Source: Barron’s

Lululemon (NASDAQ:LULU) reported a quarterly revenue of $1.4 billion and an EPS of $2.28. The company beat on revenue and earnings. The stock is off about 5% post-earnings. I had the following takeaways on the quarter.

Strong Revenue Growth

Traditional retailers have had a difficult time growing revenue. Lululemon and off-price retailers like Burlington Stores (NYSE:BURL) and Ross Stores (NASDAQ:ROST) have been outliers. They have demonstrated solid top-line growth. The trend continued for Lululemon whose $1.4 billion in revenue rose 20% Y/Y. Its annual revenue also rose by over 20%. The company has a cult-like following, and sales of its yoga pants athleisure wear likely reflect this.

Comparable sales were stellar. Lululemon garnered 9% constant dollar comparable sales growth in its store channel, while increasing square footage at the same time. The company opened 12 net new stores during the quarter. While retailers like J.C. Penney (NYSE:JCP) and Macy’s (NYSE:M) are culling stores, Lululemon is increasing its store count. Direct-to-consumer (“DTC”) reported a 41% increase in comparable sales on a constant dollar basis. E-commerce represented 33% of total revenue, up from about 27% in the November quarter. Increased traffic drove revenue growth in-store and online. This is important. The ability to drive traffic without heavy discounting could help Lululemon continue to differentiate itself from other traditional retailers.

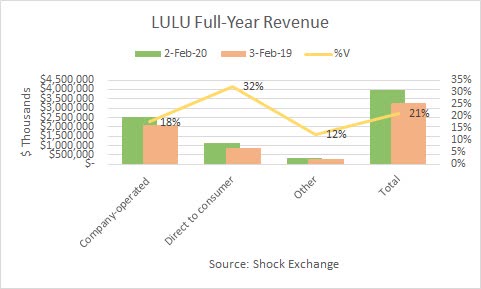

Lululemon reported full-year revenue of about $4.0 billion, up 21% Y/Y. As the company gets bigger, it may be more difficult to maintain its current growth rate. A positive is that DTC is the fastest growing segment. DTC has a segment operating income margin of 42%, versus about 31% for the total company.

Expanding Margins

The ability to drive traffic to the stores without heavy discounting is important. It has the potential to keep margins from eroding. Lululemon achieved a gross margin of 58.0%, up about 70 basis points versus the year earlier period. The variance was due to an increase in overall product margin and favorable mix. On a dollar basis, gross profit of $811 million was up 21% Y/Y. SG&A costs of $394 million were 28.2% of revenue, down 70 basis points versus the year-earlier period. The fallout was that EBITDA margin of 33.2% rose 80 basis points. EBITDA of $464 million rose 26%, outstripping revenue growth.

Lululemon was able to continue to invest in its online channel without sacrificing margins. In my opinion, the DTC is a competitive advantage. It allows management to mine data and stay abreast of customer buying patterns. This could also help better manage inventory and avoid stale products. DTC also has higher margins. If it continues to grow faster than the rest of the business, then margins could improve further.

Cloudy Outlook

Management gave no earnings guidance for the next quarter due to the negative impact of the coronavirus:

Broadly speaking and similar to many of our peers, we are seeing virus-related impact on performance across our markets. In North America and Europe, our stores have been closed since March 16. Stores in New Zealand are closed at this time, while Australia is operating on reduced hours. In China, all of our stores except our location in Wuhan are open with most operating on regular schedules. Our stores also remained open in other Asian markets, except for Malaysia, where our two locations are currently closed. In addition, we are closely monitoring our supply chain and staying in constant contact with our vendors as they too navigate this situation.

Given the rapidly changing nature of current events, we have decided not to provide financial guidance at this time. That said the underlying health of our business is strong which provides us with many levers to successfully manage through this period.

The company’s online platform could provide a buffer as most sales of apparel will take place online for now. However, the temporary store closing could cause sales to decline next quarter. Lululemon has over $1.0 billion in cash and no debt. Its strong liquidity and pristine balance sheet should allow the company to weather the storm amid a dismal retail sales environment. It could also gain more ground as weaker retailers struggle for survival.

Conclusion

There is no guarantee retail sales will return to previous levels after the impact of the coronavirus subsides. LULU trades at 23x last 12 months EBITDA. Its lofty valuation could take a hit. The stock is off over 15% year to date. It could come under pressure amid a cascade of negative economic data. I rate LULU a hold.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year – a 33% discount.

Disclosure: I am/we are short LULU, ROST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment