Melpomenem/iStock via Getty Images

Here is a sign that the U.S. financial markets are disjointed and facing interesting times going forward. Look at this picture.

The Federal Reserve has just raised its policy rate of interest and is threatening up to five more increases, some even half-point raises, this year.

The Federal Reserve is also threatening to reduce the size of its securities portfolio and reduce the size of its balance sheet.

What should stock market expectations be?

Well, one might think that investors would believe that the stock market should decline.

And, this would create a negative environment for stock buying.

But, guess what?

Stock prices have been going up ever since the Federal Reserve raised its policy rate of interest.

And, guess what else?

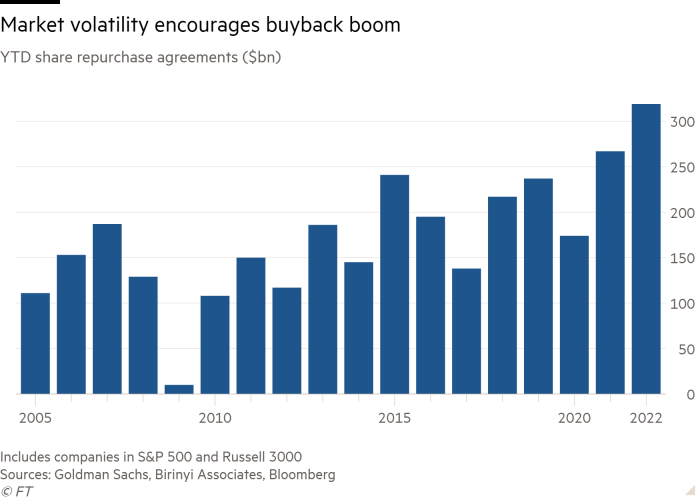

“U.S. companies are rushing to repurchase large volumes of shares to take advantage of recent stock market volatility and reassure investors as growth slows,” according to Nicholas Megaw, writing in the Financial Times.

“A record $319 billion of share buybacks have been authorized this year according to Goldman Sachs.

Share Repurchases (Goldman Sachs)

This performance, to me, is a sign of all the liquidity that is floating around the economic system due to all the money that the Federal Reserve has pumped into the U.S. banking system over the past two years.

These company efforts put up a strong front to shareholders. Why would companies buy back their stock unless they believed that their stock price was going to rise sometime in the not-too-distant future?

“Accelerated repurchases send a strong signal to shareholders because the cash is committed to buy back the stock upfront,” explains Michael Voris, Goldman Sachs’ head of structured equity.

“The total is already almost four times higher than the amount reported in the first quarter of 2021 and is likely to grow further as companies begin reporting first-quarter results next month.”

This Is What The Federal Reserve Is Facing

The Federal Reserve has tossed so much money into the financial markets since early in 2020 that corporations and financial organizations feel so rich with funds that they are acting in ways analysts do not expect.

The Federal Reserve wants to fight inflation?

Yet, in a situation like the one described above, the Fed has to fight against a record number of stock buybacks while it is trying to slow down economic growth.

And, this is just one of many examples of market disequilibrium that the Fed must fight against to combat inflation.

This is a condition that the Federal Reserve has created over the past couple of years and now must fight against in order to deal with some rather high levels of inflation,

The Fed must now battle market conditions that it created.

Investors must be aware of what is going on in the financial markets so that they understand the real battle the Fed is fighting.

In normal times, stock buybacks signal to the market that corporations are dealing from a strong, underlying strength and that things are looking positive for the future.

Corporations are usually pretty stingy with their cash balances, especially if they are expecting difficult times ahead. They want their cash to fall back on if needed.

But, corporations are acting even more aggressive this time around.

Just increasing authorizations does not mean that the funds will be spent immediately. Corporations can take several years to fulfill their plans to buy back their stocks.

In the current case, companies have publicly announced more than $33 billion of so-called accelerated share repurchases. This allows them to buy back large volumes in a matter of months, as Goldman’s Mr. Voris stated above.

This effort on the part of these corporations just makes the Fed’s job that much harder.

And, as I have indicated, this situation relating to stock buybacks is just one of the disequilibrium conditions that now exist in the financial markets, conditions that will make it just that much harder for the Fed to succeed in its fight against inflation.

It’s not a pretty picture.

Be the first to comment