sturti/E+ via Getty Images

Intro

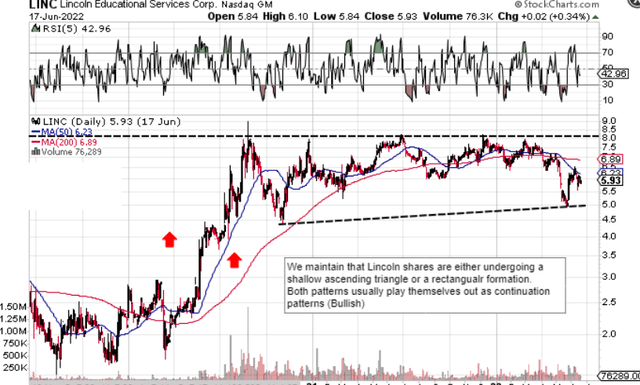

If we pull up a technical chart of Lincoln Educational Services Corporation (NASDAQ:LINC), we can see that shares in the latter stages of May fell below $5 a share. Since then, we have seen an impressive recovery (current standing of $6.10) although shares still remain trading well below their 200-day moving average of $6.89. However, as long as the recent May lows hold, there is every chance that either a very shallow ascending triangle (continuation pattern) or a rectangle formation (also a continuation pattern) is playing itself out here. As the technical chart clearly demonstrates, there have been plenty of opportunities to take out the $7.50 to $8 level in previous months with conviction. The attractiveness we see here is with respect to the height of the formation. Therefore, let’s go through Lincoln’s recent trends concerning its profitability to see if there is indeed some merit to what we are seeing in the stock’s technicals.

LINC Technical Chart (Stockcharts.com)

Profitability

First off, Lincoln’s trailing annual revenues of approximately $340 million are the best we have seen since fiscal 2012. This growth is being driven by a sustained increase in the student headcount which doesn’t look like it will slow down anytime soon. In the recent first quarter, top-line sales grew by almost 6% to hit $82.6 million with the headcount growing by 4.4%. Although student starts (which is a key metric analysts study in this stock) surprisingly fell in the first quarter, investors should not read too much into this. The reason being is that Lincoln is currently implementing a new hybrid model (Classroom/Online Blend) which most likely affected the numbers due to timing schedules. We expect this to be ironed out in due time as the CFO still expects student starts to grow by roughly 7.5% in fiscal 2022. The important point here from a shareholder’s standpoint is that the classroom must always take precedence over any online activity as this is how Lincoln made its name in the first place.

From a core profitability standpoint, Lincoln has now made approximately $31 million in net profit over the past 4 quarters. Approximately $19 million in net profit on sales of around $357 million are management’s estimates for full-year fiscal 2022. Despite Lincoln’s lower expected profitability this year (for reasons which have been clearly earmarked), the company’s bottom-line numbers since fiscal 2019 have been well above historic trends and more growth looks like it is on the way.

We state this because Lincoln is in the envious position of having demand come from not just one angle but two. On one hand, you have students looking for stable careers and on the other side, you have multiple corporates who are in dire need of trained graduates in specific areas. Take Ford (F) for example, which is footing the bill for a month-long post-graduate training program geared towards mobile repair and maintenance on Ford’s vehicles. The key piece of information from a demand standpoint here is that the training program is open to all of Lincoln’s automotive technology graduates as Ford desperately needs to increase the number of mobile technicians on the number it employs presently.

Given how the automobile industry is changing, this is excellent marketing for Lincoln with respect to its prospective students who eagerly want to increase their chances of finding stable employment. Suffice it to say, Lincoln is intent on going where the demand is. Whether this is through hooking up with corporate partners such as Ford or Republic Services or doing it alone (such as the new dental assistant course in Ney Jersey), Lincoln is determined to meet this demand.

To do this, management knows it has to have more campuses in strategic locations to be number 1. Recent transactions support the company’s line of thinking with the present cash balance of approximately $66 million well up from the $27 million number in the same period of 12 months prior. Although the leaseback transactions from the fourth quarter last year have already been accounted for, more funds will hit the balance sheet shortly from the Nashville campus sale.

Suffice it to say, Lincoln’s streamlining strategy to free up its balance sheet to enable more investment, as well as more operating leverage, looks to be paying dividends at this point. The beauty of its model is that when done correctly and at scale, it should have significant demand from both the corporates as well as the student population. Shares at just over 9 times forward GAAP earnings taking the above into account look pretty cheap from our standpoint.

Conclusion

Therefore, to sum up, if Lincoln has the wherewithal to deliver massive value in its existing programs as well as the markets where it has identified significant staff shortages, then we definitely see shares breaking out of the rectangular formation discussed above. We look forward to continued coverage.

Be the first to comment