Mlenny/iStock via Getty Images

Investment Thesis

Lucid Group, Inc (NASDAQ:LCID) still has a long way to go before achieving its Tesla (TSLA) moment. TSLA has had a meteoric rise in value during the COVID-19 pandemic, thereby giving its long-term investors a portfolio boost by over 700% in the past two and a half years. Additionally, it is essential to note that the rally was supported by TSLA finally achieving FCF profitability in FY2019, and net income profitability in FY2020, as well as delivering over 936K vehicles in FY2021. It led to the massive growth in TSLA’s Enterprise Value from $53B in July 2019 to $673B in July 2022, while also not forgetting its peak Enterprise Value of $1.22T in January 2022.

Given that LCID is a good distance away from the global EV leader, it is apparent that investors would still need to wait patiently for quite a few years, before successfully cashing in their stocks. We shall discuss this further.

LCID Is Still A Newbie In The EV Market

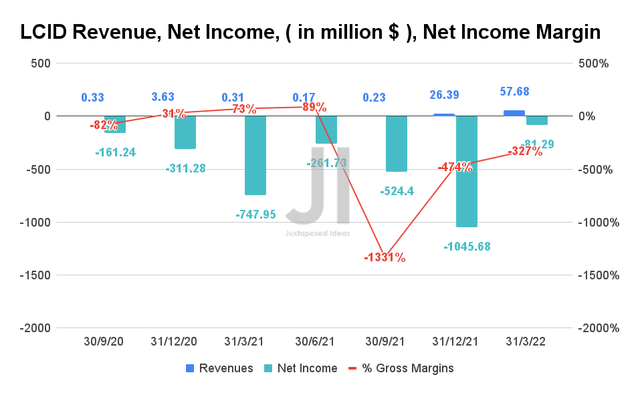

LCID Revenue, Net Income, and Net Income Margin (S&P Capital IQ)

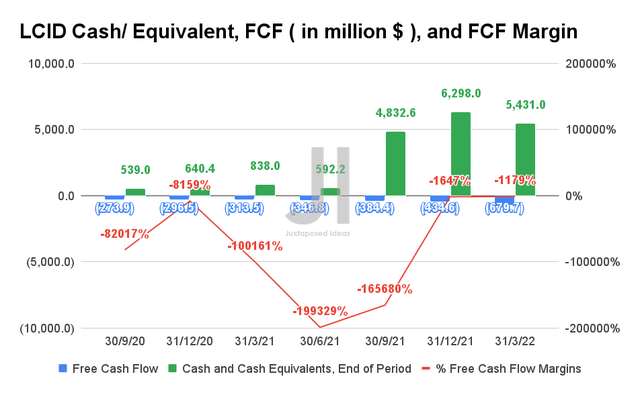

As a nascent company, LCID reported revenues of $57.68M with net incomes of -$81.29M and gross margins of -327% in FQ1’22. Given its recent IPO in July 2021, the company is still swimming in massive cash and equivalents of $5.43B in FQ1’22. Nonetheless, it is evident that given the nascency and aggressive growth trajectory, the company has yet to report positive Free Cash Flows (FCF), with FCF of -$679.7M and FCF margins of -1179% in FQ1’22.

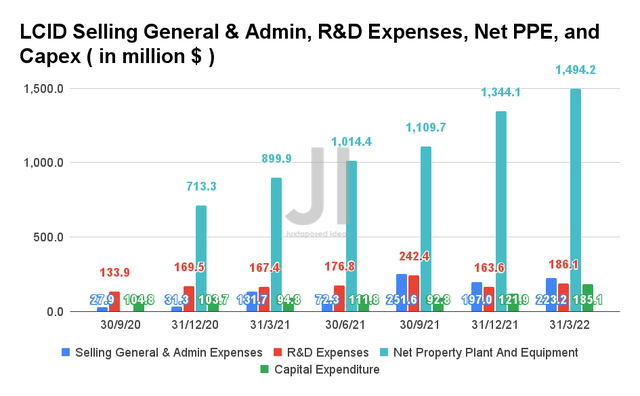

LCID Cash/ Equivalents, FCF, and FCF Margins (S&P Capital IQ) LCID Selling, General & Admin, R&D Expenses, Net PPE, and Capex (S&P Capital IQ)

With $409.3M of operating expenses in FQ1’22 and guidance of over $2B in capital expenditure for the year, LCID is looking at a total of $3.63B in expenses for FY2022. It is evident that the company is gearing up to be an all-in-one automaker, given its proprietary powertrain technology and in-house developed software, thereby justifying its growing R&D expenditure.

LCID is also aggressively expanding its manufacturing capacity in order to deliver up to 14K vehicles in FY2022 and eventually, 100K to the Saudi Arabia government by 2033. Nonetheless, we are not concerned about its execution, given its existing installed manufacturing capacity of 34K annually as of FQ1’22 and growing capacity of up to 245K from its expanded Arizona and Saudi Arabia plants. Moreover, by 2025, LCID also aimed to produce up to 500K vehicles annually, thereby placing it firmly as a strong player in the EV industry moving forward.

However, it is also important to note that the availability of semiconductor chips remains a temporary headwind for LCID’s ramping-up efforts. In addition, given its lack of profitability, we do not expect a massive rally or recovery for the stock anytime soon, given the macro issues and bearish market sentiments.

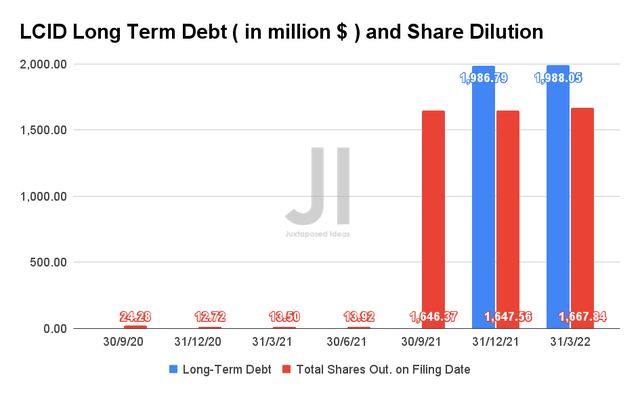

LCID Long Term Debt and Share Dilution (S&P Capital IQ)

Therefore, it is evident that LCID will be further relying on debt and/or share dilution to fund its operations and expansions moving forward. The company also reported $174.5M in share-based compensation (SBC) for FQ1’22, with a projected sum of up to $700M in SBC expenses for FY2022, assuming a similar rate of expenses. As a result, it is not far-fetched to assume that LCID would be raising more capital by 2023, given the current cash burn rate.

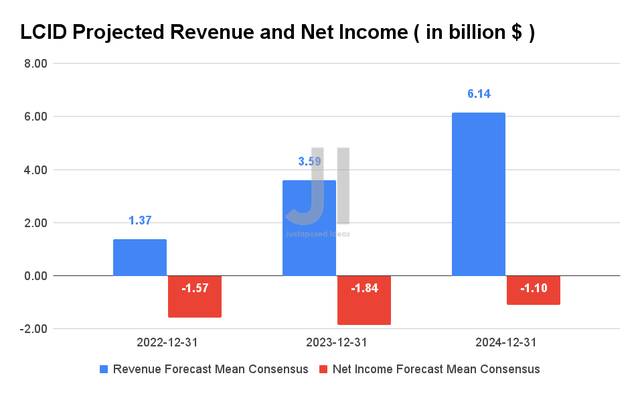

LCID Projected Revenue and Net Income (S&P Capital IQ)

Over the next three years, LCID is expected to report impressive revenue growth at a CAGR of 509.56% while only reporting net income profitability from FY2025 onwards. Consensus estimates that the company will report revenues of $1.37B and a net income of -$1.57B in FY2022, representing excellent YoY revenue growth of 5053%.

Therefore, LCID investors must be well aware of the potential debt leveraging and share dilution as the company continues to raise capital to fund its growing operations. Nonetheless, there is no real cause for concern since Saudi Arabia’s Public Investment Fund, worth a whopping $620B, is a key investor in the company. In addition, LCID also managed to secure up to $3.4B in financing and incentives to build and operate its Saudi Arabian plant. Given the support of such a strong backer with deep pockets, LCID’s growth trajectory could very well be accelerated indeed. However, there is also a chance of failure, given the massive reliance on the Saudi Arabian market.

So, Is LCID Stock A Buy, Sell, or Hold?

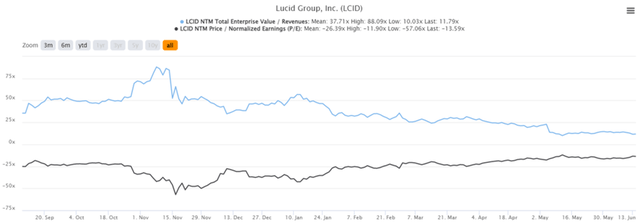

LCID 1Y EV/Revenue and P/E Valuations (S&P Capital IQ)

LCID is currently trading at an EV/NTM Revenue of 11.79x and NTM P/E of -13.59x, lower than its historical mean of 37.71x and -26.39x, respectively. The stock was also trading at $16.60 on 14 June 2022, down 71.2% from its 52-week high of $57.75, though at a premium of 25.2% from its 52-week low of $13.25.

LCID 1Y Stock Price (Seeking Alpha)

Nonetheless, despite the drastic moderation in November 2021, it is evident that the LCID stock may see further retracement moving forward, given the macro issues and bearish market conditions. In addition, we may potentially see lower deliveries in the next few quarters, given the reduced chip supplies from its exposure to China’s Zero COVID Policy. Therefore, we would encourage more patience before adding more exposure.

In a similar conclusion to our previous analysis on Rivian (RIVN), these start-up EV companies have a high potential for success, since they are not dragged down by the older ICE segments, as experienced by legacy automakers such as General Motors (GM) and Ford (F). Nonetheless, given its nascency, lack of profitability, and potential reliance on debt leveraging and share dilution, LCID is only suitable for speculative investors with higher risk tolerance and excess capital for long-term investing. However, it is entirely possible that the stock may achieve its Tesla moment in the far future, given the financial support.

As a result, we rate LCID stock as a Hold for now.

Be the first to comment