tupungato

Today I will be completing a deep-dive on LVMH (OTCPK:LVMHF, OTCPK:LVMUY), the largest luxury house in the world. Within, I will be delving into a piece of the company’s spectacular backstory, breaking down their complex house of brands, taking a look at recent financials, and performing an analysis on where exactly the company may find itself in the coming years.

There is something magical about resiliency. This phenomenon is rarely exhibited within the modern investment industry, with many companies falling victim to ever-increasing rates of technological innovation, poor management, and disruption. Luxury Brands however stand in defiance, and have been able to scoff off these happenings, demonstrating remarkable anti-fragility over the course of oftentimes centuries of existence. Whether it be through their capacity to create a sense of exclusivity and scarcity with their product or services, or their ability to bolster craftsmanship impossible to replicate elsewhere, these brands have been able to intertwine themselves with the very fabric of modern affluence and the complex psychological underpinnings of our existence. As long as our species remains a social one, there will be luxury companies, and as the largest Luxury Brand in the world, LVMH likely stands to benefit.

The origin stories …

In the spring of 1835, the 13-year-old Louis Vuitton started a trek that befits the opening scene to a captivating movie. The teenager traveled almost 300 miles to Paris, taking odd-jobs along the way to survive, eventually reaching the city and starting an apprenticeship at Monsieur Maréchal’s box-making and packing workshop. After spending 17 years there, honing his abilities and serving elite clientele such as Eugenie de Montijo, the wife of Emperor Napoleon III, Louis eventually decided to go out on his own. After opening his first store in 1854, Louis would spend considerable time innovating his trunks’ designs, creating rectangular and canvas products that would grow in popularity and eventually allow for the man to open his second shop in 1859. Like most stories of resiliency, the business would suffer setbacks. During the Franco-Prussian War in 1870-1871, his workshop was looted and destroyed, an occurrence that would not deter Vuitton, instead motivating him to reestablish the business and set up a new workshop in Central Paris. As a result of steadfast determination, Louis Vuitton’s operations expanded to heights never thought imaginable, and eventually resulted in his products traversing European waters, with the opening of his first shop in London occurring in 1885.

With Louis’ death in 1892, the company then passed on to his son, Georges Vuitton. Georges would play a part in the continued expansion of the brand, as he travelled across the United States to sell Louis Vuitton products, created the company’s famous monogram logo, a design that to this day showcases his father’s initials, the graphic flowers, and quatrefoils, and thought-up the pick-proof spring buckle single lock systems that are still intertwined with many Louis Vuitton pieces. In 1936 the company was passed down, yet again, to another member of the Vuitton family, Gaston Louis Vuitton. During his multi-decade tenure, the company would start to incorporate leather into its products, and revamped their monogram canvas so that it could be used across multiple different styles. Flash forward to 1970, when Gaston passed, the company’s helm was then taken by his son-in-law, Henry Racamier. As a result of the desire to expand the brand’s footprint/presence across the world, the company formed an alliance with a counterpart, Moët Hennessy, a revered brand that deemed this partnership enticing due to the fact they were facing threats of a potential takeover. In 1987, LVMH was officially formed. Therein, squabbles over leadership positioning emerged, and, as a result, the wolf in cashmere, Bernard Arnault, was welcomed through the gates of the company in the hopes that his presence would act as a mediating force. This would be the turning point in the rise of Bernard Arnault.

The now second-richest man in the world, and the head of the LVMH empire, Arnault began his career within his family’s construction and property business firm, Ferret-Savinel. After spending years leaning out the operation, his eyes turned into an opportunistic situation in 1984. Aided by the fact that the French Socialists had switched over to a more conservative economic course a year prior, Arnault saw an opportunity when the textile firm Boussac, of which housed the famous brand Christian Dior, went bankrupt. Enlisting the services of a senior partner of Lazard Fréres, Arnault was able to obtain $65M in financing from the bank, alongside $15M of his family’s own capital, to acquire Boussac. After trimming the fat from the business to arrive at what he viewed as the potential cornerstone of a luxury goods powerhouse, Arnault did not rest on his laurels, and instead searched far and wide for opportunities. After being invited into the inner circle of LVMH by Racamier, the head of Louis Vuitton, Arnault would “switch sides”, partnering with an additional entity brought in to assist, Guinness PLC. In an action many have deemed ruthless, Arnault formed a holding company with Guinness, of which held 24% of LVMH’s outstanding shares at the time. Arnault then spent an additional $600M to acquire another 13.5% piece of the company, and an additional $500M in 1989 to arrive at 43.5% ownership and 35% of total voting rights, achieving the “blocking minority” he required to direct the LVMH group as he saw fit, rather than assist the party he was brought into the picture by to retain their hand at the helm. After assuming control of the company, Arnault stepped on the gas, increasing revenues by a factor of 5 and the company’s market value by a factor of 15 over the course of the next decade, numbers that appear minuscule to what the company is now capable of in 2022.

What does the company look like today?

Decades later, LVMH is now a luxury house that has aggregated and organized 75 different brands under one roof. Out of the 75 brands, only 6 of them are younger than 5 years, showing the company’s dedication to owning houses that have stood the test of decades. The company operates in six distinct segments. Four of these business groups, i.e. Wines & Spirits, Fashion & Leather Goods, Perfumes & Cosmetics and Watches & Jewelry are brands with similar production and distribution processes, whereas the other two: Selective Retail, and Other represent entities with their own distinct operations that have little bases of comparisons. Each of these will be discussed hereafter (all monetary values are in millions of euros).

Wines & Spirits

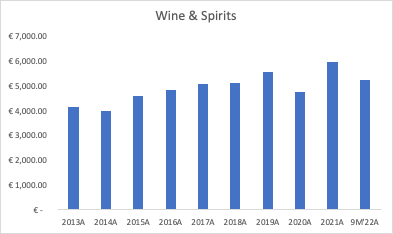

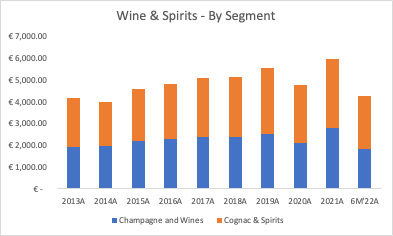

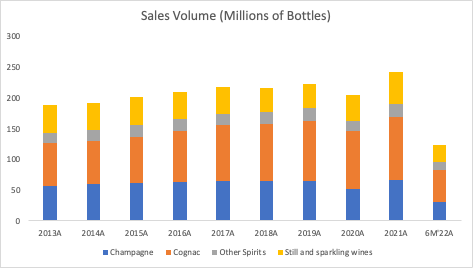

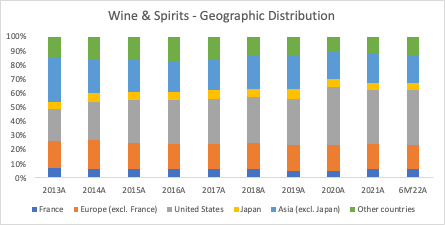

Within this operating group are 26 different houses, including distinguished century-old vineyards such as the Clos Des Lambrays, prestigious brands like Moët Chandon and Hennessy, and some newer esteemed brands such as the night-life-revered Belvedere. The operating group can be split into two unique sections, Champagne & Wines, and Cognac & Spirits. From 2013 to 2021, this business group has displayed slow and steady growth, increasing associated top-line by approximately 4.6%, increasing sales volume in millions of bottles markedly within each segment, and weathering the majority of the pandemic-induced storm to return to the growth trajectory it was previously on. Geographically, over the course of the last few years, demand has remained strong in Asia and Europe, but has been trumped by the strong growth in spending associated with the US:

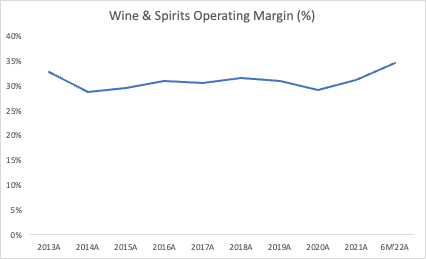

The strong momentum has continued into both the first ¾ of the year from a revenue perspective and the first ½ of the year from a sales volume perspective. Delving into the former, wine & spirits continued its strength, displaying 14% organic growth, a 1% structure impact and 8% currency-induced tailwind to improve 23% YoY. Total volumes grew YoY as well, with the four constituents, (champagne, cognac, other spirits, and still & sparkling wines) changing 17%, (2)%, 31% and 15% YoY in 6M’22A, respectively. The eye-sore here is evidently the slight decline in Cognac volumes. Hennessy was and continues to be particularly impacted by the lockdowns seen across China, as well as a series of supply chain constraints in the US. With deliveries catching up to backlogs into the latter part of H1, volumes should potentially stabilize heading into the remainder of the year, contingent of course on whether or not China continues with their ludicrous zero-Covid policy. This should continue to be monitored heading into the latter part of the year, especially given that Cognac is responsible for a large portion of this operating group’s success. When everything is merged together, you have a best in-class portfolio of sparkling and non-sparkling wine estates, dominant cognac presence, and a company that is focused on expanding elsewhere with presence in other spirits ranging from vodka and tequila, to whiskey. In 2019, it was estimated that the LVMH portfolio accounted for nearly 22% of all champagne sales and nearly 46% of cognac sales, an astonishing metric. Things to consider going forward are the fact that LVMH does not maintain full ownership of the group, with 34% being owned by Diageo (DEO) (OTCPK:DGEAF). In addition, there has been major growth in the popularities of spirits outside of wine, champagne and cognac globally, a phenomenon that LVMH doesn’t have the most ideal exposure to. Regardless, as supply chain pressures ease, it will be up to LVMH to continue to expand internationally and gain market share doing so, an enticing prospect given the overall profitability of this operating group:

Fashion & Leather Goods

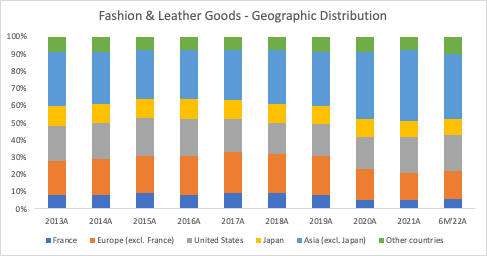

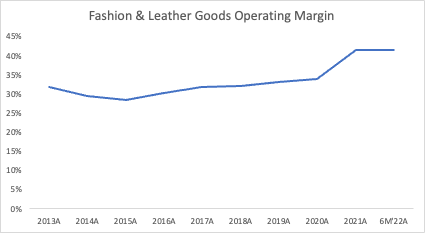

The Fashion & Leather Goods business segment is comprised of 14 different houses including the likes of Loewe, Louis Vuitton, Moynat, Fendi, Christian Dior, Givenchy, Kenzo, Marc Jacobs and more. By far, this is the most important component of the LVMH business. Comprising 40% of Total Revenues, the top-line of this operating group has increased at an approximate 15.3% CAGR between 2013 and 2021, and has continued a steadfast rate of growth into 9M’22A, increasing 31% YoY, with 24% of that growth attributable to organic improvements and the remaining 7% to currency tailwinds. Geographically speaking, from 2013 heading into 6M’22A, we’ve evidently seen a noticeable uptick in the amount of revenue attributable to the Asia region, a phenomenon that will likely need to continue if growth is to maintain its current trajectory. Also, notably, this rapid growth has been sustained all while continuing to expand the already supremely high operating margins of the segment as a whole:

Looking forward, the brands with the highest contributions to this operating segment, i.e. the likes of Louis Vuitton, Christian Dior, Fendi, Celine, Loewe, etc. will need to continue expanding and innovating with their product lines, as well continue their steadfast focus on having excellent retail network, the likes of which are the origin points for 94% of this segment’s revenue. On the Q3 revenue call, LVMH’s CFO was adamant about the fact that “luxurynomics” do not follow the same trajectory as the economy overall. Consumers in this area are less sensitive to macroeconomic turmoil, and inflationary pressures are able to be passed along to the consumer without the batting of an eye, a phenomenon that arises as a result of brand desirability, a good sign going forward for the segment overall.

Perfumes & Cosmetics

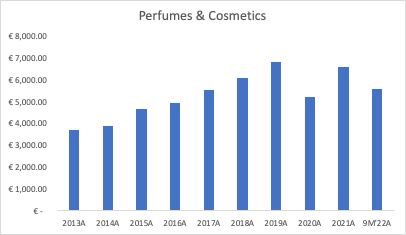

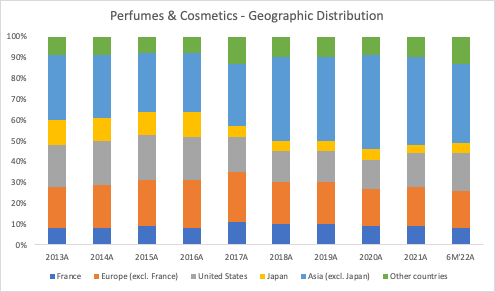

The Perfumes & Cosmetics business segment is home to 15 different houses, the oldest of which dates back to 1803. Examples of brands include Gurelain, Parfums Christian Dior, Givency Parfums, Cha Ling, Fenty Beauty by Rihanna, and more. From 2013 to 2021, this segment compounded its top-line at an approximate 7.5% CAGR, diminishing as a % of total however, coming in at approximate 9.9% in 9M’22A compared to 13% in 2013, a result of the commendable growth of Fashion & Leather goods. One may notice that 2021 numbers did not normalize fully to trend. Notably, this operating segment is highly selective about their distribution. Despite pandemic-headwinds easing off, limited recovery in some areas of international travel and reopening of points of sale dampened recovery. Even so, the group decided to remain selective, limit promotional offers and develop online sales channels, unlike competitors who increased their proportion of discounted sales or sales in parallel networks. Recovery continues to progress into this year, with the operating segment displaying 19% YoY growth for 9M’22A, 12% of which is organic and the other 7% of which is a result of currency tailwinds, driven by growth in fragrances demand and the normalization of makeup demand in the United States. From 2013 to 6M’22A, Geographic distribution remained relatively constant, with Asia less Japan growing the most noticeably during this period:

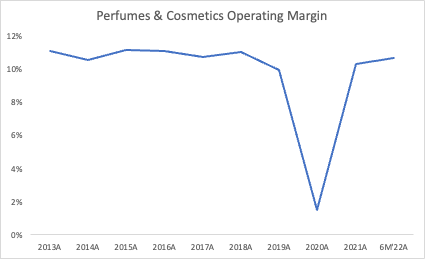

Looking forward, investors can likely expect continued progress and market penetration with the product lines housed by this operating segment. In the next year, Parfums Christian Dior, Guerlain, Parfums Givency, Maison Francis Kurkdisain and Fresh are engaging in varying degrees of flurrying activity, ranging from the relaunch of new lines, reinventions of star products, unveiling new opuses and initiatives, etc. However, given the fact that these brands are a low proportion of total top-line, combined with the low operating-margin nature of the business, they are unlikely to have major impacts on LVMH’s bottom line going forward:

Watches & Jewelry

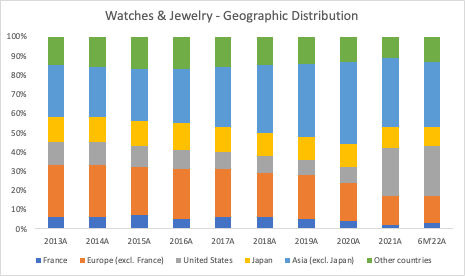

This operating segment contains 8 different houses, Chaumet, Tiffany & Co, Tag Heuer, Zenith, Bulgari, Fred, Repossi and Hublot. The transition into hard luxury is arguably one of the most exciting developments of late, a phenomenon I will touch upon later. The top-line of this segment has scaled at a fast pace from 2013 to 2021, increasing at a CAGR of approximately 16.2% and accounting for approximately 13% of Total Revenues in 9M’22A, compared to approximately 9.3% in 2013. As a result of the company’s various acquisitions, the geographic profile of this revenue has differed quite substantially, with noticeable share now shifting over to Asia excl. Japan and the United States (primarily due to the recent Tiffany acquisition). Growth continued into 9M’22A, with associated revenue increasing 23%, 16% attributable to organic growth and the other 7% to currency tailwinds.

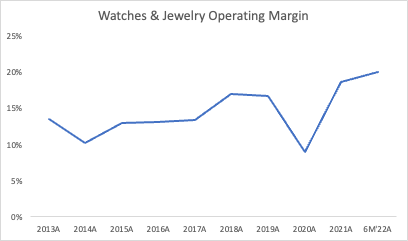

Looking forward, it will be important for this segment’s brands to maintain strict cost controls while expanding, keep up their focus on craftsmanship, as well as direct steady efforts at nurturing various relationships with celebrities, business icons, sports organizations (NFL, NBA in Tiffany’s case, World Cup in Hublot’s, as examples), etc. to ensure that these brands maintain their ability to intertwine themselves with the upper echelon of modern culture. Bulgari has arguably been the best performer herein into this difficult environment, with Tiffany maintaining steady growth. In inflationary environments, as mentioned on the Q3 revenue call, consumers tend to lean towards purchases of gold rather than silver (where Tiffany excels), therefore they have slowed slightly, a phenomenon that will need to be monitored. Nonetheless, growth is an exciting prospect when one gauges the marked improvement in Operating Margins seen of late:

Selective Retail

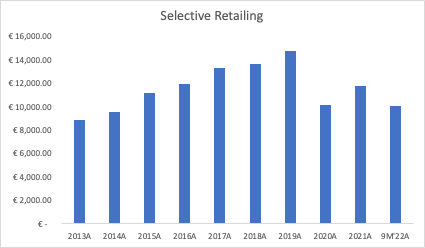

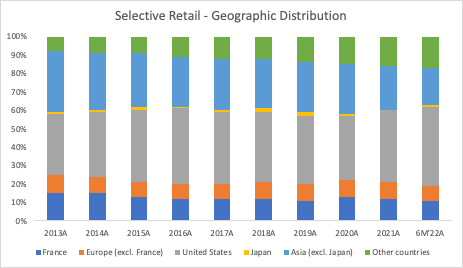

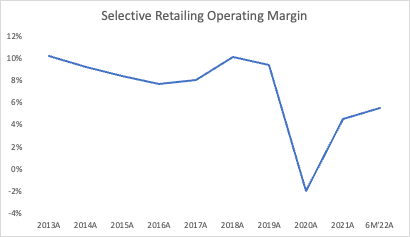

The Selective Retail Operating Group contains 5 houses. Retail locations such as Le Bon Marché Rive Gauche and La Grande Epicerie De Paris, retailers focused on providing customers with unique shopping experiences in their stopovers or during their travel experience with DFS and Starboard Cruise Services, and mega global brands like Sephora. This segment has grown more slowly than its peers from 2013 to 2021, increasing at a 3.5% CAGR, and decreasing from approximately 30% of Total Revenues in 2013 to approximately 18% in 9M’22A. From 2013 to 6M’22A, the segment has made substantial progress internationally and in the United States, particularly with Sephora’s key integration with Kohl’s (KSS) across the landmass. Lastly, momentum was noticeable heading into 9M’22A, with the segment growing 30% YoY, a result of 20% of Organic Growth and 10% currency tailwinds. Despite that, growth has still not returned to the pre-pandemic trend:

Looking forward, progress, especially with the retail stores and unique experiences tied to stopovers and cruise ships, will be largely contingent on travel maintaining its recovery trajectory. Sephora has been investing heavily in improving customer experiences through the adoption of omnichannel experiences, developments that should spur customer contentment going forward. In addition, the company has made noticeable expansionary efforts into the UK with their Feelunique acquisition. The sore spot with these figures is tied to DFS (also not majority-owned by LVMH, 39% ownership is held by another party). The house has been seriously impacted by the zero-Covid policies in China and will likely continue to feel the brunt of these decisions. With that in mind, these developments again have little impact, as of right now, on the company’s bottom line. Regardless, they play an essential role in the company’s provision of unique experiences to luxury customers and are thus critical going forward.

Other

This segment, though not of enough importance to warrant delving deeply into, consists of ten different horses, ranging from the Royal Van Lent yacht manufacturer, the Belmond luxury hotel chain, a series of print media entities such as Connaissance des arts and Les Echos, etc.

With all of LVMH’s unique parts in mind… what does the company look like when everything is put together?

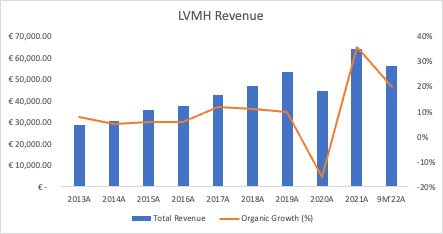

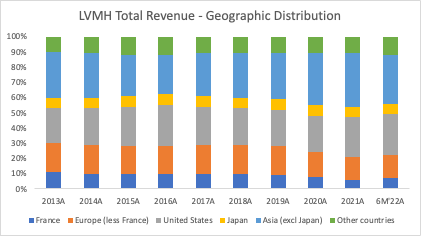

From 2013 to 2021, LVMH’s topline has compounded at a rate of 10.4%, with the average pre-pandemic period organic growth rate (2013-2019 inclusive) coming in at approximately 8%, a level that should be returned to once operations normalize in the future. During that period, there has evidently been an increase in the importance of the Asian and American consumers, end-markets that will need to be monitored to ensure demand is maintained at beneficial levels going forward. For the 9M’22A, organic growth came in at 20%, highlighting that FY’22 is likely to come in very strong and that the growth trend set pre-pandemic is likely to be exceeded in the interim:

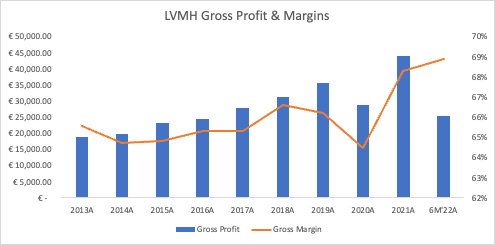

During the same period, we saw a slight uptick in gross margins, reminiscent of values typically seen in SaaS operators, increasing from approximately 66% in 2013 to 69% 6M’22A:

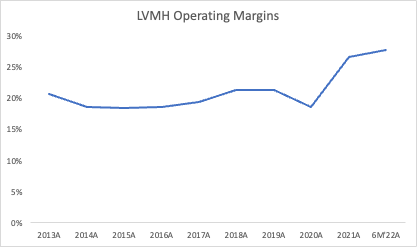

Operating efficiencies started to creep through from 2013 to 6M’22, with Marketing & Selling Expenses, as well as General & Administrative Expenses decreasing relatively speaking from 37% to 35%, and 8% to 6% as a proportion of top-line. As a result, operating margins for 6M’22A were best in class, values that could likely come in even higher if the company were to stop reinvesting so heavily in their business going forward:

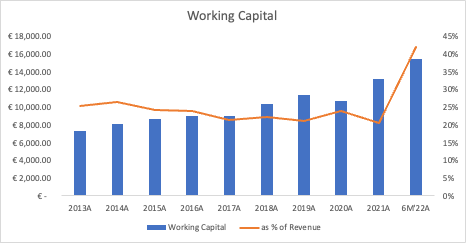

Similar to other retailers & consumer goods companies, working capital has seen an uptick over the course of the last 6 months. This metric is one I will be monitoring going forward to ensure inventory has been able to properly offloaded into a normalized environment:

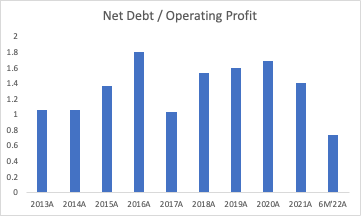

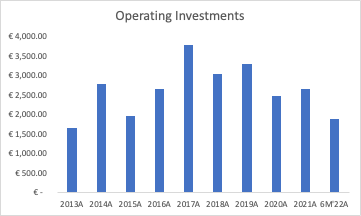

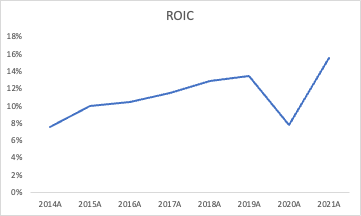

The company’s substantial progress has been achieved while maintaining a conservative financial profile (as measured by Net Debt/EBIT coming in at 0.74 for 6M’22A), continuing to direct steady amounts of capital at operating investments to strengthen their foundation and scale, and displaying commendable ROIC over the last few years:

With this insight into LVMH’s past, how should we think about the future?

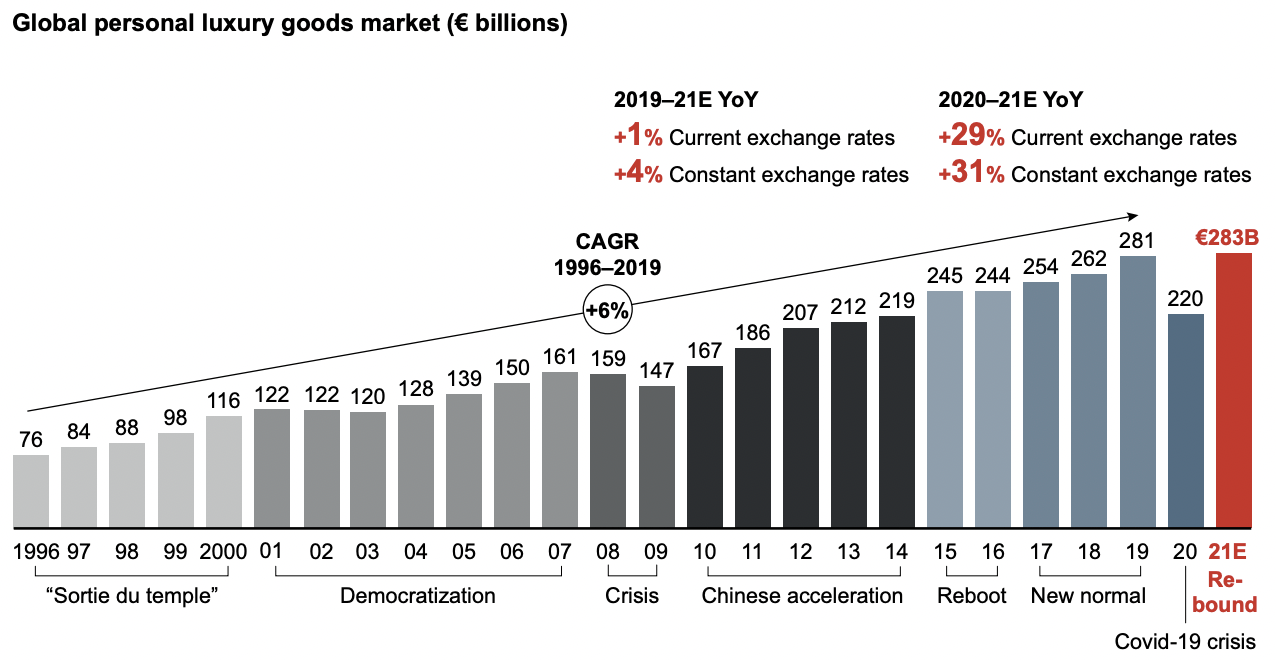

Over the course of the last two decades, the Global Luxury Goods Market has grown at a remarkable pace, as illustrated by the following Bain & Company figure:

Looking at how these values have changed over the years, a few things stand out, particularly the growth of spend related to China and the resiliency of the category overall. Honing in on the former, there is still room to grow in the Chinese market. Although we have seen dampened activity this year as a result of the zero-Covid policy, a degree of normalization will likely occur once these enactments fade away. With approximately 20% of total luxury spend in 2021 attributable to China, growth is still anticipated to occur with restrictions lifted, with the region expected to become the largest luxury market in the latter half this decade. This is evidently an idealistic scenario and will need to be continually monitored, especially given the geopolitical tensions that are running rampant globally at the moment. A decay in relations between countries could negatively impact the ability for LVMH to operate internationally in the future. Moving on to the latter, we have seen how the luxury industry has responded to two crises. Dips in total spend were observable both during the GFC and the pandemic; however, the overall resiliency of the affluent should be noted and considered when one is pondering the impact of a potential lasting and looming recession. With the global luxury market expected to grow to approximately €360B by 2025 (an 8.4% CAGR from 2021E), as well as continued opportunities in both China, and other international markets such as India and Africa, I don’t think it is unreasonable to underwrite 5% continued growth in the market overall heading into the end of the decade (if economic situations become less doomy). The continued growth of LVMH’s main brands, particularly with the likes of Dior, as well as the company’s expansion into the hard luxury space, a strategic move made possible with the company’s 2011 acquisition of Bulgari and the 2021 acquisition of Tiffany, represent an interesting opportunity for the next decade. On the hard luxury side of the equation, there’s a structural opportunity here as a result of the lack of name-brand penetration in this area (approximately 20% worldwide), an exciting prospect if LVMH is to continue expanding therein.

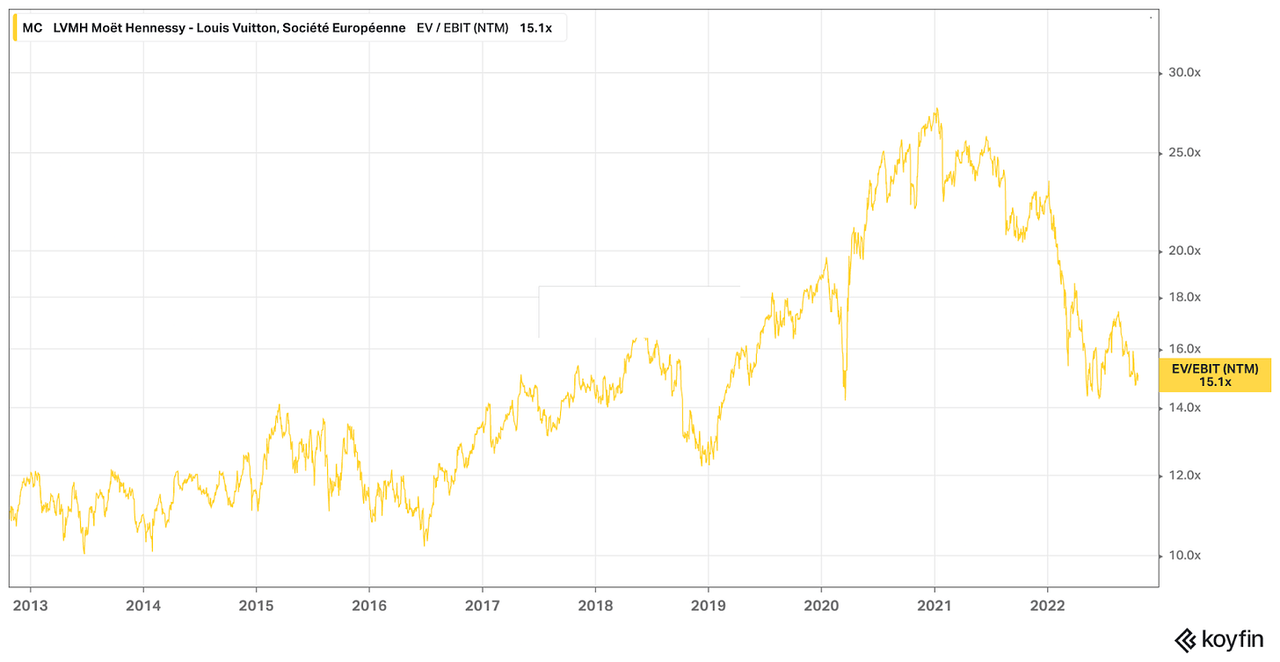

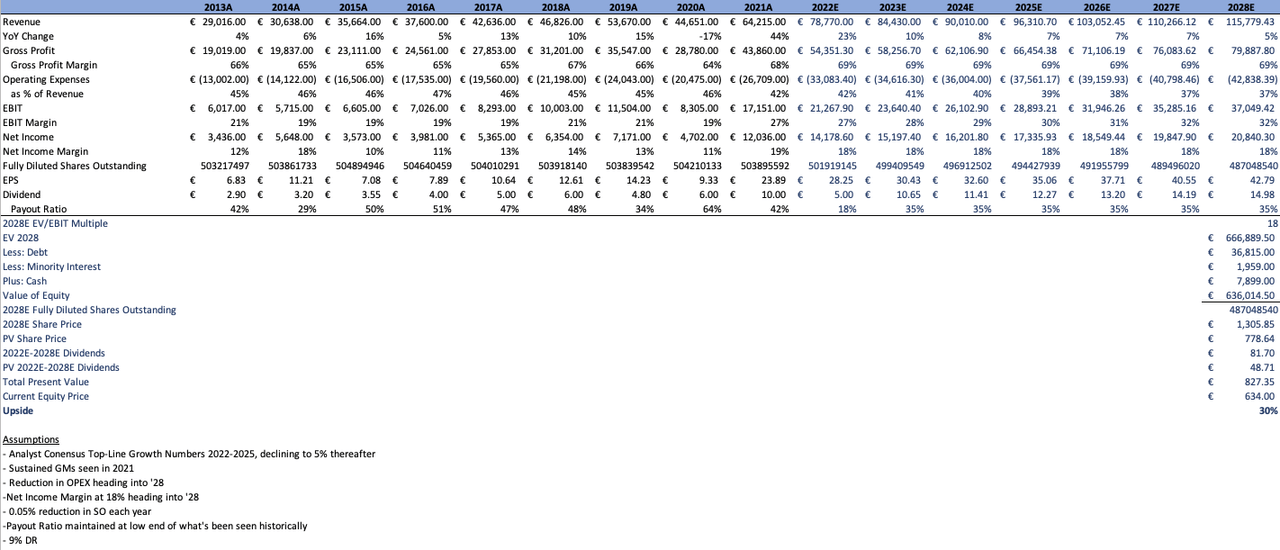

All in all, I believe LVMH represents an opportunity to get in on the ground floor of one of the most timeless, exceptionally managed luxury houses in the world, of which contains brands that have demonstrated remarkable resilience throughout a series of crises; an enticing prospect for someone who is such a big fan of resilience like myself. When I modelled out what I feel to be a reasonable, albeit extremely idealistic, scenario (at a premium 2028 EV/EBIT multiple in the mid-range of what we’ve seen historically), we arrive at decent upside. In the event of faltered execution, economic contraction, etc., this may obviously change but I believe these estimates are achievable:

The elephant in the room with this story, all else considered, is the succession trajectory. Arnault’s children are involved with the business currently; however, it is still up for debate whether or not they will possess the business prowess, managerial excellence and overall ruthlessness that has made Arnault such a good leader in the first place. Although I can see Arnault being one of those individuals, such as Buffett and Munger, that live well into their 90s and continue working while doing so, this is an existential threat that bears mentioning and monitoring.

In short, I will be covering LVMH for years to come. It is a fascinating story of some of the world’s most cherished brands, an epitome of anti-fragility with key houses having been around for centuries, and is an interesting exhibit of human psychology in the business space. I look forward to continuing to write about LVMH and hope you enjoyed this deep-dive.

Disclaimer: The information and research contained herein is all my own opinion and should not be used as a substitute for proper due diligence. Please consult your financial advisor and evaluate your financial circumstances before making any investment decision.

Disclosure (as of October 22, 2022): MT Capital Research holds no position in the securities discussed herein and does not anticipate to initiate a position in the forthcoming five days.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment