Olemedia

When Livent Corporation (NYSE:LTHM) reported third quarter earnings earlier this month, the results didn’t contain any big surprises. The company grew both revenue and adjusted EBITDA by impressive amounts when compared to last quarter and by orders of magnitude when compared to the same quarter last year. In response, one would think that the market would have bid-up the stock but, unfortunately, that wasn’t what happened at all.

In fact, as soon as investors got one look at Livent’s results, they began dumping the stock. On the second day after the release, the shares traded at an intraday level that was almost 12% below the level at which they closed before the numbers were released. Part of the reason for the price shock was that Livent’s revenue fell short of analyst’s expectations. But another reason, was that management narrowed full-year revenue and adjusted EBITDA guidance within the previously stated ranged. Essentially, management was telling investors that operations should continue at a steady pace and not to expect any big upside surprises in the next quarter.

However, while that may be true, what was interesting about the Q3 earnings call was not what management had to say about the next quarter, but rather their discussion about Livent’s longer-term strategic direction. In this article, we’ll discuss management’s comments and what they may mean for the stock over the medium-to-long term.

Third Quarter Results

Although Livent’s Q3 results missed analyst expectations, they certainly weren’t bad. If we compare Q3/22 with Q3/21, we see massive improvements in every performance metric. But we’ll put aside the year-over-year comparisons as most investors are, by now, well aware of the huge run-up lithium prices have experienced over the past year.

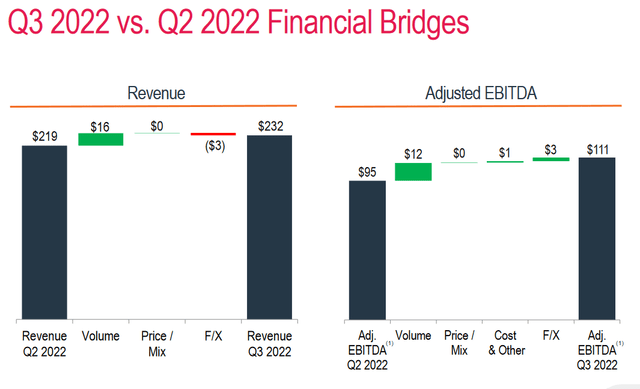

However, even when limiting our scope to quarter-over-quarter comparisons, we see that Livent is a company that’s firing on all cylinders. Its $232 million Q3 Revenue was 6% higher than the Q2 number and the $111 million Adjusted EBITDA was a full 17% higher then what was reported just 3 months ago. Cash flow is also looking good as the company’s Adjusted Cash from Operations has totaled $330 million so far this fiscal year.

As can be seen in the exhibit above, third quarter growth came from higher sales volumes while the impact of higher pricing was minimal. And that occurred even as the price of lithium in the open market kept rising throughout most of the last quarter. The reason for the lack of price impact is that most of Livent’s client contracts use fixed prices; meaning that the company’s ability to benefit from the current rise in lithium prices is limited.

In addition to that, management has said on many occasions that they expect 2022 total volume sold on an LCE basis to be roughly flat when compared to 2021. That’s because no meaningful volumes from capacity expansions are expected to come online until 2023. So, some of Q3’s sales volume growth may simply have been the result of timing differences.

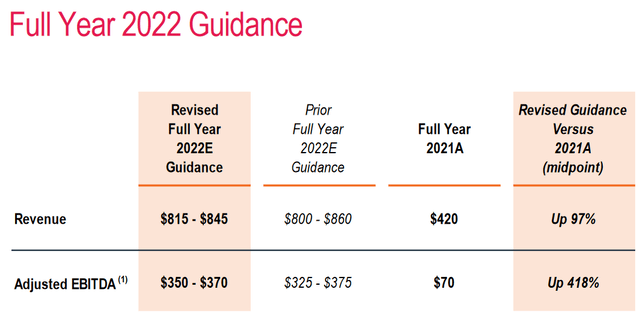

The impossibility of meaningful production increases in the short-term, coupled with Livent’s inability to increase prices on many of its current contracts is a big reason why management was able to provide a narrower range of guidance. On the Q3 call, management revised revenue guidance to between $815-$845 million from the previous $800-$860 million range and to $350-$370 million Adjusted EBITDA from the previous $325-375 million. Given that the price and production variables will remain relatively fixed, management has a good idea of where full-year numbers will come in at.

This lack of any potential upside surprise over the next few months is why the market hammered the stock when results were released. But the adoption of a short-term view that only stretches one or two quarters down the road, may cause some investors to miss growth opportunities that the company is positioning itself to exploit in the medium-to-longer term.

Variable Prices & Expanded Capacity

Management is well aware of the fact that having a contract portfolio that is heavily weighted towards fixed prices has resulted in the company having to forgo some revenue growth. During the Q3 call, Livent’s CEO Paul Graves said that, “I personally believe the day of the fixed price contract has been killed by the last 12 months.” He went on to state that as Livent’s client contracts come up for renewal they will be rolled-over, “into some form of market-based pricing.”

Now, it’s extremely unlikely that Livent migrates its contract portfolio to agreements based on nothing but the spot price of lithium. The downside risk for the company would be too great. However, it’s probably safe to assume that Livent will begin employing a broader range of price caps and collars as well as other measures to increase the correlation of Livent’s revenue to the spot price of lithium. And in this environment of high lithium prices, that is something that will certainly benefit the stock.

The other major factor that looks set to help grow the company’s revenue is the capacity expansion scheduled to occur over the next few years. Livent has several projects in the works and remains on track with regards to their timelines.

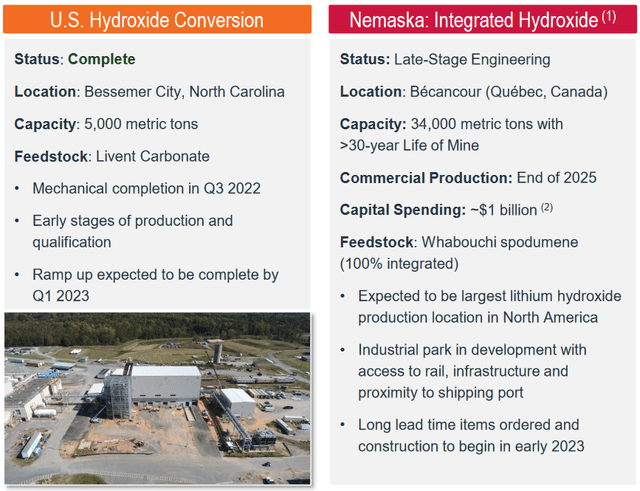

The construction of a 5ktpa lithium hydroxide project in Bessemer City, North Carolina, is complete and is now in the early stages of production. The project should be fully ramped by Q1 of next year. In addition to that, Livent plans to complete its 15ktpa hydroxide facility in China by the end of 2023. These two projects alone will grow the company’s hydroxide production capacity by 80% over current levels.

The company also plans to complete the first phase of its Argentinian carbonate expansion plans next year. That should allow for the production of an additional 6k uncommitted tonnes in 2024 which is a 25% increase over current production at the Argentinian site. Nameplate capacity at the location will eventually grow by 20ktpa of carbonate once the project is fully ramped in 2024. The second phase of that project will see another 30ktpa come online in 2025.

While somewhat further off into the future, the company’s Quebec-based Nemaska project will eventually add 34ktpa of battery-grade lithium hydroxide production capacity. And while that project is a 50/50 joint venture with an investment fund controlled by the Quebec government, it will provide Livent with a valuable entry into both hard-rock mining and the Quebec market. In fact, during the Q3 call Graves mentioned that he saw, “Quebec as being the second hub for Livent after Argentina, and frankly, probably surpass Argentina with time.” That could be an indication that the company has future expansion plans in the province.

Downside Risk

Of course, betting on a company that’s planning to grow its operations while simultaneously increasing price sensitivity to an underlying commodity brings with it some risks. Investors in the company’s stock would probably suffer if the price of lithium fell sharply or if any of Livent’s projects fell way behind schedule.

Takeaway

While Livent’s results will probably be steady for the next one to two quarters, it continues laying the groundwork for future growth. The gradual roll-over of existing client contracts from fixed-price to market-based pricing along with the eventual bringing online of its various expansion projects should ensure that. And the stock should respond to these events by continuing its climb.

Be the first to comment