chaofann/iStock via Getty Images

Dear Friends & Clients:

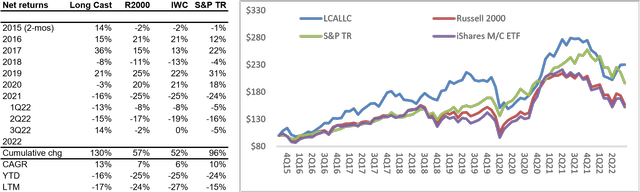

For the 3Q22 quarter (ended Sept 30, 2022), cumulative net returns increased 14%. YTD returns are down 16%. Since inception in November 2015 through quarter end 3Q22, LCA has returned a cumulative 130% net of fees, or 13% CAGR. As a backdrop to returns, since inception we comfortably exceed two widely used representative indices for passive small company investing, the iShares MicroCap ETF and Russell 2000 Index, and at present, the S&P as well.

Because our portfolio is concentrated on just a handful of typically small “off the beaten path” businesses, we can expect variance from and greater volatility than the indices. Past performance is no guarantee of future results.

As a reminder Long Cast Advisers does not invest in the hydrocarbons or aerospace / defense industries. Just about every quarter, I write – and then delete – a more comprehensive section about the decision to avoid these areas of the market. Given some recent conversations I’ve had about whether or not I do “impact investing,” it seems an appropriate time to address it

I’d previously thought of “impact investing” as a form of ESG investing, but it seems more a sort of Peter Lynch “buy what you know” meets PT Barnum “buy for the show”. It includes portfolios running the gamut from companies representing “conservative values” to those whose products promote “liberal values”, whatever any of that means.

I was recently told by one Wealth Manager that “impact investors” will tolerate sub-par returns. The value investor in me scoffs at the notion of investing in companies divorced from return expectations. Yet, one can observe that shoppers tend to spend money on things for the sake of how it makes them feel, and shopping shares certain features with investing, so why should it be different? One needn’t look far to see how lines that normally separate things can often blur.

As a long term investor, I view myself as a part owner of a business. I don’t seek out businesses I know, I seek out investments that can return 2x in five years, but I very much enjoy the aspect of being a part owner of businesses whose products I use or “observe in the wild”.

We don’t own shares in CoreCard (CCRD, something I think belongs in every small cap investors’ portfolio) because they process payments for the ParkMobile app, but I do enjoy using the app knowing that ~$0.04 of every transaction generates revenue for one of our holdings. When my wife broke her arm, I’m certain it wasn’t so a surgeon would install a plate using a Depuy/Synthes torque limiting driver made by PDEX, but knowing that’s what he used is pretty neat, IMHO.

The inverse of this utility function defines my principle of avoidance. I appreciate the benefits afforded by a strong military and an oil and gas industry without which our society as we know it would not exist. But I don’t want to – nor am I compelled to – be a part owner of companies that drop bombs on people’s heads or that contribute to the greenhouse effect, which is like a bomb dropping on our heads in slow motion. I simply don’t want to participate in those ecosystems more than I do already.

What would make me change my mind? When I covered the Engineering & Construction sector, I was elbow deep in the petrochemical space. The “Majors”, their service providers and their downstream refiners and processors, headquartered here and operating globally, are organizations that regularly implement complex feats of incredible technology, including in some cases in the alternative energy space.

If the technologies around various kinds of mitigation or sequestration improve, if the balance of carbon outputs shifts and if the market assigns zero terminal value on the assumption that “there is no oil post 20XX”, I think it would be foolish to not re-consider my views. I won’t remain didactic if the facts change, but I will abide by the investment parameters set by my clients, should there be any.

I’ve been told that what I am describing isn’t “Impact Investing”. I’ll leave it up to organizations with larger marketing departments and sales teams to lean more heavily in. The impact I want to make first and foremost is on my client’s capital; to pay for college, a down payment on a house, a vacation, a scholarship, retirement, et al.

Narrowing my strike zone by avoiding certain industries is part of this process. At best, it offers an alignment of principles. At worst, it offers clients exposure to a set of assets different from what they’ll find elsewhere. In a decision-making business-like investment management, revisiting and articulating the reasons behind decisions is an essential aspect of the job.

Portfolio Update: Review of Top Holdings

Top performers in the quarter were QHRC, CCRN and RBCN. Major detractors were CCRD and AIM). I wrote substantially about these companies in last quarter’s letter, which was less than 90-days ago and my reasons for owning them haven’t changed (though RBCN was acquired).

I recently had a call with the CEO of CCRN to address some concerns about qualitative issues I’d observed in their business. His answers were reasonable. The team he’s assembled has significant and material experience at AYA and AMN, the two largest companies in the space. Having covered business and industrial services for many years, I think entrepreneurism and technology are operational and cultural foundations for success and we spent some time drilling into this. I laid out my variant perspective in last quarter’s letter and think ingredients are in place for continued outperformance.

I continue the effort to upgrade our portfolio by consolidating around what I believe will be the highest IRR ideas. In this vein I have exited long-term holding PSSR, at a substantial loss. This is the airport management system that fumbled its transition from a niche embedded system (mechanical radar) to a platform driven ADS-B world. It is our second largest detractor from returns to date, exceeded only by CTEK, which we exited last quarter

Investing in “platform” businesses can offer wonderful returns, but many small companies often fail in their efforts to achieve “platform status”. I’ve had mixed results investing in the theme. I did poorly with OTCQB:PSSR in aviation and many years ago in ACEC in telecommunications; both companies were too small to penetrate a market that was consolidating or had consolidated around large players.

We did well with ARIS) (dealer management software; lots of niche disaggregated small businesses) and I’m confident that the payments systems and exchanges we own are terrific businesses; CCRD is an example of the former and we own OTCPK:FRMO partly for its position in the Miami Exchange, nee Minneapolis Grain Exchange.

I mention all this because in selling one company that failed in the transition from legacy enterprise to subscription, I am adding another that’s evolving through the process. It’s a small company with a newly installed management team that helmed a prior successful investment of ours. The company is attempting a two-step evolution, from a transactional business to large corporations to a subscription system and ultimately to a platform for managing and organizing niche data sets. Notably it is targeting the disaggregated SMB market.

We’ve owned a small position primarily on my trust in management. Having observed the company over the last year and watched it skillfully adapt and upgrade – they’d inherited a business that had suffered with under investment and under management – I’ve gained more comfort in their ability to address the threats and opportunities ahead. We don’t enough, yet.

In Conclusion: On The Arts

I recently came across a quote from Adam Grant’s book “Originals” about Galileo and his discovery of mountains on the moon and I cherry picked it to make a pithy comment about art and investing.

“When Galileo made his astonishing discovery of mountains on the moon … he recognized the zigzag pattern separating the light and dark areas of the moon. Other astronomers were looking through similar telescopes but only Galileo was able to appreciate the implications of the dark and light regions … He had the necessary depth of experience in physics and astronomy, but also breadth of experience in painting and drawing. Thanks to artistic training in a technique called chiaroscuro, which focuses on representations of light and shade, Galileo was able to detect mountains where others did not.”

Anyone living in a built environment is surrounded by art, and though it might all fade into the background, it is there, by design and sometimes by regulations. Often, unless it’s presented in context like in a museum, it goes unnoticed. And because it goes unnoticed, its value is overlooked.

Art not only offers an opportunity to notice things a little bit differently – a critical aspect of investing – it adds beauty and meaning to our lives. I really couldn’t say it any better than Leo Lionni did in “Frederick the Mouse” so go have a baby, buy the book, read it to them and you’ll understand where I’m coming from.

And then when you read the next 10K or 10Q, expert network or conference call transcript, consider the subtext of what they’re talking about and why. I’m not suggesting that something magical will appear but in the practice of observing things a little differently, at some point, a public filing or transcript will stand out that rings a little different, whose subtext offers a more honest accounting of operations than the normal, rosy-eyed pabulum.

Then you may realize you have found a company that “thinks” and operates differently and maybe it is worth a little extra time. Among our holdings, I think CCRD and RELL, communicate and operate differently.

Seeing things through the same lens as everyone else but coming to a different conclusion is itself an art and it is central to investing in a market that is not supported by zero priced TINA money. With the markets finally pricing risk and money, it is a stock pickers environment. There is always value in doing a little (or a lot of) extra work to find incremental information, because you need to know what you don’t know, but there is a portion of investing – somewhere between 20% and 80% I’d say – where the value add isn’t the incremental data, it’s a variant perspective on the same data as everyone else.

As always, I appreciate your entrusting me with your capital and the responsibility of being its steward. If you would be so kind as to forward this letter to friends or institutions who might be looking for an investment manager with experience and a track record on the smaller end of the market cap spectrum, I would be grateful for the effort. I look forward to continuing this conversation into the future.

Sincerely / Avram

Brooklyn, NY, October 2022

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment