DarioGaona

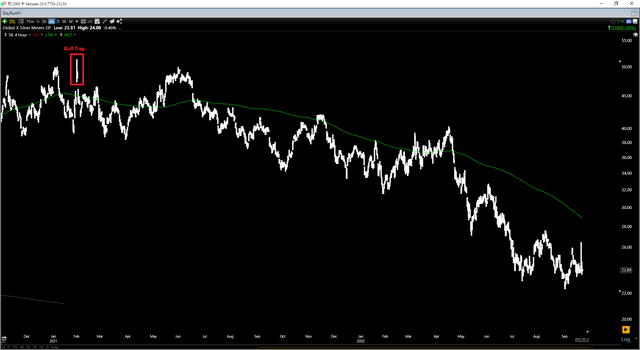

It’s been a tough year thus far for the Silver Miners Index (SIL), with several producers seeing their margins pinched from a combination of inflationary pressures and a lower silver price. This margin compression was not surprising in the slightest and was one reason to underweight or avoid silver producers, given that they were up against very difficult year-over-year comps, lapping an attempted silver squeeze last year, which sent the price north of $29.50/oz, and trapped many investors that chose to chase gaps higher in silver stocks.

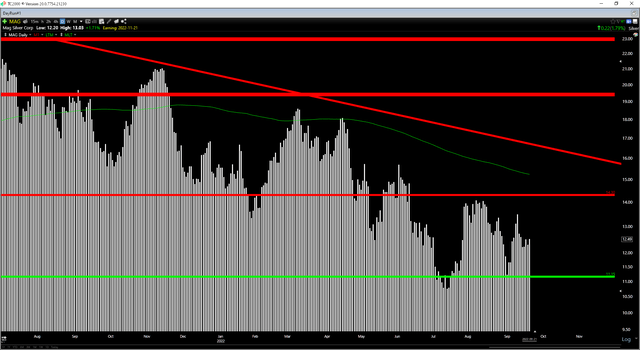

Silver Miners Index (TC2000.com)

Unfortunately, the sharp decline in the silver price has left some producers like Endeavour Silver (EXK) producing the commodity at a negative margin, and we’ve also seen accelerated share dilution for some names with questionable acquisitions like Pitarilla, Roxgold, Mercedes, Homestake Ridge, and El Cubo, among others. This is similar to what we saw in the last cycle for gold miners. However, the difference is that this time around, the gold producers have been conservative. In contrast, many silver miners haven’t hesitated to acquire either mediocre projects or pay up for projects in the wrong portion of the cycle.

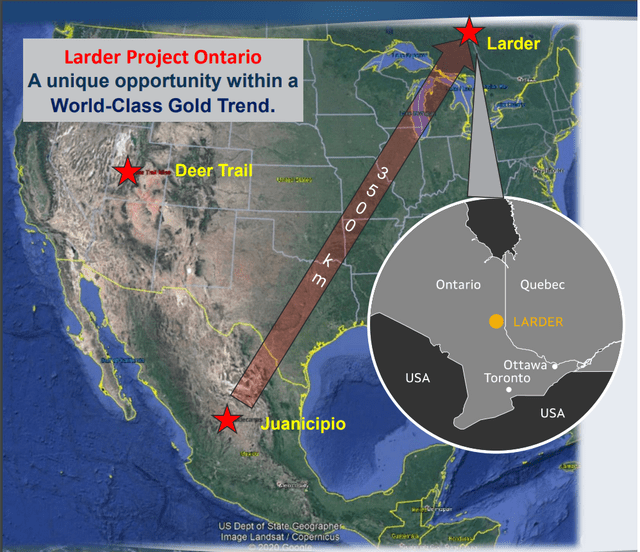

That said, there have been a couple of exceptions. One was Hecla’s (HL) acquisition of Alexco, and another was MAG Silver’s (NYSE:MAG) acquisition of Gatling. In the latter case, MAG Silver took advantage of a management team that hasn’t created any shareholder value at Bonterra or Gatling, scooping up a million-ounce project in the Abitibi region for less than $20 million. This has given MAG a third asset in its portfolio, and with Fresnillo (OTCPK:FNLPF) doing the heavy lifting at Juanicipio, MAG is in a position to explore for a potential second mine with zero share dilution. Given this low-risk business model, I would expect dips below $11.75 on MAG to present buying opportunities.

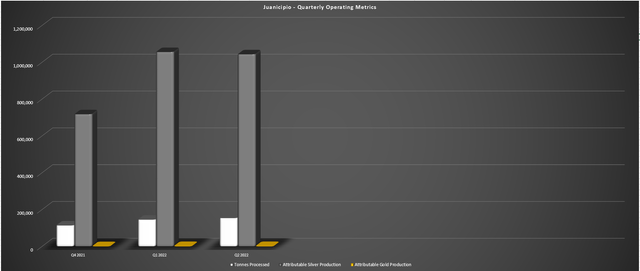

Juanicipio Operations (Company Presentation)

Q2 Results

MAG Silver released its Q2 results in August, reporting that a record amount of material from its shared (44% / 56%) Juanicipio Mine was processed through Fresnillo’s Saucito and Fresnillo plants, with tonnes processed coming in at ~154,100, up 6% on a sequential basis. This translated to the total production of ~2.21 million payable silver ounces and ~5,100 payable gold ounces, resulting in attributable production to MAG Silver of ~1.04 million ounces of silver and ~2,470 ounces of gold.

Juanicipio – Quarterly Operating Metrics (Company Filings, Author’s Chart)

The major news, though, was that the tie-in to the national power grid, which was more than six months delayed, was finally on the horizon, with Fresnillo reporting that it continued to expect a ramp-up to 85-90% of nameplate capacity by year-end. For those unfamiliar, the news of a delayed tie-in was what hurt MAG Silver’s share price earlier this year because while MAG was fortunate to benefit from idle capacity at Fresnillo’s plants nearby, Juanicipio wasn’t operating at anywhere near its true potential. The reason is that the current quarterly processing rate was well below the expected 350,000+ tonne processing rate once at nameplate capacity (4,000 tonnes per day).

Just last week, we received news that all construction related to the final tie-in to the electrical grid had been completed, and all systems were ready to be energized. However, the CEF requested additional testing to verify the compatibility of the new substation equipment installed by Juanicipio and the older state-owned electricity regulator’s infrastructure. This process isn’t expected to last long, with commissioning planned within the next six weeks, with a ramp-up in Q4 to well over 3,000 tonnes per day. The update is great news for MAG Silver, which can now expect the 2023 production profile at Juanicipio (MAG holds 44% interest) to come closer to mirroring the mine plan (~24 million silver-equivalent ounces in the first six years).

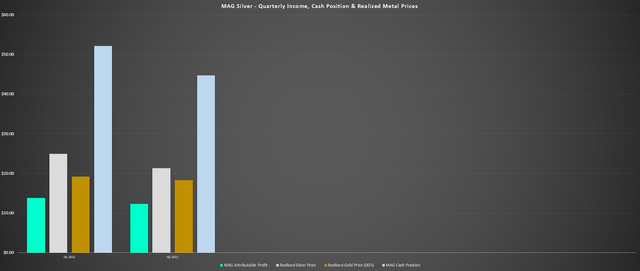

Juanicipio – Quarterly Income, Cash Position & Realized Metals Prices (Company Filings, Author’s Chart)

The good news is that while MAG Silver has awaited this tie-in and the ramp up to a more significant production rate, the company has been keeping busy and generating cash, with an income of $26.1 million year-to-date, despite the pullback in silver prices that impacted Q2 pricing ($21.32/oz realized price). This has allowed the company to maintain a strong balance sheet with over $44 million in cash, allowing MAG to fund any commitments at Juanicipio and, just as importantly, funnel money towards its two exploration projects: Deer Trail in Utah and its new Larder Project in the Abitibi Region of Ontario.

Some investors might be a little spooked by investing in anything with the name silver in it, which is understandable when the silver price has suffered a more than 30% decline from its 2021 highs at the same time as inflationary pressures have worsened, pushing costs higher. That said, MAG Silver has two key differentiators. The first is that Fresnillo is the operator at Juanicipio, meaning that it is doing the heavy lifting while MAG Silver can maintain a very tight employee base and keep G&A low. The other is that Juanicipio is one of the highest-margin mines globally, with all-in-sustaining costs likely to come in below $6.50/oz even after accounting for inflationary pressures.

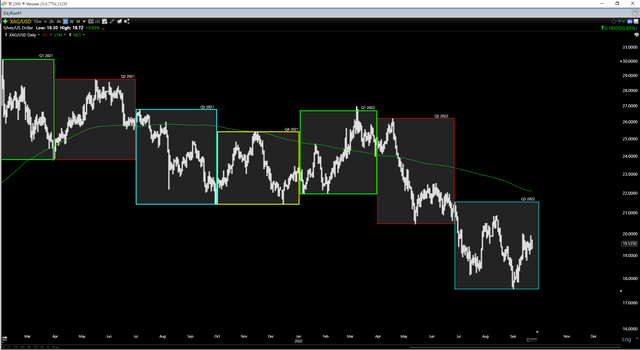

Silver Futures Price (TC2000.com)

This means that even at a $19.00/oz silver price, which I would argue to be quite conservative, the project is still generating an AISC margin of ~$12.00/oz, well above the industry average AISC margin of $3.00/oz at these silver prices. Hence, while there is some risk that a few mines could be temporarily suspended if the silver price remains below $19.00/oz for an extended period, Juanicipio is not one of these mines. In fact, it can easily handle a cyclical bear market in silver, and even a more extended secular bear market, if this did come to pass.

Larder Project

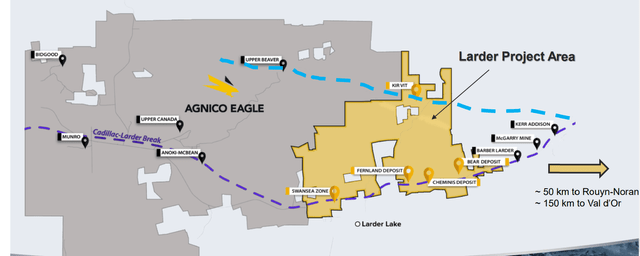

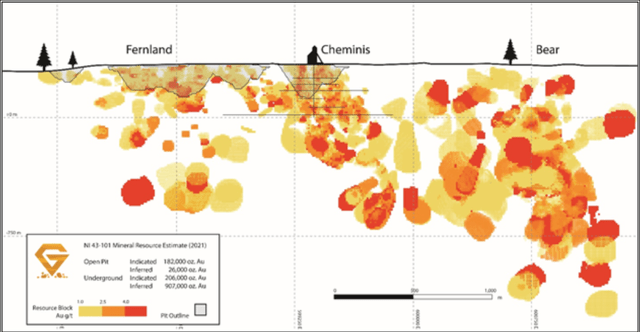

The good news is that MAG Silver isn’t resting on its laurels with Juanicipio finally bearing fruit and has added another project to its portfolio through the acquisition of Gatling: Larder. This project lies east of Agnico Eagle’s (AEM) massive land package in the Kirkland Lake Camp and is home to over 1.2 million ounces of gold across multiple deposits (Fernland, Cheminis, Bear). The ~3,300-hectare land package lies on the Cadillac-Larder Break, which runs through Agnico and MAG’s properties (previously Gatling Exploration), but drilling has been focused on mineralization above 500-meter vertical depths.

Larder Project Area (MAG Silver Presentation)

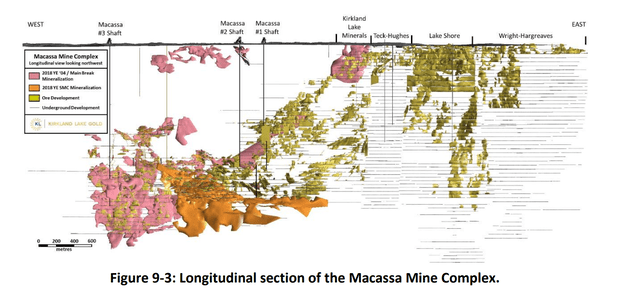

For those familiar with the Kirkland Lake Camp, the highest-grade mineralization has been uncovered at depth, with Macassa being the highest-grade gold mine in Canada (16+ grams per tonne of gold), Kerr Addison also being a famous underground mine to the east (11 million ounces produced), and Upper Beaver also getting the most interesting at depth. The same is also true of Lake Shore, Teck-Hughes, and Kirkland Minerals. This appears to be the focus of MAG Silver, which plans to test targets at depth vs. hunting down lower-grade material delineated by previous operators.

Macassa Mine Complex (Macassa Technical Report) Larder Project Resources (Gatling Exploration)

While it’s early to speculate on what success MAG Silver might have, the team will have a strong balance sheet to fund exploration at Larder. The current plan is to initiate a Phase 1 Drill Program this year, with results that should follow next year. At the same time, MAG Silver should see a steady stream of results from a Phase 2 drill program at Deer Trail in Utah, making for steady news flow from the company next year with results coming from three properties, with the most exciting by far being Juanicipio.

MAG Silver Projects (Company Presentation)

For now, I have assigned a combined $100 million to Deer Trail and Larder, given that these projects haven’t received much attention to date from MAG Silver. However, given that MAG is looking for carbonate replacement deposit [CRD] mineralization at Deer Trail and much higher-grade potential at Larder, we could see a sharp increase in this assigned valuation if MAG’s exploration is successful. Hence, the ongoing exploration of these projects is a nice bonus to the investment thesis and worth closely monitoring. Let’s take a look at MAG’s valuation:

Valuation & Technical Picture

Based on ~101 million fully diluted shares and a share price of $12.50, MAG Silver trades at a market cap of ~$1,260 million. If we compare this figure to an estimated net asset value of $1.17 billion, MAG Silver is trading at only a slight premium on a P/NAV basis. This is a very reasonable valuation given the company’s lower-risk business model relative to other silver producers, with Fresnillo doing the heavy lifting at Juanicipio and the company now more diversified with its exploration projects in Utah and Ontario. Given this model, I believe a fair multiple for the stock is 1.50x P/NAV, translating to a fair value of ~$1,755 million or $17.40 per share.

From a current share price of $12.50, this $17.40 price target translates to a 39% upside from current levels, but it assigns just $100 million in combined upside to Deer Trail and Larder. Given that these projects can be moved along without share dilution, a major discovery could positively impact the share price. So, with MAG in the enviable position that it can fund its projects without share dilution and the fact that I’ve conservatively valued these projects, the price target could prove conservative.

Moving to the technical picture, MAG Silver broke below major support at $14.30 earlier this year, a negative development. This is because key support levels, once broken, often become new resistance as some investors that accumulated at this support level may be anxious to get out at break-even after suffering through a draw-down. Based on the stock having support at $11.15 and resistance at $14.30, the current reward/risk ratio comes in at 1.33 to 1.0 ($1.80 in potential upside to resistance, $1.35 in potential downside to support).

I prefer a minimum reward/risk ratio of 5.0 to 1.0 to justify entering new positions in small-cap names. Still, given that MAG Silver’s business model is very unique relative to other silver producers, one could argue for a lower threshold. However, even at a 4.0 to 1.0 reward/risk ratio, MAG Silver would need to dip below $11.75 to enter a low-risk buy zone. So, while I see the stock as undervalued and one of the safer ways to get silver exposure (industry-leading margins at Juanicipio), the stock would need to decline below $11.75 for me to get more interested.

Summary

MAG Silver stands out as one of the few investable names in an industry group that’s become largely un-investable due to the squeezed margins of many producers and some mediocre acquisitions that make it tough to get behind the management of other names. In MAG’s case, the company saw minimal dilution related to its entry into the Abitibi with its Larder acquisition, can finance its projects with minimal (if any) share dilution, and is protected from lower silver prices due to phenomenal margins at Juanicipio.

These attributes make MAG Silver much less risky than its peer group, and the team certainly has a key asset in Dr. Peter Megaw, who has decades of exploration experience in Mexico to put the team’s growing cash balance to work. Given this attractive investment thesis and the potential for growth into a multi-asset producer later this decade, if Larder or Deer Trail can deliver, the sector-wide correction has provided a decent entry point into MAG Silver. That said, from a technical standpoint, the lower-risk buy point looks to be sub $11.75, where MAG Silver would come within 5% of strong support at $11.15.

Be the first to comment