viper-zero

By Valuentum Analysts.

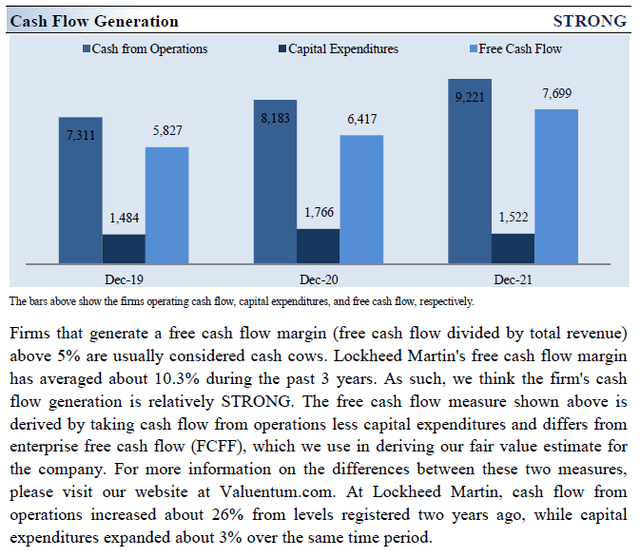

Given rising geopolitical tensions across the globe, we think it is prudent for investors to take a look at defense contracting names. Lockheed Martin Corporation (NYSE:LMT) is our favorite idea in this space given its large backlog, stellar free cash flow generating abilities, strong forward-looking dividend coverage, resilient business model (Lockheed Martin can effectively pass along inflationary pressures and other cost input headwinds to its customers), and exposure to attractive spaces of the national defense and space economies. Shares of LMT yield a nice ~2.5% as of this writing.

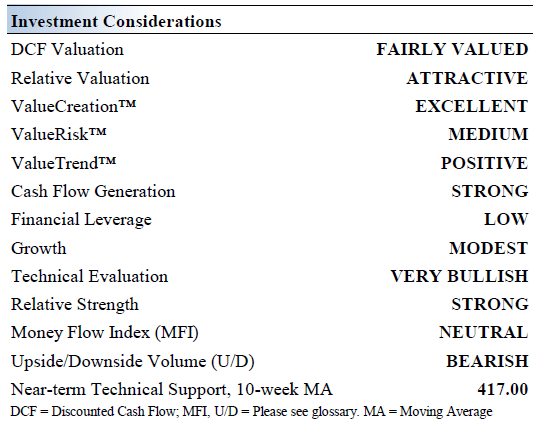

Lockheed Martin’s Key Investment Considerations

Image Source: Valuentum

Lockheed Martin is a global security and aerospace company that is principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services. The company was founded in 1909 and is headquartered in Maryland.

The evolving global security landscape dictates the need for powerful systems like the F-35 Lightning II, Littoral Combat Ship, integrated missile defense and advanced satellites. Lockheed Martin is well-positioned to meet the needs of governments across the globe.

There are numerous geopolitical conflicts to be aware of including; simmering U.S.-China tension, perennial threats coming out of North Korea, the U.S. sanctions campaign against Iran, and the Russia-West standoff over Russia’s invasion of Ukraine. The outlook for national defense spending from the U.S. and its Western allies is robust given the geopolitical backdrop.

Lockheed Martin’s backlog continues to be very healthy, providing ample visibility as it concerns the firm’s future cash flow performance. As the outlook for defense spending from Western militaries remains robust, Lockheed Martin’s growth runway is immense as it works hard to keep those militaries in tip-top shape. Lockheed Martin’s exposure to the rapidly growing space economy further supports its outlook. That includes various offerings that meet commercial, governmental, and national defense needs. Lockheed Martin’s potential upside here is quite substantial.

Earnings Update

On July 19, Lockheed Martin reported earnings for the second quarter of fiscal 2022 (period ended June 26, 2022) that missed consensus top- and bottom-line estimates largely due to special items that should eventually resolve themselves. Supply chain hurdles and delays in signing new major contracts covering its F-35 jet fighter offerings were key headwinds, though Lockheed Martin appears to be turning a corner on this front.

In August 2022, the US Department of Defense [‘DoD’] awarded Lockheed Martin a $7.6 billion for 129 additional F-35 jet fighters. Additionally, after getting grounded for two weeks by the US Air Force, the military branch resumed flying its F-35 inventory in August 2022. Combined with other good news, such as Lockheed Martin securing a $0.5 billion deal from the government of Italy (via the US DoD) in August 2022 and a $0.2 billion deal in July 2022 to upgrade the Australia Canada United Kingdom Reprogramming Laboratory (also via the US DoD) covering activities related to the F-35 Joint Strike Fighter program, it appears Lockheed Martin is firing on all-cylinders once again.

Pivoting to its fiscal second quarter earnings, Lockheed Martin generated $15.4 billion in GAAP revenue (down 9% year-over-year) and $2.0 billion in GAAP operating income (down 10% year-over-year) last fiscal quarter. Sales declined at each of its core business reporting segments (‘Aeronautics,’ ‘Missiles and Fire Control,’ ‘Rotary and Mission Systems,’ and ‘Space’), which dragged down its operating income due to decreasing economies of scale.

On the surface it looked like a brutal report, though again we will stress here that Lockheed Martin’s performance was held down by special factors. Last fiscal quarter, Lockheed Martin delivered 35 F-35 aircraft (down two year-over-year), six C-130J aircraft (up six year-over-year), 25 government helicopters (up five year-over-year), and five international military helicopters (down two year-over-year). Going forward, aided by recent contract wins and the eventual fading of supply chain hurdles, Lockheed Martin should be able to ramp up deliveries of its aerospace offerings which will support both its revenue and operating margin performance.

Lockheed Martin’s backlog stood at $134.6 billion as of June 26, 2022. That enormous backlog underpins its bright growth outlook and provides a tremendous amount of visibility as it concerns the company’s future cash flow performance (defining free cash flow as net operating cash flow less capital expenditures). During the first half of fiscal 2022, Lockheed Martin generated $2.2 billion in free cash flow and spent $1.5 billion covering its dividend obligations. We appreciate the firm’s ability to generate substantial “excess” free cash flows after covering its total payout obligations. Lockheed Martin also spent $2.4 billion buying back its stock during this period, utilizing its balance sheet to do so.

At the end of the fiscal second quarter, Lockheed Martin had $1.8 billion in cash and cash equivalents on hand with no short-term debt and $11.6 billion in long-term debt on the books. We caution that Lockheed Martin’s net debt load is a concern, though a manageable one given its ample cash on hand and ability to generate substantial cash flows in almost any operating environment.

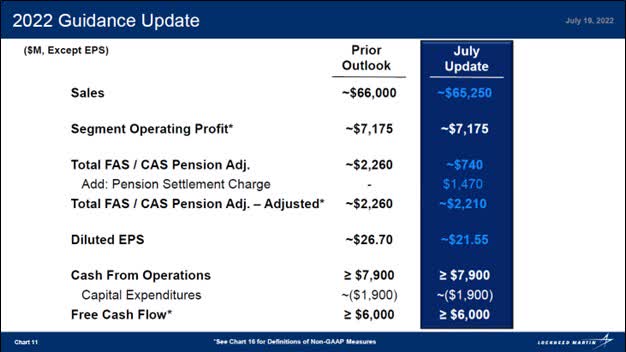

Guidance Update

During its fiscal second quarter earnings update, Lockheed Martin revised its full-year guidance for fiscal 2022. Lockheed Martin maintained its guidance that calls for at least $6.0 billion in free cash flow and ~$7.2 billion in segment operating profit guidance this fiscal year. The firm reduced its fiscal 2022 sales guidance for its Aeronautics, Missiles and Fire Control, and Rotary and Missile Systems segments while the sales guidance for its Space segment remained the same.

Its diluted EPS guidance was reduced “to reflect the impact of one-time items, such as the pension transfer, debt refinancing and year-to-date mark-to-market adjustments” according to management commentary during Lockheed Martin’s latest earnings call. Additionally, the firm’s management noted that the sales guidance reduction “reflect[ed] supply chain impact and award timing” and that by focusing on operational execution and cost reduction efforts, Lockheed Martin would still be able to “deliver higher operating margins” which we appreciate.

Lockheed Martin is still guiding to generate substantial free cash flows this fiscal year. (Lockheed Martin – Second Quarter of Fiscal 2022 IR Earnings Presentation)

Space Upside

As we mentioned previously, Lockheed Martin’s upside in the realm of the space economy is quite sizable. Lockheed Martin played a role in the National Aeronautics and Space Administration’s [“NASA”] ongoing Mars 2020 Perseverance Rover mission by developing the technology used in the aeroshell that protected the rover during the trip in space and down to the Red Planet. Additionally, Lockheed Martin developed the Mars Helicopter Delivery System [“MHDS”] for Ingenuity, the helicopter that joined the Perseverance rover on its journey to Mars. The MHDS was designed to safely transport and deploy the helicopter during the mission. Perseverance and Ingenuity were launched in July 2020 and have been patrolling Mars since February 2021.

Furthermore, Lockheed Martin recently invested in the San Francisco-based startup Orbit Fab via its Lockheed Martin Ventures wing. Orbit Fab is developing an innovative end-to-end satellite refueling technology known as the Rapidly Attachable Fluid Transfer Interface [“RAFTI”], which aims to make the refueling of satellites while in orbit an easier task. RAFTI “can also be used as a drop-in replacement for existing satellite fill-and-drain valves,” according to Lockheed Martin.

If successful, RAFTI offers satellite owners and operators a way to extend the lifecycle of their assets which could result in major cost structure improvements for those entities, thus supporting the viability of the in-space economy. Lockheed Martin noted that “the RAFTI fueling port has flight heritage, having flown on the company’s Tanker-001 Tenzing in [June 2021]. The tanker is an on-orbit fuel depot.” Big picture, as the in-space economy grows and the use of satellites continues to grow, there will be a great need to efficiently maintain and refuel these operations.

Another interesting realm of the in-space economy Lockheed Martin is catering to concerns upgrading in-space satellite systems. In August 2021, Lockheed Martin announced that its In-space Upgrade Satellite System [‘LINUSS’] been put through environmental testing activities and was ready to get launched into space later that year. The goal here is to “[demonstrate] how small CubeSats can regularly upgrade satellite constellations to add timely new capabilities and extend spacecraft design lives” with each CubeSat being “about the size of a four-slice toaster” according to the press release. Lockheed Martin has also been developing its SmartSat technologies, defined as “transformational on-orbit software upgrade architecture,” to beef up its suite of satellite and space-related solutions.

These endeavors tie into some of the other satellite-related projects Lockheed Martin has been working on, with its partners, of late. Here is a key except from Lockheed Martin’s website (emphasis added):

LINUSS will be able to work in tandem with another of Lockheed Martin’s on-orbit innovations, the Augmentation System Port Interface [‘ASPIN’]. ASPIN is a docking adapter that Lockheed Martin will include in its baseline LM 2100 combat satellite bus as a novel way to add new mission capabilities after launch. It allows satellite operators to unlock a new range of upgrade options, including processors, storage and sensors and to replace or retrofit components after launch. Its design was not only focused on power and data, but with plenty of open space to support future refueling interfaces, of which Orbit Fab’s RAFTI could be one.

Together with software-defined platforms like SmartSat, Lockheed Martin’s approach will enable the kind of mission flexibility and network resiliency demanded by the U.S. military for Joint All-Domain Operations [‘JADO’].

For reference, JADO is “a new warfighting concept” that involves “synchronizing major systems and crucial data sources with revolutionary simplicity, MDO/JADO provides a complete picture of the battlespace and empowers warfighters to quickly make decisions that drive action” according to the company’s website. Lockheed Martin’s satellite business is catering to a combination of commercial and national defense needs, and we appreciate the firm’s focus on innovation.

In April 2022, Lockheed Martin announced that it had released a Mission Augmentation Port [‘MAP’] interface standard to support on-orbit docking in the satellite industry. That interface standard is open-source and non-proprietary, and is intended to facilitate the growth of the broader space economy. Here is what Lockheed Martin’s website had to say on the decision:

The data released by Lockheed Martin can be used by designers to develop their own MAP-compliant docking adapters that will – barring some required discussion between servicers and hosts to coordinate missions – permit interoperability of docking satellites. Specifically, the documents released contain the information required for a compliant physical mate of docking port halves, such as the dimensions of plates and petals. While determined to be application specific, suggestions for electrical interfaces and docking profiles are included.

Here is a link to those documents for those that are interested. We appreciate Lockheed Martin’s efforts to enable the proliferation of the space economy.

Lockheed Martin’s Economic Profit Analysis

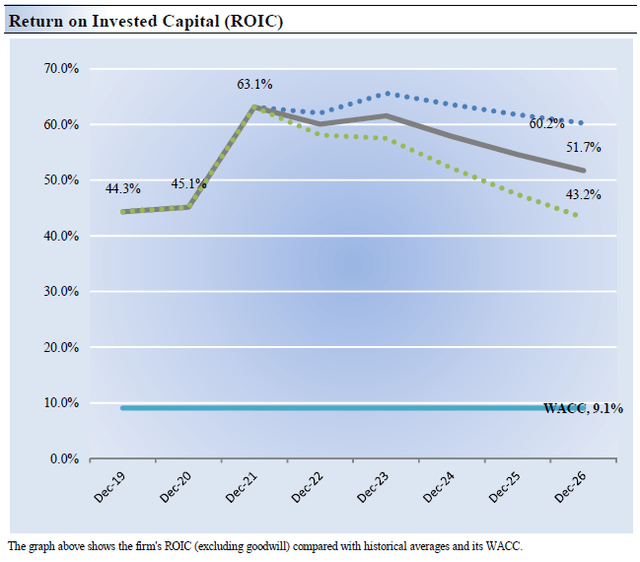

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital [“ROIC”] with its weighted average cost of capital [“WACC”]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Lockheed Martin’s 3-year historical return on invested capital (without goodwill) is 50.9%, which is above the estimate of its cost of capital of 9.1%.

In the down chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Lockheed Martin has historically been a tremendous generator of shareholder value and we expect that will continue to be the case going forward, highlighting one of the reasons why the firm is one of our favorite defense contractors.

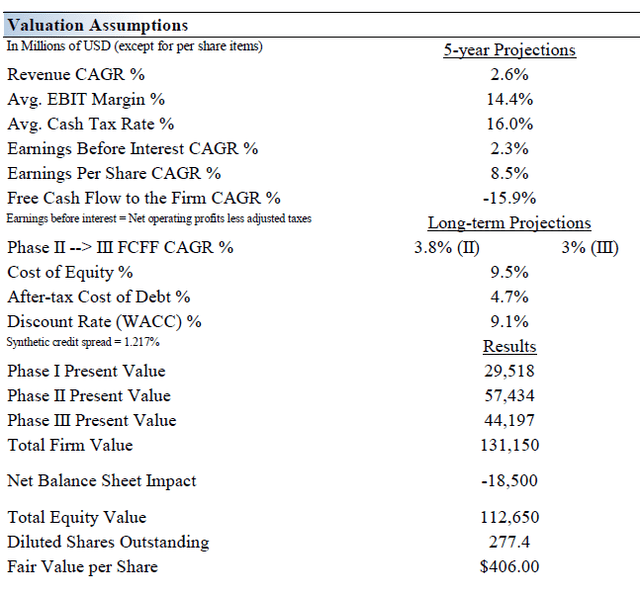

Lockheed Martin’s Cash Flow Valuation Analysis

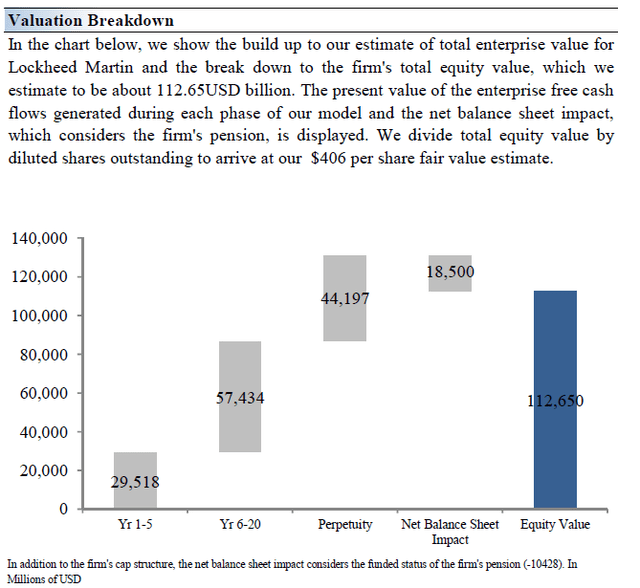

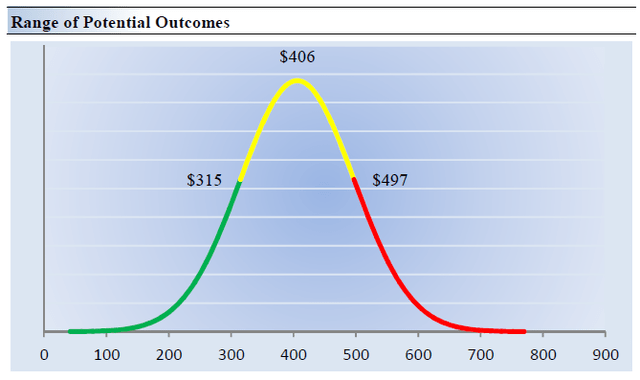

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of balance sheet considerations. We think Lockheed Martin is worth $406 per share with a fair value range of $315.00 – $497.00. Given that Lockheed Martin is once again firing on all cylinders, we think the firm could test the top end of our fair value estimate range in the current geopolitical environment.

The near-term operating forecasts used in our enterprise cash flow model, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 2.6% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 7.6%.

Our model reflects a 5-year projected average operating margin of 14.4%, which is above Lockheed Martin’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 3.8% for the next 15 years and 3% in perpetuity. For Lockheed Martin, we use a 9.1% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum Image Source: Valuentum

Lockheed Martin’s Margin of Safety Analysis

Although we estimate Lockheed Martin’s fair value at about $406 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graph up above, we show this probable range of fair values for Lockheed Martin. We think the firm is attractive below $315 per share (the green line), but quite expensive above $497 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Dividend Considerations

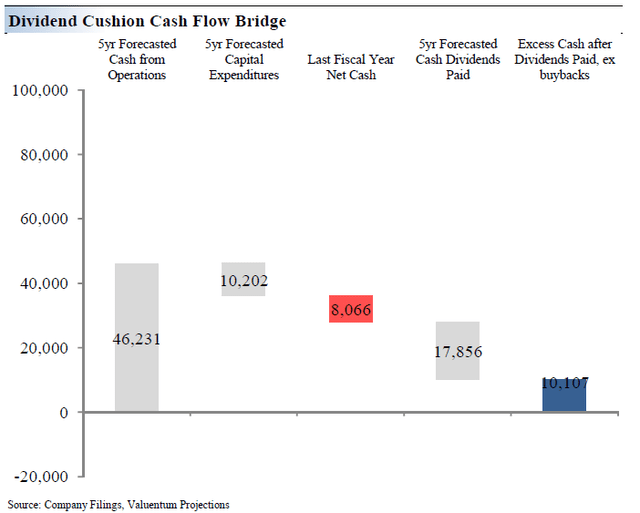

Lockheed Martin’s forward-looking dividend coverage is quite strong. (Valuentum)

The Dividend Cushion Cash Flow Bridge, shown in the image up above, illustrates the components of the Dividend Cushion ratio and highlights in detail the many drivers behind it. Lockheed Martin’s Dividend Cushion Cash Flow Bridge reveals that the sum of the company’s 5-year cumulative free cash flow generation, as measured by cash flow from operations less all capital spending, plus its net cash/debt position on the balance sheet, as of the last fiscal year, is greater than the sum of the next 5 years of expected cash dividends paid.

As the Dividend Cushion ratio is forward-looking and captures the trajectory of the company’s free cash flow generation and dividend growth, it reveals whether there will be a cash surplus or a cash shortfall at the end of the 5-year period, taking into consideration the leverage on the balance sheet, a key source of risk.

On a fundamental basis, we believe companies that have a strong net cash position on the balance sheet and are generating a significant amount of free cash flow are better able to pay and grow their dividend over time. Firms that are buried under a mountain of debt and do not sufficiently cover their dividend with free cash flow are more at risk of a dividend cut or a suspension of growth, all else equal, in our opinion.

Generally speaking, the greater the “blue bar” to the right is in the positive, the more durable a company’s dividend, and the greater the “blue bar” to the right is in the negative, the less durable a company’s dividend.

Lockheed Martin’s free cash flow generating capacity is strong, and by comparison, it runs a rather capital-light operation. Though Lockheed Martin has a sizable net debt load, the firm’s large backlog and strong cash flow generating abilities underpins its strong forward-looking dividend coverage. We view Lockheed Martin’s dividend growth potential quite favorably for this reason, and please note that our Dividend Cushion process takes expected dividend increases into account (in our model, we assume Lockheed Martin pushes through low double-digit to high single-digit annual dividend increases over the coming fiscal years).

Concluding Thoughts

We remain impressed by Lockheed Martin’s cash-generating prowess, though changes in US government funding will have an outsized impact on its future financial performance. As geopolitical tensions are on the rise, the environment is supportive of increased defense spending worldwide, in our view, particularly in the U.S. and at other Western nations. Lockheed Martin’s enormous project backlog provides tremendous cash flow visibility. The company’s growth outlook is quite promising.

There is a lot to like about Lockheed Martin’s forward-looking dividend coverage, though we caution that the firm’s net debt position and competing uses of capital (the company has historically repurchased a sizable amount of its stock) are key concerns to be aware of. Lockheed Martin must continue to win new contracts from the US government to maintain a steady flow of business, but we are comfortable with its current backlog. The company’s business model is incredibly resilient and there is not much that can derail Lockheed Martin. Future acquisition activity should be monitored.

We like Lockheed Martin as a top-notch income generation idea in the current geopolitical environment. The company also offers investors some capital appreciation upside potential as well, as is worth a close look by investors.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment