NiseriN/iStock via Getty Images

Any football enthusiast is well versed with the club fondly known to many as Man U. Manchester United plc (NYSE:MANU) is a club that boasts of twenty league titles and 12 FA cups coupled with numerous community shields and league cups. The organization is known for having top-tier footballers, namely David Beckham, Wayne Rooney, Ryan Giggs, Cristiano Ronaldo, Paul Pogba, and many others that have proudly played or are still playing for the team. Sir Alex Fergusson coached the team for over twenty years and led the entity to achieve extensive accolades.

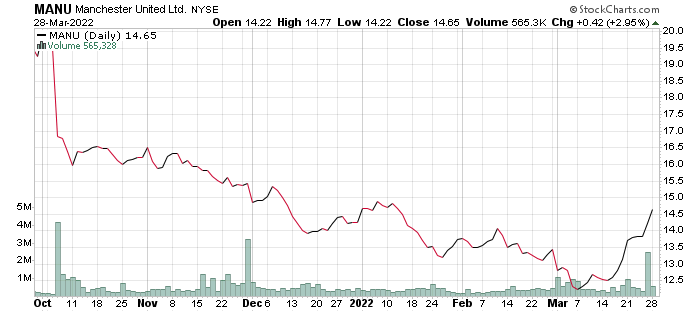

StockCharts.com

Manchester United is reeling from the ramifications of the pandemic on football revenue that primarily led to a substantial increase in debt that could prove detrimental to the club if not mitigated.

Revenue Streams

For most patrons of sports, football is synonymous with wealth. There are numerous sources of revenue for football clubs in the present day. The stadium alone makes considerable money, but caution must be exercised when assessing income from the football ground and the club itself-the football ground rakes in extensive revenue on match days. Match days are categorized into different departments, notably ticket sales and food plus drinks.

Within the Old Trafford stadium, Manchester United is able to charge every person that enters the stadium on game days. The club’s brand visibility is attributed mainly to the high ticket sales. In 2019, the revenue for match days was $141 million; in 2020, the revenue was $111 million; and lastly, in 2021, the revenue from match days was $9.82 million. The steep reduction in matchday revenues is owed to the Covid-19 that halted football for some time, and spectators were not allowed in stadiums.

Another source of revenue for football clubs is broadcasting revenue. Football is a sport that is loved across the globe. It is revered by many, and broadcasting stations are always clamoring to get rights to air football matches, leading to substantial revenue generation for football clubs. In 2019, the broadcasting revenue for Manchester United was $306.32 million. In 2020, the revenue dropped extensively to $173.41 million, and lastly, there was a surge in income in 2021 to $353.37 million.

The drop in broadcasting revenue in 2020 was mainly a result of football being halted due to the spread of the Coronavirus. Order was restored in 2021. Lastly, the other major source of income is through commercials and player transfers. The commercial revenue stood at $349 million in 2019, $345 million in 2020, and $321 million in 2021. For the players, it is mainly through a capital gains context. It involves obtaining players at a specific price, growing and building them to the point of extensive talent such that if the contract expires and the player wants to leave, the club can sell the player at a markup. It is often a bone of contention for players, clubs, and society whereby players are seen as commodities. Still, it is an integral part of football and a significant source of income for most football clubs.

Financial Performance of the Club

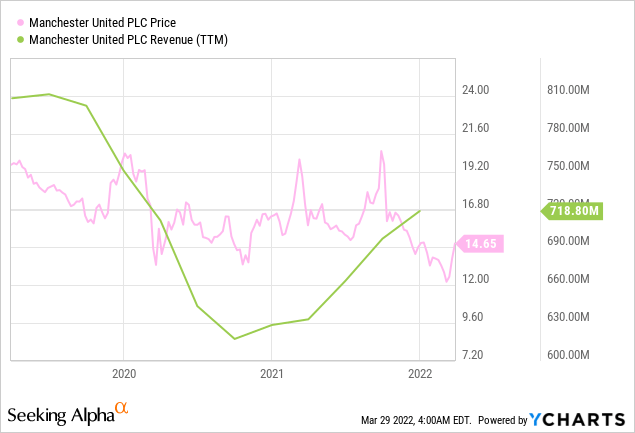

YCharts.com

Manchester United’s revenue for 2021 was $718 million. The revenues increased sharply in 2021 owing to the return to normalcy of most sporting activities, including having matches and spectators during games. The operating experiences are relatively high and stand at $714 million in 2021. The operating expenses are mainly salaries, benefits, and costs tied to maintaining the stadium and having matches.

The net income was a $124 million loss in 2021. The pandemic widened the losses in that fans could not attend matches, and the team could not take part in pre-season tours. The club is still reeling from the effects of the Covid-19 pandemic, and the club is expected to break even by mid-year in 2022. The increase in wages is highly attributable to participation in the Champions League.

Fans returning to the stadiums are highlighted in the organization’s accounts in 2021, raising the revenues substantially by over $140 million. The average match day income per day was roughly $19 million since the stadium’s re-opening grew from $2 million the previous year. There was substantive interest in the club owing to Cristiano Ronaldo’s return, which brought more fans to the club to watch matches. The wages were affected substantially with the signing of Ronaldo, Jadon Sancho, and Raphael Varane, leading to an incline of 23%.

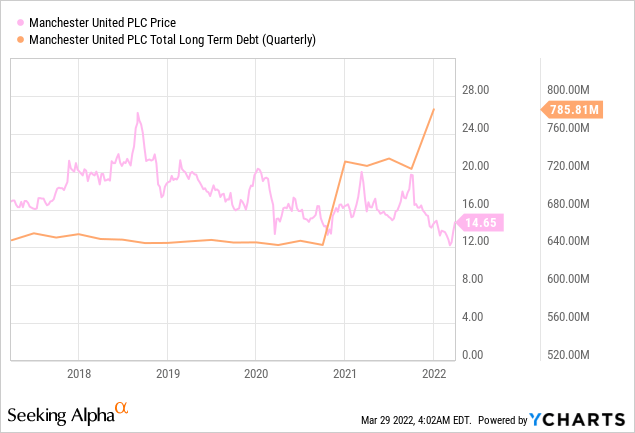

YCharts.com

The long-term debt of the organization was $785 million in 2021. Manchester United is ranked as the third club in the English Premier League with the highest debt. Chelsea takes the top spot with a debt of $1.8 billion. Debt is frowned upon in the English Premier League, as many believe it is due to the increase in foreign ownership of numerous clubs within the league.

The owners are spending large amounts on players, leading to a highly competitive environment that is not sustainable in the long run considering the external shocks that have arisen, such as the pandemic and the war in Ukraine. The surge in foreign ownership has many clubs revamping stadiums and changing strategy, leading to an incline in expenses that is becoming difficult to sustain or meet by revenue generation.

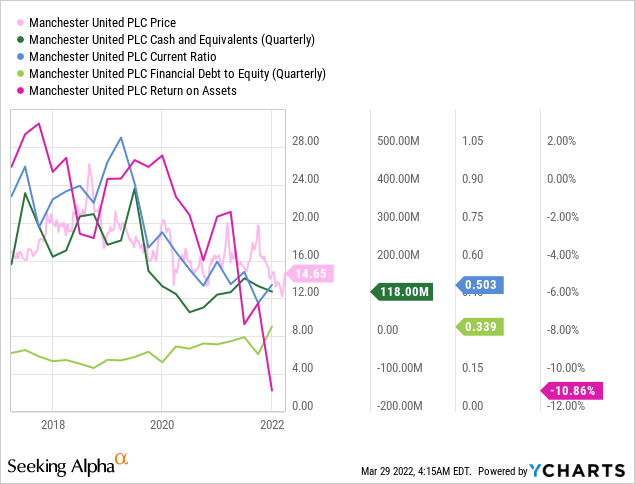

YCharts.com

Cash stood at $118 million in 2021. The cash position was highly attributable to the dip in profits due to the pandemic’s ravaging effects coupled with the fact that there was little or no need for cash with minimal activities taking place. The receivables of the club rose sharply from $33 million in 2019 to $148 million in 2020, which was a challenging year for most organizations in meeting their obligations.

The current ratio is most recently 0.503, which means that the organization can utilize its current assets extensively to generate revenue. The debt to equity ratio is 0.339 in 2021. The debt to equity ratio increases over time, which can prove worrying to shareholders as it indicates a higher level of risk for the organization-the return on assets ROA -10.86% in 2021. Manchester United is not utilizing its assets effectively to generate a considerable return.

Future Outlook

The increase in debt is expected to increase over the 2022 period, but as things return to normal, this has a high probability of falling over time. Manchester United also has experienced an unprecedented period of performing dismally in football. The departure of Sir Alex Fergusson has left a large gap within the coaching front, which has led to numerous shifts in coaches and players. It has consequently led to a dent in the team’s brand value but that has not caused substantial damage, owing to the patronage associated with football clubs.

Fans are also eager to go back to stadiums and watch football; therefore, the revenue for match days and broadcasting fees are expected to increase immensely over the next three years. Revenue and employing pragmatism in player spending are essential to ensure additional revenues and lower debt dependency to sustain the business. Additionally, the club must focus on generating revenue through pre-tours that have proved lucrative in the past.

The future direction of Manchester United plc is directly determined by its ability to convert revenues to profit. Revenues appear to be on the recovery following the pandemic decline, with $720 million reported in 2021, halfway to a complete recovery to the revenue of over $800 million reported in 2019. This room for revenue growth, based on the fact that we know Manchester United plc has historically reported such highs, provides assurance to investors that as the pandemic effects lessen daily, profits should return. With regards to how recent events should affect revenue potentials, I believe that over the medium to long term, any mitigating effects will be largely outweighed by the longstanding position that Manchester United occupies as one of the top European clubs.

The issue of debt, which may look concerning due to its significant rise over the most recent quarters, is also not a massive inhibitor to Manchester United’s growth. With the debt to equity ratio only climbing to 0.339 in 2021, it is still significantly under what is considered worrying for the industry. The very fact that a rise in revenue has accompanied the increase in debt should alleviate investors’ fears that the company may be under too heavy of a debt burden.

While in the coming quarters, it is hard to say whether the debt will return to normal levels, I believe there is strong evidence to support that revenues are highly unlikely to outpace debt growth. There remains significant growth enabled by the recovery, along with further expansion, such as the acquisition of more top players.

With all of these factors taken into consideration, I believe there is ample evidence to support the recovery of the nearly 28% decline in share price since early October last year. As a result, I believe there exists a significant opportunity for investors to begin to build a long position and see growth in their portfolio as Manchester United plc returns to the top of its game.

Be the first to comment