Melpomenem

The market was devastated by Lumen Technologies (NYSE:LUMN) deciding to eliminate their dividend, but the move and the corresponding collapse of the stock price ensures the promised stock buyback will happen. The market appears to misunderstand that a corporation shifting from a large dividend to a share buyback makes the stock more valuable. My investment thesis remains very Bullish on Lumen, with the stock dropping to $6.

Shift To Stock Buybacks

The shift from a dividend to stock buybacks naturally makes the stock more valuable. In the case of Lumen, the company will no longer pay out a $1 annual dividend amounting to a 10% annual dividend yield with the stock trading around $10. Instead, Lumen will repurchase up to $1.5 billion worth of shares over a 2-year period and effectively reduce the share count by a large amount in the process.

Oddly, a lot of investors appear to question whether with the new CEO will actually repurchase shares since a lot of corporate share authorizations don’t actually lead to share buybacks. As with any share buyback, Lumen authorized shares to be repurchased, but any company can’t immediately repurchase shares due to regulatory limits.

A company can only repurchase 25% of the daily shares and is restricted from buying back shares during the buyback blackout period unless the company has a 10b5-1 plan for defined purchases. In addition, a corporation is prevented from buying shares at a price above the highest independent bid or the last transaction price.

Under this scenario, Lumen has roughly 18 million average shares traded daily, limiting buybacks to just over 4 million shares on a daily basis. The company can only buy $25 to $30 million worth of stock when the market is open, so Lumen can’t quickly execute any large-scale buyback without an accelerated plan that doesn’t appear in at the cards right now.

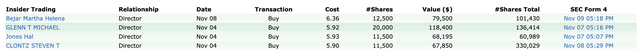

Investors should have confidence in the share buybacks due to insiders snapping up shares after the stock collapsed below $6. In total, four different directors have purchased 55,500 shares of Lumen in just a week at a total cost of $334K.

The amount spent so far on insider purchases isn’t massive, but all of the directors are spending real cash to invest in front of large share buybacks announced by Lumen and supported by the BoD. If Lumen doesn’t actually repurchase shares, these directors are just throwing away money.

The stock only has a market cap of $6.6 billion now. With $750 million in annual share buybacks over the next 2 years, Lumen will now repurchase over 10% of the outstanding shares each year.

Instead of a 10% dividend yield with $1 billion in annual capital returns, Lumen is set to deliver a 10% dividend to shareholders via share reductions by only spending $750 million. If a shareholder was willing to pay $10 for a 10% dividend yield, one should pay $11 for the stock with 10% less shares outstanding.

Lumen didn’t alter the financial picture of the company in the process of eliminating the dividend. The market wrongly portrays any dividend cut as due to a weakened financial picture, but the executives at the large telecom viewed the stock price as not fairly pricing in dividends, making a share buyback more beneficial to shareholders.

Gross Negligence To Not

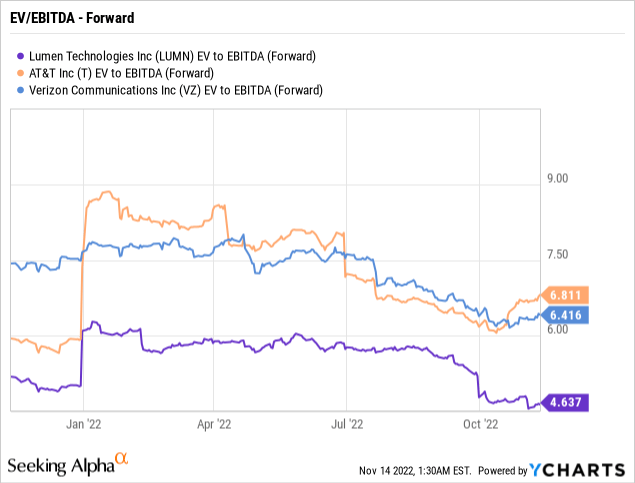

Management reinforced the concept that Lumen was too cheap to keep paying a dividend. The stock now trades below forward EV/EBITDA targets below 5x while AT&T (T) and Verizon Communications (VZ) trade closer to 7x.

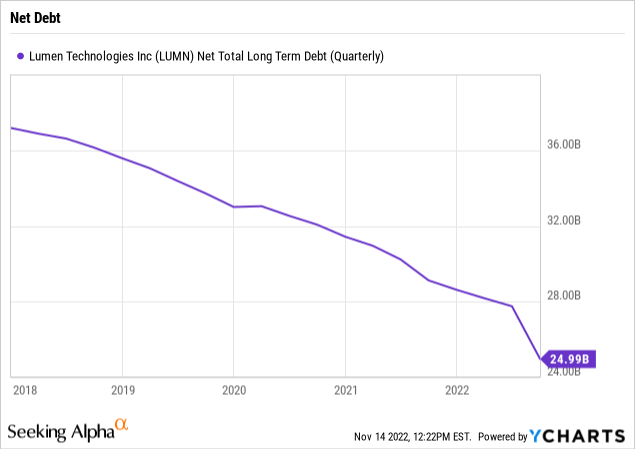

Lumen won’t retain many investors not repurchasing shares at this valuation level. The telecom is set to generate $2.2 billion in free cash flow this year and without any capital returns the company would end up just cutting the net debt position in the process.

The above EV/EBITDA position becomes even more attractive, with free cash flows going towards lowering the EV part of the equation. Either via share buybacks or the ultimate repayment of debt, the EV will fall and the multiple shrinks unless the stock rallies from here.

In addition, Lumen has closed the Brightspeed deal providing over $7.5 billion in cash and debt forgiveness. In addition, the company announced another potential deal worth $1.8 billion for the EMEA business. The company is flush with cash, and not repurchasing shares after the stock has fallen 40% due to eliminating the dividend would be pure gross negligence.

Investors should note that retired Lumen CEO Jeff Storey made the following share buybacks statement on the Q3’22 earnings call, with the BoD making decisions between starting a buyback or keeping a dividend when the stock was regularly above $10 and had fallen to $8:

We believe that the current market value of our shares dictates that the long-term value creation is better realized through share repurchases rather than the payment of a dividend.

As I said, we have authorized an up to $1.5 billion two year program, and believe it is more attractive to retire shares at today’s prices than to pay dividends at today’s yields. We have long supported the dividend as a good vehicle for value delivery, but at today’s stock price, that is no longer the case. We expect to opportunistically repurchase shares over the life of the program.

Under the leadership of Storey, Lumen has already made dramatic reductions to the debt levels. The company previously cut the dividend in order to reduce debt levels, and the management team kept those promises over the last couple of years.

The biggest negative about all of the deals to sell off units of the business is the perpetual cycle of reducing revenues. The revenue reduction feeds into the fears the business won’t ever turn around, but Lumen can now repurchase shares to take advantage of those irrational fears.

Takeaway

The key investor takeaway is that Lumen fell below $6 due to the market not understanding the buyback shift and structural issues with an investor base requiring a dividend to stick around. Insiders are already taking advantage of this system by repurchasing cheap shares and the company should be buying stock on a regular basis now. The only reason to not repurchase shares would be a stock rally back above $10 and that isn’t the case here.

Be the first to comment