cokada

Investment thesis

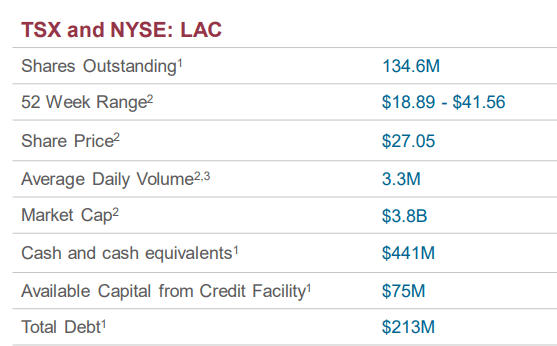

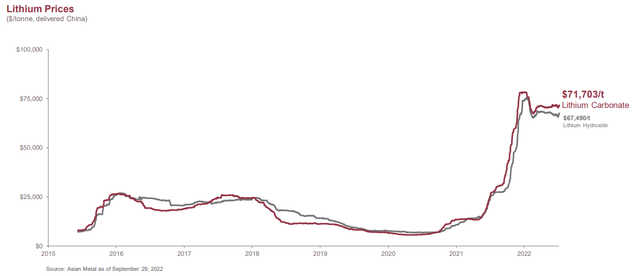

Within the context of the continuing EV boom, lithium miners have been seeing a very strong run in terms of stock price, as well as in terms of financial results, with favorable lithium prices improving revenues and profits. In order to have improved revenues and profits on the back of strong lithium prices, one has to actually produce lithium. That is not the case with Lithium Americas (NYSE:LAC). It is a future lithium producer. There would be nothing wrong with it, if it was not a future lithium producer with very significant start-up and ramp-up capital needs, within the context of interest rates going up. In a best-case scenario, Lithium Americas will achieve its ramp-up of production on schedule, but with significant debt-servicing costs going forward. In a worst-case scenario, it may have to slow down its project development timeline, in order to avoid taking on debt that will be very expensive to service for years to come, which will affect its profitability. Alternatively, stock dilution may be the way forward. Either way, it is hard to see value in this stock, with an over $3 billion market cap.

Projected revenues from its current projects, versus its market cap and debt:

With few revenue streams from its current operations, there is not a lot that can be reported on this company’s operational results.

Lithium Americas

So far, it has accumulated $213 million in long-term debt. It remains to be seen how it will approach its capital-raising needs going forward. If it will add more debt, it will add significantly to future debt-servicing costs, which will impact profit margins. If it will dilute the stock, it will impact investors immediately.

Lithium Americas

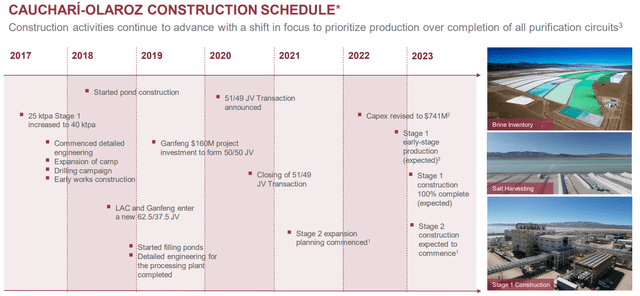

The main project that Lithium Americas is set to complete is the Cauchari-Olaroz site. It will have a first-stage production capacity of 40,000 tons of lithium per year. At the current spot price of $71,000, yearly revenues will come in at $2.8 billion, with Lithium Americas entitled to 49% of it. Stage 2 will add another 20,000 tons.

Lithium Americas may be able to generate enough free cash flow to support the stage 2 part of the Cauchari-Olaroz project. However, it also has two other projects in the early stages of development. One is in Argentina, at Pastos Grande, and it is estimated to have a final capacity of 24,000 tons/year. There is also the Nevada project at Thacker Pass, which can have a 2-stage total capacity of 80,000 tons/year. It is not entirely clear how the capital needed to execute these projects will be raised, or how much it will cost. Perhaps it will be a combination of stock dilution as well as taking on more debt.

Investment implications:

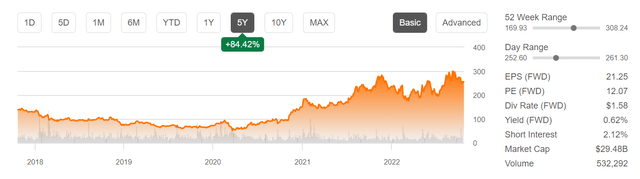

With a market cap in the $3 billion range, it is unclear how much more upside there is in this stock, especially since stock dilution is likely to take place. looking at the long-term, it could achieve total production of as much as just over 110,000 tons attributable to the company. At the current spot price, it can be worth as much as $7.8 billion in revenues each year. Assuming that it will achieve a net profit margin of 10% at some point, once most ramp-up costs will be paid down, its market cap will not likely exceed those revenue levels. For comparison, Albemarle (ALB) currently trades at a forward P/E ratio of about 12, so a P/E ratio of 10 is a reasonable expectation. Lithium Americas could exceed its revenue level in terms of market cap, mostly on the back of higher profit margins than the 10% I am assuming. The path to higher profit margins however may be hard to attain.

Seeking Alpha

In terms of revenues, Albemarle is expected to see about $7.5 billion this year, from its lithium and other segments combined, which is comparable to expected revenues for Lithium Americas down the road, once all the current projects will be completed. Profit margins are running pretty high, however, with the latest quarter showing a 42% profit margin. There are many factors that make for such a high-profit margin, including the company’s mature business model, with accumulated assets over decades, and a favorable business cycle, where it took on new debt and refinanced old debt during the low-interest rate period of the post-2008 era.

With a lot of lithium production capacity buildup in the pipeline, it is understandable why the market is so bullish on Lithium Americas stock. Lithium is apparently in a massive, perhaps unstoppable bull market and as previous price history suggests, it may not necessarily crash back down to earth too drastically.

Lithium Americas

The fact is that we have no way of knowing if lithium prices will remain at the current elevated levels, or drop down to something that will resemble the past five-year average. Keeping this in mind, revenues and profit assumptions for Lithium Americas need to be assessed accordingly. Mining is a very volatile business, regardless of the minerals that are being mined.

There is also the issue of stock dilution as well as debt issuance at current and presumably future higher interest rates. My guess is that all companies that need significant ramp-up and start-up costs will opt to issue more stock as a way of limiting future debt-servicing financial burdens. As production will ramp up and revenues will start flowing in, we will likely see a significant increase in this company’s market cap. How much of that increase will benefit current investors will depend to a great extent on how much stock dilution will take place along the way.

It should also be noted that Lithium Americas is pursuing a plan to split the company into a North American unit, as well as an Argentine unit. It is not entirely clear how investors will fare within the context of such a profound transformation for a company that is yet to prove itself in terms of profitability and other financial metrics. At the moment investors should see it as a net risk in my view, given that there are too many variables that can affect the execution of such a plan as well as the aftermath.

As investors are looking for exposure to anything that is related to lithium supply, given the continuing EV boom, it is easy for lithium mining stock valuations to get carried away. Indeed, gains can be achieved on the back of others getting carried away. But we have to be careful not to get caught out when fundamentals end up having the final say. The fundamentals for Lithium Americas appear to show only moderate upside potential, with too many potential pitfalls along the way. Lithium Americas may become a major lithium miner this decade. It is not entirely certain that investors along for the ride will see a lot of benefits.

Be the first to comment