alvarez

Loma Negra (NYSE:LOMA) is the largest cement manufacturer in Argentina.

For a detailed review of the company’s operations please refer to my introductory article from July 2021 and the follow up article from June 2022.

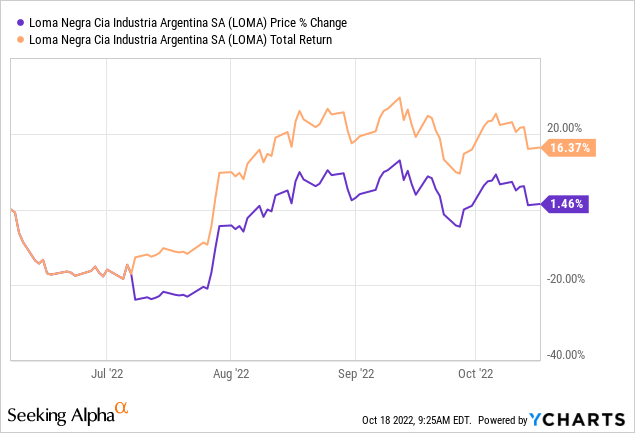

After I recommended a buy rating for LOMA in June, the company paid an extraordinary dividend that elevated the investment’s return to almost 17%, compared with price appreciation of only 1.5%.

In this reevaluation of the company’s financials using data from the first and second quarters of fiscal year 2022, I find the company has not been able to use its brand equity to increase prices. Revenue has fallen in real terms even although volumes have grown more than 10%. That means prices have been significantly behind inflation.

LOMA does not benefit from operational leverage, because a substantial portion of its costs are relatively variable (labor, materials and energy). Depreciation makes up only 10% of COGS. Therefore, in order to grow profits it has to grow revenues at more or less the same level. In my calculations I find that LOMA might be as much as 40% behind the revenue level required to justify its current market cap. Although the Argentinian economy might recover further, particularly in terms of prices, it might not be enough to fill a that gap.

Note: Unless otherwise stated, all information has been obtained from LOMA’s filings with the SEC.

Previous thesis summarized

Again, for a detailed review of the company’s operations please refer to my introductory article from July 2021 and the follow up article from June 2022. In this section I will provide a short summary.

LOMA is the largest cement manufacturer in Argentina, with a market share that oscillates around 50%. The company has its core manufacturing facilities some 300 kilometers from Argentina’s capital and largest city, and concrete and distribution centers in the country’s north and center. LOMA sells most of its production through exclusive wholesalers and distributors.

The company completed the expansion of its main plant in 2021, expanding its capacity to 12 million tonnes a year, against last year sales of 6 million tonnes, and expected 2022 sales of 6.5 million tonnes. It represents a big portion of the country’s total capacity, estimated between 19 and 21 million tons, according to the Argentinian Cement Manufacturers Association (the association lists 16 million tons for 2020, before the 3 million from LOMA’s expansion were added).

Argentina has a lot of spare capacity in cement production. This year, record in terms of cement dispatches, is expected to end with 13 million tonnes sold, that is, 65% of the capacity.

In terms of financial condition, I found LOMA to be a company with a strong balance sheet, holding cash and having negligible debts. Having repaid most of its debts and after finishing the plant expansion project, I expected the company to generate between $20 and $50 million in FCF.

Current situation

With hindsight, I believe I recommended a high price for LOMA, considering that I expected between $20 and $50 million in FCF, against a market cap of $750 million. Maybe I was too bullish on the Argentinian recovery. The trade ended up paying well because LOMA paid a lofty dividend, albeit it was a one-time event that cannot be repeated with self financed funds.

Today, the situation has changed in some aspects, while others remain the same. The Argentinian economy is still recovering, with record cement dispatches. However, LOMA is only maintaining the same level of real revenues it generated last year, which indicates lack of pricing power. Finally, the company has taken debt to pay dividends, although this does not represent a significant financial risk yet.

Economic recovery in the construction industry

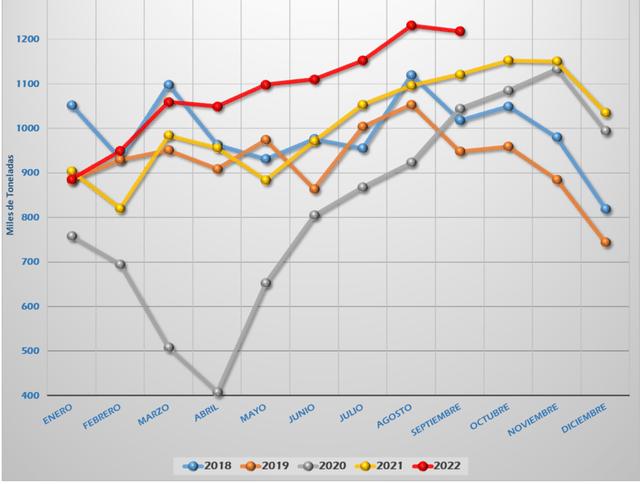

This year is a record for the Argentinian cement industry. Like the chart below from the cement association shows, 2022 is surpassing the past five years by a substantial margin. With an expected year end dispatch of 13 million tonnes, 2022 will record the largest dispatch in Argentinian history.

Monthly cement dispatches, thousand tons. (National Cement Manufacturers Association (AFCP))

Lack of pricing power

This situation has not been different for LOMA, which currently holds 50% of the market. The company saw its 2Q22 volumes grow 20% on a YoY basis, and its 1H22 volumes grow 15% on a YoY basis, according to the earnings report for 2Q22.

But at the revenue level, LOMA has not grown that much in real terms. Net revenue grew 1% in real terms comparing 1H22 with 1H21. Coupled with 13% volume growth, it indicates that the real price of cement decreased around 12%. That has meant lower gross profits, by 7% in real terms, and lower pre-tax profits, 20% in real terms.

I cannot understand why LOMA is not able to at least pass the input cost increases caused by inflation to its customers. The company is the market leader, and although cement is a commodity, it should be able to at least keep real prices constant. My conclusion is that this may be simply a timing issue, particularly after checking that cement prices went up in line with inflation in August and July, according to the Argentinian Statistics Institute.

Historically low construction prices

Like in many other industries, the generalized fall in disposable income that affected Argentina between 2018 and 2021 has also impacted cement and construction.

The construction cost per square meter measured at the financial rate of exchange (not intervened and used by families to save in dollars that are then used to purchase property, usually with cash) has moved significantly. In a calculation presented for Cordoba, the country’s second largest city, the price per square meter moved from $1,100 in 2017 to a low of $300 in October 2020. Using calculations for August 2022 from Apymeco, shows a price of around $630. That is, there has been some recovery but not even close to what is needed to return to 2017 levels. Construction costs do not only include cement, but many other items as well. However, it works as a proxy for the industry dynamics.

The situation might not change fast, because there is currently an oversupply of housing inventory, which translates to record low prices. According to Maure Real Estate, the sale price per square meter for some of the most exclusive neighborhoods in the country’s capital has fallen steadily in 2021 and 2022, and is now lower than in 2012. With record cement dispatch, those inventories are not getting any lower soon.

Leveraging with debt and dividends

Finally, LOMA distributed dividends for almost $1 per ADR between April and July. Only the April dividends show up in the latest reports, for 2Q22. Of course, LOMA is far from generating $1 in earnings per ADR, so the company was actually leveraging by paying that dividend.

LOMA also entered into short-term loans in dollars and pesos. The company had almost no long term debt by December 2021, but has now increased its dollar denominated debts to $145 million (only $65 million show up in the 2Q22 report), and its peso denominated debts to AR$9 billion (~$60 million).

In the case of the peso denominated debt, it pays interest rates around 50%, which are very negative considering yearly inflation around 80%. However, the dollar denominated debt is very expensive. The $65 million loan pays 3-month LIBOR + 8% and matures in 2024, according to the company’s 2Q22 report. Data for the remaining $80 million loan was not reported as of 2Q22, although it also pays a variable rate, tied to SOFR.

Considering only the positive dollar denominated real rates, LOMA has increased its financial costs by maybe as much as $15 million for the next year. Converted this represents AR$2.2 billion at the official rate used to pay debts. It is a number to consider given the AR$10 billion generated in pre-tax profits for 1H22, but it should not put the company at risk.

Profitability calculations and price implications

If cement dispatches are record high, construction prices are record low and the company has low debt, then why is it not a buy? Because of price and earnings generation capacity compared to the stock price.

LOMA currently trades at $750 million. If the investor is really bullish on the recovery of the Argentinian economy, particularly in terms of construction prices, he could ask for a current 8% net earnings yield, only to beat inflation. That translates to $60 million or AR$18 billion at the distributable financial rate.

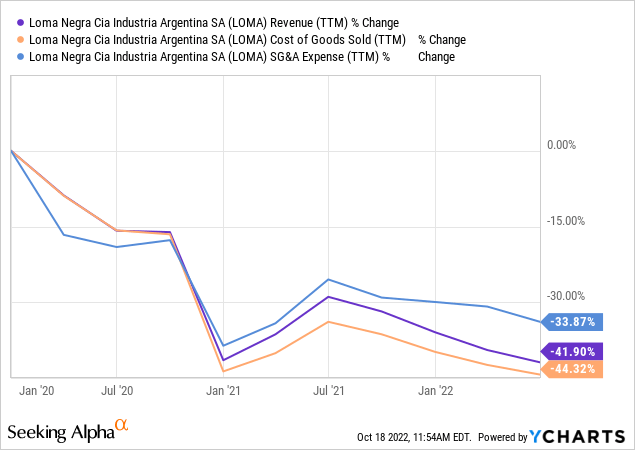

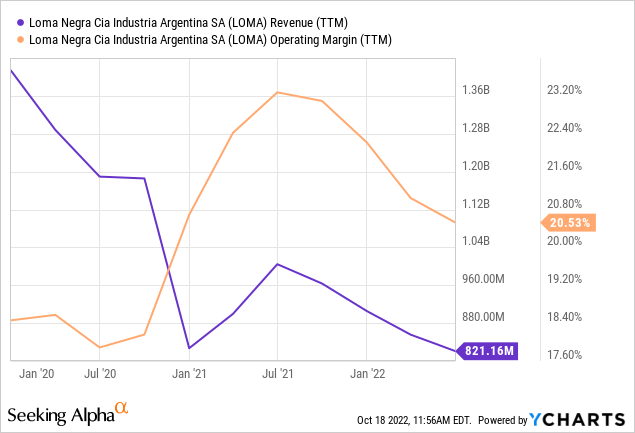

With an effective tax rate of 35% in Argentina, those AR$18 billion become AR$27 billion in pre-tax earnings. In terms of expenses, we add back AR$2.2 billion in interest, and treat the rest of the costs as variable. The first chart below shows how SG&A and CoGS move significantly in line with revenue. The second chart shows that although revenue levels have moved significantly, operating margins have not, indicating a variable cost structure.

Therefore we consider an operating margin of 19%, just to err on the conservative side. With AR$30 billion required to pay for interest and generate an 8% net earnings yield on the current market cap of $750 million, the company has to generate AR$160 billion in revenue.

LOMA is not even close to those numbers. 1H22 revenues reached AR$48 billion, which adjusted for 21% inflation between July and September imply current constant revenues of AR$58 billion. As can be seen in the cement dispatch chart in the industry section, there is some seasonal increase towards the second half of the year in the industry, but it is not super significant.

LOMA should more than double its revenues in the second half to achieve yearly revenues of AR$160 billion in fiscal year 2022. For next year, it should increase them by 38%, in real terms, that is, above inflation.

I do not believe the company is currently able to do that. Even if the cement industry continued growing at 10% rates, it should increase real prices by more than 25%. And that is only to yield 8% on its current price.

Conclusions

I made a mistake by recommending LOMA in June 2022. It ended up well because the company paid a substantial one-time dividend that cannot be justified with current earnings and that I had no way of forecasting. It was luck.

However, doing a revaluation of the company does not yield the same result now. Although the company will probably increase profitability if the Argentinian economy keeps growing, the increase required to justify its current price is too large for the company to pull it off in the short to medium term. There are probably other better opportunities in the Argentinian market.

Be the first to comment