BING-JHEN HONG

Taiwan Semiconductor’s (TSMC) (NYSE:TSM) August revenue rose 58.7% to a record high of NT$218.13 billion ($7.06 billion) on soaring global demand. Revenue for the first eight months of the year totaled NT$1.4 trillion, a 43.5% YoY increase.

TSMC Tailwinds

Migration to More Profitable Smaller Nodes

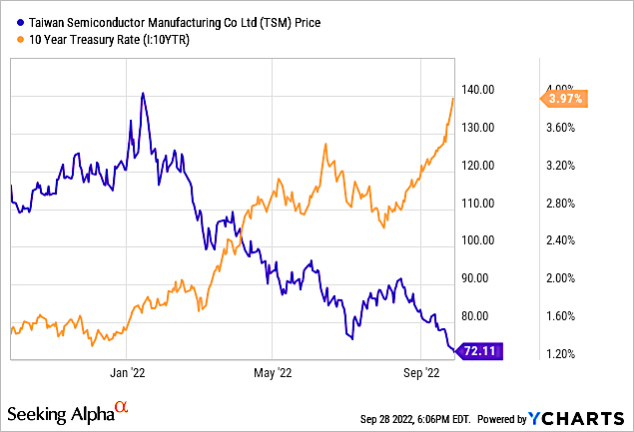

By technology, 5nm process technology contributed 21% of total wafer revenue in 2Q22 while 7nm accounted for 30%. Advanced technologies (7nm and below) accounted for 51% of total wafer revenue, as shown in Table 1.

TSMC’s 5nm node production will excel in 2023 as more customers beyond Apple (AAPL) use the company’s foundry for production of their chips. Advanced Micro Devices (AMD), NVIDIA (NVDA), Qualcomm (QCOM) and others are migrating to the technology at TSMC over the next few quarters.

Meanwhile, TSMC will ramp its 3-nm production next year, with Apple the top customer.

TSMC reported on September 7 that its production capacity remains fully utilized, following a media report that four of its major clients have scaled back orders, according to Chinese-language Economic Daily News.

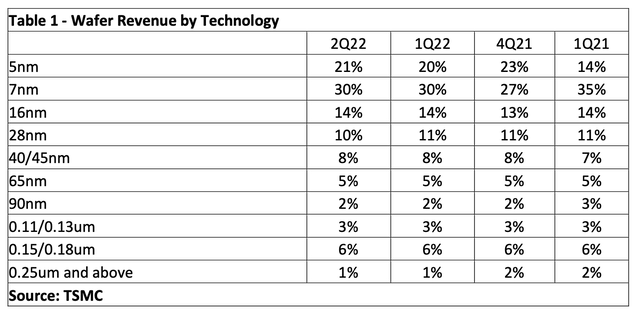

Table 2 shows estimates of TSMC’s ASP (average selling price) by node, according to our report entitled “Global Semiconductor Equipment: Markets, Market Share, Market Forecast.”

In 2021, the ASP was $10,775 for 7nm wafers and $14,104 for 5nm wafers. In 2023 during full production, 3nm wafers will be priced at $19,865. I anticipate prices will decrease 5%/year following the start of full production.

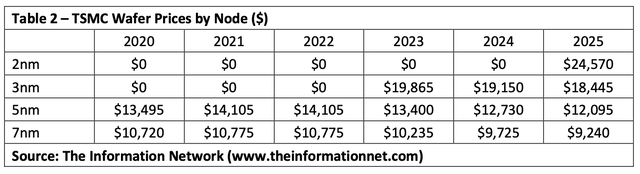

TSMC not only dominates the overall foundry sector, it also dominates based on production capability. Chart 1 shows revenue by node for the top pure-play foundries. We can see that in the 3-7nm node range, there are only two foundries making chips, and TSMC has more than a 90% share of revenues. Likewise, TSMC also has a dominant position in the 7-28nm node range.

Chart 1

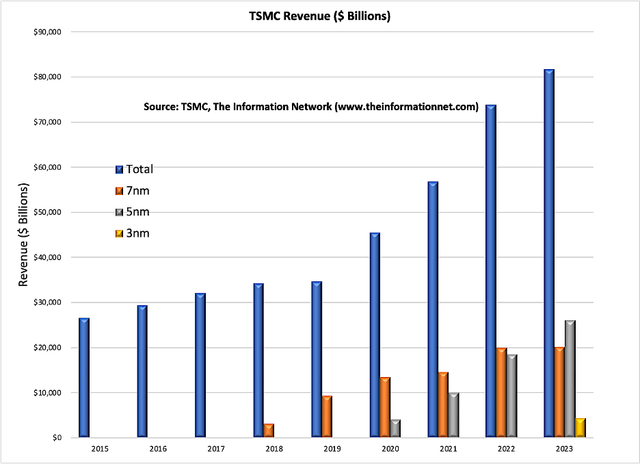

Chart 2 shows TSMC’s revenue by Node forecast to 2025 when its 3nm node chips will be in production (yellow bar). The Total Revenue (blue bar) increases dramatically starting in 2020 with the introduction of high ASP low node chips.

Chart 2

TSMC Top Manufacturer in Taiwan

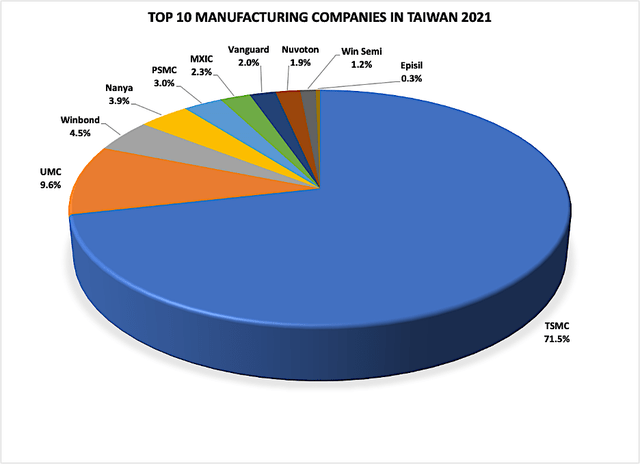

Chart 3 shows how TSMC dominates the manufacturing sector in Taiwan with a 71.5% share.

Chart 3

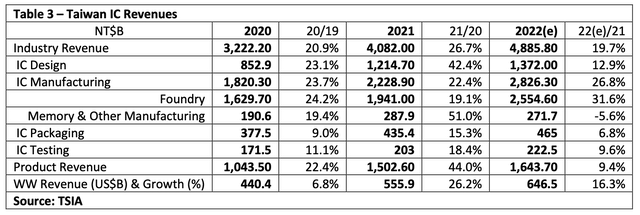

Table 3 shows Taiwan’s IC revenues estimated for 2022. Taiwan IC revenue in 2022 is expected to reach NT$2,826.3B in manufacturing (US$95.9B) (26.8% growth, Foundry NT$2,554.6B (US$86.3B), up 31.6%; Memory and other manufacturing products NT$271.7B (US$9.2B), down 5.6%).

TSMC Headwinds

Price Hikes Rejection

Previously, it was rumored in the industry that the price of TSMC would increase next year, ranging from about 6% to 9% according to the process, but later it was rumored that there was a negotiated correction. The increase jumped from 3%, and the growth rate of the mature process was 6%. However, the latest rumor is that Apple, a major customer, refuses to raise prices.

At present, NVIDIA, another major customer of TSMC, also intends to request the same treatment. The industry estimates that MediaTek, as the third-largest customer of TSMC, is also expected to receive “exemption from price increase” treatment.

Apple iPhone 14 Sales Faltering

A recent report that Apple is pulling back from plans to boost iPhone production when an expected demand spike didn’t show up.

Apple is telling suppliers to back off from an effort to boost assembly of iPhone 14 models by up to 6M units in the second half, Bloomberg reports, instead focusing on a flat 90M-handset forecast consistent with the prior year.

Apple had boosted projections as it headed into its launch event for the iPhone 14, and suppliers had started preparing for a 7% boost to orders. But the anticipated demand hasn’t materialized, and Apple is reversing course, according to the report.

The higher-priced iPhone 14 Pro models are reportedly seeing more demand than the lower-priced phones, and at least one supplier is shifting capacity toward the premium models in response.

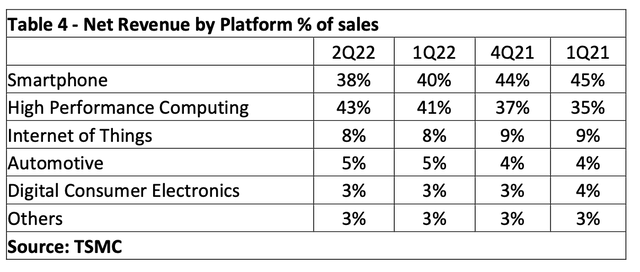

Table 4 shows that by platform, Smartphones and HPC represented 38% and 43% of net revenue respectively, while IoT, Automotive, DCE, and Others each represented 8%, 5%, 3%, and 3%.

Thus, smartphone sales as a percentage of revenues have decreased from 40% in 1Q22 to 38% in 2Q22, and from 45% in 1Q21.

TSMC Customers Cutting Orders

On Sept. 8, 2022, Chinese-language Economic Daily News reported that four major TSMC clients – MediaTek (OTCPK:MDTKF), Advanced Micro Devices, Qualcomm, and NVIDIA – have scaled back their orders, citing a JPMorgan Chase & Co. (JPM) report.

The order cut has led TSMC to shut down four EUV lithography machines, which roll out high-end chips, the report said.

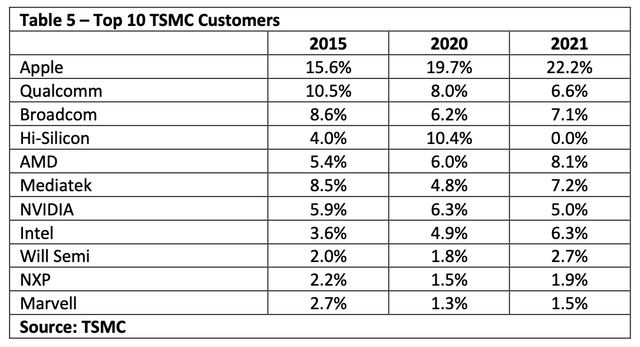

Table 5 compares TSMC’s top 10 customers for 2015, 2020 and 2021. We see the growth of Advanced Micro Devices as a leading customer, and the drop in Hi-Silicon, which was the second-largest customer in 2020 and dropped to 0.0% in 2021 due to the U.S. restriction of commercial transactions with its parent company Huawei. Revenues for the top 10 companies increased 7% in 2021 following a 28% YoY in 2020.

Investor Takeaway

Slow sales of Apple’s new iPhone 14 will be strongly negative for TSMC. Apple has reportedly told suppliers to rein in efforts to increase iPhone 14 assembly by as much as 6 million units in the second half of the year. As a result, Apple will aim to produce 90 million handsets for the period, which is around the same amount it produced in 2021 and in line with Apple’s original forecast this summer.

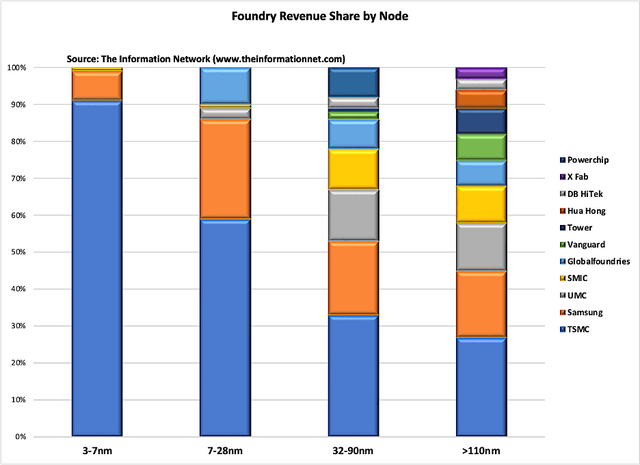

Even before these headwinds, TSMC stock has been dropping. According to my analysis, the drop in TSMC’s share price is largely due to macroeconomic factors and not due to any technological or financial headwinds. The drop, as noted in Chart 4, shows the inverse correlation of technology stocks, including TSMC, and the 10-year Treasury Rate. Since January 2022 the rise in the 10-year due to inflation fears has significantly impacted technology stocks and TSMC, although analysts at Morningstar found minimal correlation between the 10-year treasury and technology stocks over a 15-year period.

Chart 4

YCharts

Although a cut in iPhone (50% of Apple’s revenue) shipments will be a strong headwind for Apple, the Mac (10% of revenues) is also a major source of Apple’s revenues. Apple’s M2 Pro will be the first chip to adopt TSMC’s 3nm. It is expected to arrive in the year’s 2H 2022. By the end of 2022, Apple will be the first client to adopt 3nm chips after the delay with the Intel (INTC) Meteor Lake.

TSMC is in a league of its own, with more than a 50% share of the overall pure-play foundry business and a 91% share of <7nm node capacity. Strong demand for HPC and Automotive chips (with the transition to EVs), along with a planned $42.6 billion capex spend in 2022 will keep TSMC a strong buy through 2022. I continue to watch if any of these headwinds will impact TSMC’s capex.

TSMC remains my top semiconductor manufacturer, but because of macro-drives headwinds that override its micro tailwinds, I have a HOLD on the stock.

Be the first to comment