jimfeng/E+ via Getty Images

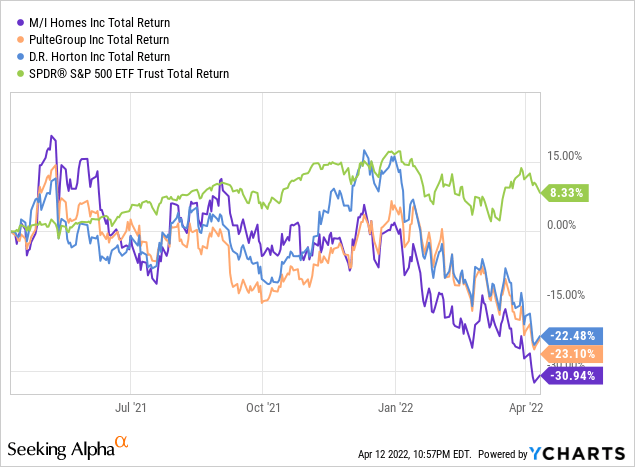

Over the last twelve months, homebuilders have been slammed from mounting uncertainty in the sector. While the S&P 500 is up 8%, D.R. Horton (DHI) and PulteGroup (PHM) are down ~22%; M/I Homes (MHO) has fared the worst at a loss of 31%. At this point, homebuilders are selling at remarkably low PE multiples of 3.5-5.5x at a time when housing starts up 6.8% to 1.769 million. Investors are nevertheless expecting doom & gloom-possible bankruptcy, sharp declines, and crippling supply chain constraints, among other factors. Investing in such a beat up sector is never for the faint of heart, but investors have the opportunity now to get in at historic lows. For context, M/I trades at just 2.3x forward earnings despite having a clean balance sheet, as reflected in the Debt/Equity multiple of 0.6, and is in a sweet enough position that it recently increased its buyback program by another $100 million, bringing the total repurchase program to 10.4% of the total market cap. Accordingly, while the stock is highly volatile at a beta of 2.0 and offers no dividend, there’s more of a hedge story here than meets the eye.

There’s little-to-no analyst coverage on the stock, but the 2 analysts identified by Seeking Alpha data have the stock at a “buy” and “strong buy”. In equal opposition to Mr. Market’s sentiment, all the past three pieces by different authors on Seeking Alpha have been positive as well. With the housing market trending upwards, I believe now is an opportune time to invest in unloved assets. M/I Homes’ growth story looks significantly discounted at a PEG of just 0.26 vs. 0.52 for D.R. Horton.

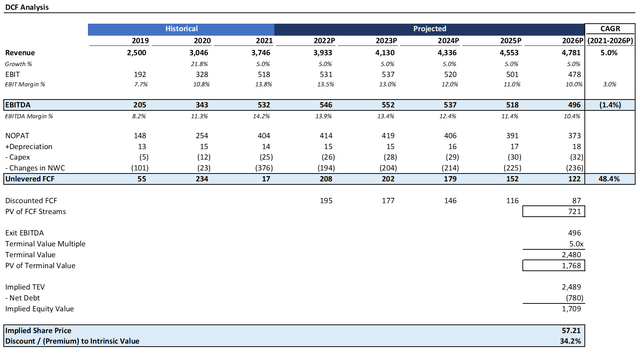

DCF Analysis Indicates Significant Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecast revenue growing at a slow 5% grate into 2026. I assumed margins actually contracting by 350 bps into 2026 to 10.0%, below 2020 levels. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at a little shy of $500 million, which is below 2021 levels.

Source: Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 5x and a discount rate of 7%, the stock is ~35% below intrinsic value. Needless to say, my assumptions for margin contraction, a slow growth rate, and a low multiple are already conservative. Accordingly, I have more than meaningfully factored in the downside scenario. Historically, M/I Homes’ EBITDA multiple has been in more of the 6-9x area, so there’s plenty of hedging already assumed in the terminal value, where most of the valuation resides anyway.

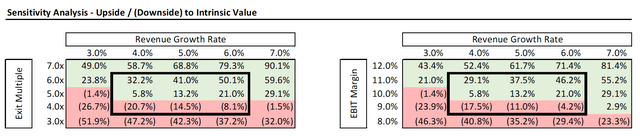

Source: Created by author using data from Yahoo! Finance

The market is pricing this stock as if it doesn’t have any growth potential. Should the stock’s EBITDA multiple expand to the low end of the historical range at 7x, there’s upwards of 40% upside. While returns are not particularly sensitive to growth, they are to margins. A 1% change in margins yields a ~25% change in potential returns. With a 10% terminal EBIT multiple assumed in my analysis, however, there’s not much more room for further contraction.

Why The Stock’s Low PE Multiple is Unjustified

There are several reasons why I believe M/I Homes will deliver strong returns and not simply be a “value trap”. Firstly, though the stock trades as if it’s heading for imminent bankruptcy, the last quarter was actually the strongest its ever been financially with $1.6 billion in equity, a cash balance of $236 million, and zero borrowings under a $550 million credit facility. So, the Debt/Capital ratio improved from 34% to 30% y-o-y. At the same time, the company is demonstrating strong momentum across all markets, is opening up in Nashville this year, and has a robust backlog to capitalize on. SG&A improved 130 bps, reflecting a management team that is firing on all cylinders. Backlog is up by ~50%, with around a two year supply and lots of options to allow for flexibility.

I also believe the trend towards millennials coming into home ownership will also allay investor concerns about a generational shift in the rent-vs-buy debate. Towards that end, the company’s Smart Series Home provides an affordable and personalized option specifically well suited towards millennials. Currently, nearly half of all young adults 18-29 live with their parents, so there’s a substantial amount of pent-up demand for new ownership. The latest data by Freddie Mac showed that around 45% of mortgages secured were by first-time home buyers. So, there is more of a demand momentum story here than the stock’s price would suggest.

Lastly, and this is obviously very speculative, I also believe the company–in light of its strong financial standing and the synergies to be had from scale in the homebuilding sector–is a potential takeover target. When company’s pursue M&A, market power is one of the key considerations. By acquiring M/I Homes, a larger player could help gain market density and greater pricing power. Ordinarily, leverage would be an issue, but that isn’t a concern here, as M/I Homes has a strong balance sheet. Moreover, M/I Homes has a strong position in lower-end priced homes, so it would provide a favorable portfolio diversification for a larger homebuilder that needs to address the affordability crisis without complementing its existing market.

Risks

Obviously, no stock with a beta of over 2.0 is without any risks. In the most recent quarter, new contracts were down 18% y-o-y. At the same time, gross margins declined sequentially from the impact of peak lumber. I am also concerned about the possibility of higher mortgage rates, combined with high housing prices, stymying demand for new ownership. Management has said that they plan on raising prices where they can; should this be met with a noticeable pullback in demand, it will be a catalyst for further erosion in shareholder value. In addition, a lot of would-be homebuyers are still on the fence with housing prices at an all-time high; if this trend doesn’t correct any time soon, I suspect these individuals will get more stuck on renting into the foreseeable future.

Conclusion

It’s easy to be sour on anything home related right now. However, homebuilders are trading as if imminent bankruptcy is around the corner. In M/I Homes case, just a little more than two years of earnings is all that is needed to return your entire equity investment. So, the downside story and possibility of increased mortgage rates have been materially factored into the stock price. With actionable catalysts in the company’s Smart Series Home option, continued execution in SG&A rationalization, and demonstration of a robust financial profile, M/I Homes is positioned to prove the bears wrong. If you want to avoid volatility in the short-term, this stock is not for you; but those that are willing to bear through this thick and thin are likely to see strong returns over the long-term. M/I Homes has a strong financial profile and is a solid player in its space; as the dust settles from the pandemic and housing uncertainty, I expect the stock to deliver strong returns.

Be the first to comment