simpson33/iStock via Getty Images

Thesis

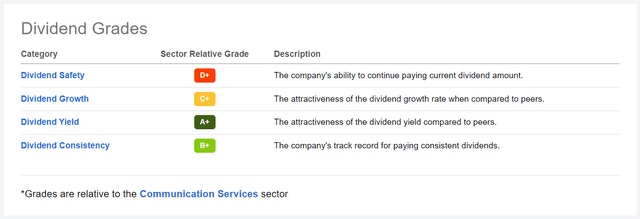

Lumen Technologies, Inc. (NYSE:LUMN) offers a 10% dividend yield. But I argue investors should be cautious towards LUMN stock, and skeptical that the headline dividend yield will be sustainable over a longer period, as it appears that Lumen is operating a structurally shrinking business. Notably, every FY since 2018, Lumen has recorded lower revenues year over year. And this trend is expected to continue, according to analyst consensus estimates. Personally, I value LUMN stock at $8.48/share, and I expect a dividend cut that brings the company’s shareholder distribution more in line with long-term cyclical adjusted business profitability.

For reference, Lumen stock has depreciated by about 24% YTD, versus a loss of 19% for the S&P 500 (SPY).

About Lumen

Lumen Technologies is one of the US’ largest communications companies. Lumen operates in two key segments: Business and Mass Markets. The company provides communication infrastructure and offers related services such as cloud computing and application services, communication and collaboration solutions, data center services, content delivery services, and managed security services. As of December 31, 2021, Lumen had approximately 4.5 million broadband subscribers.

On August 1 Lumen completed the divestiture of its Latin American business for $2.7 billion, and management expects to close the sale of 20-state ILEC businesses in the fourth quarter of 2022. According to management commentary, the proceeds of the divestitures will fund expansion into new business opportunities such as edge computing, network security and fiber upgrade. Otherwise, the company will likely not be able to return to business growth.

Contracting Revenues

From 2018 to mid-2022, Lumen’s topline has decreased at an annual compounded rate of approximately 5.7% (trailing twelve months reverence), clearly underperforming the growth of the US economy. Notably, from $22.5 billion in 2018 Lumen’s revenue fell to a lower number every single consecutive year and is now at $19.02 billion (trailing twelve months reverence).

High Financial Leverage

Moreover, investors should consider that Lumen is operating with elevated financial leverage. As of June 30, Lumen recorded total debt of $8.9 billion against cash and cash equivalents of only $360 million. Accordingly, Lumen has a net-debt position of almost triple the company’s market capitalization. In an environment of rising interest rates, this could pose a significant risk to the company and shareholders – not necessarily because Lumen could default on the debt, but because the higher debt servicing costs will eat into earnings.

Challenging Outlook

According to data compiled by Bloomberg (analyst consensus estimates as of September 5th), Lumen’s topline is expected to contract at a compounded annual rate of about 7% through the next 3 years, reaching $14.7 billion in 2025. Over the same period, profitability is expected to decrease at a similar pace with EBITDA for 2025 estimated at $5.7 billion and consensus net income expected at $750 million, or $0.77 per share. That said, considering a $1/share dividend yield, earnings will likely fail to cover dividends as early as 2024.

Target Price Estimation

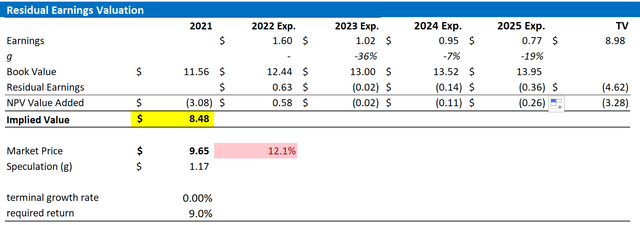

To estimate a company’s fair value, I am a great fan of using a residual earnings model, which anchors on the idea that a company’s valuation should equal its discounted future earnings after a capital charge.

My assumptions for Lumen are as follows:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal until 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analysts’ consensus is usually quite precise.

- To estimate the capital charge, I anchor on Lumen’s cost of equity at 9%. This is in line with the estimate given on Bloomberg.

- To derive Lumen’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 0 percentage points. This is materially higher than Lumen’s cyclically adjusted growth for the past 5 years and the company’s estimated growth through 2025, but I am cautious in applying a negative terminal growth rate.

Based on the above assumptions, my calculation returns a base-case target price for Lumen of $8.48/share. Accordingly, my analysis implies that LUMN stock is trading close to fair value.

Analyst Consensus EPS; Author’s Calculation

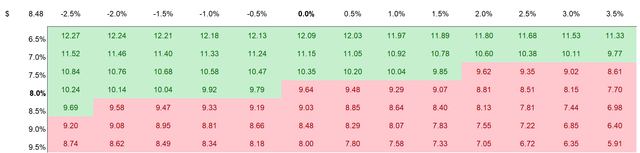

I understand that investors might have different assumptions with regards to Lumen’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Conclusion

If Lumen’s 10% dividend yield were without risk, then the case for investing in LUMN stock would most certainly be attractive. But an investor’s reality is more complex than looking at the headline number. Reflecting on a structurally shrinking business, paired with elevated financial leverage – which is especially dangerous in a rising interest rate environment – I believe Lumen’s shareholder distributions are not sustainable. The equity valuation, however, looks balanced as compared to fair value. Based on a residual earnings framework, anchored on analyst consensus EPS, I calculate a fair implied share price for LUMN of $8.48/share.

Be the first to comment