onurdongel/E+ via Getty Images

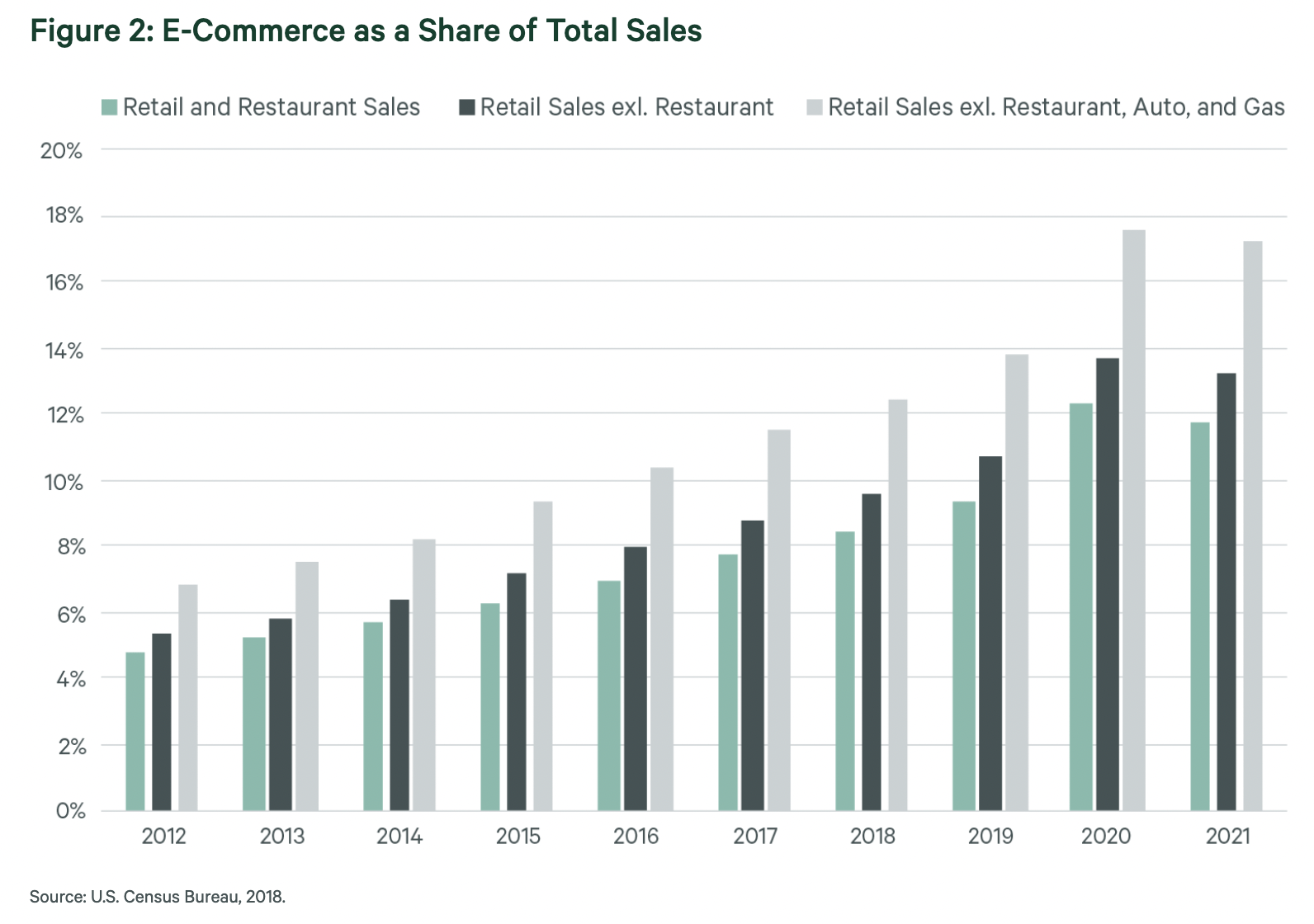

Macerich (NYSE:MAC) is a company that has remained a battleground stock for a long time. Bears have broadly argued that its focus on brick-and-mortar retailing is increasingly out of place in a world fast accelerating into a digital-only future. Indeed, the bears have congealed around the rise of eCommerce as a per cent of total retail sales and the implications this will have on Macerich’s rental revenue and cash from operations. Essentially, for them there now exists a clear and vivid future where shopping centres become a stranded asset as footfall declines and tenant bankruptcies pick up. This in turn will snowball into more widespread store closures and lead to an erosion of Macerich’s lease pricing power and rental income base.

This was the dominant narrative in the pre-pandemic and pandemic years and would see common shares in the Santa Monica, California-based company decline as its dividend was slashed and its cash from operations became less stable.

CBRE

The broader macro context is also not helpful. Consecutive interest rate hikes by a hawkish Fed have ruptured the capital markets and led to a great decline in consumer confidence and real disposable incomes. Inflation and supply chain headwinds have also caused a not immaterial retrenchment of underlying retailer profitability. A recession is looming and the impact could see even more tenant bankruptcies than has historically plagued the industry.

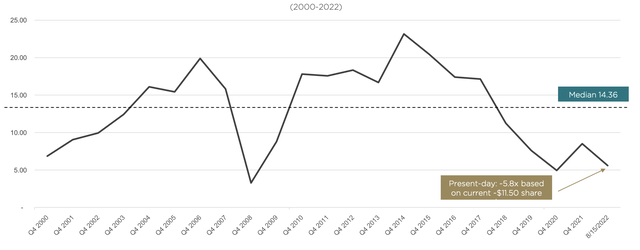

However, Macerich’s current valuation seemingly entirely accounts for this and more. The company currently trades at a trailing twelve-month price to FFO of 4.16x, nearly 70% lower than its sector average of 13.29x. The majority of the company’s operating metrics also continue to trend well with tenant sales, leasing demand, occupancy recovery and net operating income all showing strength.

Brick-And-Mortar Property In The Shadow Of The Pandemic

Macerich last reported earnings for its fiscal 2022 second quarter saw revenue come in at $204.9 million. This was a decline of 5.3% over the year-ago quarter and a miss of $1.18 million on consensus estimates. This came on the back of re-leasing spreads that narrowed from the comparable year-ago quarter.

Sales per square foot during the quarter rose to a record high of $860 with overall tenant sales realizing a year-over-year increase of 2.2% during the quarter. This was as occupancy also grew to reach 91.8%, an increase of 240 basis points compared to 89.4% at the end of the year-ago quarter. The company executed 274 leases during the quarter, a 27% increase versus the year-ago quarter.

Broader anchor replacement has been progressing well with Primark (OTCPK:ASBFY) setting up at Macerich’s Green Acre Mall and Tysons Corner Center. More experience-oriented tenants also signed new leases to become anchors with Pinstripes and Life Time Fitness moving into Broadway Plaza.

FFO during the quarter at $0.46 per share beat consensus estimates of $0.44 but was down from $0.59 in the year-ago quarter. This supported a quarterly dividend payout of $0.15 per common share, which when annualized against the current price stock price would provide a well-covered yield of 6.87%. The company of course has the capacity to increase this in the medium-term but the cloudy economic backdrop meant management kept the last dividend payment unchanged. Conserving cash to meander through the certain economic uncertainties that lay ahead is important and a dividend increase should not be expected in the short term.

The Bears Are Wrong On Macerich’s Future

Macerich remains undervalued relative to its historical trading multiples. This is as its operating metrics continue to record healthy growth. The company continues to attract new tenants to its properties to replace the bankrupt Sears and management has demonstrated an ability to adapt to the changing retail environment with leases signed with an increasing amount of non-traditional retail and non-retail tenants.

Whether Macerich will beat the bears depends on how well it moves through a post-pandemic reality which will be defined by hyper-digitalization from the continued rise of eCommerce. However, this always exists on a spectrum and brick-and-mortar retailing will be around for a very long time. The company’s A-class shopping centres are located in attractive urban and suburban locations and feature a needed mix of shopping, dining, entertainment, and coworking experiences. Hotel and multifamily uses are also increasingly playing a part in Macerich’s portfolio.

The market has gone too far and the risk-off trade has become too comical in its scope. Excessive dread had meant an overselling of what remains fundamentally sound companies. Macerich has been driven to new lows that defy historical precedence. The company is currently trading way below its median price to FFO multiple of 14.36x, which creates the potential of strong returns for current shareholders if and when sentiment improves to remove the current bearish overhang. Of course, this will only happen if the financials continue to grow and tenant bankruptcies do not experience a spike in the coming quarters of economic disruption. The bears would certainly have gotten this terribly wrong if this does not happen.

Be the first to comment