Market sentiment analysis:

- Market confidence has dropped a little but the major themes of stronger US stocks and a firmer US Dollar will likely re-emerge.

- In the meantime, IG client sentiment data are sending out a bearish signal for NZD/USD ahead of another expected interest rate increase in New Zealand tomorrow.

Trader confidence remains high

Trader confidence is still lofty in the markets and that should ensure that the major themes of stronger US stock indexes and a firmer US Dollar reassert themselves after a pause for breath. As the EUR/USD chart below shows, the pair is modestly higher Tuesday but the downward trend remains intact, with the USD helped by the re-nomination of Jay Powell as Fed chairman.

EUR/USD Price Chart, Daily Timeframe (May 20 – November 23, 2021)

Chart by IG (You can click on it for a larger image)

How to Trade Gold: Top Gold Trading Strategies and Tips

Bearish NZD/USD

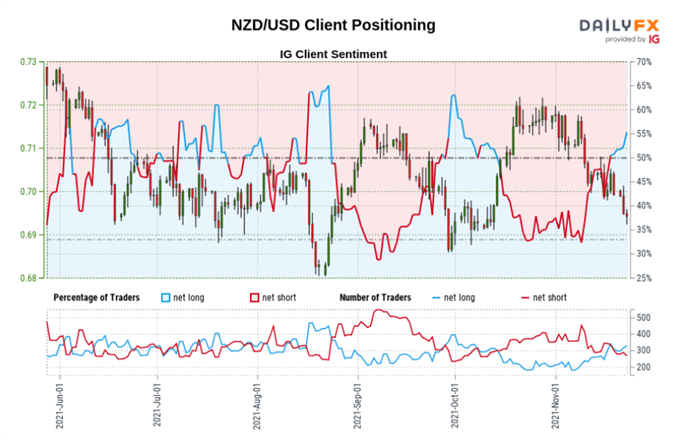

Turning to the IG client positioning data, the numbers are currently sending out a bearish signal for NZD/USD even though the Reserve Bank of New Zealand is widely expected to follow up its October interest rate increase with another 25-basis-point raise at its meeting Wednesday.

The retail trader data show 54.91% of traders are net-long, with the ratio of traders long to short at 1.22 to 1. The number of traders net-long is 1.49% lower than yesterday but 30.95% higher than last week, while the number of traders net-short is 6.87% lower than yesterday and 23.88% lower than last week.

Here at DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.

In this webinar, I looked at the trends in the major currency, commodity and stock markets, at the forward-looking data on the economic calendar this week, at the IG Client Sentiment page on the DailyFX website, and at the IG Client Sentiment reports that accompany it.

— Written by Martin Essex, Analyst

Feel free to contact me on Twitter @MartinSEssex

Be the first to comment