FinkAvenue

Thesis

Lululemon Athletica Inc. (NASDAQ:LULU) is scheduled to report its Q2’22 earnings release on September 1. Retail stocks have continued to come under pressure in Q2 as economic headwinds intensified. Coupled with surging inflation rates, the market also battered LULU toward its recent July lows.

However, Lululemon has also proved the resilience of its omnichannel operating model, given its robust growth cadence in Q1. In addition, we postulate that a lower-than-expected inflation print in July also helped lift buying sentiments on LULU, as it bottomed out, in line with the market’s bottoming process.

However, we observed that LULU is still priced at a premium, given its recovery from its July lows. Coupled with potentially slower growth cadence moving forward, we posit that the market may demand higher free cash flow (FCF) yields as a result.

Therefore, we urge investors not to buy this dip, as we expect LULU to underperform the market in the medium term. Accordingly, we rate LULU as a Hold for now.

Omnichannel Strategy Helped Sustain Its Growth Cadence

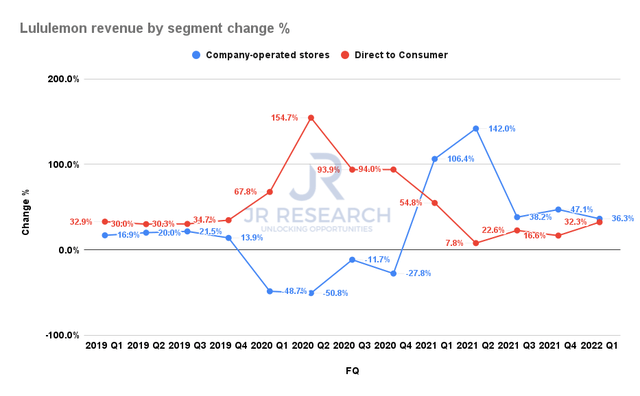

Lululemon revenue by segment change % (Company filings)

As seen above, Lululemon’s omnichannel operating model has been constructive in sustaining the company’s growth cadence over the past three years. Direct-to-consumer (DTC) proved critical during the pandemic-driven phases, even though its growth has moderated. As the economies reopened, Lululemon’s physical store sales also recovered remarkably, compensating for the moderation in DTC sales.

As a result, despite the marked normalization for both channels over the past few quarters, Lululemon has proved the success of its product and distribution strategies.

But, Growth Is Still Expected To Moderate Further

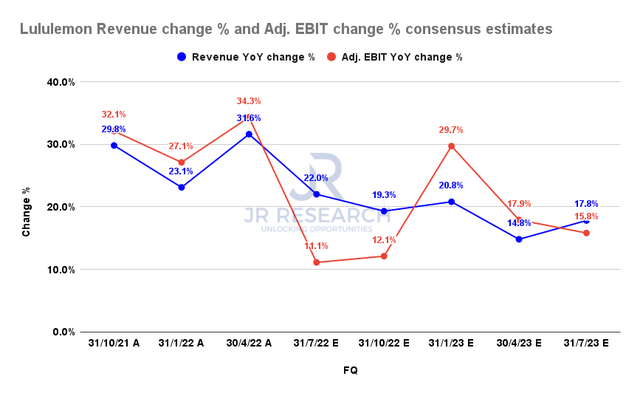

Lululemon revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that Lululemon’s revenue growth could continue to moderate further, even as it continues its focus to double its men’s segment.

The company also guided for a medium-term revenue target of $12.5B by FY26. Given the company’s TTM revenue of $6.644 in Q1, the company’s guidance implies a revenue CAGR of 14.23% through FY26. Therefore, we believe it’s pretty clear that investors should not expect Lululemon to continue delivering its robust revenue growth rates moving forward.

However, Lululemon has always been a strong generator of underlying profitability growth. We observed that Lululemon posted a 10Y TTM revenue CAGR of 20.1%. Moreover, the company delivered a 10Y EPS CAGR of 19.4%, converting its topline growth into healthy profit growth.

As a result, we urge investors also to consider a slowdown in bottom-line growth dynamics, as Lululemon’s revenue growth normalizes further.

LULU Is Still Priced At A Premium

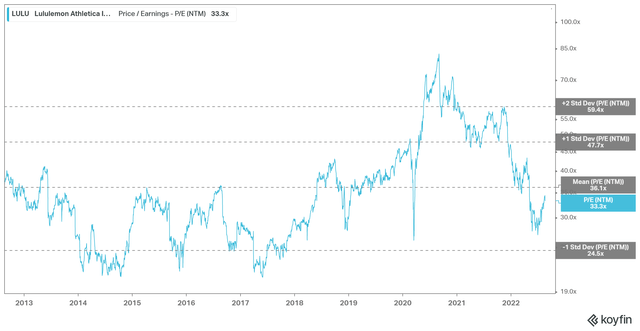

LULU NTM normalized P/E valuation trend (koyfin)

We observed that LULU’s NTM normalized P/E has recovered from its July lows to 33.25x, suggesting a steep growth premium. Furthermore, its valuation is also quite close to its 10Y mean, as seen above.

Note that LULU has traded closer or below one standard deviation from its 10Y mean in past instances where an entry point would have been more palatable. Therefore, we posit that LULU’s valuation is more well-balanced now but not attractive enough, given its slowing growth momentum.

Is LULU Stock A Buy, Sell, Or Hold?

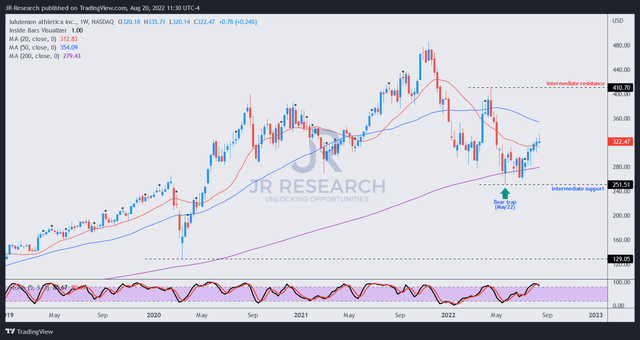

LULU price chart (weekly) (TradingView)

As seen above, we are confident that LULU has likely bottomed out in July, which is close to its May bear trap (indicating that the market denied further selling downside decisively). Therefore, an entry point could be attractive if LULU pulls back closer to its May/July lows and is supported.

However, we don’t see any potential buy trigger at the current levels. Coupled with what we believe is a pretty well-balanced valuation, we don’t find LULU attractive at the current levels due to its embedded growth premium.

There’s little doubt that LULU is a very high-quality retailer, but it doesn’t mean that the investment thesis is attractive, considering its valuation. As a result, we rate LULU as a Hold for now.

Be the first to comment