PonyWang

Magnachip Semiconductor Corporation (NYSE:MX) is a relatively minor player with lots of assets and opportunities that minimize and leave us bullish.

All ten Seeking Alpha analysts covering MX over the past 18 months recommend a buy or strong buy. Few Wall Street analysts cover the stock but they, too, see potential opportunity in owning the shares. We have the average price target potentially at $22; that represents a 44.17% upside from the current price of $15.26. Others see a 64% upside with an average price target of $25. The stock hit a 52-week low of $13.04 just 26 days ago. Shares are down almost 26% for the year.

Seeking Alpha’s Quant Rating improved in July and contributes to our bullish position:

Quant Rating Changes (seekingalpha.com/symbol/MX/ratings/quant-ratings)

The Company and Industry

Magnachip Semiconductor Corporation designs, manufactures, and supplies analog and mixed-signal semiconductor platforms and display solutions for communications, consumer, industrial, and automotive applications since 2004; i.e., everything Internet. The company’s own sales force sells metal oxide semiconductor field-effect transistors, insulated-gate bipolar transistors, AC-DC converters, DC-DC converters, LED drivers, regulators, and power management integrated circuits for appliances and electronic devices internationally.

The semiconductor industry is essential to national economic growth and national defense. You can read other articles we wrote about semiconductor companies here and here.

Cold Environment

Beware, there are risks in owning MX shares. MX has a small $685M market cap, while the market caps of news-making competitors are in the billions. MX is a lightly traded stock averaging 523K shares traded daily. The stock and the company do not get much press and draw limited investor interest.

MX hovered in the $15-$16 range most of the year. MX price moves, up and down, were linked to earnings reports and takeover rumors. Otherwise, the share price was laggard.

Trading volume is used by investors to identify trends and contributes to their buy and sell decisions. Caveats from Seeking Alpha warn that

Stocks with low volumes can be difficult to sell because there may be little buying interest. Additionally, low-volume stocks can be quite volatile because the spread between the ask and bid price tends to be wider. Stocks with a high volume and a rising price are generally easier to sell at a desirable price.

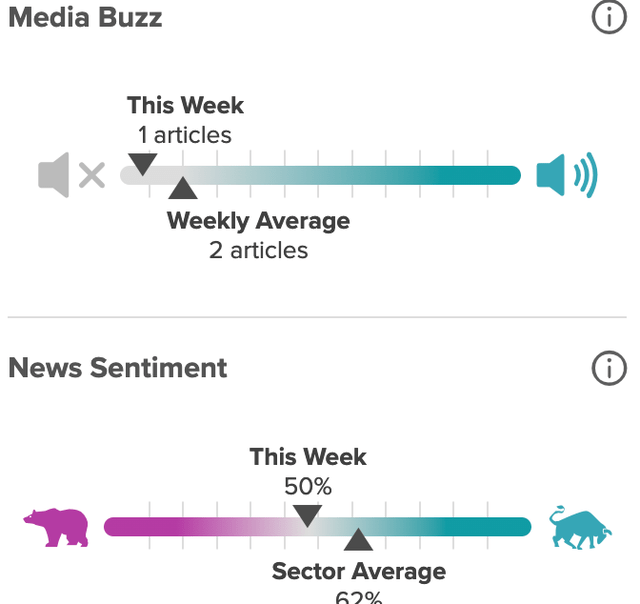

Few articles appear in the financial media about MX unless from a press release and takeover talk. On average, MX gets one article per week The outlets’ lists of best buy semiconductor industry stocks do not include the company. It is too small, does not make markets, or has enough followers.

Articles and News Sentiment (tipranks.com/stocks/mx/stock-news)

Hedge funds decreased their holdings by ~320K shares last quarter; their action contributes to the dive in price from $19.95 at the start of June. Insiders reportedly sold 60K shares and bought about 25.5K shares over the last 18 months. We do not get a full picture of corporate insider trades because the company is based in Luxembourg.

Another risk to buying stock in a small Luxembourg company is the headwinds of support it faces from behemoths in the world’s biggest economies. The U S government is planning to invest $52B primarily in semiconductor chip R&D to invigorate U S-based chip manufacturing. China has a $150B investment in their domestic production. Taiwan leads in innovative chip development.

Opportunities

On a positive note for retail investors, the European Union is easing funding rules for public and private investment to build innovative semiconductor facilities. They see the need to boost their own chip industry to enhance and sustain other manufacturing sectors. More than €43 billion will be broadly matched by long-term private investment via the core of the Chip Act. The goals of the Act and the money boosts companies like Magnachip that have been at a disadvantage where other nations are subsidizing their industry.

The EU is easing funding rules for public and private investment to build innovative semiconductor facilities to boost its chip industry. More than €43 billion which will be broadly matched by long-term private investment are the core of the Chip Act. The goals of the Act and the money puts companies like European Magnachip somewhat at a disadvantage when other nations are subsidizing the industry now.

the low trade volume leaves the stock non-volatile. The Beta is 0.29. The company diligently maintains its business operations in the semiconductor chip rather than software fields. According to the Worldwide Semiconductor Technology and Supply Chain Intelligence service, global semiconductor revenue is expected to reach $661 billion in 2022; that implies 13.7% year-over-year growth. 2021 revenues reached $582 billion.

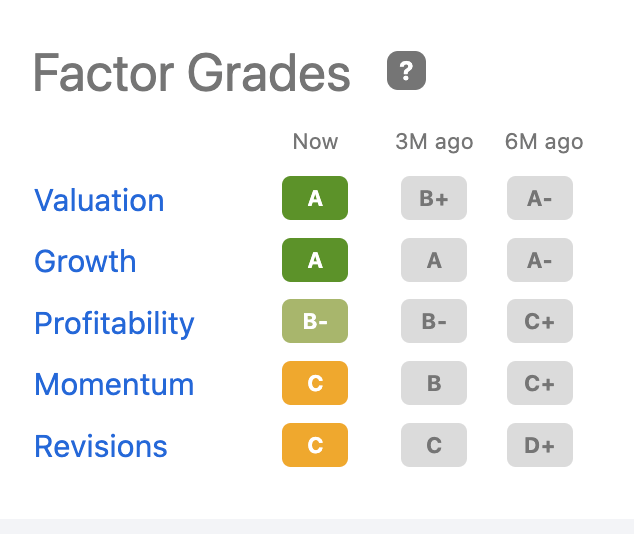

Magnachip gets from Seeking Alpha an A grade for valuation, A for growth, and B- for profitability up from C+ six months before.

Factor Grades MX (seekingalpha.com/symbol/MX)

Short interest is a healthy 3.3% and the PE is +19. In May, ’22, Magnachip beat EPS estimates by four cents but missed on revenue (-15.4% Y/Y). Supply chain issues persist. In March 2022, Deloitte Thailand claimed that “customers waiting as long as 20-52 weeks for various types of semiconductors.”

Magnachip confirmed Deloitte’s assessment cautioning in its Q1 report that supply chain challenges persist. Our projected earnings per share are 18 cents for the second quarter compared to $0.15 EPS in the same quarter last year. The next financial report is scheduled for August 7, ’22.

Several fresh developments present potential opportunities to investors. In May, the company announced a milestone by surpassing 730 million units in cumulative shipments of organic light-emitting diode display driver integrated circuits (OLED DDICs) as of the end of Q1. The company is focusing future efforts on the global solar energy market after unveiling a new 650V insulated gate. Magnachip introduced in July a new 24V MOSFET for wireless earphone batteries to better protect circuits. These innovations emanate from its South Korean facilities.

Another opportunity presented itself to MX shareholders earlier in the year. South Korea’s LX Group approached Magnachip about taking over Magnachip. The stock popped 17% on the news in one day. Offers and counter offer ensued.

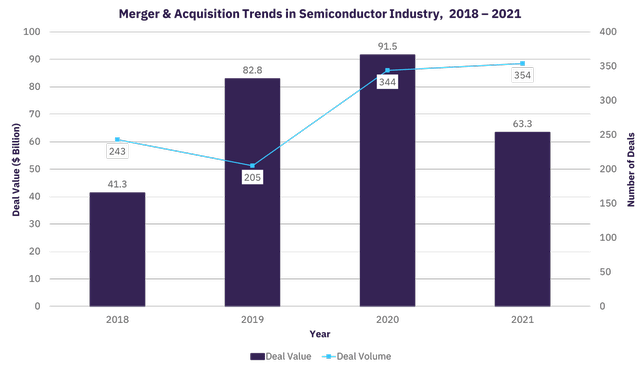

In June MX dived from $19.95 to $13.76. Investors remain hopeful a deal will close. The industry is rife with M&A activity, especially targeting smaller companies. It is now a trend in the industry and investors might want to jump aboard this ship.

M&A Trends (globaldata.com/data-insights/semiconductors/changing-landscape-of-the-semiconductor-industry/)

Takeaway

Magnachip Semiconductor is attractive to industry behemoths because the company is relatively small (~$440M in revenue in FY ’22) but innovative and profitable. But supply chain issues persist slicing revenue. Inflation is a threat to maintaining the healthy 34.7% gross profit margin and 16.2% net income margin. Magnachip’s innocuous debt of $3.8M is well offset by the $285M it holds in cash and equivalents. Having institutions, insiders, and hedge funds controlling ~73% of the shares, we believe, will spark a sale per a good enough offer. Apparently, the question is no longer when a sale will happen but for how much.

Be the first to comment