_laurent

Investment thesis

LVMH (OTCPK:LVMHF) is one of the best European companies in terms of cash flow generated due to its supremacy in the world of fashion, and luxury more generally. It posted sensational growth results in the first half of 2022 that have widened its competitive advantage even more. Using a discounted cash flow at the current price LVMH might be a bit expensive, but it is not overvalued enough to open a short position. I would personally consider a buy on $550, so at the current price I consider it a hold.

Recession-proof revenues

In the current period where inflation is at 40-year highs and the major central banks are aggressively raising interest rates, it is very complex for a company to be able to perform better than the previous year. The recession is now upon us, and many companies are already warning their shareholders in advance that short to medium-term results will not be like those of the past. LVMH can be described as one of the few exceptions from a profitability point of view, as the first half of 2022 achieved excellent results. Apparently, for consumers, a sharply struggling macroeconomic environment is not so relevant, probably because those who buy these luxury goods have a solid financial position.

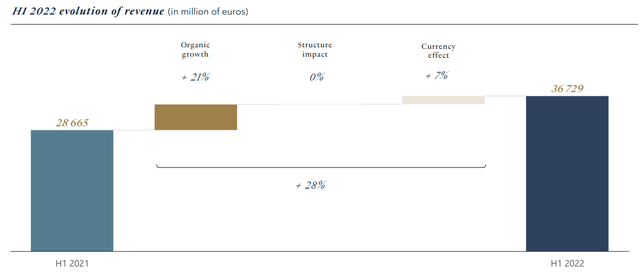

H1 2022 evolution of revenue

The analysis of LVMH’s first-half 2022 revenues will take place starting from the general context and then going into the details.

In H1 2021 revenues were €28.66 billion, while in H1 2022 they reached €36.72 billion, about €8 billion more. There was a total growth of 28%, composed of 21% from organic growth and 7% from the favorable exchange rate. As LVMH is a European company, the strengthening of the dollar affected its profitability positively, as it made exports to the U.S. more advantageous.

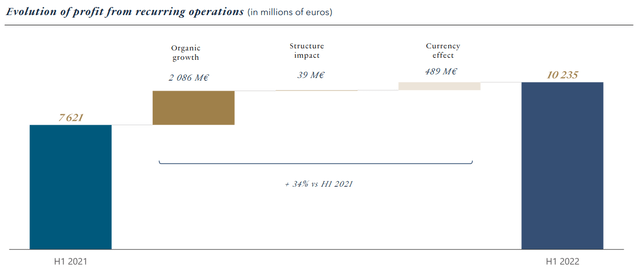

As for operating income, on the other hand, it even increased more than revenues. There was a year-on-year improvement of 34% compared to H1 2021, and the new operating margin was 27.80% (in H1 2021 it was 26.70%). LVMH not only grew in terms of revenue, but also improved its operational efficiency.

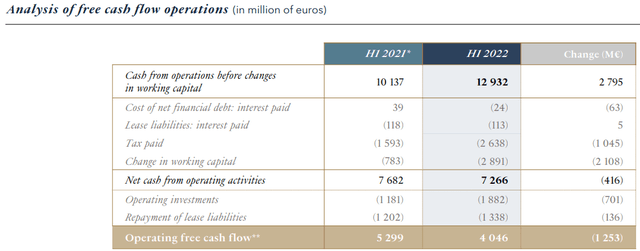

The only undertone of this H1 2022 concerns operating free cash flow compared with that of the previous year. There was a deterioration of €1.25 billion, mainly due to the change in working capital. If we did not consider this last item LVMH would have achieved a better result here as well.

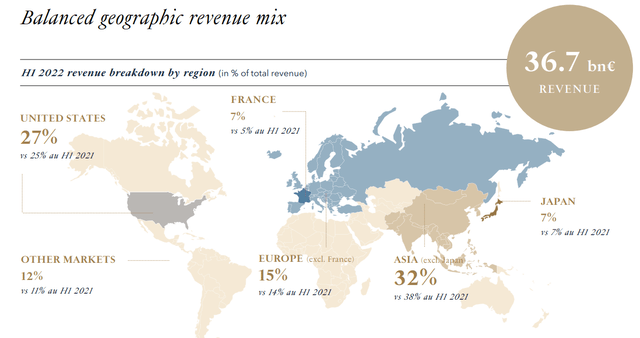

Revenues by country

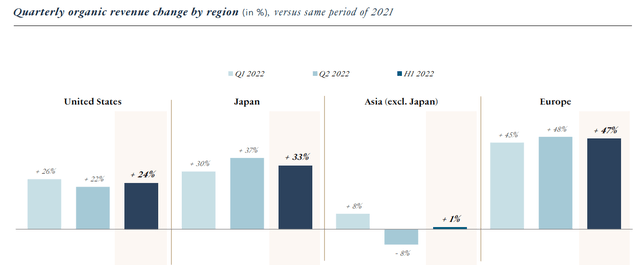

LVMH operates all over the world, so it is necessary to understand the evolution of revenue trends in different parts of the world.

From this picture the first thing that stands out is that the Asian segment is definitely the one that is struggling the most. In the major economies of the world, especially in Europe, there has been significant organic revenue growth. But why is growth in Asia lagging behind the rest of the world? The problem is always the same: Covid-19. Policies to combat Covid-19 in China are among the strictest in the world, and even today many cities must undergo relatively long lockdowns even if only a handful of people are infected. As long as China is so tough in cracking down on the virus, the Asian sector will be the most problematic for LVMH.

Since in H1 2021 38% of LVMH’s revenues came from the Asian segment, this is definitely a hindrance to growth. To date, the general growth in sales in other countries is putting this on the back burner and making LVMH less dependent on China. On the one hand, this can be good for encouraging diversification, but on the other hand LVMH is focusing less and less on its most important geographic segment. To date, revenues continue to increase in the double digits, but in the face of a major recession in the West, the Asian segment probably could have mitigated the losses. What is more, China’s middle class is rapidly increasing its wealth, and this could have brought ample benefits to a company like LVMH that sells luxury goods.

Revenues by sector

In this section we are going to break down H1 2022 revenues by market segment. LVMH presents a very diversified business that is not only based on the sale of the main brand Louis Vuitton.

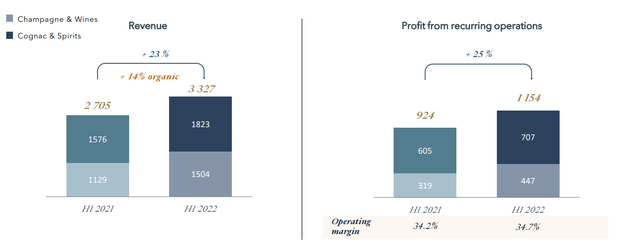

Champagne & Wines

This operating segment includes the sale of champagne, wines, and spirits under the Moët & Chandon, Dom Perignon, and Hennessy brands. Revenue growth over H1 2021 was 23% and the operating margin improved by 0.50%. Considering that this is a saturated market segment an organic growth of 14% is a great result.

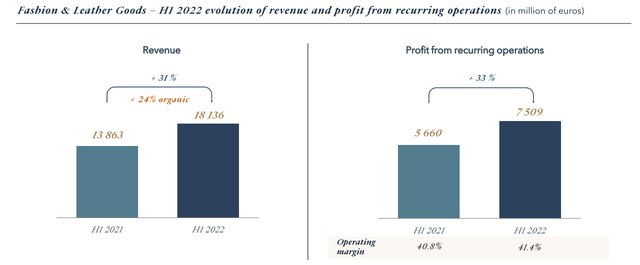

Fashion & Leather Goods

This is by far the most important market segment for LVMH in terms of revenue as it owns brands such as Louis Vuitton, Fendi, Celine, Christian Dior, Givenchy, and Kenzo. The 24% organic growth over H1 2021 has further magnified LVMH’s already dominant position. Suffice it to say that Kering (OTCPK:PPRUF) (the main competitor) in H1 2022 had total revenues of €9.93 billion, practically half as much. And we are not even considering LVMH’s other market segments. The gap was already overwhelming before, but over the past year it has widened further.

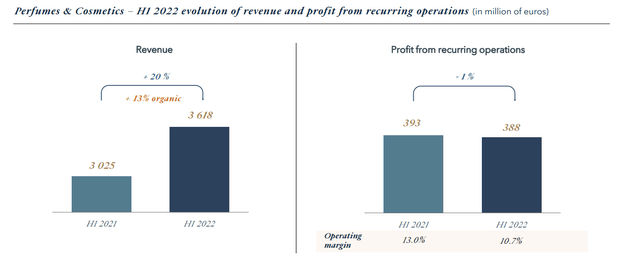

Perfumes & Cosmetics

The Perfumes & Cosmetics segment includes brands such as Christian Dior, Guerlain, and Parfums Givenchy. This segment also achieved double-digit organic growth in H1 2022 compared to H1 2021, however it saw a 2.3% contraction in operating margin. Perfumes such as Sauvage, Miss Dior, and L’Interdit remain successes on a global scale, but the cost incurred to produce them has increased, which is why the margin contracted. Overall, the result can be considered positive, but not on par with the other segments.

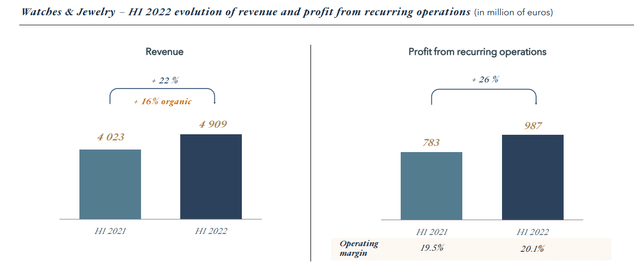

Watches & Jewelry

This segment includes brands such as Chaumet, Bulgari, Tag Heuer, Zenith, and Tiffany. Again, growth was double-digit and in addition, the operating margin increased by 0.60 percent. Within jewelry, the Tiffany brand is among the most important and again this year it has driven up LVMH’s revenues. The style of its jewelry over the years has managed to influence the entire industry: it represents the epitome of competitive advantage.

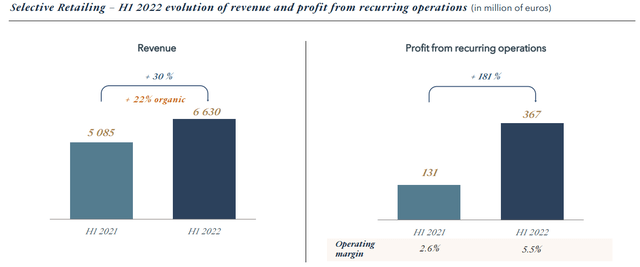

Selective Retailing

This segment is the one that probably surprised the most and includes the sale of products through authorized retail sellers such as Le Bon Marché Rive Gauche, DFS, Sephora. Compared to H1 2021 there was an organic growth of 22%, and most importantly, the operating margin more than doubled. The increase of Sephora stores in the U.S., the progressive re-openings of DFS in Australia and the Middle East, and the launch of Le Bon Marché’s new digital platform contributed to this achievement.

Overall, there was no struggling segment, but at most we find segments that grew less than others. The retailing and fashion segments are the ones that in terms of revenue are most valuable and are also the ones that have performed best, which is why I consider this H1 2022 to be a success. I do not expect this growth to be sustainable from a long-term perspective, but it is certainly further strengthening LVMH’s position in the short term. Its competitive advantage is among the strongest ever in my opinion, as it has brands that have been generating steady and growing cash flows for decades. The quality and image of this company’s products are known worldwide and it is unlikely that this will change in the future.

How much is LVMH worth?

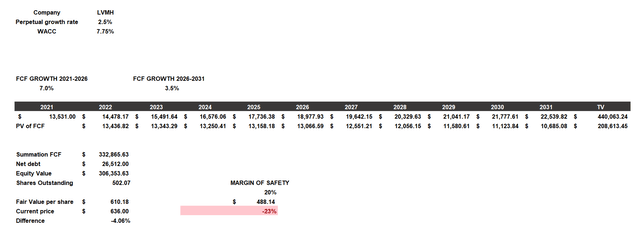

To understand what LVMH is worth I will use a discounted cash flow. This model will be constructed as follows:

- The cost of equity will be 8% and includes a beta of 0.97, a country market risk premium of 4.70%, a risk-free rate of 3.50% and additional risks of 0.50%. The after-tax cost of debt will be 4.32%.

- The capital structure considered will be 15% debt and 85% equity, with a resulting WACC of 7.75%.

- The source of net debt and equity outstanding is TIKR Terminal.

- Expected growth will be calculated on 2021 free cash flow and considers 7% until 2026 and 3.50% from 2026 to 2031. I wanted to include conservative growth rates since I expect that in the long run growth will tend to settle down. It is not reasonable to include a double-digit growth rate from now to 10 years.

According to my assumptions, the LVMH’s fair value is $610, so the stock is slightly overvalued. I tend to use a margin of safety before buying a company to limit valuation errors, and in this case if I considered one of 20%, I would have to buy this company at $488 per share. This is quite far from the current price, but still does not make me think about selling this company. I would not sell a company with a clear competitive advantage and generating huge cash flows just because it is slightly overvalued. We have to discount the fact that to be a shareholder in LVMH there might be an additional premium to pay because it is one of the best European companies. Personally, I would think about buying an initial position around $550, so at the current price I consider it a hold.

Be the first to comment