D3signAllTheThings

Lithium Americas Corp. (NYSE:LAC) reported earnings, which weren’t too exciting considering the company is still in pre-production. However, this weekend’s “vote-a-rama” and the Senate passing the Inflation Reduction Act, which includes significant support for electric vehicles (“EVs”) and battery supply chain development, is much more notable. Finally, we are fast approaching a final decision from the court on whether the company’s Thacker Pass project can proceed.

Earnings Update: Not Too Exciting

The company reported a net loss of $16.6 million for the second quarter. However, this number was heavily influenced by a derivative adjustment, and Lithium Americas’ loss is partially driven by equity holdings anyhow. With that in mind, perhaps it is better to look at the company’s cash outflow for the period. At the end of the second quarter, Lithium Americas had $445.5 million in cash compared to $492.35 million at the end of the first quarter. With this amount of cash remaining, Lithium Americas looks to be well-capitalized to self-fund a good portion of Thacker Pass should it be approved (though it looks like the company may get a low-cost loan from the Department of Energy).

This is especially true once we consider the soon-arriving cash flow from Caucharí-Olaroz. Lithium Americas and Ganfeng Lithium (OTC:GNENF, OTCPK:GNENY) are focusing on finishing production capabilities at this point before fully developing the purification plant:

With construction over 90% complete, focus has shifted to prioritize production over completion of all purification circuits. As a result, a portion of the purification process designed to achieve battery-quality is being deferred until early 2023.

At the same time, Lithium Americas reports much of the plant is near commissioning and that the company is transitioning workers from construction to operations. Given what we currently know, I expect “production” in the second half of 2022, but revenue coming from the site (given the deferment of the plant’s completion) probably cannot be expected until perhaps the first quarter of 2023.

There was not much other news in the quarter other than a plan to reach a construction decision on Pastos Grandes.

Senate Passes the Climate Bill: More Exciting

In more important news this weekend was the Senate’s passage of the “Inflation Reduction Act,” a massive climate, health, and tax package. This package includes many, many provisions and faces some amendments on the floor Sunday, but its climate portions remained largely intact. As I have previously covered here, the bill is not a complete slam-dunk for domestic lithium production. However, it can be expected to further spur demand for battery storage via electric vehicle subsidies and provide additional tax incentives and funding for developing a domestic battery supply chain (all of which is good for Lithium Americas).

Observing how Lithium Americas’ stock behaved over the past week when the bill was looking closer and closer to passage, we can see how excited the market was. Similar moves took place for other lithium players as well.

Lithium Americas Stock 1-Week Chart (Seeking Alpha)

With this in mind, we can expect further upside if the House approves the bill this week. A vote is expected and given the party line support in the Senate for the measure, it would be a significant upset to see a Democrat-controlled House defeat the bill now.

Upcoming Trial Summation and Decision: The Big Unknown

Perhaps the most important upcoming catalyst, up or down, for Lithium Americas is the court decision over whether Thacker Pass will be allowed to be built.

The court decision is imminent, with final briefings expected to occur on August 11 (this Thursday). A company with a 60% share in a 1.75% gross revenue royalty on the Thacker Pass project, Trident Royalties PLC, expects the decision the same day.

Even if the decision is not publicly announced Thursday, this final appeal is make-or-break for Thacker Pass. And as we’ve covered previously, it seems likely that the court will rule in Lithium Americas’ favor with the Federal government backing them.

When this decision comes out, the most significant risk to the company will disappear. If the court rules in Lithium Americas’ favor, you can expect shares to jump.

Shares Are Still Cheap

Given so much pent-up uncertainty into this week, there is a good amount of risk weighing on Lithium Americas’ share price (though with the movement in shares over the past few weeks, it looks like more people are betting on good results in Congress and the Courts).

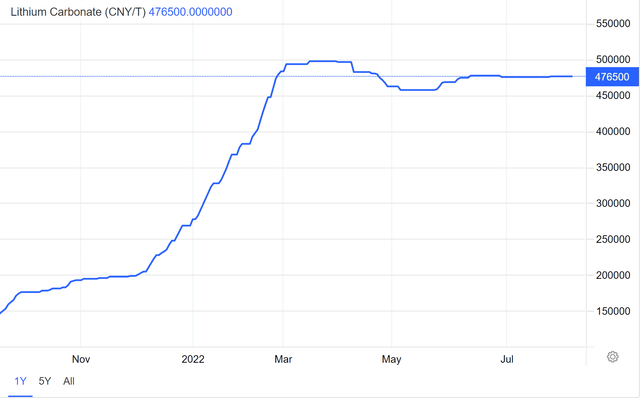

Lithium prices remain at record highs. And I expect the Senate bill will only help keep them there longer.

Lithium Carbonate Price in CNY (Trading Economics)

I think Lithium Americas really does have the potential to become the next great lithium conglomerate for the 21st century with a market cap in excess of $76 billion given the company’s diversified stakes in three excellent projects and additional equity holdings. With a market cap of just around $3.68 billion now, there’s a lot of upside in the coming years.

Takeaway

Lithium Americas has excellent potential in the long term. And the next week may be the most catalyst-filled that its stock has ever experienced. While earnings aren’t the most exciting (yet!) from Lithium Americas, this week’s House vote and court decision have the potential to send shares skyrocketing. Thacker Pass is worth $50 billion to the company and solidifying its construction is a massive deal. As for the climate bill, it only further reinforces the importance of a domestic lithium supply chain: something Lithium Americas is integral to.

Be the first to comment