we published Manufactured Housing: Recession Resistant REITs. Manufactured Housing REITs – one of the most “recession-resistant” property sectors given their countercyclical demand profile – have rebounded over the past month following uncharacteristic underperformance in early 2022. MH REITs have remarkably delivered nine consecutive years of outperformance compared to the broader REIT Index, benefiting from strong operational execution, significant supply constraints, demographic tailwinds, and high barriers to entry. While MH REITs have historically been among the most rate-sensitive sectors due to their remarkable consistency in delivering steady 3-4% rent growth, we believe their inflation-hedging potential is underappreciated.

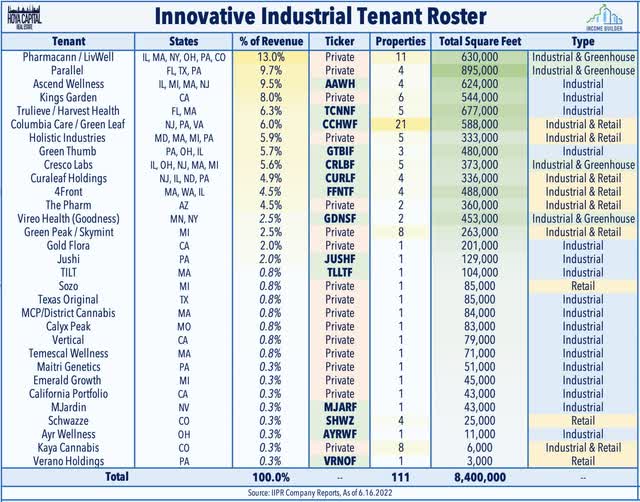

Cannabis: Downward selling pressure continued across the cannabis sector, however, amid concerns over the financial health of tenant operators given tightening credit conditions and stalled progress on legalization legislation. Our recent report – Cannabis REITs: Weeding Out the Weak – noted that cannabis REITs have faced remarkably few tenant non-payment issues. Owning the “Pharmland” – the physical real estate – had been one of the few cannabis plays that has worked during a decade-long stretch of dismal investment performance from broader cannabis ETFs. Innovative Industrial (IIPR) announced that it amended its lease with Green Thumb Industries which provides $55M in reimbursement to Green Thumb for the recently completed development of an industrial building for cannabis cultivation and processing in Pennsylvania. IIPR owns and leases two regulated cannabis cultivation and processing facilities in Illinois and Ohio to Green Thumb besides the Pennsylvania facility.

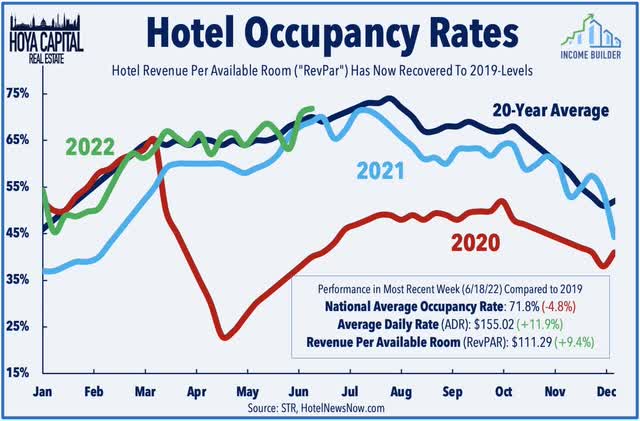

Hotel: This weekend, we’ll publish an updated report on the Hotel REIT sector to the Income Builder marketplace. Despite depression-like levels of consumer confidence and surging transportation costs, U.S. consumers have continued to travel this summer at levels that are within shouting distance of pre-pandemic rates. In the latest report from STR, U.S. hotel revenue per available room (RevPAR) reached an all-time weekly high on a nominal basis and a pandemic-era high on an inflation-adjusted basis for the week ending June 18th. While occupancy rates are still about 5% below 2019-levels, average room rates are higher by nearly 15% on average, driving a 9.4% increase in comparable RevPAR. Skepticism over the sustainability of this momentum, however, has pushed hotel REITs lower by nearly 20% over the past month. In the report, we’ll discuss our updated outlook and recent allocations.

Mortgage REIT Week in Review

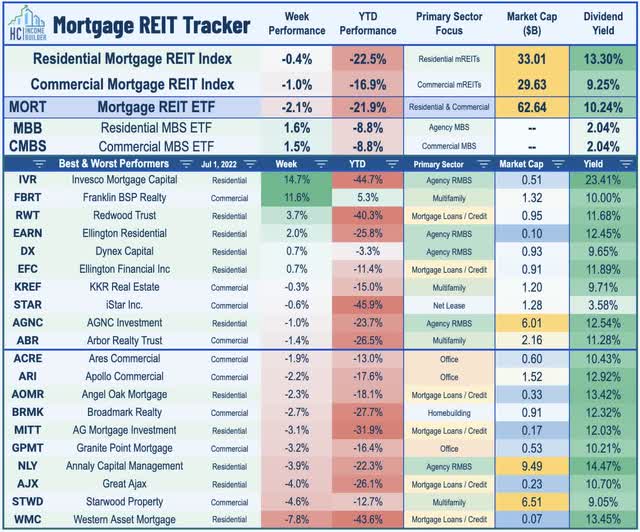

Mortgage REITs held onto most of their double-digit rebound this week amid a strong bid for mortgage-backed securities with the iShares MBS ETF (MBB) pushing its rally to nearly 4% over the past three weeks – the strongest three-week gain on record. Invesco Mortgage (IVR) surged another 15% this week after holding its dividend steady and providing a business update that noted that recent declines in its Book Value Per Share (“BVPS”) were not as steep as many feared. IVR estimated that its BVPS was in a range of $15.94 to $16.60 as of June 17th – down roughly 22% at the midpoint of its range from the end of Q1 – but far less than its share price decline during this period. On the downside this past week, Western Asset Mortgage (WMC) slipped about 8% after announcing a 1-for-10 reverse stock split of its common shares which will be effective as of the market open on July 11, 2022.

REIT Capital Raising & REIT Preferreds

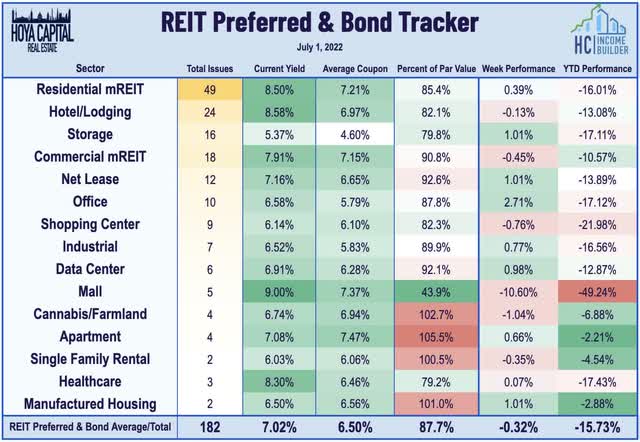

Despite the rally across the fixed income space, preferred securities were roughly flat on the week following last week’s bounce. The Hoya Capital REIT Preferred Index finished lower by 0.3% this week following last week’s sell-off. The preferred series of Southerly Hotels (SOHO) – one of two REITs with suspended preferred distributions – were notable upside standouts this week after the company completed the refinance of a Florida hotel and commented that the deal “facilitates a clearer path toward paying off our preferred dividend obligations.” On the downside this past week once again were the preferreds of Cedar Realty (CDR), which now trade at one-third of their par value following CDR’s acquisition by Wheeler Real Estate (WHLR) – a controversial deal that benefited common shareholders at the expense of preferred holders, as WHLR is expected to pause CDR’s preferred dividends.

2022 Performance Check-Up

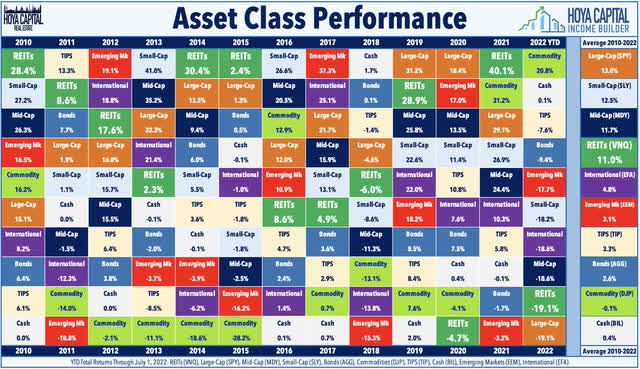

With the first half of 2022 now in the books, Equity REITs are now lower by 20.0% on a price return basis for the year while Mortgage REITs have slipped 21.9%. This compares with the 19.7% decline on the S&P 500 and the 19.1% decline on the S&P Mid-Cap 400. With the exception of the student housing and casino REIT sectors, every property sector is in negative territory this year while nine property sectors are lower by over 20%. At 2.89%, the 10-Year Treasury Yield has climbed 138 basis points since the start of the year, briefly breaking through the prior post-GFC-high rate of 3.25% reached in 2018 and touching a recent high of 3.50%. The 2-Year Treasury Yield has climbed from 0.73% to 2.84%. With the outperformance this week, REITs were able to leapfrog over Large-Cap Equities to climb out of the basement of the performance tables on a total return basis.

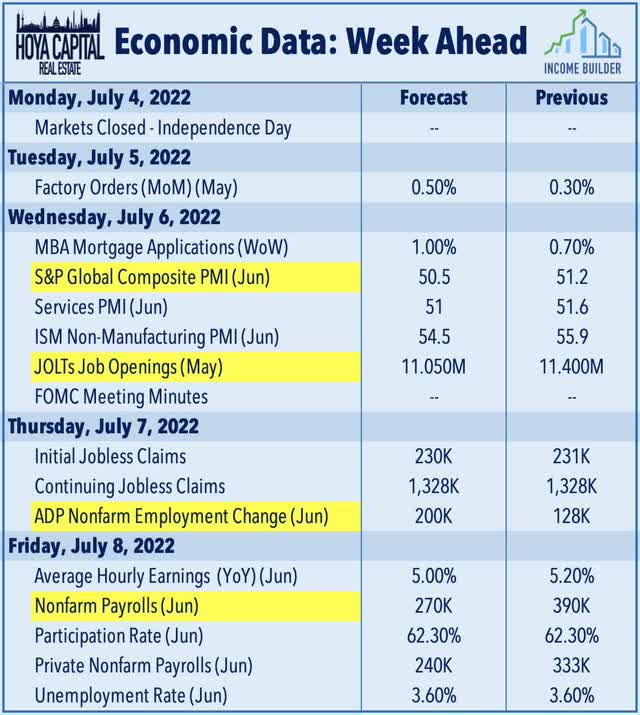

Economic Calendar In The Week Ahead

Employment data highlights another busy week of economic data in the Independence Day-shortened week ahead, headlined by JOLTS data on Wednesday, ADP Employment and Jobless Claims on Thursday, and the BLS Nonfarm Payrolls report on Friday. Economists are looking for job growth of roughly 260k in June which would be the lowest month-over-month increase since the start of the pandemic as the U.S. has now recovered 95% of the 22 million jobs lost from the COVID-related economic shutdowns. The unemployment rate, meanwhile, is expected to stay steady at 3.6%. Purchasing Managers’ Index (“PMI”) data will continue to be a major market focus – particularly in Europe and Asia – as recent reports have barely managed to hold on to the breakeven 50-level.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment