JHVEPhoto

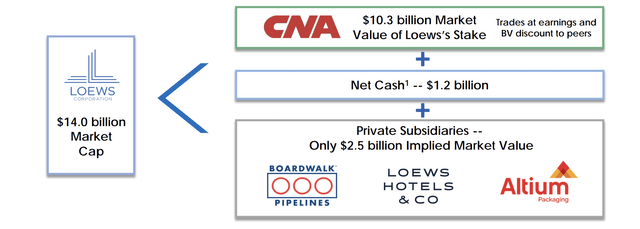

Loews Corporation (NYSE:L) is a diversified conglomerate. The company has a market capitalization of roughly $13.5 billion and the ability to continue growing this asset base for the long run through several diversified businesses. That consistent long-term growth strength is worth paying close attention to as a part of a retirement portfolio.

Loews Corporation Overview

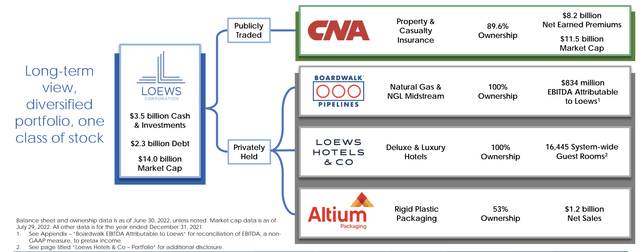

Loews Corporation has an impressive portfolio of assets distributed across several companies.

Loews Corporation’s largest source of money is CNA Financial, a Chicago based insurance company it owns almost 90% of. The business continues to earn substantial premiums, although its value has stagnated since the late-90s. The business has a roughly $11 billion market capitalization, meaning that its ownership stake is roughly $10 billion.

That makes up more than 70% of Loews Corporation’s value. That stake provides hundreds of millions in annual cash flow. The company also has two entirely owned businesses, Boardwalk Pipelines and Loews Hotels & Co., along with a 53% in Altium Packaging. The 47% sale of Altium Packaging valued the overall business $2 billion.

Loews Corporation 2Q 2022 Results

Loews Corporation had a reasonable 2Q 2022, showing the continued strength of the company’s assets.

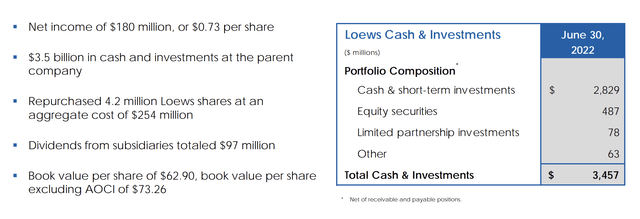

The company has $3.5 billion in total portfolio effective cash. From a financial basis, the company’s annualized net income is roughly $720 million. The company also earned a substantial $97 million in dividends from subsidiaries, supporting the core of its cash flow. The company repurchased 4.2 million shares for $254 million, something it’s consistently done.

We’d like to see the company continue to repurchase shares. The company is trading below book value showing the strength of its portfolio. The company does have $2.3 billion in total debt, with $1.2 billion in net cash across the business. Outside of the value that puts the total value of the company’s stake at $12.5 billion.

Loews Corporation Financial Trends

Loews Corporation has impressive financial trends across its businesses.

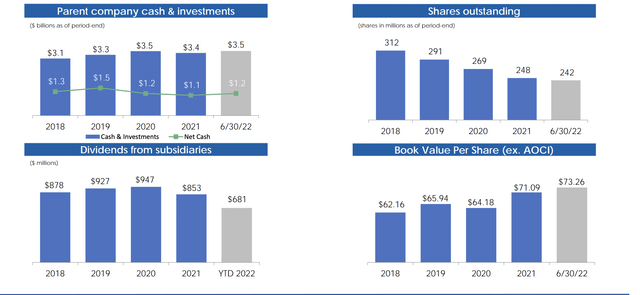

The company’s net cash position has remained roughly constant. Its cash position has trended up slightly but so too has the company’s debt. Maintaining this constant with a reasonable net-debt is fair. The company has managed to grow book value per share and dividends from subsidiaries have been growing.

The company has a dividend of just under 1% and it’s been aggressively focused on reducing shares outstanding. The company has cut its shares outstanding by 75% over the last 5 years, although it hasn’t driven substantial increase in the company’s share prices. We see the continuance of this driving strong returns.

The company has the financial strength to repurchase roughly 10% of its shares annually.

Loews Corporation Subsidiary Growth

Among the company’s largest sources of potential strength is the growth of its subsidiaries.

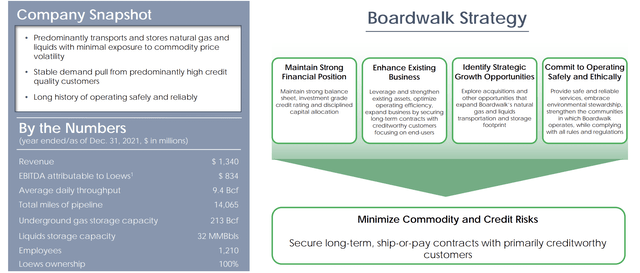

Loews Corporation’s Boardwalk Pipeline Partners is a small midstream company with long-term reliable contracts and substantial growth potential. The company has a mixture of gas and liquids storage capacity along with 14 thousand miles of pipelines moving 9.4 Bcf / day. The company extracts pay as it moves volumes across the pipelines.

The company has $8.9 billion in backlog, with 96% based on firm contracts, representing backlog of almost 7 years of revenue for the company. The company has several different growth projects here that can bolt-on to its existing portfolio of assets, helping it to increase revenue at each stage of the process.

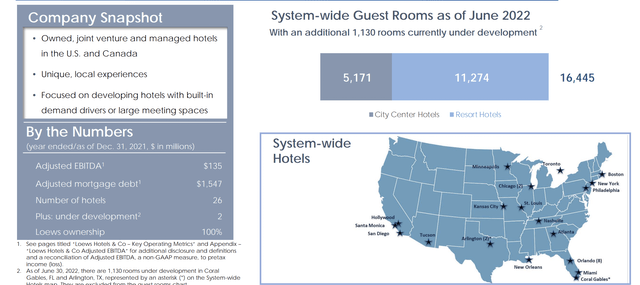

Another source of consistent growth for the company is its Loews Hotel business. The company has more than 16 thousand rooms here, with more than 1000 rooms under development. Many of these rooms are at “resort hotels” but the company has a strong distribution of its hotels throughout the United States.

The business is 100% owned by Loews and has $135 million in adjusted EBITDA with $1.5 billion in adjusted mortgage debt. Finances were impacted heavily by COVID-19, the company’s 2021 adjusted EBITDA was less than 60% of 2019 as the company saw only 55.2% occupancy versus 82.5% occupancy in 2019.

As the company’s operating metrics improve, we expect EBITDA to recover significantly. For perspective, compared to Marriott (NASDAQ: MAR), the company’s hotel business would be valued at roughly $3 billion.

Loews Corporation Cash Usage

Loews Corporations sees itself as undervalued and as a result views buying back shares as an optimal decision.

We feel that the company’s private subsidiaries are significantly undervalued. We’d like to see the company make several decisions to unlock value. First, we’d like to see the company reduce the stake of its CNA stake. The stake continues to make up the majority of the company’s values tying their values closely together.

Second, we’d like to see the company diversify. Share buybacks unlock value, but so does buying new investments. The company’s Boardwalk Pipelines, Loews Hotels, and Altium Packaging businesses are all strong, but the company hasn’t made a major new acquisition in a while. The oil collapse took out the company’s Diamond Offshore drilling business.

Still over time, we expect the company to be able to drive shareholder returns.

Thesis Risk

The largest risk to our thesis is the underperformance of certain subsidiaries. CNA Financial for example has seen its share price stagnate since the late-1990s. That stagnation has heavily affected the company’s value, and continued underperformance, in our view, will continue to hurt the company’s ability to drive shareholder returns.

Conclusion

Loews Corporation has a unique and distributed portfolio of assets. The company’s businesses, across the board, were uniquely susceptible to the COVID-19 business with its oil, pipeline, and hotel business. However, the company is well on the path to recovery, and we expect the hotel business especially to improve.

The company has utilized a strategy of aggressively repurchasing shares to unlock value, since 2013, it has retired over 37% of its common stock. While this value has yet to be communicated to shareholders, and we’d like to see additional diversification, we expect over time, it’ll result in strong overall shareholder returns.

Be the first to comment