Natali_Mis

Like most value investors, I get more excited when markets are down versus the other way around, as this generally provides the best opportunities to find good companies trading at attractive prices. That’s why the recent market rally has made me more cautious about deploying new capital.

However, there are still quite a few names that are trading well below their near-term highs. This includes LyondellBasell (NYSE:LYB), which is still trading well below its high of $112 from as recently as June. In this article, I highlight what makes LYB an attractive buy for high income and potential capital appreciation, so let’s get started.

Why LYB?

LyondellBasell is one of the largest plastics, chemicals, and refining companies in the world, and is the largest producer of polypropylene compounds and largest licensor of polyolefin technologies. LYB’s products and materials advance modern needs, such as lightweight and flexible packaging, stronger pipes to protect water supplies, and refined products to enhance vehicle efficiency.

In the trailing 12 months, LYB generated $53.5 billion in total revenue, representing a 54% increase from $34.7 billion in full-year 2019. This growth trend continued during the second quarter, with sales growing by an impressive 28% YoY to $14.8 billion. This was driven by growth in the intermediates and derivatives segment, which achieved record profitability, as LYB’s Houston refinery ran at 95% of full capacity to support increased demand for gasoline, diesel, and jet fuel as demand for travel has surged.

Not all segments were rosy, however. While North American demand for consumer packaging remains strong, LYB is seeing some challenges in volumes in Europe due to moderating demand and downtime at its cracker in France. Moreover, China markets remained weak due to logistical challenges there and COVID lockdowns.

Looking forward, I see potential concerns in China moderating as lockdown measures have eased. Moreover, I’m also encouraged by management’s discipline in deploying capital, as it has seen a robust 24% return on invested capital over the trailing 12 months.

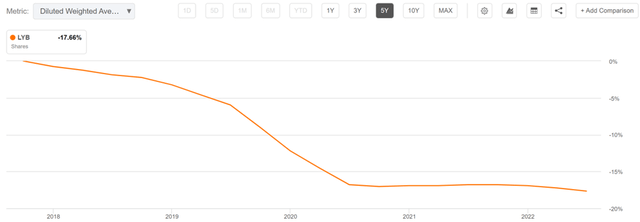

Management has also been aggressive in returning capital to shareholders, with $2.1 billion in capital returns in the form of dividends and share buybacks during the second quarter. As shown below, LYB has aggressively reduced its share count over the past 5 years by 17.7%.

LYB Shares Outstanding (Seeking Alpha)

Also encouraging, LYB is positioning itself well for a renewable future as it grows its plastics production using renewable feedstocks. This progress was noted by management during the recent conference call:

In addition to our renewable energy goals, LyondellBasell is growing our production of plastics utilizing renewable feedstocks under our CirculenRenew brands. Last year, we processed 12,000 tons of renewable feedstock in Europe, and we are forecasting to increase this number to 40,000 tonnes across both Europe and the United States during 2022. This material is being run through our existing ethylene cracker assets in Westling, Germany and Channelview, Texas with the goal to increase scale over the coming years since we see that the demand for these products is growing.

The growth of renewable feedstocks is one part of our broader mission to expand the reach of our sustainable products, including those sold under the Circulen brands. Since launching our Circulen brands in 2019, we have sold over 140,000 tonnes of products based on recycled and renewable feedstock. This represents more than the amount of polyethylene and polypropylene consumed by the population of Houston in 1 year. LyondellBasell is doing more than simply talking about the circular economy. We are building real businesses that can help provide a more sustainable future for our customers and society.

Meanwhile, LYB maintains a solid BBB-rated balance sheet. It also pays a respectable 5.2% dividend yield that’s well covered by a 27.5% payout ratio, and the dividend has a 5.8% 5-year CAGR and 6 years of consecutive growth.

LYB remains rather cheap at the current price of $92.33 with a forward P/E of just 5.5, sitting well below its normal P/E of 9.8 over the past 12 years. Sell-side analysts have a strong buy rating on LYB with an average price target of $102.30, equating to a potential one-year total return of 17%, including dividends.

Investor Takeaway

LyondellBasell is a top-quality chemical company that’s benefiting from strong end market tailwinds. The company has a solid balance sheet and is returning a lot of capital to shareholders via dividends and share repurchases. It’s also trading at a very cheap valuation, making it an attractive investment at the current price.

Be the first to comment