gradyreese

Investment Thesis:

Microcaps are a Neglected asset class. Less-researched companies have proven to provide greater risk-adjusted returns than more-researched companies. High insider ownership typically signals confidence in a company’s prospects. MPX insider holdings are in excess of 65%. This gives the company’s management an incentive to make the company profitable and maximize shareholder value. Almost $300M has been returned to shareholders in MPX’s 20 years as a public company, demonstrating an investor-orientated capital philosophy. As a consumer discretionary product, correlated to the interest rate environment and economic cycle, the market might have already discounted most of the potential risks that come with a recession. As we will see in the valuation analysis, the stock at the current price is undervalued.

Article Agenda:

We will look at the past 10 years of financial data to determine if three key attributes apply to MPX.

- Growth (Top-Line, Bottom-Line, Cash Flow)

- Debt Ratios

- Reasonable Valuation

Through the historic growth, we conservatively project cash flow and earnings into 2032. By utilizing realistic multiplicators, we establish a share price for 2032. Subsequently, we calculate the internal rate of return of an investment in MPX stock over the next decade.

The ideal situation would be a combination of 1) earnings growth, 2) multiple expansion, 3) share count reduction. Companies that pull off these three levers have the potential to be 10 baggers in a decade.

1. Growth:

During the past 10y, MPX has been totally knocking it out of the park. Not only revenue and EBITDA grew impressively, but also free cash flow (cash flow from operations – capex) has been growing very nicely from 8 million in 2012 to 34 million in 2022 TTM. This is a whopping 4X in hard cash production. As this wasn’t enough, MPX has been buying back shares in the last decade, reducing the share count by 10%. The result is a 5X in free cash flow per share (from $0.2 to $1). This is hard cash that can be distributed at the discretion of the board to the shareholders.

The chart below captures the outstanding progress over the past decade. Three considerations (bullet points below) can be made to add to the qualitative discussion of their performance:

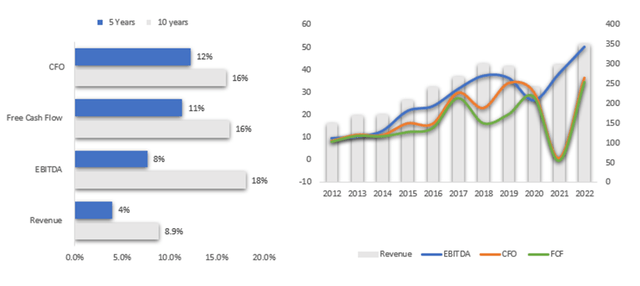

5- & 10-Year Growth Metrics (SA & Author)

- Accounting is doing a fine job: Cash flow growth rates shadow EBITDA. This gives us confidence in the quality of the reported earnings since these get translated into hard cash on the cash flow statement.

- Growth is decelerating. Ultimately, companies cannot grow faster than the whole economy forever. Otherwise, a company that grows perpetually faster than GDP would be greater than the whole economy at some point in the future. Businesses mature and saturate their total addressable market. When compiling our growth forecasts for the next decade, we will take this into account and haircut the growth rates further. As a sidenote, according to research, the recreational boat market is set to grow at a 6% annually during this decade, which would imply an unchanged growth rate. (Recreational Boat Research)

- Cash flow (11% 5y CAGR) and earnings are growing faster than revenue (4% 5Y CAGR). This underscores the operating leverage at MPX and the improved net income margin. MPX has grown net income margin to ~ 20%, which is healthy and provides a cushion in case demand slows down.

2. Debt Ratios

MPX has 0 long-term debt. Shareholders benefit in different ways from companies that don’t use debt in their capital structure:

- Equity-only capital structure: All the cash produced can be distributed to shareholders or re-invested into the business.

- Higher EPS: A company has higher earnings since there is no interest payment to be made (especially in an increasing rates environment)

- Solvency: A debt maturity cannot send MPX into bankruptcy because of the incapacity to refinance.

- Optionality: A company with 0 debt could take on some debt (conservatively up to 3X EBITDA) in case it decides to change its capital structure. In the case of MPX, theoretically, they could issue 100 million debt to: a) invest into growth, b) repurchase stock -> boost EPS, c) fund a temporary business deterioration where cash flows are 0 or negative.

In their most recent 10-Q, they disclosed off-balance sheet items related to long-term liabilities. These items are guarantees: ‘to assist dealers to obtain financing’ (Page 22 most recent 10-Q), for a total of $10.2 million as of 30 Sep 2022. Even though we don’t see the size as material for now, we would not want to see these guarantees grow excessively. These guarantees are liabilities that in case of an economic crisis would certainly produce losses and be a cash flow drain.

3. Valuation:

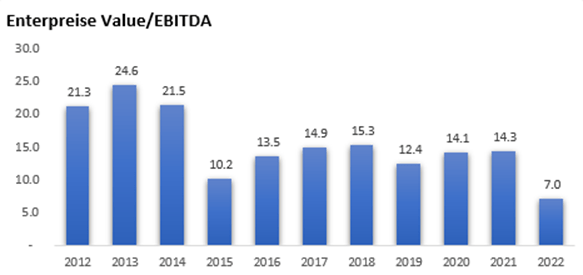

The 10-year average EV/EBITDA (chart below) is 15. The 2022 TTM ratio has been compressed to 7. Two factors here are at play:

1) The market cap has fallen.

2) 2022 TTM EBITDA is high relative to history and 5-year average.

EV/EBITDA Multiple History (SA & Author)

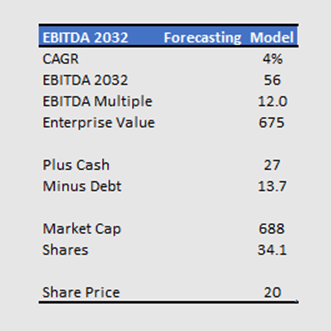

For the purpose of valuation in the year 2032, we will grow EBITDA at 4% (as seen in the chart above, that would be half the growth we saw in the past 5 years and less than industry estimates).

We will utilize an EV/EBITDA multiple of 12, which is conservatively below the average of the past decade.

We are haircutting EBITDA from $50 million TTM to its 4-year average. The past year has been characterized by high pricing power due to a demand surplus to supply. We prefer to remove this effect and start compounding our growth from a more normalized level.

With these inputs, the stock could be at $20 by the year 2032.

Potential Return:

By purchasing today’s MPX at 11.10, holding it for 10 years, and then selling the stock at 20 (Below: EBITDA Forecasting Model), a shareholder will obtain $8.90 in capital gains.

EBITDA Forecasting Model (Author)

Additionally, a shareholder is entitled to the free cash flow the company is producing. These cash payments may or may not be disbursed directly via dividends. Alternatively, a company can repurchase stock or invest in M&A or other operations that would expand the business and incentivize growth.

2022 free cash flow per share is $1. It has been growing at 11% CAGR in the past 5 years and we will conservatively give it a 4% growth rate for the next 10 years. FCF per share shall eventually be $1.5 by the year 2032.

Recap:

- Buy at $11.10

- Sell at $20 in 2032.

- Collect $12.5 FCF (free cash flow), directly or indirectly, each year.

- IRR (Internal Rate of Return) of 18% per annum. A $100 investment would develop into $510 in the course of 10 years.

Risks & Challenges:

Being a consumer discretionary product, correlated to the interest rate environment and economic cycle, MPX is facing some risks going into 2023. Considering that rates have gone up considerably in the past 18 months, this is having an impact on the economic cycle and the ability for customers to purchase recreational boats. Additionally, high inflation and high fuel costs negatively impact the demand for fuel-powered boats, the core business of MPX.

The accelerated trend post-pandemic for consumers demanding a product that lets them enjoy their free time with their families and beloved ones in an isolated fashion had a positive impact on the boating and motorhome industry. The increased demand, together with the supply shortage, allowed companies to improve their margins thanks to strong pricing power. I do see the possibility for these preferences to revert to their long-term trend.

The ownership structure is concentrated at over 60% in the hands of Gary W. Rollins (age 78), member of the board since the spin-off from RPC, Inc. in 2001. We do like companies where insiders have skin in the game, but it also, in this case, opens up the question of a succession plan and the possibility of someone selling those 22 million shares, or part of them. Being a microcap with low liquidity, the sale of 100k shares has already an impact on the share price.

Conclusions:

During the last 5 years, MPX has produced $110 million in hard cash. $100 has been distributed to the shareholders in the form of dividends and buybacks. The 2022 dividend is $17 million, which leaves ample space to maneuver (since FCF is > 30 million). Our conservative growth estimation would produce a return of 18% pa., which is almost double the return the S&P 500 has produced on average in the past century. Since the market cap of this stock is small and the floating available market cap is only ~$130 million, the daily volumes are such that large institutional investors tend to shy away from these opportunities. Overall, I think the risk-adjusted returns for this stock are very compelling.

Be the first to comment