DeanDrobot/iStock via Getty Images

Canadian companies continue to be a great choice for U.S. investors looking to diversify their holdings internationally without venturing too far. This includes stocks I’ve written about previously, such as the telecommunications and banking giants BCE Inc. (BCE) and Bank of Montreal (BMO).

This brings me to Manulife Financial Corp. (NYSE:MFC) which currently throws off an even higher yield than the aforementioned two stocks. In this article, I highlight what makes MFC a solid value buy for income and growth, so let’s get started.

Why MFC?

Manulife Financial is one of the Big 3 life insurance companies in Canada, sitting alongside peers Sun Life and Great West Life. Beyond life insurance, MFC also provides wealth management products and services to individuals and group customers in Canada, the U.S., and Asia.

MFC has a long operating history of 130 years and at present, it has C$856 billion in global wealth and assets under management, making it a top 10 asset manager in Canada. MFC’s track record as a reliable asset manager gives it a competitive moat, as this results in sticky customer relationships, as noted by Morningstar in its recent analyst report:

Overall, we believe MFC’s asset management business has a narrow moat driven by switching costs and intangible assets. Although switching costs are not explicitly large, inertia and the uncertainty of achieving better results elsewhere tends to keep investors invested with the same fund for a period of time. Asset managers generally gain intangible asset moats from having strong and respected bands as well as a track record of maintainable and successful investment performance.

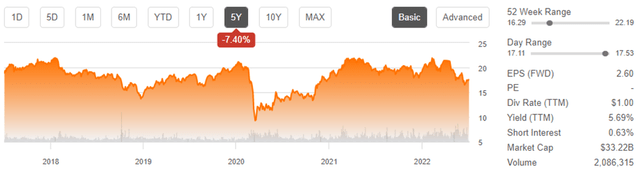

Concerns of a global recession has pushed MFC’s stock price down by a material amount, from a 52-week high of $22 achieved as recently as February down to just $17.52 at present. As shown below MFC now sits even below early 2020 trading range of $20-21.

MFC Stock Price (Seeking Alpha)

One may think that MFC’s business is doing poorly based on its stock’s performance in recent months, but that doesn’t appear to be the case. This is reflected by encouraging Global Wealth and Asset Management net asset inflows of C$6.9 billion during the first quarter, far surpassing the C$1.4 billion that MFC saw in the prior-year period.

Net book value is down 14% YoY, however, as tight COVID restrictions in Asia lowered NBV, partially offset by robust double-digit growth in both the U.S. and Canada. Nonetheless, MFC still maintains a strong core return on equity of 11.8% and a LICAT (Life Insurance Capital Adequacy Test) ratio of 140%, sitting well above the 90% regulatory limit set by Canada’s OFSI.

Looking forward, I would expect for MFC’s Asia business to recover in the second half, as many of the lockdown measures in China have eased. MFC has demonstrated strong momentum in Hong Kong, where it’s gained market share, and increased its ranking by one spot as the number five insurer there.

Moreover, it appears that MFC is doubling down on its momentum in China, as a recent report described MFC’s move towards gaining full control of its Chinese joint venture, signaling a potential $7.8 billion total addressable market, as noted below:

Chinese regulators have accepted Manulife Financial’s application to gain full control of its Chinese joint venture, Reuters reported Wednesday, citing two people with knowledge of the matter, as the world’s second-largest economy continues to open up its financial sector to allow foreign firms full ownership of their operations there.

Canada’s biggest life insurer is seeking to boost its stake in its joint venture to 100% from the current 49%, Reuters said, a move that would increase its presence in China’s growing funds market. Assets under management in the funds industry in China are expected to grow to $7.8T by 2025 from $3.8T in 2021, consultancy McKinsey projects.

The acceptance of the application by the China Securities Regulatory Commission brings Manulife a step closer to gaining full control of the JV. Though the timing isn’t yet known, an approval could come soon, one of the sources told Reuters.

Meanwhile, I see the recent weakness in MFC’s stock as presenting a good opportunity for long-term income investors. At the current price of $17.52, MFC gives an attractive 5.9% forward dividend yield. This comes with a low 37% payout ratio, an 11.2% 5-year dividend CAGR, and 6 consecutive years of growth.

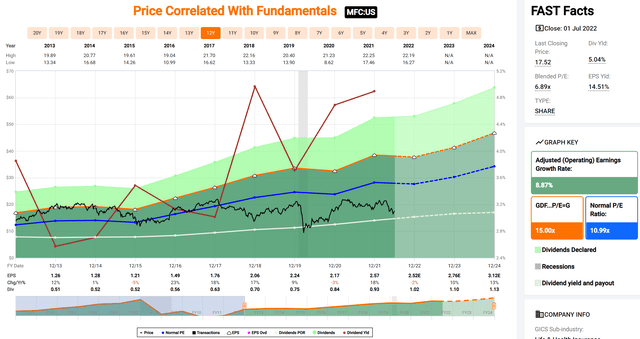

It also carries a blended PE of just 6.9, sitting well below its normal PE of 11.0 over the past decade. Analysts expect low to mid single digit EPS growth in the second half of this year, with a strong uptick to low to mid-teens EPS growth next year. Both Morningstar and sell side analysts have a price target of $22, implying a potential one year 31% total return including dividends.

MFC Valuation (FAST Graphs)

Investor Takeaway

Manulife Financial’s long-term outlook remains strong, with Asia business expected to recover in the second half and potential upside from full control of its Chinese JV. Meanwhile, MFC is seeing robust net asset inflows and has demonstrated strength in its core U.S. and Canada businesses. Income investors looking for a high yield stock that’s trading at a discount may want to consider picking up some MFC shares here.

Be the first to comment