cagkansayin

Co-produced with Treading Softly

Look at your trash can. Is it full or empty? How about the one outside your house? How full is it? Do you fill it up weekly, or does it generally sit mostly empty?

Trash. It’s something our current society generates tons of. Actually, thousands of tons of trash end up in landfills every year. Taking up otherwise useful space and creating large man-made artificial mountains.

Why not burn it? “Oh, that’s bad for the environment!” you might contend, but is it not bad for the environment to leave trash in massive heaps – every time it rains chemicals and such leak into the soil and off into the water table.

Interestingly, Waste-To-Energy technology has been around for decades, but lately, it has picked up steam as a “renewable” energy source. Carbon capture technology has improved over time, and with an efficient burning process, waste can be readily converted to energy to power homes.

One leader in this space is Babcock & Wilcox Enterprises (NYSE:BW). BW does not pay a dividend on its common shares. While others might invest in it anyway simply because they like its environmental focus, not having a dividend is a deal killer for us. We are income investors looking for a source of income to fuel our lifestyles.

So where can we find it with BW? When you like a company, but it doesn’t pay a dividend, look higher up the capital stack. BW has two attractive baby bonds that will provide us income and a higher position in the capital structure to boot!

Let’s look closer at this longstanding U.S. company.

What Do They Do?

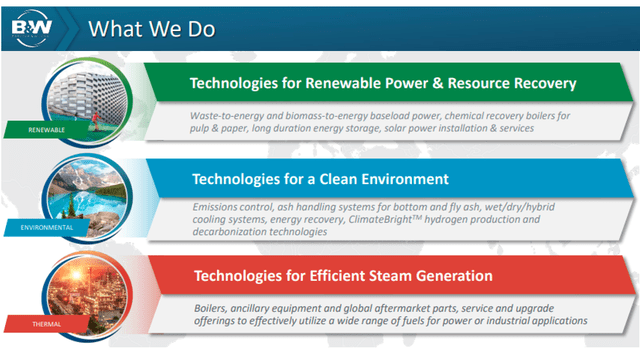

BW is broken down into three main reporting segments.

Babcock & Wilson Earning Slides

These segments are Renewable, Environmental, and Thermal. The main growth focus of BW is currently their renewable segment, which has been their recent revenue growth driver.

In essence, their segments work hand in hand but can be used piecemeal by third parties as well.

BW’s Renewable segment has been the fastest growing in recent times. Renewable technology is all the rage these days – how many publicly traded solar panel companies have come and gone? However, BW is not focused on operating locations. BW’s role is building the projects that other firms like NextEra Energy Partners (NEP) would own and operate. As such, the growing demand for solar energy to be built benefits BW.

Their Waste-to-Energy and renewable biomass projects continue to gain attention and strength in their order backlog. BW is primarily a builder and servicer of the plants, not the operator. So their revenue will be lumpy based on when projects begin and end, but they don’t carry the costs or risks of operating the plants.

BW’s Environmental segment focuses on carbon capture and similar technologies. These are added to currently operating facilities or constructed alongside newly built locations.

The Thermal segment focuses on the boiler itself and related infrastructure. Most power plants still focus on the age-old methodology of heating water into steam and turning large turbines to generate electricity. The means of heating the water may vary – coal, biomass, nuclear, etc. – but the need for a turbine and boiler along with the related pipes is universal. BW builds, upgrades, and services this infrastructure for power plants and industrial furnaces around the globe.

Financial Check Up

BW has been in the process of going through a company revitalization. For some time, BW’s financial health and earnings struggled to find a solid footing as the company invested heavily in the renewable/environmental side of its business. It often takes time for new investments to start paying off, which can mean a difficult period. This is now starting to reward them as their project backlog has grown and new revenue is coming in.

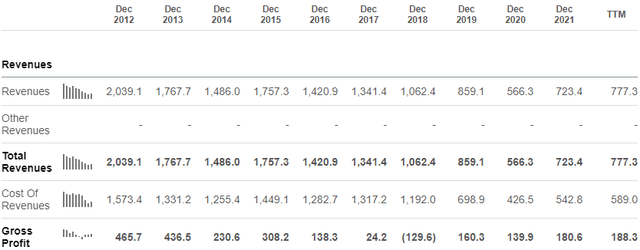

Seeking Alpha

Looking over the last ten years, BW has seen its revenues decline and its profits turn negative in 2018 before recovering. Currently, BW is generating similar profits with less revenue coming in. Their change in focus has produced a higher margin business.

To survive this season of change and hardship. BW was forced to tap into the capital markets. They did so three times through 2021, issuing two baby bonds and one preferred security. They did this in 2021 to pay off other loans and clean up their balance sheet. This effort left them carrying $334.3 million in debt and $100 million in preferred equity.

Their Adjusted EBITDA of $32 million for the first six months of 2022 provides an interest coverage ratio of 1.49x, this is a large improvement from the first six months of 2021, which had an interest coverage ratio of only 1.07x.

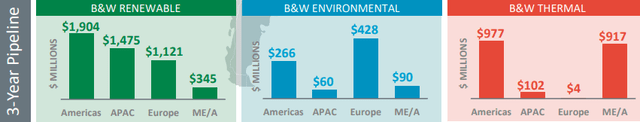

We expect their coverage ratio to continue to climb in the coming quarters as business picks up speed. BW has over $7.5 billion in its pipeline, excluding parts and services. (Source: B&W Investor Presentation)

B7W August Presentation

This will provide a significant increase in revenues and EBITDA. BW finished 2021 with a coverage ratio of 1.79x, and we expect it to be similar for 2022 or stronger.

It Pays to be a Bond Holder

Regarding income, we prefer to be first in line to get paid. With BW, we see two excellent means to get paid:

- Babcock & Wilcox Enterprises, Inc., 6.50% Senior Notes Due 12/31/2026 (NYSE:BWNB) – Yield to Maturity 8.7%

- Babcock & Wilcox Enterprises, Inc. 8.125% Senior Notes Due 2/28/2026 (NYSE:BWSN) – Yield to Maturity 9.3%

Both are excellent sources of income however, at the time of writing, BWSN is more attractive with a higher YTM. However, either baby bond gives an excellent source of income now until 2026. BWSN has already passed its call date (and will tend to trade closer to its par value). However, the current redemption price would be $25.75, and it goes down by $0.25 each February until it reaches par $25.00 in February 2025.

BWNB has a different early redemption option, which is detailed in the prospectus. If called before the 2026 par call date, a Make-Whole provision requires the payment of the present value of remaining scheduled interest payments.

What about their preferred shares? Babcock & Wilcox Enterprises, Inc. 7.75% Series A Cumulative Preferred Stock (BW.A) has a current yield of about 9% and becomes callable in May of 2026. This current yield may be attractive, however both BWNB and BWSN have a much higher degree of safety and similar YTM offered than the higher-risk BW-A. The preferred does pay a qualified dividend if owned in a taxable account (whereas the bonds pay interest). If you can get a similar return with the lower risk of a bond, go for the lower risk!

Shutterstock

Conclusion

BW has undergone a heavy transition and shift of focus. The risks of bankruptcy are now firmly in hindsight. BW’s management executed effectively to remove other higher-cost debt by issuing two baby bonds and a preferred stock through 2021.

While BW’s common stock can be a wild ride without the reward of a strong common dividend, we can see that climbing higher into the capital stack, passing over the preferreds, and moving into their bonds allow us to lock up some great income for years to come.

Your retirement needs to be paid for, and buying lower-risk investments like baby bonds can be a way to enjoy that income without the worries that a common dividend cannot match. BW’s ability to pay its current interest costs is not in question now, and its continued revenue growth makes being a bondholder attractive.

Looking at BWSN and BWNB, we would personally initiate a position in whichever one has a better Yield-to-Maturity at the time of purchase, we provide real-time YTM data on our Model Portfolio for High Dividend Opportunities members to make this easier for them.

Buy income, relax, get paid, repeat. That’s the beauty of income investing.

Be the first to comment