NotYourAverageBear

Introduction

This is the second episode of a series that I introduced in my article: “Learning From Buffett About Investing In Railroads: The BNSF Caste Study”.

I highly recommend to read it because it explains thoroughly what I have found out about the way Warren Buffett thinks about the railroad Berkshire owns. I have outlined the general mind-frame of the Oracle of Omaha and what we can learn from him as we assess the publicly traded railroad companies.

The first episode dealt with Canadian National Railway (CNI). Now it is the turn of Canadian Pacific (NYSE:CP).

Canadian Pacific

All financial data are reported in Canadian dollars.

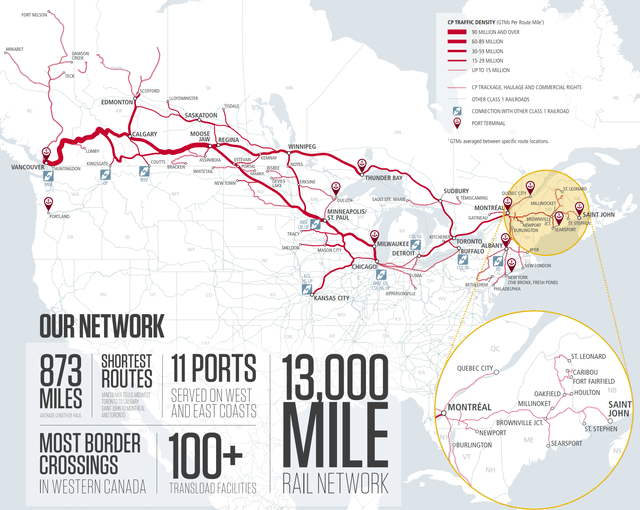

Network

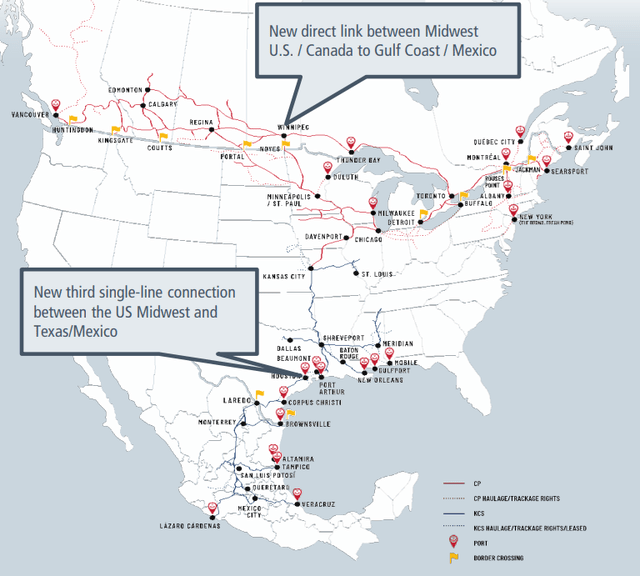

Canadian Pacific owns the shortest and fastest routes in key lanes across Canada and the U.S with its transcontinental service that provides the fastest and most consistent service between Eastern Canada, Calgary and Vancouver. The map below shows the 13,000 mile network that connects 11 ports between the west and east coasts. Until the Kansas City Southern deal the company owned an infrastructure that connected the two sides of Canada together, with tracks that encircled the Great Lakes. The moat was thus somewhat centered around its access to the Vancouver port and to the fact it had the shortest routes from Vancouver to the U.S. Midwest, from Toronto to Calgary, from St. John to Montréal and Toronto. Now, with the 7,100 route miles from Kansas City Southern, the company extends into the Midwest all the way down to Mexico.

However, the merger between Kansas City Southern and Canadian Pacific is created a new three-coastal railroad that will compete with Canadian National as shown in the map below. Not only will Canadian Pacific gain direct access to the Gulf of Mexico, but it will also own a railroad that enters well into Mexico connecting both of its coasts to Mexico City and the U.S. border.

As outlined in my previous article on Canadian National, after the merger is completed, we will have a three-coastal duopoly. However, Canadian Pacific will have the advantage of being the only railroad connecting all three North-American countries. With the current geopolitical environment making many governments reconsider their supply chain and whether or not it is safe to keep on relying on China’s manufacturing industry, Mexico is surely well positioned to become a more and more strategic labor supplier for many American and Canadian industries. Furthermore, it is worth mentioning the fact that the outcome will be a railroad that, for trains that have to move from north to south and vice-versa, can bypass the critical Chicago hub through the route Kansas City-Davenport-Minneapolis.

Sources of revenues

The company reported for the first six months of the year $3.95 billion in freight revenues which is not far from the $4.195 billion Canadian National reported though it has a network of 19,500 miles versus the 13,000 Canadian Pacific currently owns. So, from a simple freight revenue per mile point of view Canadian Pacific seems to perform better than its peer.

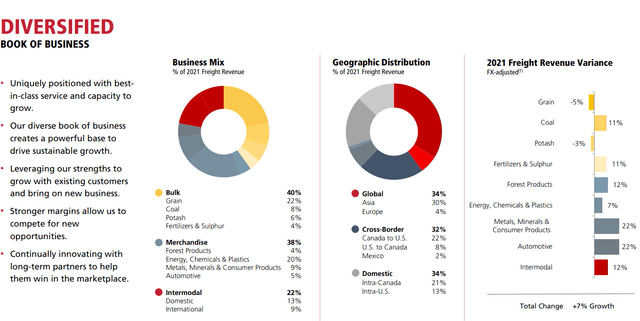

Let’s look at the business mix that generates the freight revenues and let’s look at the geographic diversification, too. While Canadian National has petroleum and chemicals as its largest commodity group, accounting for 20% of total revenues, we see that Canadian Pacific is more reliant on bulk, and within this category, on grain, which accounts for $1.68 billion or 22% of the 2021 freight revenue ($7.82 billion). It is also interesting to highlight that the company is well-diversified geographically in three main areas, accounting for a third of total revenue each. However, we see that Asia has a big weight which accounts for 30% of total revenue, compared to Europe’s 4%. This was true also for Canadian National: the west coast is more important than the east one.

Now, let’s get back to grain for a moment since it is the company’s largest market segment. Canadian Pacific is the only Class 1 railway with meaningful grain franchises in both Canada and the U.S. Its network is strategically positioned through the heart of the grain-producing regions of Western Canada and the Northern Plains of the U.S. The company provides direct access from high-throughput unit train loading elevators to major export port terminals for shipments overseas. Now, last year’s harvest saw a rather low output and this damaged Canadian Pacific. On the other hand, we know that the recent harvest, though a bit delayed, will be abundant. This situation was explained during the Q2 earnings call:

As the current crop year comes to a close, we will continue to see the headwinds from the 40% smaller Canadian grain crop until this year’s harvest starts to come off the field. We continue to offset some of that challenging conditions in Canadian grain with another strong performance in our U.S. grain franchise, which posted a third consecutive record quarter. Now looking ahead, there’s still a few months yet before the new crop is harvested, but the growing conditions have improved across all the prairies. […] we expect harvest to be later than normal, which could push grain volumes into Q4 or actually into 2023.

However, the company has not been idle during this year as it focused on investments that should enhance its results as the new harvest starts. In fact, at the end of 2021, more than 40% of CP-served train-loading facilities were HEP qualified. The 8,500-foot HEP grain train, when combined new hopper cars, will enable >40% more grain to be moved per train. It sounds like perfect timing from the company’s point of view.

Let’s recap what we have seen so far: the company owns a uniquely positioned network that will soon become the only one with access to five different coasts (western and eastern Canada, Gulf of Mexico, western and eastern Mexico), with the advantage of bypassing Chicago and being close to the key grain-producing regions. This means that Canadian Pacific is a railroad more linked to grain compared to Canadian National. This could be an aspect that may make investors choose one over the other, depending on what kind of commodity one expects to be generating more freight revenue over the next years.

Earning power

As we have learned from Buffett, it is vital that these companies, being capital intensive businesses, are able to earn enough money to cover their interest requirements in any economic conditions. Interest coverage is calculated as pre-tax earnings/interest. In 2021, the company reported and EBT of $2.73 billion and an interest expense of $440 million. The ratio is 6.20, which is lower compared to Canadian National and Buffett’s BNSF. In any case, it is a ratio that proves Canadian Pacific to be able to cover its interest expenses quite well as its EBT is still 6 times greater than its interest expense and would thus still cover them even in case of a major downturn.

As we speak of interest expenses, we can’t overlook the fact the Kansas City Southern acquisition in a stock and cash transaction representing an enterprise value of approximately US$31 billion, which included the assumption of US$3.8 billion of outstanding KCS debt. To fund the deal, Canadian Pacific issued U.S $6.7 billion and $2.2 billion notes and a US$500 million term loan to fund the cash consideration component of the KCS acquisition. It also paused its share repurchase program. This brought the long term debt to $20.13 billion (vs $9.77 in 2020) and increased the long term debt/net income ratio at 7.1 vs. 4 in 2020. However, the deal is also expected to bring about $820 million of EBITDA growth and $180 million of cost and efficiency improvements.

However, the company declares that 100% of its long-term debt is fixed rate. And as we’re focused on paying down debt to return to target leverage, also thanks to the fact that it has no near-term financing requirements.

As Nadeem Velami, Canadian Pacific’s CFO, pointed out during the last earnings call, the company is laser focused on deleveraging and it expects that by 2024 it could consider resuming its share repurchase program:

I think we’ll be in a very good position to get our leverage back down to our targeted level by the end of 2023. I’d just say that typically, we make our capital allocation decisions with the Board in that January time frame. So when I look forward, probably look at that January 2024 as a decision point around what we do with excess cash flow once we delever back to our targeted 2.5x.

In any case, we see that the earning power of the company, though weaker compared to its other two peers we mentioned, is enough to make it survive through any economic environment.

Efficiency

This is one of the key aspects to understand if these companies can become true compounders. In order to understand how the company is performing regarding its efficiency we need to consider a long period of time. First of all, we see that the company is growing its revenues steadily at a CAGR of 3.48%.

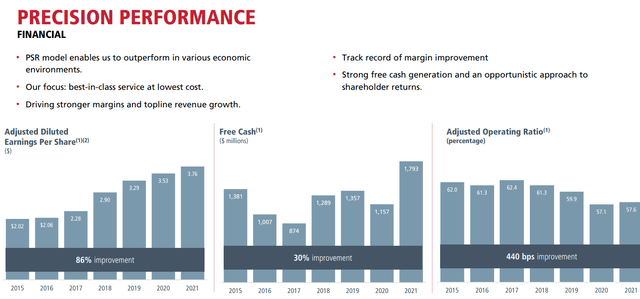

However, we need to look at the operating ratio in order to assess the company’s performance. In the most recent quarter, Canadian Pacific reported an adjusted operating ratio of 59.5% compared to a rather worse 77% reported at the end of 2012. This is a very good improvement the company has achieved.

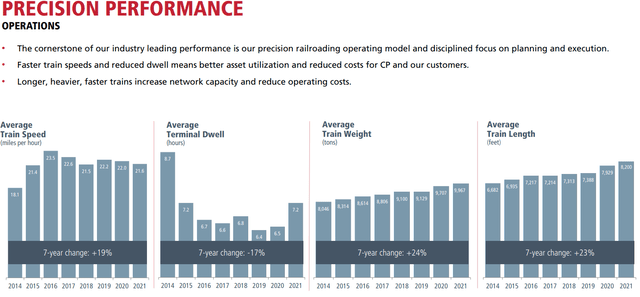

The company also highlights how the performance of its operations is indeed improving by achieving faster train speed, reduced terminal dwell (which shows a better asset utilization with cost reduction), and an increasing average train weight and length at a 7-year CAGR of almost 25%. This can explain why, at the moment, Canadian Pacific’s freight revenue is almost equal to its larger peer Canadian National.

Fuel efficiency is also of utmost importance. Year-to-date, the company reports a fuel efficiency of US gallons of locomotive fuel consumed per 1,000 GTMs (gross ton-miles) of 0.96, up 2% YoY. Canadian National, on the other hand, was able to improve its results to a record of 0.838 US gallons per 1,000 GTMs.

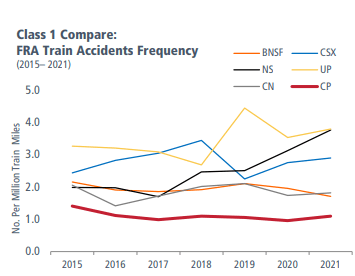

Overall, Canadian Pacific is lagging behind Canadian National as per the metrics we have seen considered by Buffett. However, we should acknowledge that the company has the lowest number of train accidents per million train mile among the six major Class 1 railroads. Its indicator of 1.08 beats the 1.82 of Canadian National in the first six months of the year. This, too, is to be factored in when we think about efficiency because every train accident has a cost both in terms of repairing and of reputation (not accounting for possible trials linked to the accidents).

CP Investor Presentation

Use of capital: return on investments and shareholder return

Warren Buffett admittedly stated that in his early years he would stay away from capital intensive businesses. However, as he matured, he realized that even capital intensive businesses can be a good investment as long as the return on capital employed is decent.

A caveat: the ROIC of each single company may not be exactly precise when compared to the others because these companies disclose that it is a non-GAAP metric. Now, at the end of 2020 the company reported a ROIC of 16.7% which is higher that Canadian National’s 14.1%. Last year, because of the cash deployed for the Kansas City Southern acquisition, this number came down to 8.2%. In any case, the ROIC reported by Canadian Pacific is satisfactory and it is still slightly above the current cost of capital of 8%.

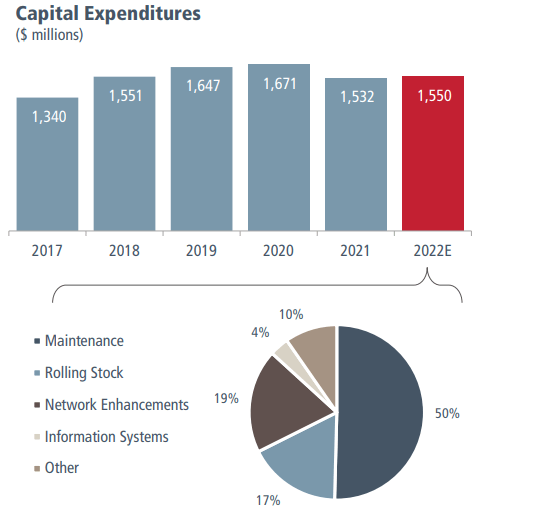

Let’s now look at the company’s capex to see what kind of investments it is doing. Here is a graph that shows how capex are clearly under control and are just below 20% of the revenue. Canadian National, so far, has been able to keep its capex at 17% of revenue.

The graph below also shows how this year’s capex is expected to be split. Half of it goes to maintenance expenditures, which is a key aspect a railroad can’t overlook. Another 19% goes to network enhancements, which is something we want to see in order to assess the company’s ability to keep on growing its train weight and length.

CP Investor Presentation

Furthermore, over the past several years, Canadian Pacific invested a total of $500 million to acquire 5,900 new covered hoppers. As we said above, the new, high capacity cars will enable the company to move 40% more grain per train.

All these investments nurture Canadian Pacific’s ability to deliver good results that enable it to keep growing while rewarding it shareholders. As shown below, the EPS and the FCF have been growing, although at different paces, while the operating ratio has been steadily improved.

As we understood in the first two articles, Buffett prefers that a company he owns earn a high ROIC. However, if the company is not able to invest all its cash at a decent rate of return, a share repurchase program or a dividend are something he very well accepts in order to redeploy the cash received at a higher return. This should make us think about the opportunity of investing a dividend exactly in the stock that paid it to us, instead of thinking about better opportunities to deploy it.

Anyhow, Canadian Pacific is rather conservative regarding the cash it returns. First of all, it paused its share repurchase program until it brings back its leverage to a net debt/EBITDA ratio of 2.5. Secondly, the dividend payout ratio has usually been under 20%, as it was 18.2% in 2021, compared with 19.8% in 2020 and 17.9% in 2019. The decrease in the ratio from 2020 to 2021 was due to higher diluted EPS, partially offset by higher dividends declared per share. The increase in the ratio from 2019 to 2020 was due to higher dividends declared per share, partially offset by higher diluted EPS. The Adjusted dividend payout ratio was 20.2% in 2021, compared with 20.1% in 2020 and 19.1% in 2019. Over the long term, Canadian Pacific targets a dividend payout ratio of 25.0% to 30.0%. The dividend growth is quite interesting as it has been above 12% for the past six years. This makes something up to the very low starting dividend yield, which currently is at 0.81%.

Future cash flows

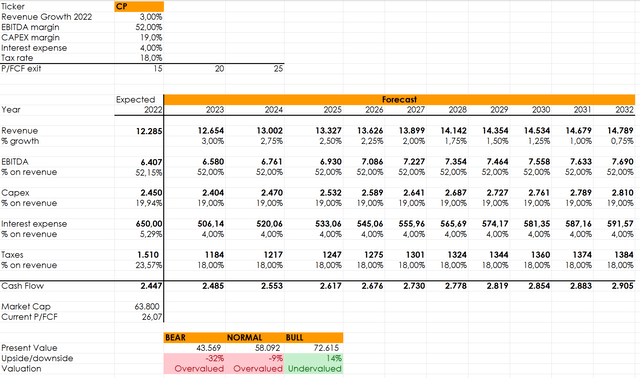

As we learned from Buffett, a business’ current value is given by the money it will earn during its remaining lifetime. So, here I would like to share a simple discounted cash flow model that projects the future cash flows of the company and sets three possible exit scenarios based on price/fcf multiples. Since I end up with a valuation that states whether the company is undervalued or overvalued in percentage points, it doesn’t really matter if you are buying the stock in Toronto or in New York.

Now, in this model I start from the 2022 expected revenue and I combine together Canadian Pacific and Kansas City Southern results. I will factor in the EBITDA growth and the cost improvements the company expects from this deal.

Author, with data from CP and KCS annual reports

Here I get a result slightly different from Canadian National. In fact, Canadian Pacific seems to trade at a premium according to my simple DCF model. Of course, the premium can be justified if we consider the quality of the KCS acquisition and the one-of-a-kind railroad that is born from this deal. However, at the moment, I would rate it as a hold and wait for a better entry point. The dividend, in fact, is also very low and it doesn’t justify by itself the investing case for the company. I have it on my watchlist and I will monitor it in case of future drops.

Be the first to comment