zhnger

There’s a clear disconnect between LVMH’s (OTCPK:LVMUY) price performance and its financials. In the first half of 2022 (H1 2022) both its revenues and earnings grew in double digits, but its price is down by 28%. This can either be a great opportunity to buy or a sign of trouble ahead, signalling it’s best to stay away. This article analyses the best course of action, keeping in mind the risks ahead and the company’s ability to weather them. It concludes that LVMH is indeed a high-quality company, whose ADRs should be bought from a long-term perspective.

Weathering a global slowdown

The S&P 500 (SP500) is down by 24% year-to-date (YTD), so it should really come as no surprise that a cyclical stock like LVMH is sagging too. The IMF projects global growth to slow down to 3.2% in 2022, almost half its levels in 2021 and even further to 2.9% in 2023. This isn’t good news by any stretch. But here are three arguments for why LVMH can still continue to be a good buy.

Varied geographical growth

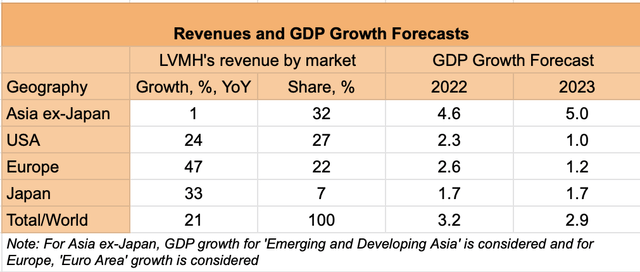

LVMH has a footprint across the world, which can hold it in good stead. Consider this. Asia-ex Japan is its biggest market, accounting for 32% of its revenues as of H1 2022. A closer look at its revenue growth across markets reveals an abysmal performance from this market of just 1% year-on-year (YoY). This resulted from an 8% fall in the second quarter, presumably as China’s lockdowns depressed demand. However, on the whole, its revenue growth was still at 28% and net profit is up by 23% as other markets stayed robust, with impressive double-digit growth for Europe, Japan and USA on an organic basis (see table below).

China could remain a drag for the rest of the year as well, with its economy expected to grow by just 3.3% in 2022, far lower than its trend growth. However, by 2023, its growth is expected to start picking up again to 4.6%, which can be a positive for LVMH. The company can also continue to be supported by Japan, whose growth is expected to stay steady next year, even as Western economies like the US and Europe slow down to a crawl. In other words, even if there’s a setback to revenue growth, it will likely be contained.

Bounce back after slowdowns

This cannot be taken for granted, of course. China’s zero-COVID-19 policy could send it right back into lockdowns especially in the winter months, when new coronavirus variants can be a risk, especially with some vaccines ineffective on them. Even if we consider the worst-case scenario of a drag on Asia-ex Japan growth as well, however, LVMH has a history of bouncing back fast.

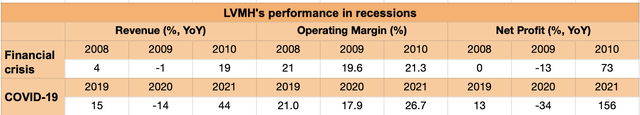

In my last article on the online marketplace for luxury fashion, Farfetch (FTCH), I referred to the example of LVMH in analysing whether luxury goods companies are immune to recessions, as some theories posit. I looked at its performance during 2008’s financial crisis-led recession. Here, the analysis is extended to include the COVID-19-driven recession going by the fact that it’s still a potential threat.

The key takeaway from this analysis is that while challenging economic times have resulted in shrinking revenues and net profits for LVMH in the past, the recovery has been swift, if not impressive. In 2010, for instance, the company showed revenue growth of 19% year on year (YoY) and in 2021 it grew by a huge 44% YoY. The pickup in net profits was even more, though at least partly due to a base effect. In 2010 they grew by 73% and in 2021 by 156%. Note also, that in both years, the company stayed profitable. Its operating margins interestingly didn’t show a significant fall in either of the slowdowns, though they have risen during recoveries.

Not that overvalued

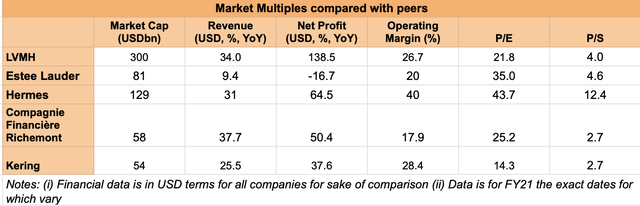

Finally, there’s the question of valuations. There’s no denying that LVMH is highly valued with a price-to-earnings (P/E) ratio of 21.8x as compared to the consumer discretionary sector at 12.9x. It’s also higher than the P/E for S&P 500 at 18.4x. This might not represent the entire picture, however. Luxury goods companies have a key advantage at the present time in their ability to pass on higher costs to customers. This shows up in routinely strong margins as noted above. LVMH also reported a strong operating margin of 27.5% in H1 2022. Many consumer discretionary companies, on the other hand, work with lower operating margins, whose margins could come under further pressure if inflation stays high.

Compared to other luxury products companies too, the picture is mixed. In my recent article on Burberry (OTCPK:BURBY), I noted that it was among the highest valued. However, Burberry is a far smaller company, which isn’t entirely comparable with LVMH either. So, here I compare it with some of the other bigger ones by market capitalisation. This analysis reveals that Hermes (OTCPK:HESAY), Estee Lauder (EL) and Richemont (OTCPK:CFRUY) actually have higher P/E ratios, even though LVMH’s financials for the last financial year were comparable if not better (see table above). Similarly, its price-to-sales ratio is nowhere close to the highest. Going just by market multiples, there’s at least a 28% upside to LVMH.

Long-Term Buy

Of course, there’s a distinct possibility that the upside won’t materialise. At least not for now. The market mood is already sombre, and there could be more pain in store going by recent earnings downgrades. This will continue to drag even quality stocks down, including LVMH. At the same time, I have little doubt that over time, it will reap investing gains. Even now, it has a 5-year return of almost 114%, which averages to over 20% a year. It can drop more in the near term, so I’d watch the price momentum carefully as there could be a better opportunity to buy it. At the same time, it’s not always easy to time the markets and since LVMH has proven itself to investors over the years, it’s quite likely to do so again unless any unforeseen situations show up. At the very least, I’d prepare to buy its ADRs now.

Be the first to comment