FinkAvenue

Introduction

Lyft (NASDAQ:LYFT) just released its earnings report for Q3 2022 and is down roughly 13% after hours as of writing this. Although the technology sector has been struggling overall and expectations were certainly mixed, it’s worth taking a look at the more granular details of this earnings print to see just what’s going on.

As a recap, Lyft is a rideshare service akin to Uber (UBER). Unlike Uber, however, Lyft is often considered a ‘pure play’ in the space as it only operates a rideshare service.

Earnings

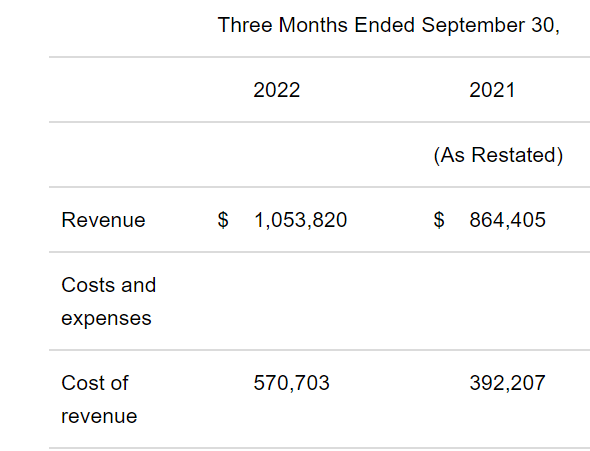

Off the bat, Lyft missed on both EPS as well as revenue. While missing on EPS is common for a growth company like this, the disparity was significant: GAAP EPS came in at -$1.18 versus -$0.50 expected. The revenue miss was not as quantitatively significant and was off by only $10M. Being a growth company, however, it is certainly a significant negative indicator that they weren’t able to meet expectations in this regard. It is up to each individual investor to determine the gravity of this.

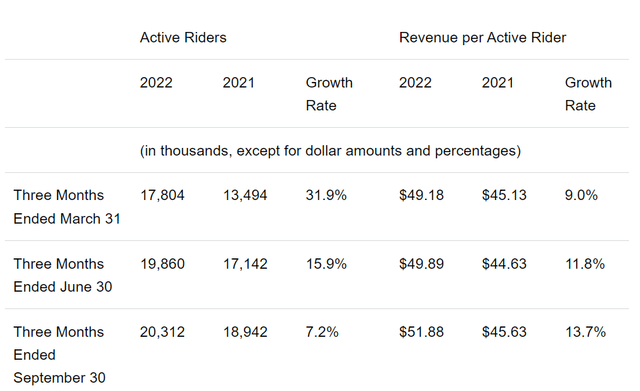

Additionally, Lyft displayed poor growth in terms of Active Riders. While Q1 and Q2 were robust on a YoY basis, Q3 showed growth of only 7.2% year-over-year.

SeekingAlpha.com LYFT 11.7.2022

As a technology investor, I look at this as the strongest signal of all. Active users, and growth therein, are absolutely essential to technology businesses. Building technology is exceptionally expensive and requires a large business to generate profits. Lyft’s growth in Active Users was basically half of what Uber’s was for Q3 2022 – 7.2% versus 13.7%.

Revenues per Active Rider looks a bit better, but this is offset by the significant growth in the company’s cost of revenue – 45.5% YoY. This means that the cost of generating revenue was roughly 4x that of the company’s growth in per-user revenue. I would not call this sustainable.

SeekingAlpha.com LYFT 11.7.2022

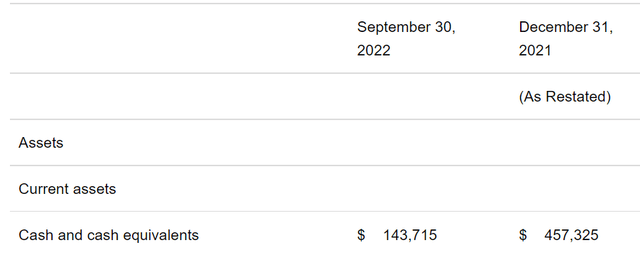

On top of all this, the company is staring down a deteriorating cash position. Please note the YoY comparison uses December as the company shifted its reporting dates during this period.

SeekingAlpha.com LYFT 11.7.2022

As seen above, Lyft has only 31% of the cash on hand that it did during the fiscal quarter last year. This implies that it may soon need to start taking on debt to continue operations, but I don’t think this will be an overly significant factor. Just like Uber, Lyft has a ‘negative operating cycle’ because it charges its customers upfront. This will allow it funnel cash through its business without taking out loans to purchase inventory as most businesses would.

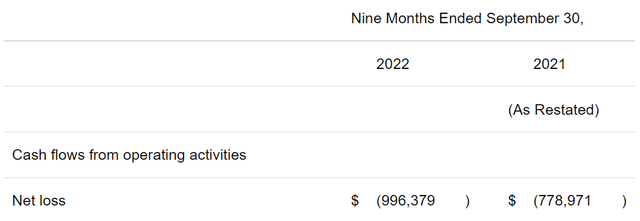

The dynamics of its cash situation are also a cause for concern. While we do not have the data broken out quarter by quarter, Lyft’s statements show an acceleration in its cash loss YoY:

SeekingAlpha.com LYFT 11.7.2022

This fact, combined with its already weakened cash position, is not a good signal for the business going forward.

Conclusion

Lyft’s business is not doing well. When we compare it to Uber’s recent cash flow positive quarter it is all the more damning. The company faces a slowing rate of growth in its userbase, a weakened cash position, and an accelerating loss of cash from operations.

As a long-term follower of the space, I have long expected this. Lyft is forced to compete on price with Uber, which is a company with 10x the revenues as well as 2 additional business lines. It is not reasonable to expect that it can continue this competition or achieve a cost of capital that its much larger competitor has. In economics, a price competition in the context of a duopoly is won by the player with the lower cost of capital – and that is not Lyft. This stock is a sell in my opinion.

Be the first to comment