Robert Way

Investment Thesis: I take a bullish view on L’Oreal S.A. (OTCPK:LRLCY) given strong sales growth, low long-term debt levels and an attractive P/E ratio.

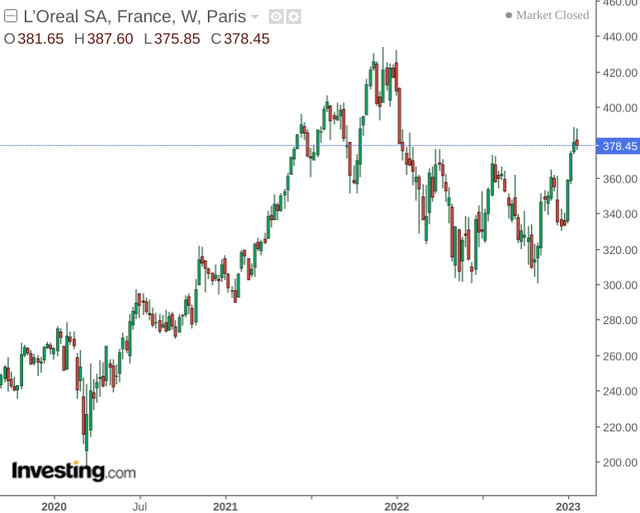

As the world’s largest cosmetic company, L’Oreal S.A. saw a strong recovery in price post-COVID – while price has consolidated over the past year owing to inflationary pressures and anticipation of a slowdown in global economic activity.

The purpose of this article is to assess whether L’Oreal S.A. could see a rebound in upside from here despite current macroeconomic pressures.

Performance

When looking at sales performance for the most recent quarter, we can see that rebound in growth compared to 2019 levels (used as a reference point for pre-pandemic performance) has been quite strong.

For instance, we can see that while sales for the first quarter of 2019 came in at €7.5 billion, this had increased to over €9.5 billion by the third quarter of 2022.

1st Quarter 2019

L’Oreal Finance News Release: First Quarter 2020 Sales

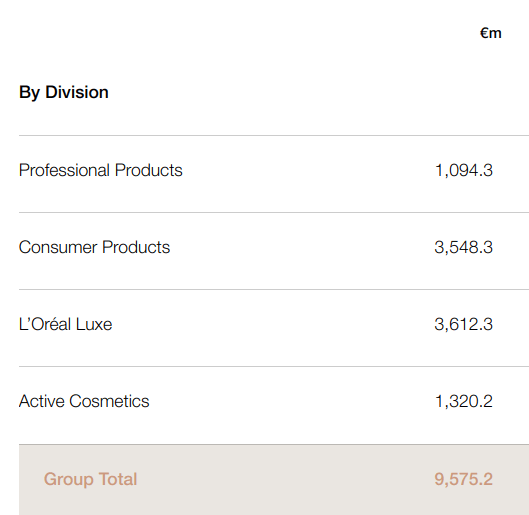

Moreover, it is also noteworthy that while the Consumer Products segment accounted for over 43% of the group total sales in the first quarter of 2019, this had decreased to just over 37% in the most recent quarter.

3rd Quarter 2022

L’Oreal Finance News Release: Third Quarter 2022 Sales

Additionally, the L’Oreal Luxe segment now accounts for nearly 38% of total sales whereas the segment accounted for just over 35% of sales in the first quarter of 2019.

With that being said, it is notable that the strong U.S. dollar had a strong impact on overall sales growth – with quarterly growth of 19.7% on this basis as compared to 9.1% on a like-for-like basis.

From a balance sheet standpoint, we can see that the company’s quick ratio (calculated as current assets less inventories less prepaid expenses all over current liabilities) has decreased significantly from 2019 – indicating that L’Oreal is in a less favorable position to meet its current liabilities using existing liquid assets.

| Dec 2019 | Dec 2021 | |

| Current assets | 13916.5 | 12075.8 |

| Inventories | 2920.8 | 3166.9 |

| Prepaid expenses | 365.9 | 503.6 |

| Current liabilities | 10868.5 | 16583.2 |

| Quick ratio | 0.98 | 0.51 |

Source: Figures sourced from L’Oreal 2021 Consolidated Financial Statements. Figures provided in € millions, except the quick ratio. Quick ratio calculated by author.

With that being said, we can also see that the size of the company’s non-current (long-term) borrowings and debt is minuscule as compared to the size of its total assets.

| Dec 2019 | Dec 2021 | |

| Non-current borrowings and debt | 9.6 | 10.7 |

| Total assets | 43809.8 | 43013.4 |

| Non-current borrowings and debt to total assets ratio | 0.02% | 0.02% |

Source: Figures sourced from L’Oreal 2021 Consolidated Financial Statements. Figures provided in € millions, except the non-current borrowings and debt to total assets ratio – ratio calculated by author.

From this standpoint, I take the view that while an improvement in the company’s short-term cash position would be encouraging – the fact that non-current borrowings and debt has remained low in spite of the pressures of the COVID-19 pandemic and recent inflationary pressures is quite encouraging.

Looking Forward

Going forward, I take the view that given the strong sales growth we have seen along with L’Oreal showing little long-term debt relative to its assets – the stock could conceivably see a rebound to above the $400 mark once again should sales growth remain strong.

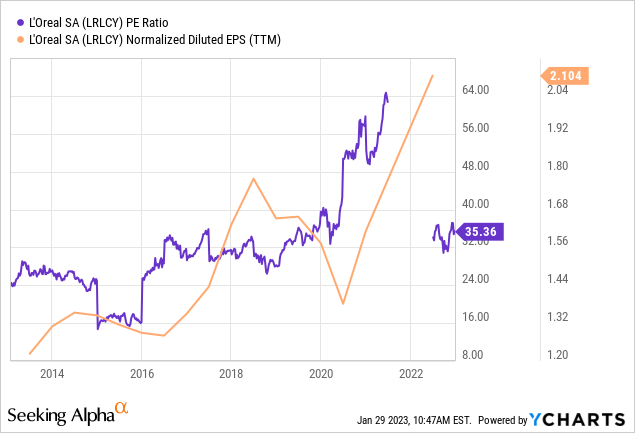

Moreover, we can also see that the P/E ratio has descended back to levels seen before 2020 while earnings per share (on a normalized diluted basis) is at a 10-year high:

ycharts.com

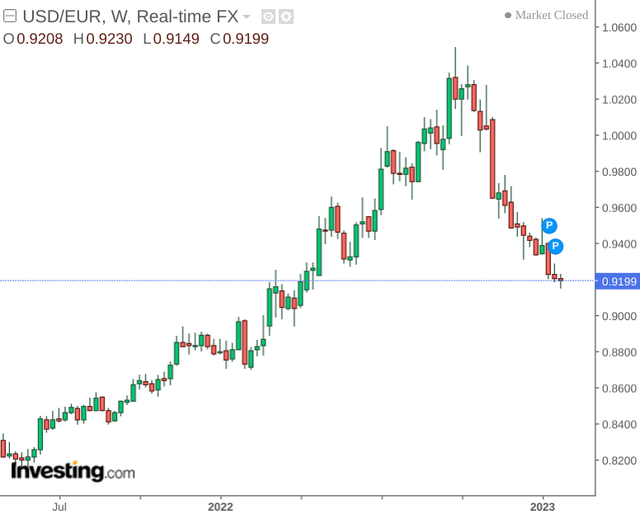

In terms of potential risks for L’Oreal going forward, we have seen that after the strong bullish run of the U.S. dollar last year – the currency is showing consolidation against major currencies including the euro:

From this standpoint, this could mean that we see sales growth negatively affected by a weaker dollar – which could in turn place pressure on further earnings growth.

With that being said, L’Oreal has traditionally had quite a strong performance in China – with makeup sales in particular having shown strong growth for Q2 2022, even with a zero-COVID policy and varying degrees of lockdowns still having remained in force.

However, with the recent abandonment of the zero-COVID policy by China – I take the view that L’Oreal could see significant growth still from this region with the rebounding of post-pandemic socialization and associated demand for cosmetic products.

Conclusion

To conclude, L’Oreal S.A. has seen strong sales performance post-COVID and I am optimistic that this can continue going forward – particularly with the full reopening of the Chinese market.

From this standpoint, I take a bullish view on L’Oreal S.A.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment