photovs/iStock via Getty Images

Main Street Capital Corporation (NYSE:MAIN) is a best-in-class business development company with a unique portfolio of debt and equity investments. Unlike many competitors, MAIN places a focus on equity investments alongside their traditional debt portfolio. Today, we are going to review the business and explore two recent investments.

Who is Main Street Capital?

Main Street Capital is a specialty finance firm that provides consolidated financing to private businesses across the country. These businesses are generally small, with annual revenue between $10 million and $150 million. This segment is more commonly known as the middle market, the heart of the American economy. BDCs operate under a unique and complex tax structure to REITs. Companies like MAIN must distribute 90% of their taxable income to shareholders as a dividend. If they meet these criteria, these businesses are exempt from corporate level taxes. BDCs have somewhat replaced the regional banks as the securitized loan concept provides a better environment for middle market loans.

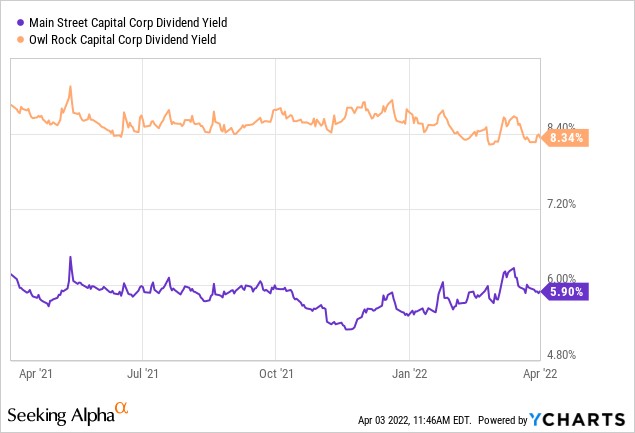

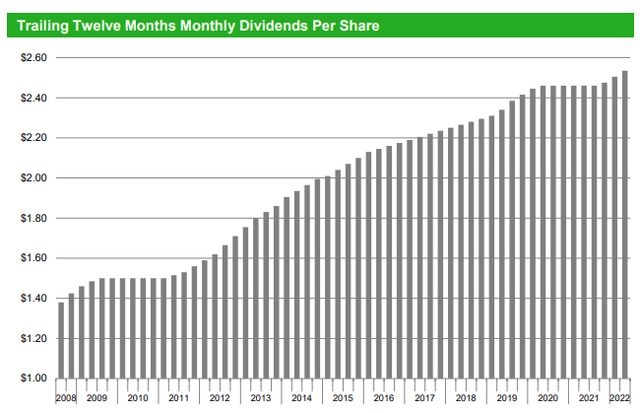

Loans made to target businesses are generally high yield with floating rates, ideal for a rising rate environment such as today. These high yield loans combined with the strict distribution requirements of BDCs often translates to impressive dividends for shareholders. MAIN currently pays a regular dividend of $0.215 per share per month, which corresponds to a current yield of around 6%. These regular dividends are supplemented by periodic special distributions which are generated through exiting equity investments. One notable benefit of MAIN has been the firm’s rising distribution. More often than not, BDCs see their income fall over time as a result of non-performing loans. In contrast, MAIN’s regular dividend has nearly doubled over the firm’s life.

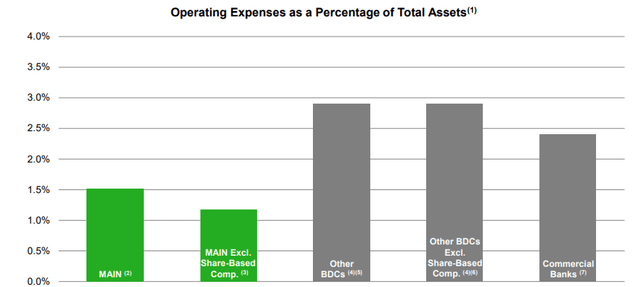

MAIN was founded in 2007, shortly before the Great Financial Crisis. Luckily, the firm survived and today trades at an equity market cap of $3.05 billion. MAIN is an internally managed business which is beneficial to shareholders through a stronger alignment of interest between management and investors. While many smaller BDCs must use an external management format because they lack the scale to operate as an independent company, MAIN is far beyond this issue. Today, the business is one of the most efficient in the segment.

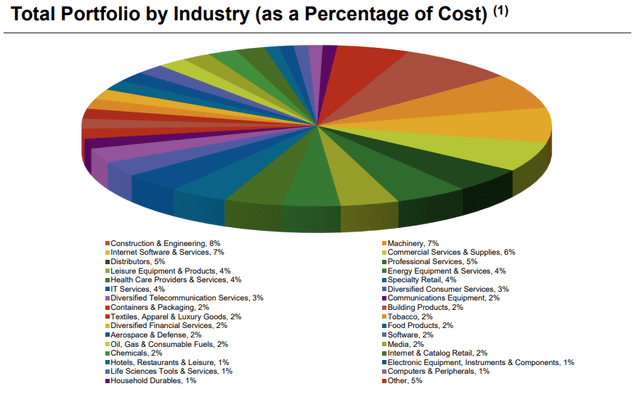

Over the life of the firm, MAIN has assembled a strong portfolio that is thoroughly diversified across industries and geographies. MAIN has invested in nearly two hundred businesses across the United States providing debt and equity packages to facilitate growth, recapitalizations, or buyouts. Most of the portfolio are in classic, recession resistant industries such as Construction & Engineering (8%) and Internet Services (7%).

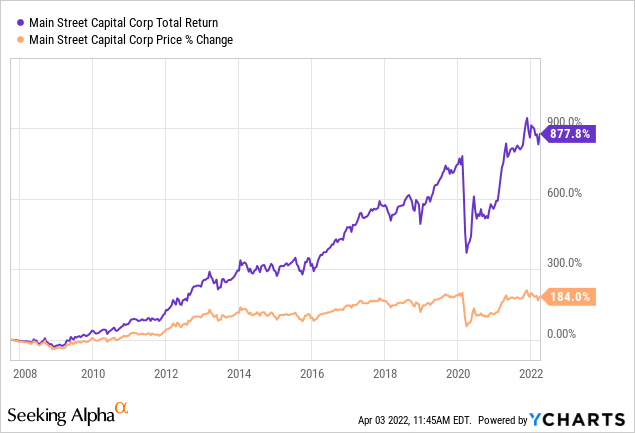

The portfolio has proven durable with a history of strong performance over the past fifteen years. The fund has survived multiple economic cycles as management has navigated stormy seas. Today, the firm is differentiated on the basis of impressive long term growth and performance. MAIN has been an innovator in growing private equity investments to the public BDC space. While many BDCs operate portfolios of loans which are relatively simple, MAIN has embarked on a path of impressive long term growth as management operates and grows their target businesses. As the portfolio has grown, the benefit has been immense to shareholders as share prices grow.

A fundamental component of this growth is the firm’s ability to consistently identify and act on new investment opportunities. Expanding the portfolio on a continuous basis man is able to grow through two main areas. The first being internal growth of portfolio companies as their earnings grow in their market shares expand. The second the firm’s ability to source new capital at subsequently place it into investment opportunities. Today we are going to focus on the second category.

New Investments

The past two years have been an extraordinary tumultuous time for investors. Facing unprecedented and unforeseen risk factors including a global pandemic, highest inflation in generations, and the largest land invasion in decades, it comes as no surprise that volatility has remained sharply elevated. Since the beginning of the pandemic, MAIN has been relatively quiet in terms of their investment activity. The firm has continued moving along servicing portfolio companies and expanding their ongoing relationships. This has provided consistent and stable growth for the company which has benefited shareholders. However, for most of this period, the business has been relatively quiet in terms of identifying and executing new investments.

However, the tides have recently begun to change. The first quarter marked a notable return of MAIN’s investment activity, with several opportunities being executed on. In just the past month, man has announced two investment opportunities which are sizable and will contribute meaningfully to the growth of the portfolio. Growth is always exciting, has new opportunity always breeds optimism among investors. However, it’s important to consistently analyze ongoing activity and ensure that this growth is consistent with the goals of the business. While venture investing is certainly exciting and seeks out high growth opportunities that can provide a strong multiple on invested capital, the strategy is inconsistent with MAIN’s investment objectives. Seeking consistent income which can be distributed to shareholders, the company needs to find businesses which are established, dominate their market, and still offer room to meaningfully grow. Now, let’s take a look at the firm’s two most recent investments and see if they made this criteria.

Batjer & Associates

On March 15th, the company announced the majority recapitalization of a leading mechanical HVAC and plumbing company based in West Texas. MAIN helped facilitate a recap of the firm, providing a $15 million investment comprised of a combination of senior secured debt and equity.

Main Street, along with its co-investor, partnered with the Company’s existing owners and senior management team to facilitate the transaction, with Main Street funding $15.1 million in a combination of first lien, senior secured term debt and a direct equity investment. In addition, Main Street and its co-investor are providing the Company with a revolving credit facility and delayed draw term loan to support its working capital needs and future growth initiatives.

Founded in 1947 and headquartered in Abilene, Texas, Batjer (www.batjerandassociates.com) is a leading provider of mechanical HVAC and plumbing contracting services, including installation, renovation, repair and replacement services for commercial and residential applications. Over Batjer’s 75-year history serving West Texas, the Company has built longstanding relationships with top tier regional contactors, municipalities and local businesses, establishing Batjer as the premier HVAC mechanical contractor within the region.

While certainly not intimately familiar with this business, some diligence into the company will show that they are an established operator in their regional market. The firm has completed projects over its 65 year history that include universities, schools, medical centers, and military installations. The nature of this business is often essential especially in an extreme climate such as West Texas. The business is inherently recession resistant and inflation resistance meaning certain risk factors which are elevated today are well protected against. I’d like to take a look back at our three criteria and review. First, the firm is well established operating long enough to collect retirement benefits. Second, the firm is a meaningful player in their respective market completing projects across both the public and private sector. Finally, the firm maintains room to grow as ongoing growth and development continuously produces in need for HVAC and utility services. The investment and the target company are both consistent with MAIN’s core strategy.

Jorgensen Laboratories, LLC

On March 31st, MAIN Street announced a $36 million investment in Jorgensen Laboratories or “JorVet”. The company is a leading supplier of vet equipment. MAIN provided an investment to help recapitalize the business including a term loan and a minority equity investment.

Main Street, along with its co-investor, partnered with the Company’s existing owners and management team to facilitate the transaction, with Main Street funding $36.4 million in a combination of first lien term debt and a direct minority equity investment.

Founded in 1965 and headquartered in Loveland, Colorado, JorVet (www.jorvet.com) provides an extensive selection of veterinary medical equipment and supplies to veterinary practices, veterinary hospitals and universities across North America through a network of veterinary-specific distributors. Building on over 55 years of experience in the veterinary space, the Company, which markets both third-party products and a wide variety of products under the Company’s JorVet brand, offers an unmatched product catalog of over 7,000 SKUs to meet the varying needs of its veterinarian end customer base.

JorVet is a ubiquitous name among the veterinary community. The business is small, employing only 40 people, but their supplier network is vast, working with over 40 international distributors. The firm provides medical equipment including instruments and sanitation equipment. The business is family owned and operated with the Jorgensen name across the management team.

The veterinary business has historically proven to be a durable industry and people are generally unwilling to sacrifice the care of their pets. Throughout economic cycles, the business has been extremely reliable with relatively few years of variation along the way. Once again, let’s look back to our three criteria and see how this investment performs. First, the business was founded in 1965 just like investment number one. Once again, the box has been checked. Second, the business is well established with a strong network of distributors which helps the firm supply the greater market. The firm does not face concentration risk as their general sales network is well diversified. Finally, the firm has room to grow with substantial upside remaining especially as Americans increase their adoption of pets over the past two years.

We feel these recent investments are consistent with MAIN’s goals and history. The business remains on track and management continues to identify and execute on new opportunities expanding the portfolio.

Conclusion

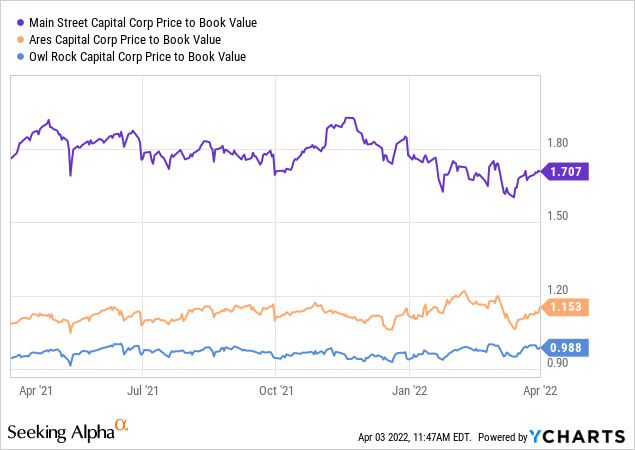

MAIN is one of few strong BDCs. The sector offers generous yield, but generally at the expense of portfolio quality and risk. In contrast, MAIN is investment grade rated, providing a sense of optimism around the fundamental strengths of the balance sheet. It also provides MAIN an advantage of accessing the capital markets efficiently. With an IG rating, MAIN can raise cheap debt and redeploy with generous spreads. However, I am pointing out the obvious here as MAIN has established itself over a long period. As a result, the firm has an expensive valuation.

The firm trades at an expensive price to book multiple, creating some risk should the valuation normalize. While this risk seems too large to ignore, it’s difficult to quantity. An important point of MAIN’s strategy is the private equity component. Private businesses are notoriously difficult to value, as there are no like kind transactions. At the end of the day, it’s impossible to truly value MAIN’s equity investments. This means that accurately understanding what the firm’s net asset value or book value looks like is difficult, if not impossible. The risk certainly still exists, as share prices are free to climb and fall based on investor sentiment. That said, MAIN’s valuation presents a unique benefit to the firm. MAIN’s Ability to issue new equity is enhanced by the premium to book value.

There is a misconception around MAIN that the yield is lower than competitors due to the equity component. This is somewhat true, as the equity investments do not provide the same dependable income as interest payments. However, MAIN’s valuation also plays a substantial role in MAIN’s lower dividend yield. MAIN’s yield on NAV is 10.2%, meaning if shareholders could purchase at NAV, their yield would be much close to other competitors such as Owl Rock Capital (ORCC).

Receiving a 5.6% yield when the portfolio is generating 10% is a tough pill to swallow. Investors are paying a premium price for a premium business. That topic will be explored in depth in another article. Even still, we cannot argue with MAIN’s success as the firm continues to remain on course. MAIN stays a buy in our book. With investment activity ramping back up, the business is on track to remain an all star in its segment.

Be the first to comment