Sundry Photography

Is there a more underrated and unloved REIT than Spirit Realty (NYSE:SRC)? This is a name which has perennially traded at sizable discounts to peers in spite of taking drastic steps to narrow that discount. SRC has a greatly improved portfolio that continues to improve as the company increases its exposure to industrial assets. The stock yields a generous 6.4% in spite of a conservatively leveraged balance sheet, solid annual lease escalators, and a generally clear forward growth profile. I continue to find the stock attractive as the high payout is coupled with tangible possibility for multiple expansion.

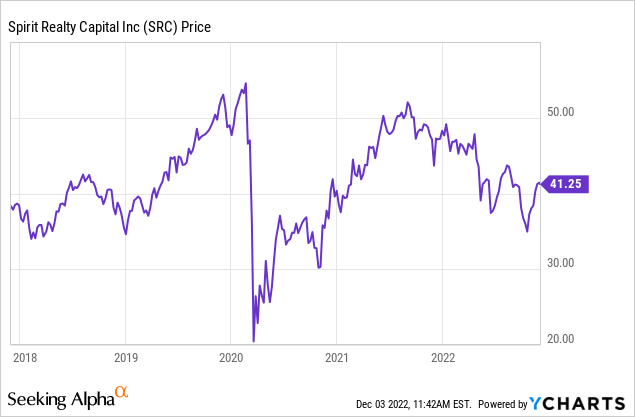

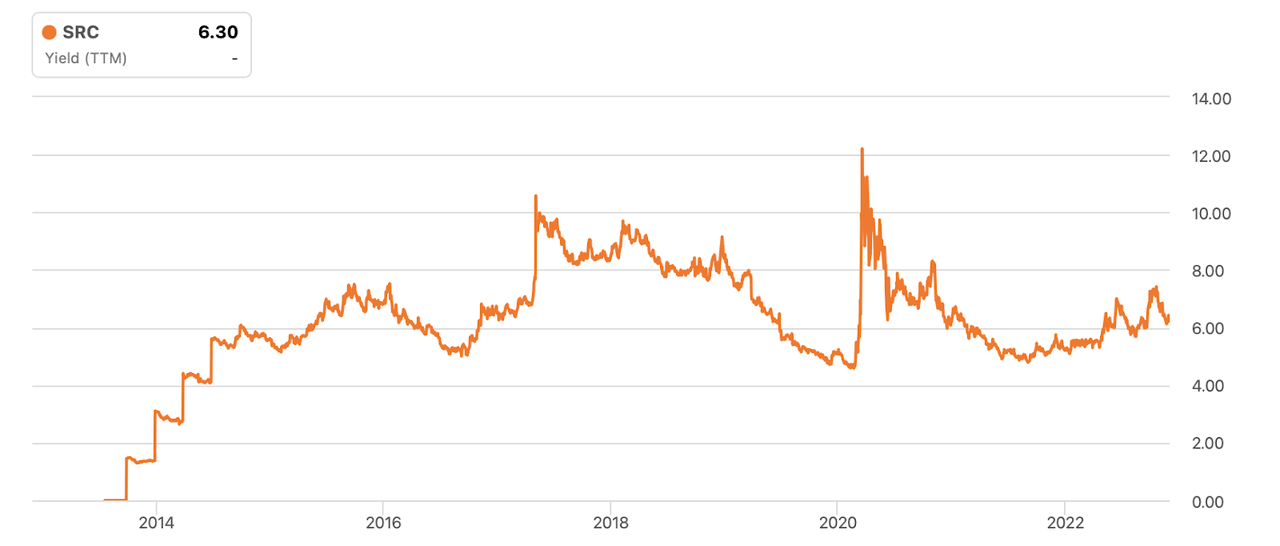

SRC Stock Price

Like most REITs with any sort of retail exposure, SRC saw its stock get obliterated during the COVID crash, but even after a huge bounce from the bottom, SRC is still trading below multi-year levels.

I last covered SRC in September where I named it an attractive replacement for STORE Capital (STOR), as STOR was taken private. SRC has since returned 13% including dividends, but I see more upside ahead.

SRC Stock Key Metrics

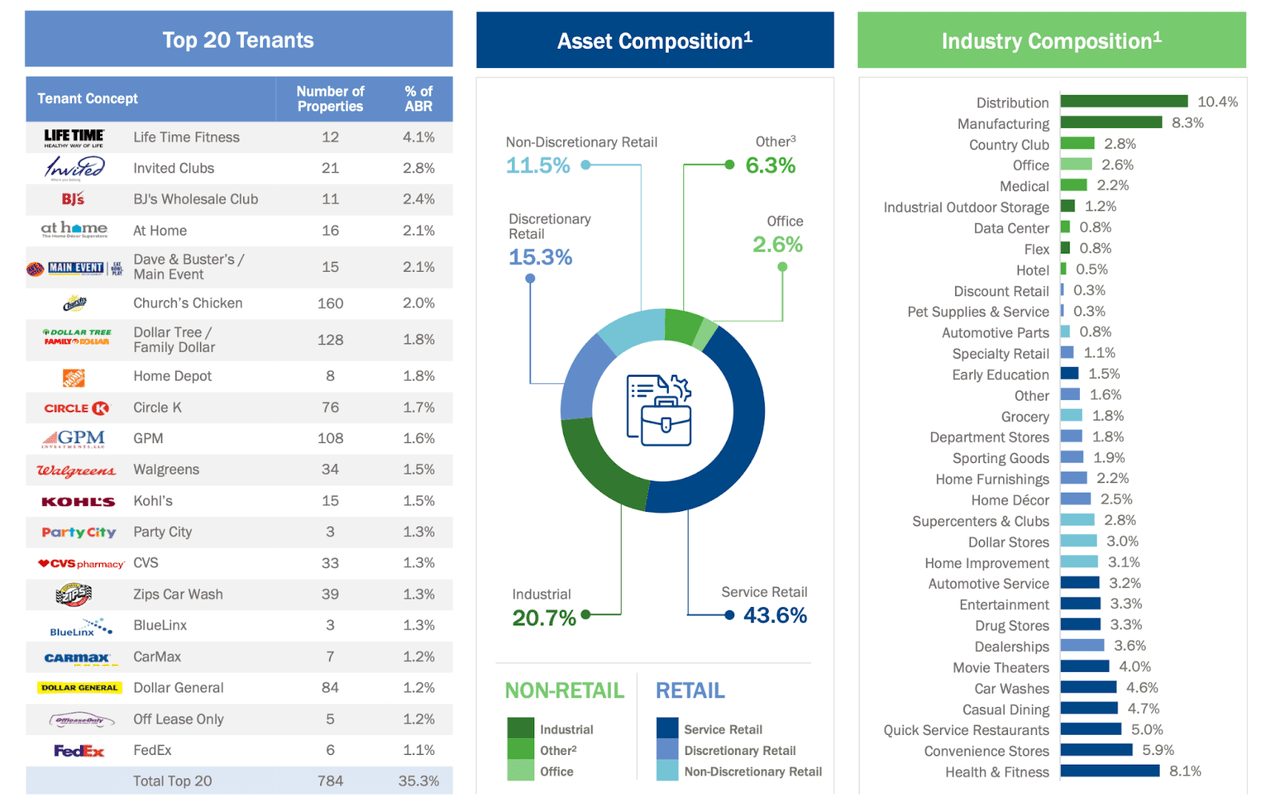

SRC is a net lease REIT (‘NNN REIT’), meaning that its tenants are responsible for real estate taxes, insurance, and maintenance capital expenditures (the ‘triple nets’). That is an important distinction. Whereas typical retail REITs have high maintenance capital expenditures, making funds from operations (‘FFO’) a poor proxy for free cash flow, SRC lacks the same recurring expenses. SRC has a portfolio diversified across various industries, sectors, and tenants.

2022 Q3 Presentation

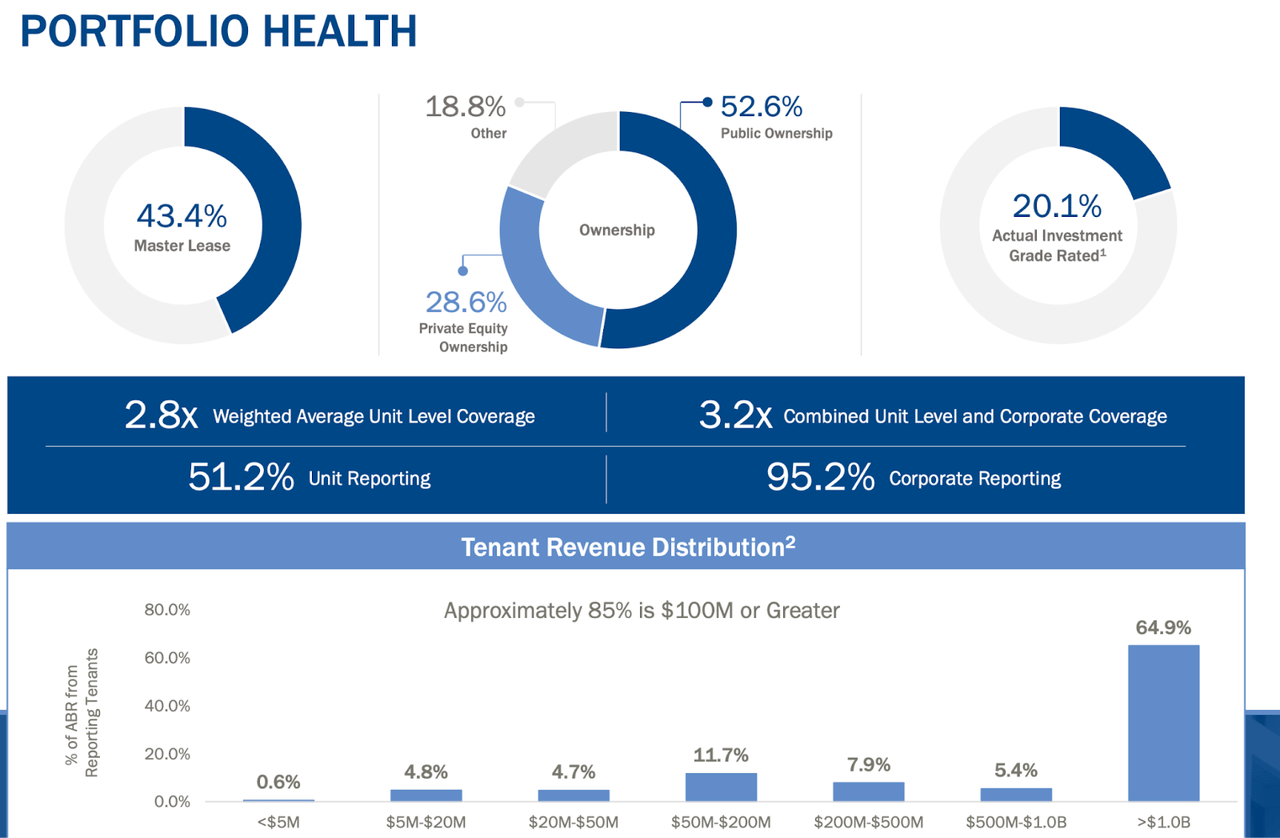

The 2.8x unit level coverage ranks competitively among peers, as does the 20.1% actual investment grade rating. SRC can be considered to have a reasonably large and diversified net lease portfolio among peers.

2022 Q3 Presentation

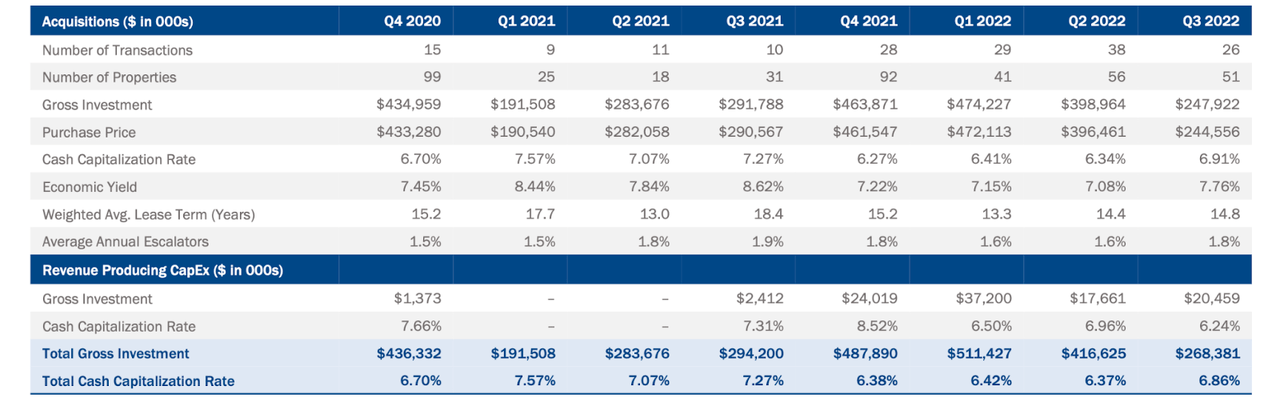

External acquisitions are the principal driver of growth for NNN REITs. SRC has been quite active on the acquisition front, though some investors may be wondering why acquisition cap rates were still a low 6.91% in the latest quarter.

2022 Q3 Presentation

On the conference call, management acknowledged a time lag for cap rate expansion, and noted that the fourth quarter has already seen cap rates expand to the low 7% range. Management also noted that today, they are seeing assets available in the “mid to high 7 to low 8 cap range for assets that a year ago were probably 150 basis points lower.”

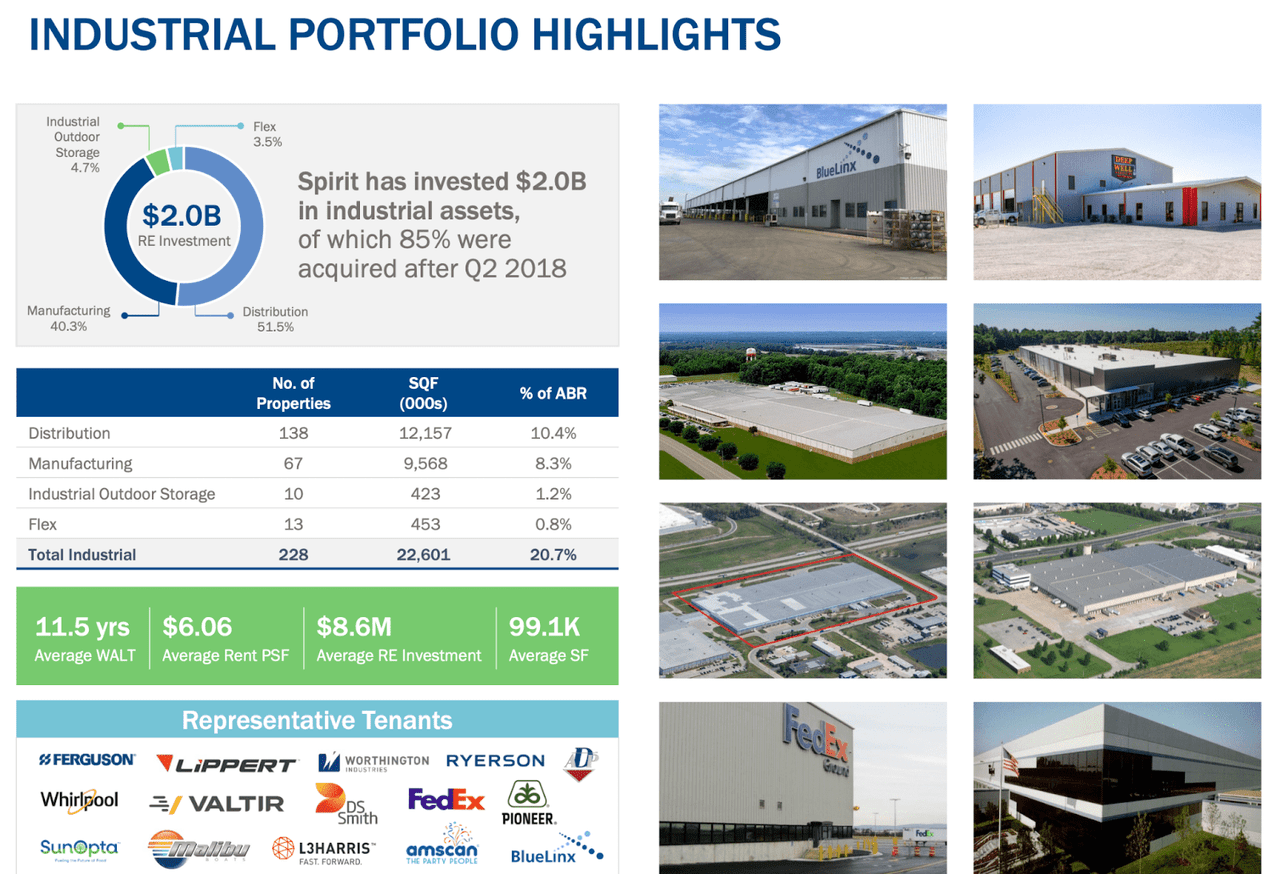

SRC has been consciously increasing its industrial exposure which now makes up 20.7% of total assets.

2022 Q3 Presentation

These industrial assets have lower average rent psf (the overall portfolio average is around $11 psf) but I don’t think readers should be expecting the typically high leasing spreads that industrial REITs like Prologis (PLD) are generating, as SRC is acquiring these assets at higher cap rates (PLD and others typically acquire industrial assets are lower cap rates). These industrial properties however do come with higher 2% to 3% annual lease escalators, which compare favorably against their expected long term 1.7% overall rate.

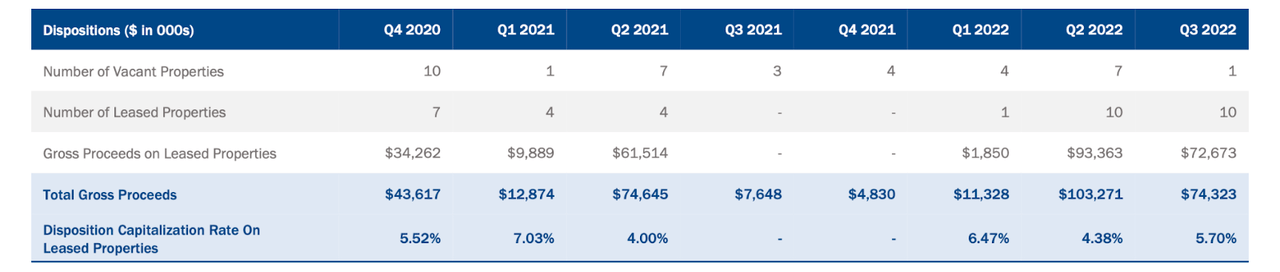

The latest quarter saw dispositions of vacant properties decline significantly as compared to prior quarters. Higher disposition activity (especially of nonperforming properties) can be a sign of weaker underwriting abilities. It may be too early to declare that SRC has seen an improvement on the disposition front.

2022 Q3 Presentation

In the latest quarter, SRC reported robust 7.1% growth in AFFO to $0.90 per share. SRC also increased its quarterly dividend 3.9% to $0.663 per share.

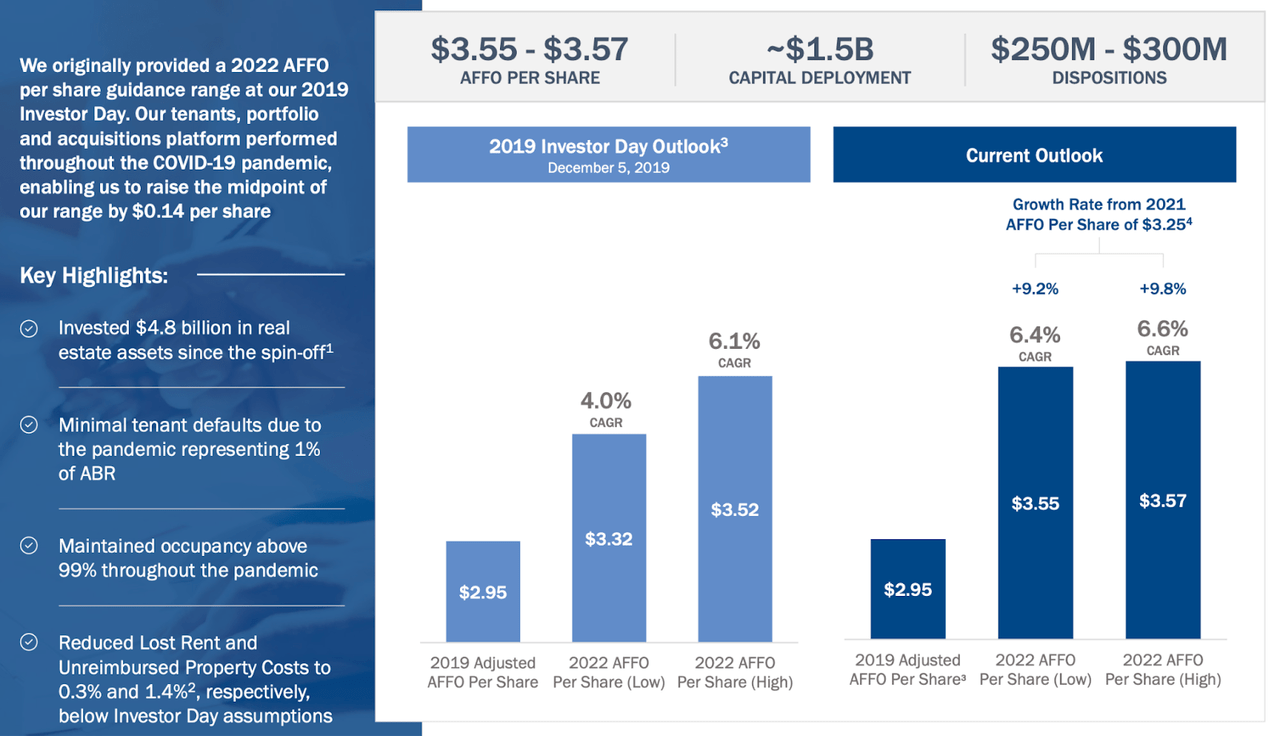

SRC is guiding for up to $3.57 in AFFO per share this year which would be ahead of the guidance given at its 2019 Investor Day.

2022 Q3 Presentation

SRC ended the quarter with a debt to EBITDA ratio of 5.4x (inclusive of preferred stock), which is a reasonable multiple as these names have sometimes allowed leverage to creep up to the 6x to 6.5x range.

Is SRC Stock A Buy, Sell, or Hold?

SRC might not look obviously cheap if one looks at their dividend yield history. This history is deceiving, however, as SRC has seemingly always traded at a sizable discount to peers.

Seeking Alpha

Whereas SRC is trading at 11x forward FFO, peer Realty Income (O) is trading at 15.7x forward FFO. That is a sizable discrepancy considering that growth rates for these two names are likely to be highly comparable, with any differences being in the 100 to 200 bps range.

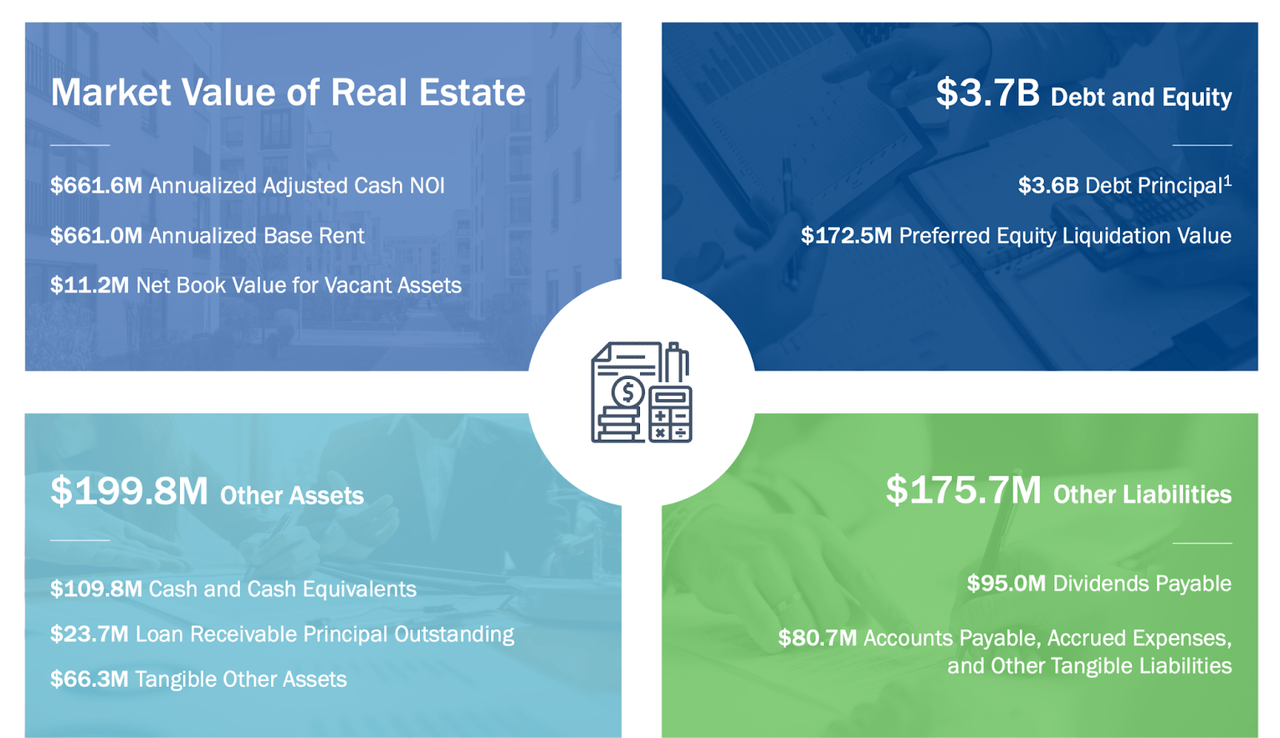

We can calculate the implied cap rate as follows. SRC generates around $661.6 million in annualized NOI with $3.7 billion debt (inclusive of preferred stock), $199.8 million in other assets and $175.7 million of other liabilities. Crunching the numbers, this leads to an implied cap rate of 7%.

2022 Q3 Presentation

With the cap rate so high and rather comparable to external acquisitions, investors would be correct in hoping against equity issuance. Management did state the following on the conference call:

And so for us, dispositions, free cash flow are really pretty critical for how we are looking at next year’s plan, obviously, given where our equity is trading right now, we are not interested in necessarily issuing at these current levels.

But some investors might wonder – do share repurchases make sense as opposed to acquiring new properties at ~7.5% cap rates? While share repurchases may be considered to hold lower execution risk, investors typically prefer external acquisitions even at slightly higher returns because “fresh” assets help to reduce portfolio risk through diversification and the longer lease terms. I’d expect SRC to continue to prefer external acquisitions over share repurchases even with a slim 0.5% ROI differential. Perhaps I should also clarify that the above statement only applies to fragmented acquisitions – I would be disappointed, for example, to see a large 7.5% cap rate acquisition of assets to one casino tenant.

I can see SRC eventually re-rating to a 5.5% yield, representing a stock price of $48.20 per share or 23% total return upside (inclusive of dividends). That is an attractive investment proposition considering the ongoing 6.4% dividend yield.

What are key risks? SRC has had tenant problems in the past, including the notable troubled exposure to Shopko which it resolved through a spin-off several years ago. It is possible that Shopko was not an isolated incident but instead just one example of poor underwriting standards at the company. While SRC trades at a large discount to O, it must be acknowledged that O has earned some premium due to its long track record of underwriting excellence. Further, while the 6.4% yield is attractive, a rising interest rate environment will make that yield look less attractive – investors should not expect no volatility from this name. I would not be too surprised to see yields expand to the 8% to 10% range under difficult economic circumstances, though the portfolio looks healthy enough to survive such a difficult period. I rate SRC a buy for those looking to supplement their portfolio with high yield and potential for multiple expansion.

Be the first to comment