dszc/E+ via Getty Images

Introduction

After enduring quite possibly the most severe downturn ever during 2020 as a result of the Covid-19 pandemic, Marathon Petroleum (NYSE:MPC) started 2021 with the massive Speedway divestiture and its accompanying massive share buybacks, which made it appear that their dividends could surge, as my previous article discussed. Since almost one year has subsequently elapsed, this article provides a refreshed analysis that now sees it being time to take profits at these record share prices, which apart from pushing their dividend yield down to a low 2.66%, also hinders the effectiveness of their massive share buybacks and thus their future dividend growth.

Executive Summary & Ratings

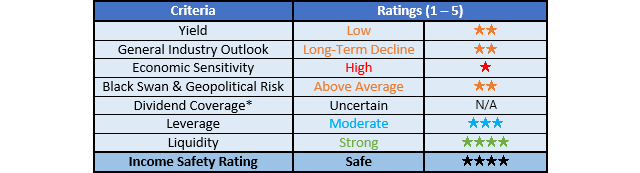

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

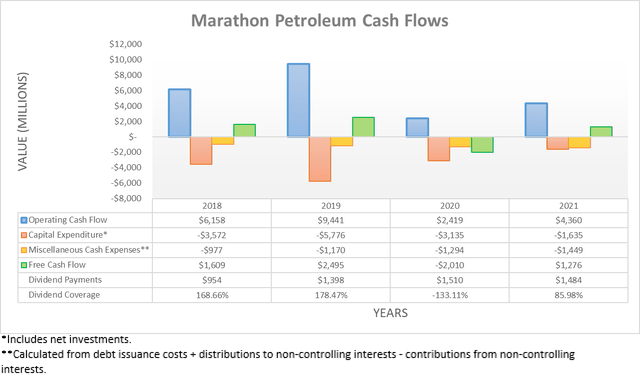

After seeing their cash flow performance demolished during 2020 due to the severe Covid-19 inspired downturn, it began recovering during 2021 as operating conditions improved. Although this saw their operating cash flow almost double to $4.36b during 2021 versus its previous result of $2.419b during 2020, it was still well below its earlier 2019 result of $9.441b before the downturn. Thankfully this stems from $4.024b of negative operating cash flow allocated to their now-discontinued operations arising from their Speedway divestiture and resulting tax payments, as per the quote included below.

“Net cash used in operating activities from discontinued operations was $4.02 billion in 2021 primarily due to tax payments related to the sale of Speedway, partially offset by a partial year of business income due to the sale of Speedway on May 14, 2021. Net cash provided by operating activities from discontinued operations in 2020 and 2019 include Speedway business income.”

– Marathon Petroleum 2021 10-K.

If their operating cash flow allocated to discontinued operations is removed from their results, it sees their operating cash flow from continuing operations at $8.384b during 2021 and thus even slightly surpassing their equivalent pre-downturn result of $7.676b during 2019. Unsurprisingly, it also sits many magnitudes higher than their equivalent previous result of only $807m during the downturn of 2020. It will be quite interesting to see how their cash flow performance goes during 2022, which is particularly tricky to predict given the inherent volatility of their industry and these highly uncertain geopolitical-driven times, although suffice to say, it appears likely to at least equal 2021 on the back of these very strong operation conditions as the world mostly exits lockdowns and other Covid-19 related travel restrictions. Ultimately, only time will tell but even more importantly, these very strong operating conditions actually hinder their long-term dividend growth and thus appeal of their shares due to their remaining massive share buybacks, as the graph included below displays

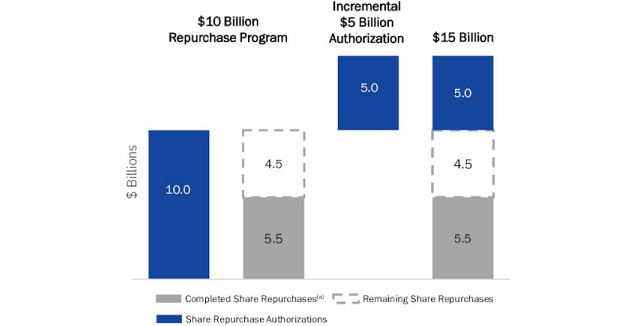

Marathon Petroleum Fourth Quarter Of 2021 Results Presentation

Whether they opt to complete the further $5b of optional share buybacks authorized is uncertain but either way, even the remaining $4.5b under their original program still represents a very large sizeable amount. Although in my view, it seems more likely that their higher $9.5b end of the range will be conducted because, in my experience, cyclical companies tend to conduct the most buybacks when operating conditions are very strong, as they are currently, which is where the problem lays.

When publishing my previous analysis, their share price was $60.04 and whilst not necessarily low by historical standards, it was still significantly lower than their current share price of $87.20, which is trading very close to its record. Even though a strong share price rally is welcomed, unfortunately, it actually negatively impacts their long-term dividend growth prospects in this situation because their main avenue for growth was via reducing their outstanding share count, as my previously linked article discussed for those interested in further details. If they conducted $9.5b of share buybacks with a $60 share price, it would remove circa 158 million shares, whereas at their $87 share price, they would only remove circa 109 million shares and thus see a difference of circa 49 million shares, which amounts to almost 9% of their latest outstanding share count of 565,212,958, which reduces their dividend growth potential comparably.

Whilst this difference may not sound too noteworthy but it should be remembered that the impacts last forever, thereby significantly hindering their appeal since their future dividends, earnings per share or any other financial metric is forever lower than otherwise would have been the case. Since these buybacks relate to their Speedway divestiture, their effectiveness is particularly important since they are asset funded and thus they cannot routinely regenerate the funds. Furthermore, it should also be considered that once these very strong operating conditions revert lower in the future given the cyclical nature of their industry, the combined absence of buying support from these massive share buybacks makes it very likely to see their share price drop even more significantly, thereby increasing the potential downside risk for investors.

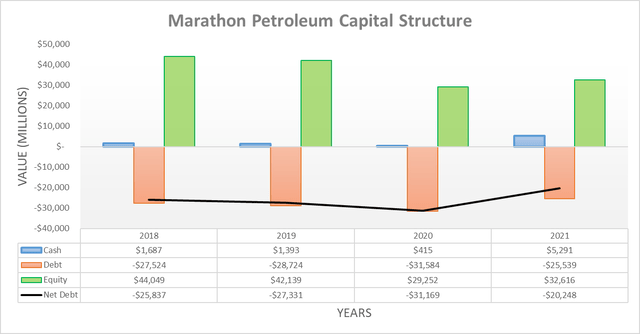

The completion of their Speedway divestiture during 2021 saw their cash balance surge whilst their debt tumbled, thereby unsurprisingly sending their net debt plunging to $20.248b by the end of the year, which represents a very large 35.04% year-on-year decrease versus their previous result of $31.169b at the end of 2020. Their balance sheet also now sports a further $5.548b of short-term investments, which if aggregated with their cash balance, sees their combined value equaling a massive $10.839b and thus able to fund their remaining $4.5b to $9.5b of share buybacks. When looking ahead, their net debt will rise upon the completion of these share buybacks, especially if they opt for the upper $9.5b end of the range, although the extent will depend upon their upcoming free cash flow that as previously mentioned, seems particularly difficult to estimate.

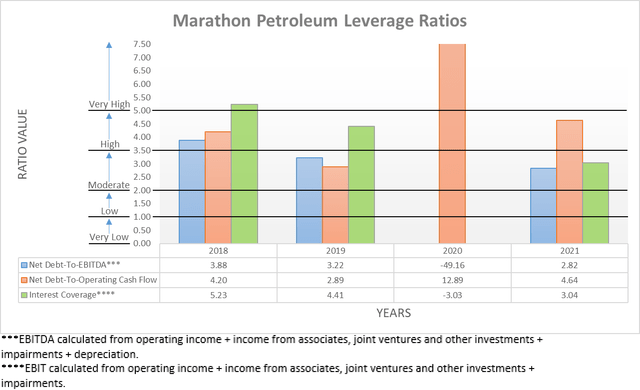

Whilst their leverage ratios started normalizing during 2021 after being rendered useless during 2020 as a result of their negative earnings, they still were influenced by their Speedway divestiture. On the surface, their net debt-to-operating cash flow of 4.64 sits within the high territory of between 3.51 and 5.00, despite their significantly lower net debt. Although this was negatively influenced by their previously discussed tax payments resulting from their Speedway divestiture and when looking at their net debt-to-EBITDA, it ended 2021 at 2.82 and thus within the moderate territory of between 2.01 and 3.50. When looking ahead, their higher net debt as they continue conducting their share buybacks will see their leverage trend higher than the prevailing operating conditions would normally entail, and whilst their current moderate leverage does not pose any risks, this dynamic could further enhance the extent that their share price drops in the future when operating conditions revert lower.

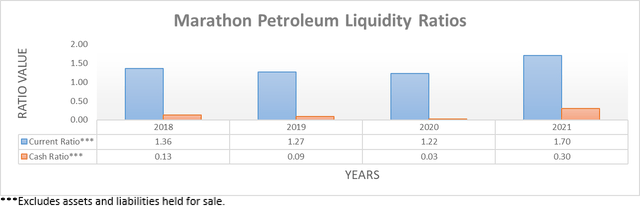

It was not surprising to see their surging cash balance dramatically boost their liquidity, which saw their already adequate current and cash ratios of 1.22 and 0.03 respectively being lifted to 1.70 and 0.30 respectively, thereby now warranting a strong rating. Whilst not necessarily required, they still retain a further $4.999b available under their credit facility and since they are a large company, there are no reasons to expect any issues sourcing liquidity as required to refinance debt maturities nor to fund other general purposes for the foreseeable future, even if central banks tighten monetary policy.

Conclusion

When viewing this situation through a checklist, it does not appear to offer the ingredients for a desirable investment; a cyclical industry with currently very strong operating conditions? Tick. Record high share price whilst conducting massive share buybacks? Tick. Whilst their share price may continue rallying higher in the short-term, I nevertheless feel that these variables make for an opportune time for investors to take profits with the potential downside risk growing uncomfortably in my eyes, and thus as a result, I believe that downgrading my previous buy rating to a sell rating is now appropriate, especially since their record high share price hinders the long-term dividend growth potential from their massive share buybacks, which was central to my previous buy rating.

Notes: Unless specified otherwise, all figures in this article were taken from Marathon Petroleum’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment