Getty Images/Getty Images News

Luckin Coffee (OTCPK:LKNCY) shares are up about 33% this year as of the time of writing. The tech-heavy NASDAQ index with the largest digital companies in the US, meanwhile, is down around 27% this year. That is quite a paradox, given Luckin Coffee’s 2020 alleged accounting scandal and the resulting delisting from NASDAQ that followed. The company’s recently reported earnings do not make me feel very optimistic although I really like Luckin Coffee’s business model. Given the situation, its stock seems to be highly overvalued. Let me explain my statements in this article.

Luckin Coffee’s business model

I got interested in Luckin Coffee just before its IPO in 2019. Although I understood at the time that IPOs are risky and the company reported substantial net losses, the business model presented by Luckin was attractive. Just as a quick reminder, the Chinese company does not operate large and comfortable cafes the way Starbucks (SBUX) does. Instead, Luckin enables its customers to download its app and order their coffee online. Luckin’s premises are mostly located in large cities near business centers and university campuses where the demand for such services is high. Luckin does not have to pay lots of money for expensive premises and has an opportunity to sell many cups of coffee each day.

It is quite a winning strategy also because of the Chinese specifics. China has traditionally been famous for its tea. The older generation still prefers drinking tea instead of coffee. But the latter is getting popular among younger people just like other “Western” habits. Younger people in China also like to order food and drinks online. This has been getting popular for several years already. In addition to these modernization and westernization trends, the Chinese middle class has been growing for a few decades already. That means the disposable incomes in China are rising, thus pushing the demand for various services, including food and drink deliveries, further upwards.

That is why I liked the idea behind this company. Now let us go to the not-so-pleasant part of the story, namely the corporate finances.

Luckin’s accounts and recent earnings results

Some investors might question a company’s earnings figures if this company was delisted due to alleged accounting misdealings. In 2020, Nasdaq delisted Luckin because of “fabricated transactions disclosed by the Company in a Form 6-K.” As a result, the company’s stock started trading on the OTC and not on the prestigious NASDAQ. This means that right now the auditing and inspection standards are much lower than they used to be before the delisting. NASDAQ’s reporting standards are higher than these of the OTC.

But let me have a look at some more accounting details. Before going into too much history let us look at the most obvious and recent things. On 22 November this year, the company published its quarterly earnings results.

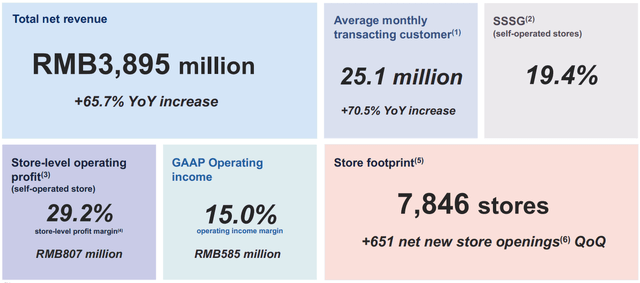

Luckin Coffee’s 3Q 2022 earnings summary

Luckin Coffee Inc.

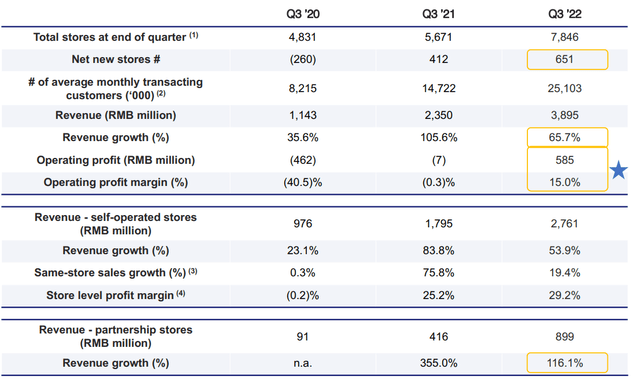

Luckin Coffee’s earnings history

Luckin Coffee Inc.

Here is what immediately makes the potential investor raise some questions – the recent results but most importantly the revenues figures exceed expectations. A 65% rise in net revenues YoY is impressive even for a high-growth company. According to Luckin’s official accounts, the company has been facing years of substantial losses. Now its operating income margin is 15%. The 2020 figures given above also seem surprising because 2020 was a poor year for the company. 2020 was also a very challenging time for China’s economy due to stringent Covid-19 lockdowns. And yet, Q3 2020 was marked with a 35.6% revenue growth.

Investors may come away with an incomplete picture based on these statements. Let me explain why the recently reported figures are higher than I’d anticipate nowadays for a Chinese company. Earlier on I wrote an article about Alibaba (BABA). Of course, it is not a close competitor of Luckin Coffee. At the same time, it is a major and successful high-growth company selling products online. So, Alibaba is not doing well enough due to the operating economic environment. The company’s revenues are still growing but the growth pace has slowed down, whilst BABA has been recording GAAP net losses for a while. Many other Chinese companies are not doing fine either. China is facing a substantial economic growth slowdown due to numerous Covid-19 lockdowns in its major cities and extreme weather conditions. There is also a rise in inflation and an economic slowdown due to the energy crisis. In China, there is also the property market decline that resulted from regulatory tightening. Unfortunately, this made developers face a liquidity squeeze. The housing demand also remains under pressure due to Covid-19 regulations.

The point I am making is that the economy of China is not going through its best days, whilst many very large and profitable companies are not doing well either. That is why it is surprising that Luckin Coffee is doing so well.

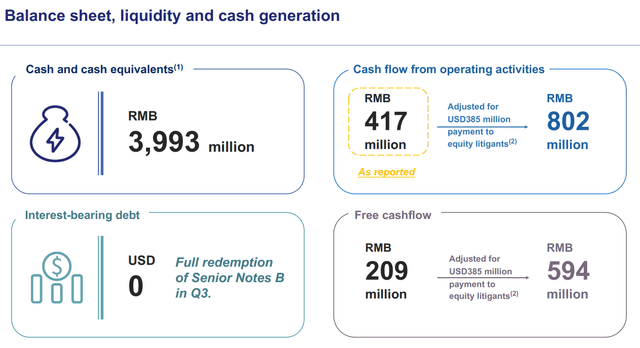

But the most unexpected things, in my view, are Luckin Coffee’s current cash situation and most importantly its complete lack of debt. This is hard to achieve for a company that has been reporting net losses for several years. In fact, even profitable companies with very high credit ratings have some debt.

Luckin Coffee Inc.

But Luckin Coffee’s reported cash is equal to RMB 3,993 million or $557 million. The company’s interest-bearing debt is equal to USD 0. That is why Luckin’s net debt is negative, quite a rare situation. According to the management, the company’s Senior B Notes were fully redeemed in Q3 2022. You might argue, of course, that plenty of cash was raised from the IPO and other investors also believed in the idea of Luckin and financed this company. But first of all, the IPO was about 3 years ago and it is very risky to directly invest in such a loss-making company. I did not dig into too many accounting details but even on the surface, it seems to me the earnings figures are far too optimistic. In my opinion, investors may come away with an incomplete picture based on these statements.

Valuations

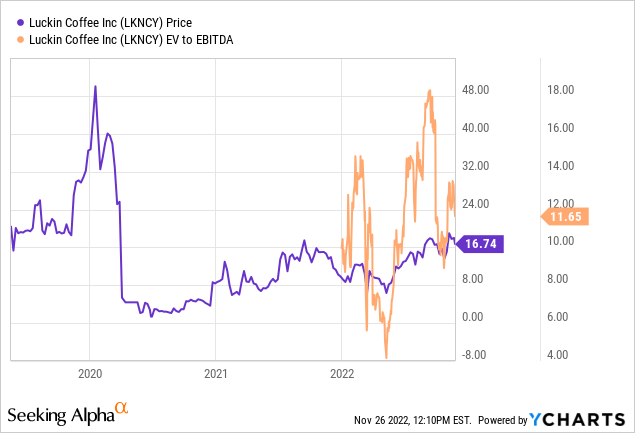

In spite of the fact the company is loss-making, Luckin’s stock price is doing very well. But let me illustrate how overvalued Luckin Coffee is.

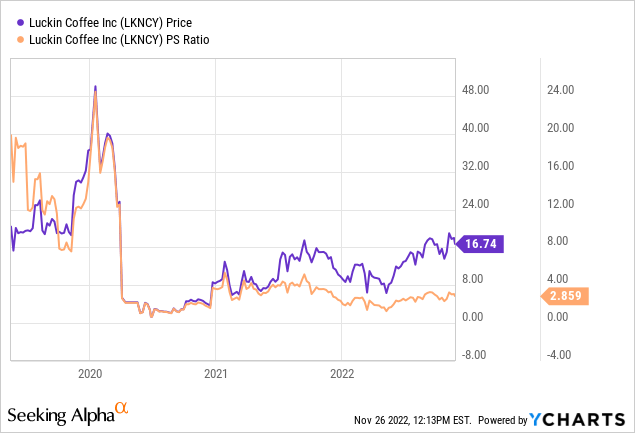

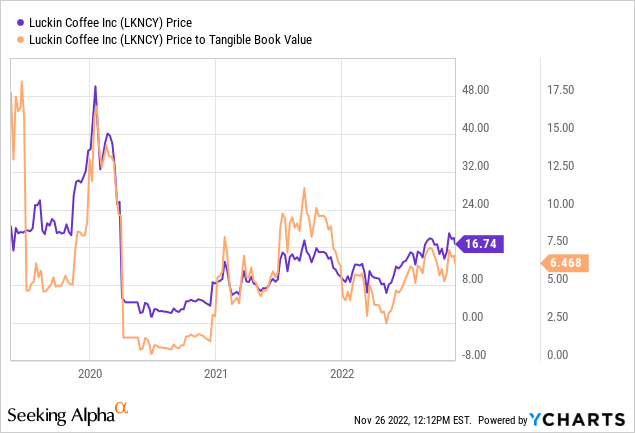

I am using the data from Y-Charts to value Luckin. The following ratios were generated: the EV-to-EBITDA, the price-to-sales (P/S), and the price-to-tangible book value per share. I am now assuming that all the accounting data used to generate these graphs are correct.

A good EV-to-EBITDA should be below 10. In our case, it is almost 12. This would be alright for a profitable and stable company but certainly not Luckin Coffee.

Moving on, the P/S ratio is almost 3. It is an average indicator of a good and well-appreciated company. Luckin is hardly the one that can be described this way.

The most interesting indicator is the company’s price-to-tangible book value per share. It is now hovering near 6.5. On average this indicator should be about 1 to 3. According to the company’s accounts, it has a negative net debt. So, its book value should be high. But it is so much lower than its market capitalization. By this criterion, Luckin Coffee is very overvalued.

Overall, the stock valuation is illogically high.

Risks

As I have mentioned above, the company’s financial position is not ideal for a value investor. The stock may lose plenty of value if a similar situation to the 2020 scandal happens again. Assuming Luckin’s earnings figures are accurate, over years of operations Luckin has never managed to record a net profit. Luckin Coffee grows too fast, which is also not a very good sign for a conservative stock buyer. It is much better for a company to aim for sustainable growth but most importantly profit maximization. This does not seem to be the case with Luckin. Moreover, we have to admit that Luckin’s stock is overvalued, given its lack of profitability.

At the same time, it is possible for Luckin Coffee to apply for listing on a prestigious stock exchange. If that happens, the company’s accounts would be audited very carefully. If the accounting figures turn out to be accurate, the company would be listed and large financial organizations would most probably invest in Luckin Coffee. Under this possible scenario, the stock will surge. So, I would not personally suggest short-selling Luckin’s shares.

Conclusion

So, to summarize, there is a very good idea behind the business model of Luckin Coffee Inc. At the same time, its results raise many questions even if we just have a look at the recent earnings presentation. In spite of the fact, there are many financial concerns, its stock is doing very well and is overvalued as far as all the ratios are concerned. I am not saying Luckin Coffee’s stock will do extremely bad in the near future. But it is not the best option for a classical value investor, in my opinion.

Be the first to comment