Robert Way/iStock Editorial via Getty Images

Introduction

Lululemon Athletica Inc. (NASDAQ:LULU) is the fastest-growing brand in the $201 billion global sports apparel market, which is poised to grow at a 4.8% CAGR from 2022 to 2028. Unlike major competitors including Nike (NKE) and adidas (OTCQX:ADDYY), the company achieved its success by targeting yoga enthusiasts and working with influencers in local communities to build a cult-like following. As fashion took on a new definition over time, consumers began to find their Lululemon leggings relevant even after yoga class.

As a result, Lululemon has grown from a local shop in Vancouver, Canada, to a $6.3 billion global brand. In the backdrop of an increasing public desire to live a healthy/active lifestyle, I believe Lululemon is well positioned to capitalize on this secular trend with a premium brand image, high-quality products, attractive margin profile, and an industry-leading balance sheet.

2021 recap

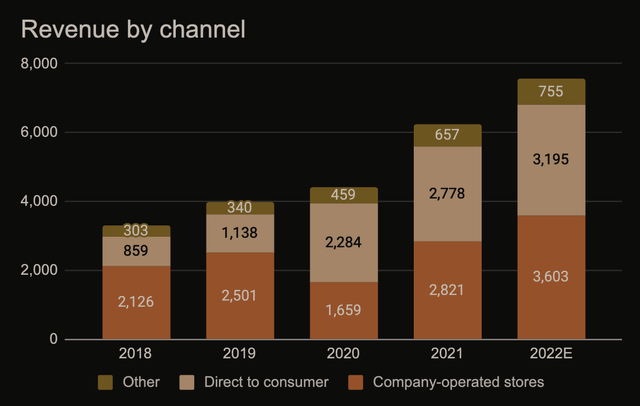

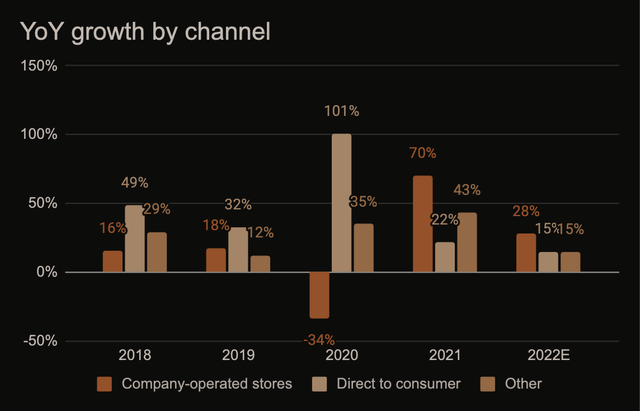

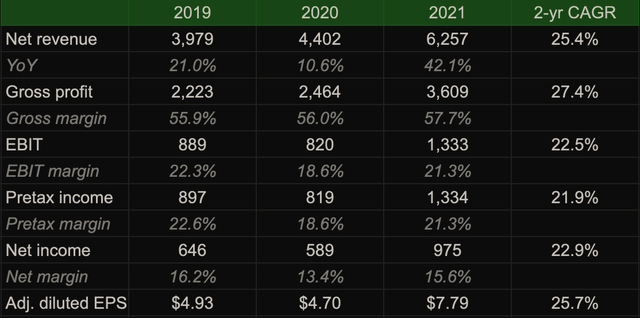

2021 was a recovery year for Lululemon, as the company generated $6.3 billion in revenue (+42% YoY / 25% 2-yr CAGR). Sales from company-operated stores saw a significant rebound from a 34% YOY decline in 2020 to a 70% growth in 2021. On the bottom line, Lululemon finished the year with a 15.6% net margin (vs. 13.4% in 2020 / 16.2% in 2019) and adjusted EPS of $7.79 (up 66% vs. 2020 and 58% vs. 2019).

In 4Q21, revenue of $2.1 billion grew 23% YOY and 23% on a 2-year CAGR basis, while store revenue increased by 47% YOY as traffic increased 50%, providing a much-needed boost for operating profit. Total comps increased 22% (32% for stores / 16% for digital) driven by positive consumer response to outerwear, second layers, and technical shorts for both women and men. Further, management highlighted its strength in Mainland China, where revenue increased more than 60% on a 2-year CAGR basis.

Like most consumer brands and retailers, Lululemon is not immune to supply chain challenges. The company used air freight to get inventory in on time for the holiday season. This weighed on product margin in 2021 with a 530 bp impact, without which margins would have been higher than 2019.

3 key drivers for 2022

It’s clear that 2021 was a year of normalization for Lululemon. As delays in ocean freight existed throughout the year, though, the company has likely been in an under-inventory position. There is pent-up demand for its most popular core products (e.g., the Women’s Align collection) that make up roughly 45% of total inventory.

For 2022, management is guiding revenue of $7.49 billion to $7.615 billion, implying a 3-year CAGR of 23% to 24% from 2019 to 2022 vs. 3-year CAGR of 19% from 2017-2020. On the bottom line, adjusted EPS is expected to come in between $9.15 to $9.35. Bear in mind this is without the impact of a newly approved $1 billion share repurchase program.

1. Physical stores are in growth mode while e-commerce continues to normalize

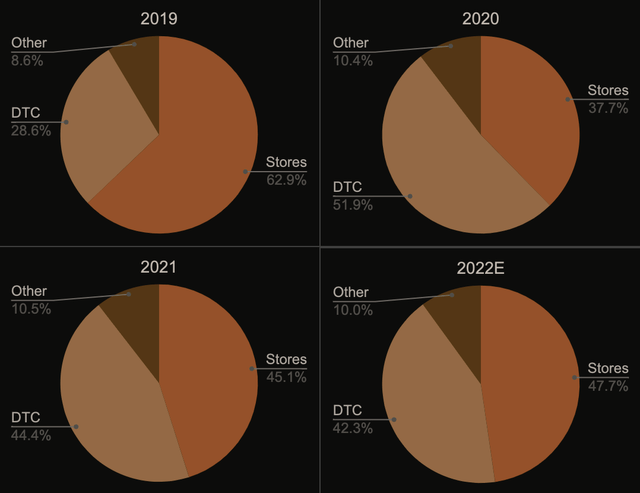

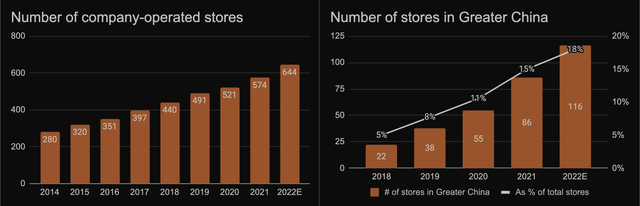

From a channel perspective, Lululemon is expecting its e-commerce business to grow in the mid-teens and will open 70 net new stores (including 40 in international markets) in 2022. As the retail business continues to recover, I believe brick-and-motor revenue will continue to be a meaningful top-line driver to account for roughly 48% of total revenue in 2022 vs. 45% and 38% in 2021 and 2020, respectively.

Company data, Author’s estimates Company data, Author’s estimates Company data, Author’s estimates

2. International expansion still in the early innings, with China being a big opportunity

Internationally, Greater China represents Lululemon’s biggest opportunity as the company has ample room to grow with just 86 stores in the region as of 4Q21. The Chinese yoga market is expected to register a 12% growth rate to reach ~$7.9 billion in 2022, of which 59% will be spent on services (yoga classes) and 41% on products (apparel, equipment and accessories). Further, the number of yoga studios in China has tripled from ~14,000 in 2016 to ~42,000 in 2021. Given that China is the fastest growing market for Lululemon, I’d expect 30 out of 40 new international stores to be in this region, representing 18% of the total store base in 2022.

It’s also worth noting that revenues from outside North American currently represent more than 80% of total revenue, so it’s safe to say that Lululemon is still in the early innings of its international expansion. It’s also good to see that management is not being overly aggressive by trying to open hundreds of stores every year.

3. Cautious on footwear, but optimistic on menswear growth

From a product perspective, Lululemon continues to enter new categories such as tennis and golf. It has recently introduced a new women’s running shoe collection named BlissFeel. While expanding into non-Yoga clothing makes sense, I’m less certain about entering the highly competitive athletic footwear market that typically comes with a lower margin profile. Nevertheless, it’s good to see that management is taking a cautious vs. all-in approach to this brand new market.

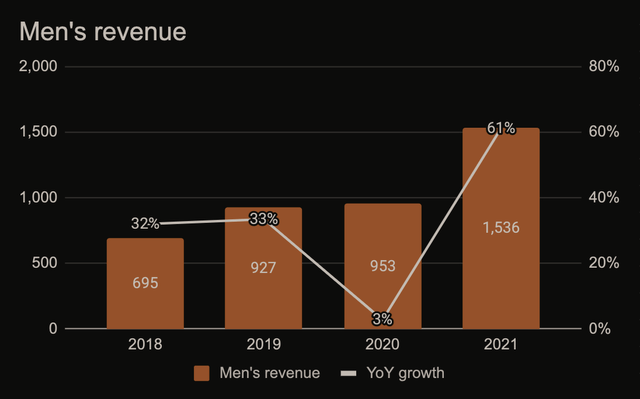

As a popular brand amongst women, Lululemon actually surprises many when it comes to its menswear business. From 2018 to 2021, men’s revenue has more than doubled from 21% to 25% of total revenue, as the brand has created solid product lines that accurately capture what men typically look for in clothing: comfort, simplicity and durability.

In the name of research, I have purchased several pairs of Lululemon pants and shorts. It has been a great experience thus far, as pilling has never been an issue and I can wear the ABC pants to several occasions from work to golf given how stretchy the fabrics are (they call it ABC for a reason, Google it). Going forward, I’d expect Lululemon’s men’s to be a strong revenue driver thanks to increased willingness for men to invest in high-quality and durable activewear.

Thoughts on the stock

Lululemon is a great company but I’d expect the stock to remain challenged in the near term given: (1) a strong post-earnings price reaction; and (2) a fragile market that will likely continue to be affected by historic inflation, the Ukraine/Russia crisis, a potential recession in 2023, and an increasingly aggressive Fed.

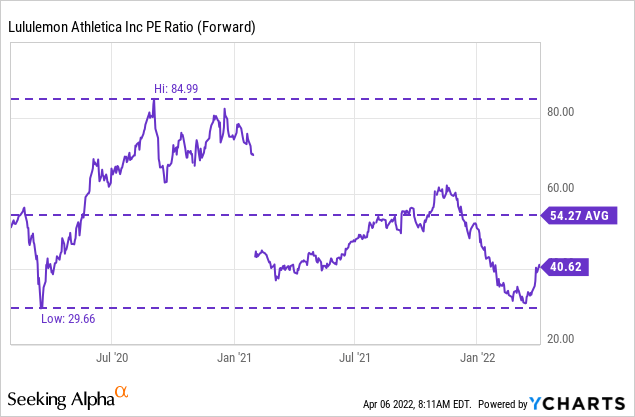

Assuming adjusted EPS of $9.4 post-buyback, the stock trades at a 2022 forward P/E of 40x, lower than the 1-year average of 54x but still expensive in the current environment. As a result, I believe it’d be prudent to begin accumulating at roughly 35x earnings or ~$330. Of course, if the market wants to go into panic mode again, the stock could easily revisit $300, giving investors a great opportunity to own a secular growth story at a fair price.

Be the first to comment