Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

We follow up on our previous article on Lowe’s (NYSE:LOW), indicating that investors should use the opportunity to sell and rotate away as the housing party is over.

LOW has fallen about 7.5% since we published the article, underperforming the SPDR S&P 500 ETF’s (SPY) 3.8% decline. While LOW’s valuation may seem more balanced now, we highlight in our valuation model why it could underperform the market at its current levels. As a result, we don’t encourage investors to add at the current levels and urge some patience.

Our price action analysis indicates that LOW is likely at a near-term bottom. But we don’t think that bottom could hold, even though it could stage a short-term rally. Also, investors should note that LOW remains entrenched in a bearish bias, having lost its bullish momentum since early May. Therefore, the price action corroborates our view that LOW is likely to be in a distribution phase before subsequently setting another steeper decline.

We revise our rating from Sell to Hold. Our revision is predicated on anticipating a short-term rally from its current near-term bottom before a steeper decline could ensue. Therefore, investors can wait for another opportunity to sell into the rally and cut exposure further.

Don’t Fight Against A Steep Fall In Revenue Growth

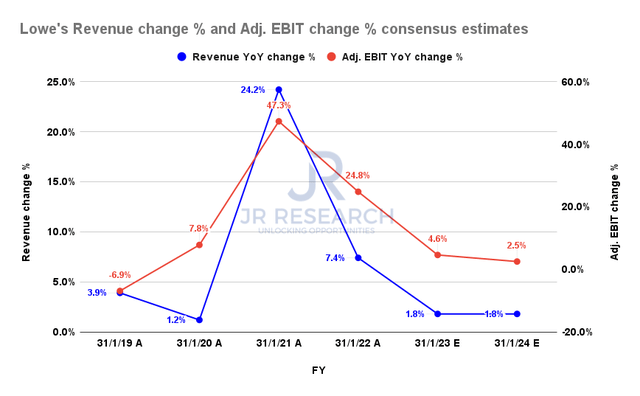

Lowe’s revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Management remains confident in its outlook, despite the heightened macro risks, inflation, and moderation in demand as the housing market has shown signs of slowing. CEO Marvin Ellison articulated in a recent June conference (edited):

The macro backdrop for home improvement remains healthy. We’re confident in our long-term outlook for our business. And as a reminder, for the group, the primary drivers of our growth have remained consistent over time. Home price appreciation, age of housing stock, and disposable personal income. As we look at our market today, real residential investment as a percentage of GDP remains supportive. (Oppenheimer Virtual fireside chat)

Notwithstanding, the revised consensus estimates highlight a steep deceleration in its revenue growth to 1.8% for FY23, down from FY22’s 7.4%. In addition, the Street is also modeling for its topline growth to remain tepid through FY24. Despite management’s optimism, even the generally bullish Street consensus is not convinced about keeping pace with FY22’s growth cadence.

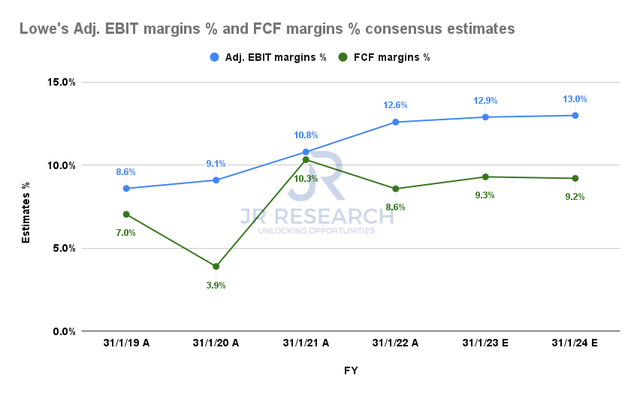

Lowe’s adjusted EBIT margins % and FCF margins % consensus estimates (S&P Cap IQ)

However, Lowe’s inherent operating leverage is expected to help it comfortably sail through the current macro headwinds. As a result, Lowe’s adjusted EBIT margins are estimated to remain robust, improving to 12.9% in FY23, up from 12.6% in FY22. Also, its free cash flow (FCF) margins are estimated to increase to 9.3% in FY23, demonstrating the Street’s confidence in the resilience of Lowe’s operating model.

Therefore, long-term shareholders in Lowe’s can remain confident as long as management continues to execute well, including on its pivot to capture market share in the Pro business.

LOW’s Price Action Shows A Worrying Bearish Bias

Despite the Street’s and management’s optimism, the market is not convinced. We believe it has been pricing in a slower revenue outlook, despite robust profitability estimates since its bull trap (significant rejection in buying momentum) in March 2022.

Furthermore, March’s bull trap sent LOW into a bearish bias. It decidedly reversed its bullish momentum that underpinned its medium-term uptrend from its March 2020 COVID lows.

Notwithstanding, LOW is likely at a near-term bottom. However, despite the possibility of a short-term rally, we don’t believe its near-term support could hold eventually. We think the market is distributing LOW in anticipation of a steeper sell-off subsequently.

Buy LOW At $149 And Below – Here’s Why

| Stock | LOW |

| Assumed entry level | $149 |

| Hurdle rate (CAGR) | 10% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 7.5% |

| Assumed TTM FCF margin in CQ4’26 | 9.4% |

| Implied TTM revenue by CQ4’26 | $116.67B |

LOW reverse cash flow valuation model. Data source: S&P Cap IQ, author

LOW delivered a market-beating 5Y total return CAGR of 20.21%. It easily outperformed the SPY’s 11.45% over the last five years. But, we caution investors to be wary of expecting LOW to continue delivering such outperformance over the next four years. As our valuation model indicates, LOW will likely disappoint such expectations.

We used an assumed entry level of $149 (LOW’s intermediate support). We then applied a market-perform hurdle rate of 10%, markedly below LOW’s 5Y CAGR.

LOW last traded at an NTM FCF yield of 7.92%, well above its 5Y mean of 5.6%. We urge investors to consider why the market sent LOW into a bearish flow despite its relatively “cheap” valuation against its historical average. As discussed in our price action analysis, we believe the market has been pricing in for further downside.

Hence, we believe using an FCF yield of 7.5% in our model is appropriate to factor in the market’s bias. As a result, we derived a TTM revenue target of $116.67B by CQ4’26, which should be achievable.

Is LOW Stock A Buy, Sell, Or Hold?

We revise our rating on LOW from Sell to Hold. Our thesis has played out over the past month as LOW underperformed the SPY. However, it’s likely at its near-term support, and therefore, investors should wait for a short-term rally to cut exposure.

Our valuation analysis indicates that LOW could disappoint investors still expecting it to outperform the market at the current levels. Therefore, we urge investors to add LOW at $149 if they are looking for a market-perform hurdle rate. If they are looking to outperform, they should wait for a deeper retracement to levels below $149 to add more.

Be the first to comment