Darren415

This article was first released to Systematic Income subscribers and free trials on Aug. 8.

Recession is on the minds of markets and many income investors. Judging from many leading indicators, the economy is clearly slowing down. The last two quarterly GDP prints have come in negative – a common proxy for a recessionary environment. Inflation remains uncomfortably high and way above the Fed’s target. Given the Fed does not have a strong track record of soft landings, it is not a stretch to assume that a recession over the next 12 months is a reasonable base case. In this article, we look at ways different investors respond to shifting market and macro conditions as well as our own approach. The key takeaway is that allocating an income portfolio based on recession forecasts is intuitively appealing but has a lot of operational pitfalls. In our allocation we put much more focus on asset valuations here and now rather than forecasts of macroeconomic activity over the medium term.

Investor Types

It has to be said the question of whether or not we are going to enter a recession doesn’t matter to all investors. We can divide investors into two broad groups – those who, once they found an allocation that works for them, keep that allocation through thick and thin, maybe rebalancing occasionally just to keep the allocation weights the same in percentage terms when asset prices move or making relative value switches if they see something in particular they like. What’s important is that this group of investors does not take its cue from the broader environment.

The second group of investors adapts the allocation profile in response to a changing market and macro picture. It is this latter group that is our focus in this article.

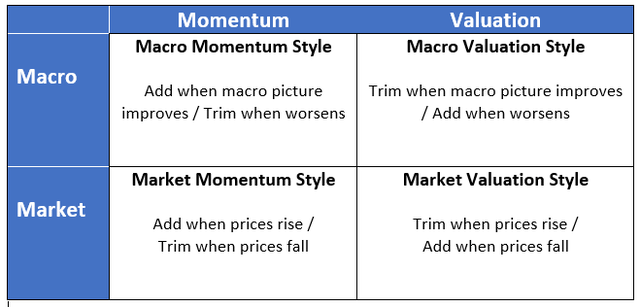

We can break down this second group further into four types based on whether they respond more to markets or macro and whether they act in a pro-cyclical (i.e. momentum) or counter-cyclical (i.e. valuations) way. Obviously, these groups are not mutually exclusive but it’s probably fair to say that most income investors lean to one style more than the others.

Here, we highlight two broad investors groups – the Macro Momentum group which will tend to derisk when they see recession forecasts creep higher and the Market Valuation group which aligns more strongly with our own allocation style.

Investors who reduce their allocations / cut the risk profile of their portfolio in response to a worsening macro outlook fit into the Macro Momentum allocation style. “Macro”, because they move in response to changes in macroeconomic activity and outlook. And “Momentum” because their profile direction reflects the direction of the macroeconomic cycle, i.e. the risk profile of the portfolio is typically the highest when the macroeconomic environment is at its peak as well. In short, these investors will tend to reduce risk exposure as they see recession estimates creep higher. They will also tend to have the lowest risk exposure at the trough in macroeconomic activity. This is a very intuitive way to allocate an income portfolio but as we discuss below it has a lot of challenges which are likely to lead to disappointing results.

Our own favored allocation profile is a different one – the one called Market Valuation. Specifically, we put a lot more weight on today’s market valuations or compensation for taking exposure to given assets. And we increase the risk level of the portfolio as valuations improve i.e. as prices fall and vice-versa. Although this may seem like “market-timing” it’s nothing more than a value-based approach to investing.

In the section below we discuss some of the reasons why we are skeptical of the Macro Momentum allocation style.

Thoughts On Recession

In this section, we highlight some of the reasons why we don’t allocate primarily based on a macro forecast or why we don’t make a lot of changes to our Income Portfolios in expectation of specific macro developments. Specifically, we highlight why we don’t like to derisk portfolios in light of rising recession indicators.

First, as most investors are well aware, markets are forward-looking. This means that asset prices will tend to anticipate and price in macroeconomic developments that occur only later.

The following chart is a good example of that dynamic. During the COVID shock in 2020, the S&P 500 fell well before corporate earnings, and even earnings forecasts, fell and bounced sharply by the time earnings forecasts troughed. In short, having maximum risk exposure when macroeconomic indicators are flashing green and having the lowest risk exposure when macro activity is in a trough will translate into buying high and selling low for the simple reason that market stay well ahead of the economy.

NB

Two, as markets cheapen, they start pricing in a significant amount of margin of safety. For example, the recent peak in corporate bond yields of around 9% means that yields could continue to rise by a further 2.25% per year without investors losing money (using a duration of 4). The combination of the current low default-rate environment with the fact that in the post-GFC period corporate yields have not risen much more above 11% offered a decent margin of safety for adding credit exposure – much more than it would have been at the macro peak in 2021 when it was closer to 1%.

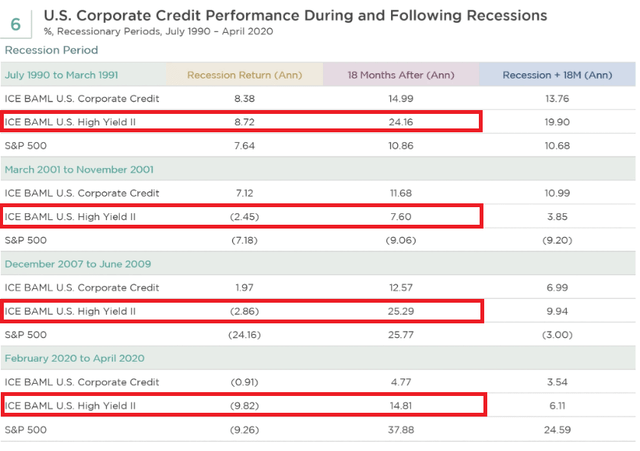

Three, as we have highlighted before, asset returns are actually OK over recessions on average. This dynamic is related to the two factors discussed above which help risky assets perform well over recessionary periods.

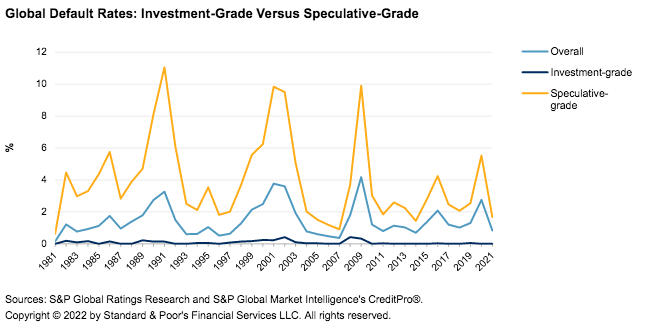

Four, valuations often overshoot eventual outcomes. For example, high-yield corporate bond default rates tend to peak around 10%, meaning annual peak losses tend to peak at around 6% (a conservative estimate as it assumes prices quickly move from par to the recovery amount). In the last few months, corporate credit yields have been trading in the range of 7-9% – clearly well above the 6% peak loss number.

S&P

Five, there is a kind of intuition that many investors have that risk increases in recessions. And, on the one hand that seems obviously correct. Recessions feel riskier because people lose their jobs, spending goes down, corporate earnings fall, companies go out of business and markets become much more volatile. However, it is also important to point out that the investment universe very much remains the same.

In other words, investors who hold corporate credit exposure in a strong macro environment also fully carry the risk of an unexpected downturn as well. The only real difference is in the compensation for carrying that exposure which is generally much larger in an environment where a recession seems likely and much lower in an environment when a recession seems unlikely. Investors who think they can gracefully sidestep every macro downturn will tend to overtrade as they will be spooked by every blip in markets, resulting in poor returns.

Stance and Takeaways

As this article suggests we have been adding exposure through the drawdown this year, particularly, once credit spreads joined interest rates in their move higher. Specifically, we have been rotating from some of our drier-powder holdings which have held up quite well year-to-date into higher-yielding assets.

We don’t have a particularly strong view on when or if the economy will enter an official recession. While we don’t ignore the status of macro indicators, our focus lies primarily in the compensation that investors receive across various types of assets. This allowed us to derisk somewhat in 2021, particularly by lightening our Portfolio exposure to CEFs, as the compensation for taking risk via CEFs was not particularly attractive.

We also try to ensure we carry some diversification across the main types of risks facing income investors: credit and duration. Specifically, we hold securities across the quality spectrum. We also see value in having exposure to duration assets, those with shorter-maturities as well as floating-rate assets.

Below we highlight some of the securities where we continue to see value. These range across a spectrum of both credit quality as well as duration profile, in large part, because the current environment is relatively unusual among those leading into potential downturns, creating significant uncertainty as to the price path of various assets over the medium term.

Specifically, valuations have adjusted somewhat already which makes higher-yielding assets more attractive than they would otherwise be. Two, Treasury yields are high which makes duration exposure reasonably well compensated. Three, both floating-rate and fixed-rate securities have significant advantages to deserve a place in a portfolio given the likely continued increase in short-term rates as well as the potential fall in longer-term rates in a risk-off environment.

In the higher-quality / duration bucket, we continue to hold the Nuveen Municipal Credit Income Fund (NZF), trading at a 5.1% yield and 5% discount as well as the Cohen & Steers Tax-Advantaged Preferred Securities & Income Fund (PTA), trading at a 7.7% yield and 8.5% discount. These funds should hold up relatively well due to their decent-quality holding profiles and a margin-of-safety valuation.

For floating-rate asset exposure we like the BDC Golub Capital (GBDC), trading at a 8.5% yield. GBDC has a higher-quality focus in the BDC space and has outperformed over Q2 with a positive total NAV return. Its net income also increased over Q2 due to the rise in short-term rates and should continue to do so over the next year which may lead to a dividend hike down the line.

The Western Asset Mortgage Opportunity Fund (DMO) also holds primarily floating-rate assets and will continue to benefit from the Fed. It also offers some diversification to corporate credit heavy income portfolios via exposure to residential household credit risk.

Overall, our view is that, while we are not chasing the current rally, we are taking advantage of valuations that remain much more attractive than they were in 2021. At the same time we maintain a reserve of what we call, drier-powder assets, which can be further deployed into new opportunities if markets do take a turn for the worse.

Be the first to comment