peshkov/iStock via Getty Images

Investment Thesis

Marathon Oil (NYSE:MRO) is an exploration and production (“E&P”) company. What sets it apart from other E&P companies is that it has a very clear capital return program.

Marathon Oil is going to return to shareholders at least 40% of cash flows from operations. I note in the article why this metric is important.

By my estimates, Marathon Oil has more than a 10% capital return program even now, after a strong rally, at a $20 billion market cap.

Altogether, I estimate that Marathon Oil is being priced at 4x free cash flow. That means that at current WTI prices, an investor buying the stock would be fully paid back in less than 4 years at the current rate.

Put another way, at current prices after 4 years, Marathon Oil would all be “free” upside to shareholders.

I rate this stock a buy.

Capital Returns Program

Many E&P companies are going to have a very strong 2022. That would make Marathon Oil a “more of the same” stock. But here’s why Marathon Oil is different.

Marathon Oil is one of the only companies I know in the E&P sector that says:

[…] minimum commitment to return at least 40% of CFO to equity investors.

Do you see what sets it apart from its peers? The cash distribution comes from the cash flows. It’s not after capex. That’s where the company is focused on.

The priority for Marathon Oil is to return capital to shareholders. There’s no ambiguity. And that’s why I believe this stock is compelling.

What’s more, Marathon Oil declares a 5% production growth cap. That means that at this point in time Marathon Oil is simply looking to minimally support growth production.

At WTI of $100, Marathon Oil sees a path to return $2 billion to shareholders annualized. A 10% capital return program, at $100 WTI.

However, given that WTI is now at $120, that means that Marathon Oil is more likely than not to return to shareholders approximately $2.5 billion of cash.

Along this framework, this is what Marathon Oil stated on its earnings call,

So obviously, we’re positioned to generate a significant and sustainable amount of free cash flow, our balance sheet is in great shape. We’ll continue to pay down debt as those maturities come along. And our current intent then is returned significant capital to shareholders really want that to be competitive.

Consequently, there’s no question that Marathon Oil is steadfast in its goal of returning capital to shareholders.

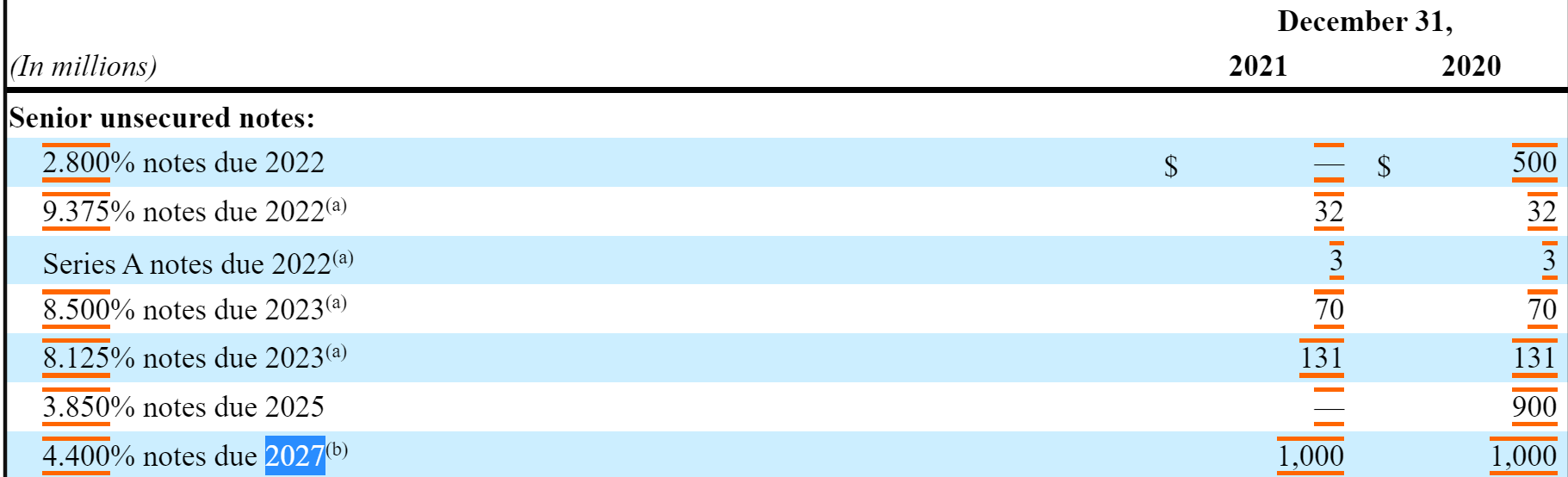

Also, as I previously noted, Marathon Oil has no material near-term debt maturity.

MRO SEC filing

Marathon Oil will pay back its 9.4% notes later in 2022. And then it has $200 million to return in 2023. But that’s really it.

And given that Marathon Oil already has approximately $840 million of cash and equivalents, that means that Marathon Oil is very well funded, with a rock-solid balance sheet.

MRO Stock Valuation — 4x 2022 Free Cash Flow

Now, let’s make some back-of-the-envelope calculations.

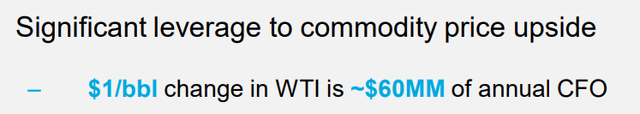

We know that for every $1 change in WTI, Marathon Oil sees $60 million of cash flows from operations.

We also know that during Q1, when oil was approximately $95, Marathon’s adjusted free cash flow was approximately $940 million.

Today, prices are approximately $120 WTI.

This implies that Marathon could make on an annualized basis approximately $1.5 billion more as a run-rate than it did during Q1. ($120 (current WTI prices)-$95 (previous benchmark)=$25; $25*60 million of cash flows=$1.5 billion in free cash flow).

So, if we annualized the $940 million from Q1 and add the $1.5 billion of free cash flow from higher WTI prices, that means we are now on a run rate of $5.3 billion in adjusted free cash flows.

This would put Marathon Oil at just under 4x free cash flow.

The Bottom Line

Marathon Oil, Q1 2022

My bullish thesis is contingent on oil prices staying high. While WTI prices do not need to stay above $100 for this investment to work out favorably, there is still the risk that as oil prices inevitably sell off from time to time and this will cause oil-related companies to also sell off.

What’s more, if oil prices start to retrace back to $100 WTI, I suspect that investors will rapidly look to take profits off the table, and this will lead to mass selling of Marathon Oil and oil-related stocks.

Consequently, there’s the likelihood that as oil stocks start sell off, many companies will undershoot and end up returning below intrinsic value once again.

Ultimately, all considered, I estimate that Marathon Oil is likely to return $2.5 billion to shareholders annualized. This equals more than a 10% capital return to shareholders. Whatever you decide, good luck and happy investing.

Be the first to comment