hapabapa

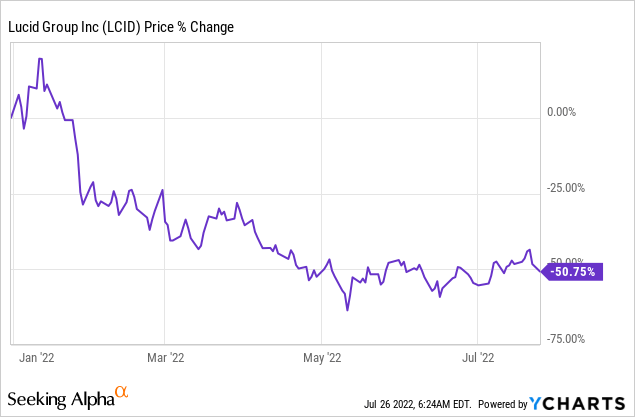

Luxury electric-vehicle maker Lucid Group (NASDAQ:LCID) has an attractive risk profile that remains skewed to the upside as the company executes on its multiyear production ramp for its first-ever production car, the Lucid Air. Reservations for the Lucid Air have soared to more than 30 thousand in FY 2022 and the second quarter will likely have seen strong growth in Lucid’s reservations as well. After a 51% decline in pricing this year, shares of Lucid have an attractive valuation!

Lucid Air reservations: Expectations for Q2’22

Lucid had more than 30 thousand reservations for its first production car Lucid Air base model or one of its higher priced, higher spec variations as of March 5, 2022. With momentum likely staying strong throughout the second quarter, I expect Lucid to reveal between 34-35 thousand Lucid Air reservations next week which means the electric vehicle marker may have amassed between 4-5 thousand additional reservations in the last three months. On a monthly basis, I estimate that Lucid likely added 1.3-1.6 thousand reservations for the Lucid Air.

Based off of 34-35 thousand reservations, I calculate a total estimated order value somewhere between $3.3B and $3.4B, assuming an average purchase price of $97 thousand per electric vehicle. Compared to May, when the estimated order book value was $2.9B, investors could see a growth rate of 14-17% in Lucid’s revenue potential.

What will be very interesting to see — and management may provide additional insight into this — is how inflation is affecting customers’ purchasing behavior of high-priced electric vehicles.

The reason why this is important is because inflation is starting to affect consumer spending behavior. Walmart (WMT) trimmed its profit outlook for FY 2022 yesterday due to inflationary pressures that force customers to cut back on discretionary spending and to spend more money on necessary items such as food and energy. Walmart’s Q2’22 earnings card proved that inflation is starting to make a big impact on how consumers are spending money and it could impact Lucid’s revenue outlook as well.

Lucid itself raised vehicle prices, depending on model, between $10-15 thousand in June 2022 and a higher sticker price could negatively impact Lucid’s reservation growth rate going forward. Since Lucid’s price increases went into effect on June 1, the second quarter includes only one month of higher vehicle prices. Since Lucid gave interested customers a heads-up about the price increase, many buyers likely pulled their reservation forward to May to benefit from lower prices. Going forward, however, higher electric vehicle prices may dampen product demand and growth in Lucid’s aggregate order value may moderate.

Production update

The big question next week will be if investors can trust Lucid’s full-year production target of 12-14 thousand electric vehicles. Lucid managed production expectations at the end of February when it downgraded its manufacturing target from 20 thousand electric vehicles to 12-14 thousand electric vehicles, showing a decline of up to 40% relative to the prior forecast.

At this point, I expect Lucid to stick to its production goal for FY 2022. The worst possible outcome next week, however, would be the reporting of production delays or slowing demand growth related to higher EV prices.

Revenue expectations remain strong

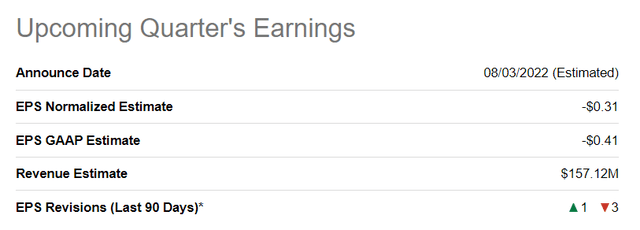

Lucid is not profitable and not expected to be as long as the company ramps production and evolves into a full-fledged EV manufacturer. Consensus predictions call for $(0.31) in non-GAAP EPS in the second quarter while revenues are expected to grow to $157.12M. Revenue estimates imply a 172% quarter over quarter increase in revenues.

Seeking Alpha – Lucid Q2’22 Estimates

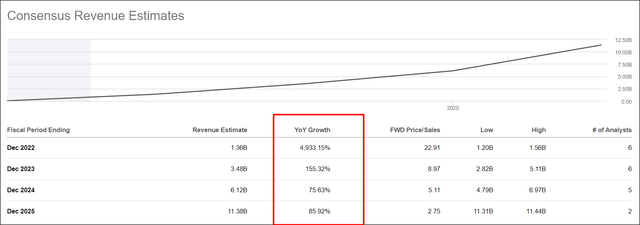

Revenue expectations, however, are much more important for electric vehicle start-ups than EPS predictions. Investors continue to expect a massive production and delivery ramp to take place for the Lucid Air and since the company is operating in an under-served market — the luxury segment for all-electric sedans — Lucid has very attractive potential for explosive revenue growth going forward. Revenues are expected to grow to $1.36B this year before rising to $3.48B in FY 2023. Because of Lucid’s explosive growth expected for the firm’s top line, the price-to-revenue ratio declines from 9.0 X in FY 2023 to 2.8 X based on FY 2025 revenues.

Seeking Alpha – Lucid Revenues Estimates

Investors also may not want to forget that Lucid recently secured a production and delivery deal with Saudi Arabia for the purchase of up to 100 thousand electric vehicles. Deals like this could make a big difference for revenue estimates going forward.

Risks with Lucid

The biggest risk for Lucid is the production ramp. The electric vehicle manufacturer lowered its production target earlier this year which solidified Lucid’s short-term down-trend. If Lucid fails to deliver strong reservation and delivery growth in Q2’22 and beyond, shares may revalue lower.

Another risk that has developed in 2022 is related to inflation. The Walmart earnings release has shown that inflation is starting to affect consumers’ purchase behavior. High inflation and cost increases for raw materials could slow product demand and revenue growth for Lucid’s high-priced electric vehicles going forward. Revenue expectations don’t yet show that inflation is a threat to Lucid, but it could become one.

Final thoughts

Lucid likely benefited in the second quarter from customers pulling their electric vehicle purchases forward to avoid higher prices after June 1, 2022. While reservation growth may have slowed after June 1, 2022, I believe Lucid is looking at 4-5 thousand new reservations that were added to the firm’s reservation books in Q2’22. I also believe Lucid will stick its FY 2022 production target. Lucid could surprise with stronger reservation and revenue growth for the second quarter next week which could push shares into a new up-leg!

Be the first to comment