imaginima

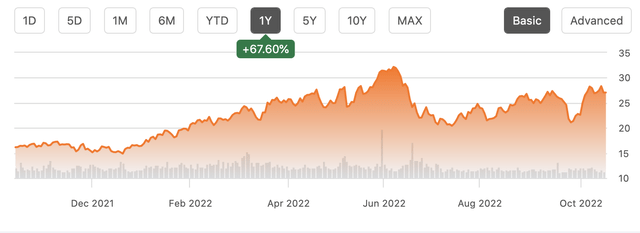

Shares of Marathon Oil (NYSE:MRO) have been an incredible performer over the past year rallying by 68% as the company benefits from the surge in commodity prices. Like many of its peers, it is prioritizing capital returns to investors. While investors who prefer special dividends may prefer Devon Energy (DVN) or EOG (EOG), those comfortable with a share-buyback oriented approach should consider MRO given its extremely attractive valuation.

In the company’s second quarter, it earned $934 million or $1.32. There was record free cash flow of $1.2 billion just in the quarter. The company executed on $760 million of buybacks in Q2, on top of the $56 million base dividend. Since reaching its debt target in October 2021, it has bought back $2.3 billion in stock, reducing the share count by 15% while paying out $200 million in dividends. The company has net debt to EBITDA of just 0.3x, will pay off debt at maturities when oil is above $60, and has $1.16 billion in cash and equivalents.

Like other E&P companies, MRO has promised to return capital to shareholders as a top priority. Under its program, above $60 oil, it is committed to return at least 40% of cash flow to shareholders, between $40 and $60 at least 30%. Below $40, there would be limited shareholder returns beyond the base dividend. At the same time, production growth is capped at 5%, so as oil gets further above $60 more capital is returned to shareholders as its cap-ex budget is limited by that maximum production growth. Indeed, since last October, 55% of cash from operation has been returned to shareholders.

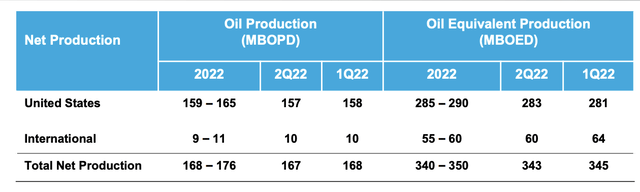

As you can see from its guidance below, the company is spending just enough on cap-ex to gently lift its production with production set to rise sequentially in Q3 from the Q2 level. It is spending about $1.3 billion on cap-ex this year (about $100 million above what it views as breakeven) and is only commissioning projects that have a breakeven at $35 WTI to ensure it does not get locked into high-cost properties, which caused it challenges when oil prices fell hard from 2014-2016.

The Bakken is Marathon’s primary play with 114mboe/d of production followed by the Eagle Ford at 84mboe/d, Oklahoma at 56mboe/d, and a small exposure to the Permian at 20mboe/d. The company is trying to grow its smaller plays with the Bakken and Eagle Ford getting 75% of the cap-ex budget this year from 90% last year. Production costs are just $5.80/boe. Marathon has also done an excellent job in locking in contracts for rigs and supplies, which have led it to face less inflation on its capital budget than some peers. Most of its rigs are contracted into 2023. Management has also secured the sand and steel they need for H1 2023 cap-ex activity. This is helping to keep all-in costs down and free cash flow up.

I also am optimistic on a unique asset the company has: an equity position in the Equatorial Guinea, where it is benefitting from surging LNG prices. With Europe needing to replace Russian natural gas exports, the LNG market is extremely tight, and realizations can be much higher than natural gas on the domestic market. With the EU-Russia fissure likely permanent (or at least several years) in my view, this should be a market with favorable pricing dynamics for some time. This play will provide $520-560 million of equity income this year.

The company has about 19% of its oil production hedged over the balance of the year with a maximum price of $97.52, above current market levels. There are no hedges for next year, and with the balance sheet so strong, there is little need to hedge as much as in the past. Assuming $100 oil, management had guided to $4.5 billion in full year free cash flow. When the company reports third quarter earnings on November 2, we may see this number come down slightly as WTI has sold off. Each $1 change in oil is about $60 million in cash flow. So, the full year should finish in the $4.25-$4.5 billion range. With an $18.3 billion market cap, the stock has roughly a 25% free cash flow yield.

I would note that free cash flow is benefitting from the fact it is not paying cash taxes due to significant operating losses built up last decade. While this was expected to be the case until 2026 at the soonest, the corporate minimum tax in the Inflation Reduction Act could lead MRO to pay some cash taxes as early as 2024. At current oil prices, this could be about a $600 million impact.

Per management, Marathon Oil needs about $1.2 billion in cap-ex to keep production flat. At $70 oil, just 35% of its cash flow is needed to sustain production, providing over $2 billion per year in free cash flow. At $85, which I view as a conservative base case, the company has $3 billion in run-rate free cash flow. While the company may spend up to $250 million on growth projects in that environment, there would be $2.75 billion in available cash flow to return to investors. As noted, share repurchases are the “preferred” supplement to the base dividend. This would be a 15% yield with about 1% via dividends and a 14% per year reduction in the share count at the stock’s current price, powering significant long-term per-share accretion.

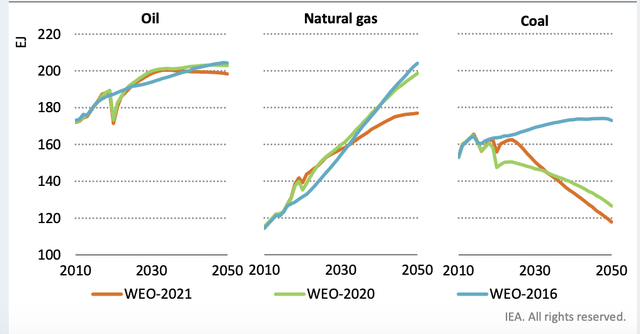

Because each $1 in oil has a $60 million impact on free cash flow, one’s view on oil prices will determine your view of Marathon. I am generally positive on oil and see risks to the upside vs my $85 base assumption. While some worry about the climate transition, according to the International Energy Agency, oil demand is expected to rise until 2030 and then only fall modestly. With cap-ex budgets low in recent years, US E&P firms showing tremendous cost discipline, and nations like Mexico facing falling production, the oil market is likely to remain relatively tight. Plus, even OPEC+ is helping to put a floor under prices.

International Energy Agency

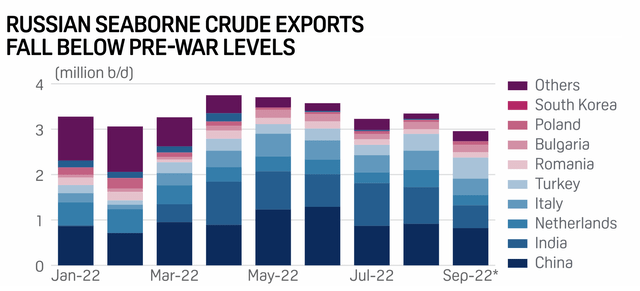

Additionally, we have seen how Russian gas export curtailments have caused European and LNG prices to soar. Less attention is being paid to the fact Russian oil exports have been falling. Plus, it faces embargo from European buyers this winter. There is a risk that Vladimir Putin significantly reduces oil exports like he did gas exports to exact economic pain on the West. A world with less Russian oil will be a world with more expensive oil. This may or may not happen but it skews the risk higher.

S&P Global

Marathon Oil has put its balance sheet on strong footing, has unique exposure to the LNG market via Equatorial Guinea, and has a compelling free cash flow profile. At my $85 oil base case, it has $2.75 billion in free cash flow alongside low single-digit production growth. At a 15% free cash flow yield, investors will enjoy significant long-term returns as the company can aggressively reduce the share count via buybacks. I would be a buyer up to a 12% free cash flow yield, or a slight discount to larger peers like EOG and ConocoPhillips (COP) as its cash flow is benefitting from the lack of cash taxes currently. This translates to a $34 share price or 25% upside in MRO stock, making it a buy at current prices.

Be the first to comment