Fox Photos/Hulton Archive via Getty Images

Thesis – Controversy at Manchester United

Historically speaking, Manchester United (NYSE:MANU) is known for its stability and footballing prowess. Off-field football media headlines are usually dominated by clubs with more volatile decision-making frameworks, such as Chelsea Football Club or Real Madrid. However, the media recently turned its attention to Manchester United after Cristiano Ronaldo appeared in an unexpected mid-season television interview hosted by Piers Morgan Uncensored.

Ronaldo is the most widely followed individual on Instagram and is considered a footballing great, thus, sparking tremendous traction. In his interview, Ronaldo revealed his dissatisfaction regarding his playing time and outlined “non-progressive” concerns about the football club.

The latter isn’t a surprise. In fact, many Manchester United legends, such as Garry Neville, have outlined their dissatisfaction with Man United’s ownership, stating that the owners aren’t re-investing adequate capital and time into the football club. In addition, Man United fans have boycotted the Glazers’ (the club’s majority owners) ownership due to their dissatisfaction with the group’s loyalty, prudence, and care.

In a dramatic turn of events, the Glazers are reportedly considering selling the club, which could spark tremendous volatility in Man United’s stock price, led by factors such as M&A price discovery, a belief of a footballing U-turn, and speculation of the club’s new brand identity.

Underlying Issues At The Club

The owners have been at the center of criticism in recent years as Man United fans have grown increasingly impatient with the team’s on-field performance. Whether the fans’ criticism is warranted or not is debatable; however, one thing’s for certain, Manchester United’s on-field performances haven’t been the same since Sir Alex Ferguson retired as the club’s manager a decade ago.

Since Ferguson’s departure, the club has hired an array of high-profile managers, including Louis Van Gaal, Jose Mourinho, and Ralf Ragnick. Moreover, the club has invested in various failed high-profile signings, such as Angel Di Maria, Radamel Falcao, Paul Pogba, and Romelu Lukaku. However, despite the club’s hefty first-team investment, it’s arguably lost its status as a title contender and has spent much of its time out of the Uefa Champions League.

The club’s on-field struggles have unfolded during an era that saw its fierce competitors, Manchester City, and Liverpool, garner exceptional results, rubbing salt into the wounds of Manchester United fans.

The club’s reported lack of investment in holistic infrastructure development has raised concerns. Additionally, many analysts, players, and football pundits have questioned the management hierarchy, leading the club into the abyss.

Will a Glazer Sale and Ronaldo’s Departure Fix Things?

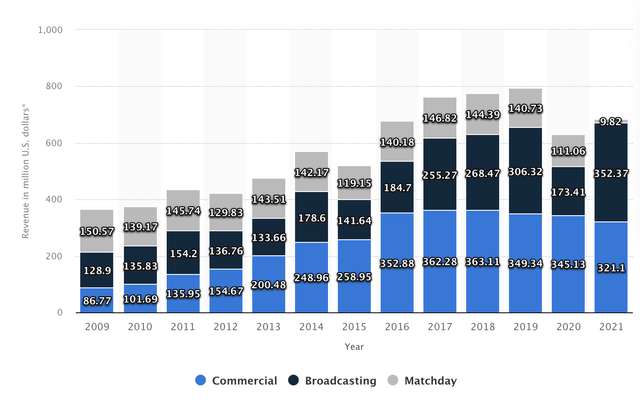

We could pardon the figures in 2020 due to the Covid-19 pandemic’s adverse effect on sporting events. However, the trajectory suggests that the club’s commercial revenue has dropped off significantly in recent years. In our opinion, this is due to lackluster on-field performances because popular player signings haven’t been far and few. Moreover, matchday sales are stagnating, indicating that United is losing its local fanbase to other clubs.

Ronaldo’s departure likely won’t fix commercial and broadcasting revenue, as his presence will probably stun sales. For example, he set a shirt sales record shortly after re-signing for the club in 2021.

Statista

Depending on the new owner’s profile, a Glazer sale could add long-term value to the club. However, this will likely take time as Manchester United needs to fix its on-field performances by once more contesting for the Premier League and reaching the Champions League knockout stages on a recurring basis. In our opinion, linear management structuring could achieve on-field success, and the club’s rich history might subsequently re-ignite supporter attention.

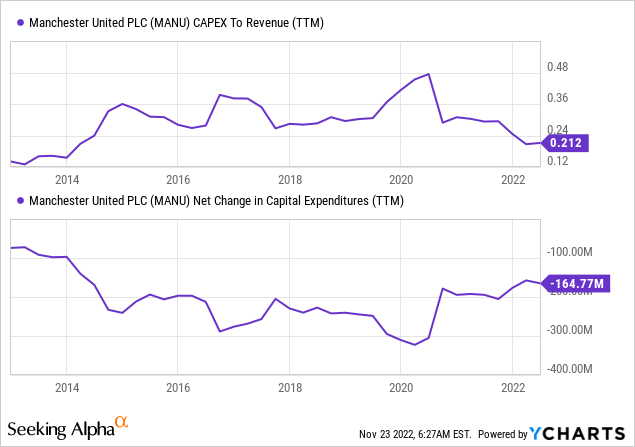

Furthermore, Manchester United will likely need to improve its net CapEx to stimulate business growth, invest in infrastructure, and maintain its stadium. In addition, we believe the club needs to cut its dividend distributions and invest the funds in the business until maturity is reached.

In essence, the club’s long-term value additivity depends on the new owner’s profile. Will it be a financial market speculator such as the Glaziers? Or, will it be a long-term investor such as Chelsea’s Todd Boehly, who broke the club’s transfer spending record in his first season?

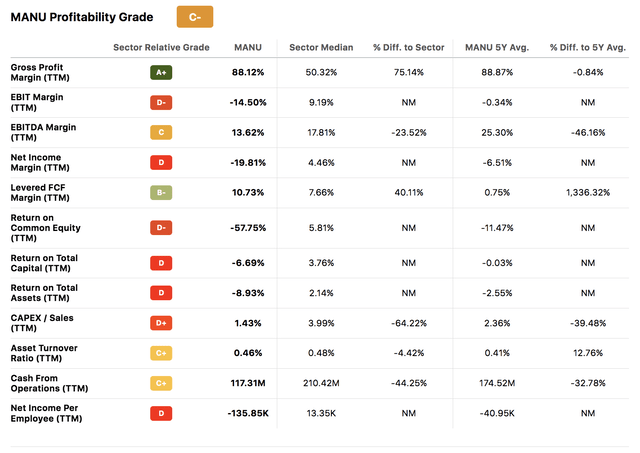

Lastly, we believe shareholder value is in poor shape. The club’s struggling with profitability, suggesting poor income statement management. Additionally, the stock’s trading at 3.43x its sales and 20.77x its cash flow, which we consider overvalued, even for a growth-stage enterprise. Also, Manchester United’s minority shareholder will need a new buyer willing to retire much of the club’s debt as its 5.02x debt/equity ratio implies the club is a liquidity risk.

Seeking Alpha

Concluding Thoughts

Despite the optimism surrounding new ownership and positive thoughts of a post-Ronaldo era, Manchester United’s fate likely rests on the profile of its potential new owners. The club’s receding commercial revenue, debt pile-up, and depleted capital expenditures need to be rejuvenated before minority shareholder value will align.

We retain our hold rating with an indefinite time horizon.

Be the first to comment