Schroptschop/E+ via Getty Images

MAG Silver Corp. (NYSE:MAG) is a Canadian mining company that is focused on developing silver-focused projects throughout the Americas. This location is something that many investors may find somewhat attractive because many countries in the Americas have a long history of protecting property rights, particularly when compared to some third-world regimes. There has been a great deal of discussion in the investment media over the past few months with regard to precious metals, although admittedly much of the attention has been on gold while other metals such as silver have been ignored. For quite some time now, silver has had much stronger fundamentals than gold. As such then, it may make some sense to have some exposure to silver in your portfolio. MAG Silver currently has a lot going for it as the company currently has no debt, low costs, and is likely to generate a great deal of growth over the next two years.

About MAG Silver Corp.

As stated in the introduction, MAG Silver Corp. is a Canadian silver-focused mining company that operates in the Americas. Currently, though, the company’s projects are all located in the United States and Mexico. This is not necessarily a bad place to be as Mexico has the highest silver reserves in North America, with an estimated 37,000 metric tonnes of economically recoverable silver reserves. This is one of the reasons why many of the major mining companies have a project or two in the nation. MAG Silver Corporation’s main project is located in one of the richest regions of the nation.

The company currently owns 44% of the Juancipio Project located in Zacatecas State, Mexico. This is still a project that is very much a work in progress as the processing plant and mine are still under construction. However, the company has been producing precious metals from the area where the project is being constructed.

During the full-year period ended December 31, 2021 (the most recent period for which information has been released as of the time of writing), the joint venture produced and sold 3,200,000 ounces of silver and 6,577 ounces of gold that were extracted from the underground material that was removed during the development process. It is quite likely that the ultimate production from the site will be much higher once the mine and processing plant are operational. We can see that simply by looking at the richness of the material that has already been processed. The resources that were just mentioned came from 251,907 tonnes of mineralized material. The plant that is being constructed at the site will be capable of processing 4,000 tonnes per day or a total of 1,460,000 tonnes during a given full-year period. This will greatly increase the production of the operational mine, as we will see shortly. However, MAG Silver only receives 44% of the project’s total output but this is not something that will change when the project comes online. The processing plant is expected to come online near future though and production is going to be ramped up over the remainder of the year so it is quite likely that we should see MAG Silver’s financial performance improve as early as 2023.

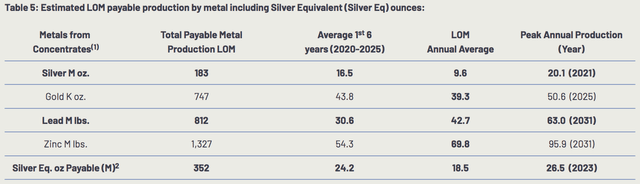

We can derive an estimated production based on the 2017 Preliminary Economic Report that was produced by an independent mining firm. Here are the consultants’ estimates of the mine’s expected production:

Juancipio Independent Economic Analysis

As we can see here, the mine is expected to produce an average of 16.5 million ounces of silver during each of its first six years of production. That represents about a five-fold increase over the average annual rate that we saw in 2021. We can clearly see that the output of this mine should be substantially higher than it is today beginning very shortly and then increasing rapidly over the course of 2022 as the processing plant is brought to 90% of its peak capacity by the end of the year.

After we consider that MAG Silver Corporation has a 44% interest in the mine, this alone pushes its production to 7.26 million ounces of silver (and 10.648 million silver-equivalent ounces) annually beginning as early as next year. This figure does not even take into account the company’s other silver-focused activities such as the Deer Trail Mine in Utah. It is still quite obvious though that the company is poised to do very well next year if the price of silver strengthens.

Fundamentals Of Silver

Fortunately, there are some reasons to believe that the price of precious metals in general and silver, in particular, will appreciate in the near future.

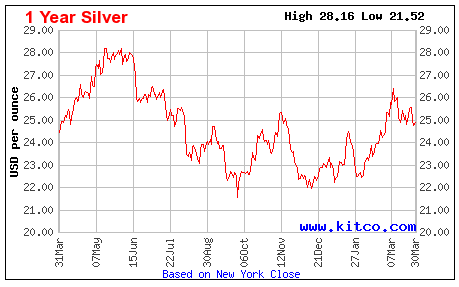

Admittedly, silver prices, in general, have not been particularly impressive lately. In fact, the price of the metal has been almost flat over the past year:

Kitco

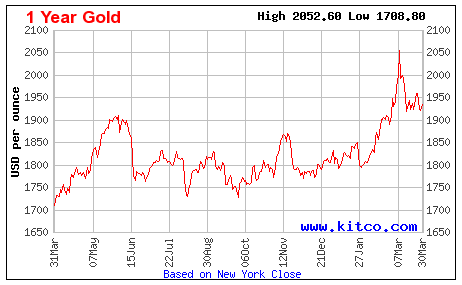

This is in sharp contrast to gold, which has seen some appreciation over the same period:

Kitco

This is something that is highly unusual over the course of history. This comes from the fact that both gold and silver have been used as money for thousands of years of human history. As a result, a consistent value of gold to silver has been typical. This caused gold and silver to be valued in lockstep with one another. Prior to the twentieth century, it typically took twelve to fifteen ounces of silver to purchase one ounce of gold. Today, the ratio is 77.70, which could be a sign that silver is currently incredibly cheap relative to gold.

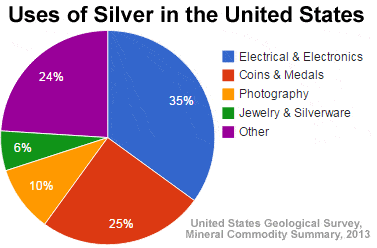

Today, silver is used as an industrial metal as well as money. This is quite unlike gold, which is almost exclusively used as a store of value. According to the United States Geological Survey, only about 25% of silver production is used in the production of coins, medals, and other stores of value. In fact, electronics and other electrical uses consume more:

United States Geological Survey

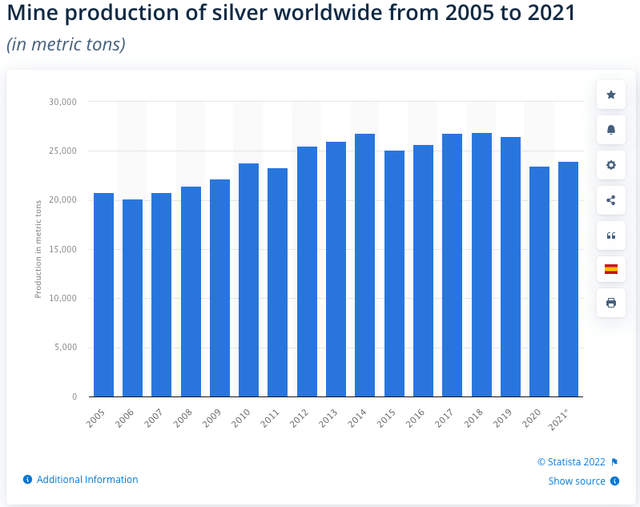

This actually points towards long-term demand growth. This is due to the growing dedication that the world has been showing to the development and deployment of solar power. This is because solar panels consume far more silver to manufacture than most other current uses. As Casey Research points out, it requires twenty grams of silver to produce a solar panel. In comparison, a cellular phone requires a scant 0.2 to 0.3 grams to manufacture and even a laptop requires only 1.25 grams to manufacture at most. The International Energy Agency currently projects that the demand for solar power will triple by 2026 compared to today’s levels. Meanwhile, global silver production has been almost flat since 2005:

There is, unfortunately, little reason to expect that the total global production of silver will increase sufficiently to match the demand from the solar industry. This could ultimately result in a supply shock that pushes up the price of the metal as the global mining industry proves unable to match the growing demand for solar power.

Valuation

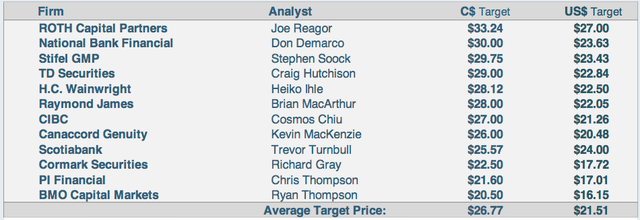

It can be admittedly very difficult to value what is essentially a start-up with negligible production that is likely to see tremendous growth. There are many analysts that have tried, though. The stock currently has a one-year average target price of $21.51 with targets ranging from $16.15 to $27.00:

MAG Silver Corp. Investor Presentation

As of the time of writing, the stock is trading for $16.13. Thus, if we assume that it hits the average price, that would represent a 33.53% gain over the next year. This is certainly reasonable. One thing that we do notice too is that every one of these estimates is higher than the current price. This could indicate that the company’s assets are currently undervalued by the market. However, this is not necessarily the case as a rising silver price, which is one of the reasons to be interested in this company, would also benefit all of its peers. Thus, it may make some sense to value the company’s stock based on its forward earnings estimates and compare these to other silver producers to see which offers the best relative valuation.

MAG Silver Corporation currently has a consensus earnings estimate of $0.55 per share for FY2022 and $1.03 per share for FY2023. Here is how that compares to some of the other silver producers on a forward price-to-earnings basis:

| Company | P/E FY2022 | P/E FY2023 |

| MAG Silver Corporation | 29.33 | 15.66 |

| First Majestic Silver (AG) | 48.63 | 28.43 |

| Fortuna Silver Mines (FSM) | 20.21 | 17.45 |

| Endeavor Silver (EXK) | 78.50 | 117.75 |

Admittedly, MAG Silver Corporation does not appear to have the most attractive current valuation here, although its valuation for FY2023 looks rather attractive if we assume that analysts’ estimates of $1.03 per share are correct. The company valued itself at $17.15 per share back in November 2021 and managed to raise about $46 million at that price. Overall, we can conclude that the valuation is probably reasonably fair, especially since we will probably have to wait until the end of 2022 to see any significant improvements in its earnings.

Conclusion

In conclusion, MAG Silver Corporation is poised to deliver a great deal of growth in the near future as it brings its flagship project online. The company may actually see greater growth than it expects though due to the very strong near-term fundamentals of silver that could easily lead to price appreciation, despite the fact that the metal has been stagnant for a while. MAG Silver Corporation is one of the very few silver-focused producers in the market and the company could very easily find itself in the right place at the right time to profit handsomely from growing demand and prices for silver. The market may not be completely appreciating this, although the fact that investors will likely have to wait a few months to truly profit should not be ignored.

Be the first to comment