zorazhuang

Investment thesis

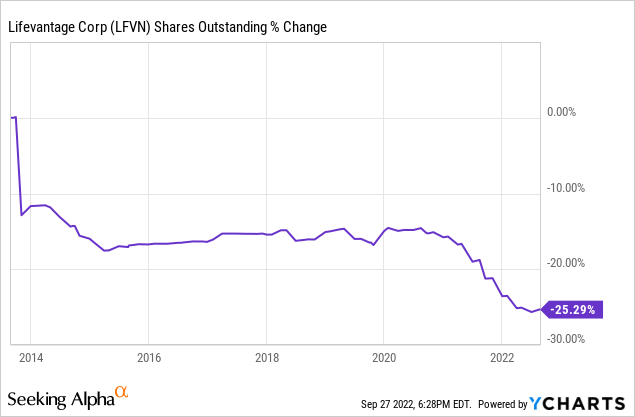

LifeVantage Corporation (NASDAQ:LFVN) is in a delicate situation: current inflationary pressures have caused a contraction in margins, which have historically been stable but not too high, and negative foreign exchange impacts are having a direct impact on revenue. These two major headwinds come at a time when investors’ patience was severely strained by stagnant revenues for a decade. All this has led to an accumulated decline of 85% in the share price during the last decade, especially since the management remains determined to keep buying back shares of the stock instead of funding growth via acquisitions.

Still, the company remains profitable and generates positive cash from operations year after year. Furthermore, it enjoys a debt-free balance sheet as it was able to pay off its debt in full in 2020, which has given way to a new dividend in 2022, whose yield is 3.3% if we take into account the current share price despite a very low cash payout ratio. Also, I consider the current cash on hand of $20.20 million to be more than enough to withstand the current macroeconomic headwinds as it is enough to cover almost five years of dividend expenses and capital expenditures. Therefore, in the following article, I will present my reasons for considering that the current share price represents a great opportunity for investors with some appetite for risk in exchange for a high potential upside.

A brief overview of the company

LifeVantage Corporation is a company focused on nutrigenomics and its products are used to improve the health and well-being of consumers. It is also focused on improving the finances of independent distributors through financially rewarding commission-based direct sales opportunities. The company develops and markets advanced nutrigenomic activators, dietary supplements, nootropics, pre- and pro-biotics, weight management, skin and hair care, bath & body, and targeted relief products.

LifeVantage logo (Lifevantage.com)

LifeVantage was incorporated in 1988 as Andraplex Corporation, but it changed its name to Yaak River Resources in 1992, Lifeline Therapeutics in 2004, and was finally renamed to LifeVantage Corporation in 2006 after acquiring Lifeline Nutraceuticals Corporation in 2005. Its market cap currently stands at $44 million, employing over 250 workers, and insiders own 8.5% of the shares outstanding, which means that the management benefit directly from the good performance of the shares.

The company has been lately expanding operations through Europe and Asia and currently operates in the United States, Mexico, Japan, Australia, Hong Kong, Canada, Thailand, the United Kingdom, the Netherlands, Germany, Taiwan, Austria, Spain, Ireland, Belgium, New Zealand, Singapore, and recently also in the Philippines. It also sells its products in other countries for personal consumption, and in China through an approved cross-border e-commerce business model.

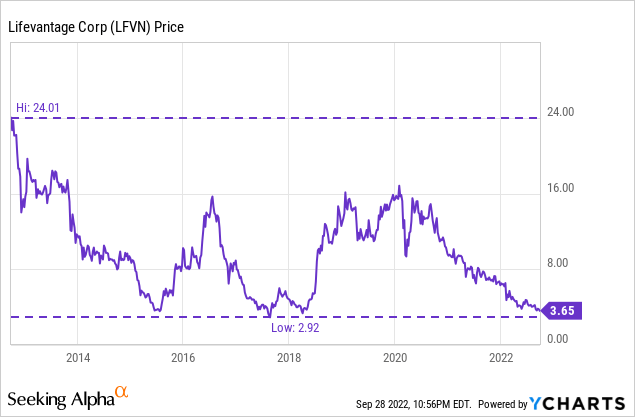

Currently, shares trade at $3.65, which represents an 84.80% decline from the highs of $24.01 a decade ago, and a 20% increase from the lowest level of the decade of $2.92 reached in 2017. Faced with such a significant fall in just a decade, it is very important to carefully analyze the company’s possibilities to continue standing and follow a path of sustainable growth, as well as its long-term profitability and viability, since investor sentiment is significantly negative, which suggests a profound deterioration in operations.

Revenue remains stagnant

Certainly, the company has experienced explosive growth in 2011, 2012, and 2013, but sales haven’t found a way to keep growing since then despite its efforts to launch new products with relative regularity. But to understand a little where the company’s current business model comes from, let’s go back to 2008. The company changed its business model in 2008 from traditional retail to direct sales through a network of independent distributors, which allowed for geographic expansion, and since then, it has expanded quickly throughout Europe and Asia, as well as in more countries in other geographies.

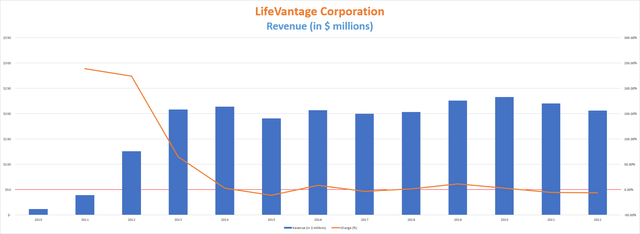

LifeVantage Corporation revenue (10-K filings)

Revenue declined by 6.28% in fiscal 2022 after a decline of 5.47% in 2021. In the last quarter, the company reported revenue of $51 million, which represents again a decline of 7.00% year over year as the company reported a $2.1 million forex headwind (without the negative foreign exchange impact, the decline would have been around 3%). Nevertheless, revenue increased by 1.8% quarter over quarter despite forex headwinds (it would have been around 4% without any negative currency impact).

The company continues to launch new products with quite acceptable regularity. For example, in June 2022, it launched TrueScience Liquid Collagen with ruby red quinoa extract, a rare key ingredient that increases collagen density by 42%, and other ingredients that help protect against oxidative stress caused by free radicals. The problem is that the company has prioritized share buybacks before acquisitions, a practice that the current management continues to do. The last acquisition took place in 2014 when the company acquired Wicked Fast Sports Nutrition, a line of sports nutrition products that includes pre-exercise and post-exercise supplements, a powdered drink mix that provides mental and physical energy, and a supplement for balancing blood sugar levels for appetite control and fat loss. This acquisition wasn’t a major one, and although the management currently has the opportunity to use the cash flows to expand its product offering via new acquisitions, it seems that they prefer to continue buying back shares as they perceive shares below their fair price and continue trying to expand by launching new products, which is (arguably) cheaper.

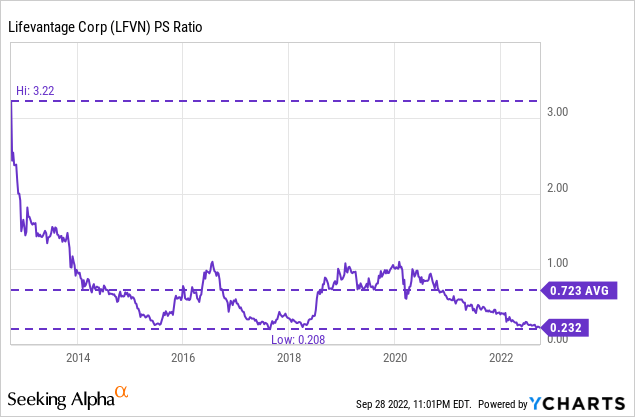

The sharp decline in the share price despite relatively steady revenue caused a depression in the price-to-sales ratio to 0.232, which means the company currently generates annual revenues of $4.31 for each dollar held in shares by investors. This PS ratio is 93% lower than a decade ago, and also 68% lower than the average of the last decade, which shows that investors are willing to pay much less for the company’s sales than they were previously as revenue remains stagnant and can’t seem to find a way to grow while margins received a significant negative impact from current headwinds. Still, it is important to note that the company’s margins are acceptable and allow the company to generate cash regularly.

Despite recent headwinds, margins are actually acceptable

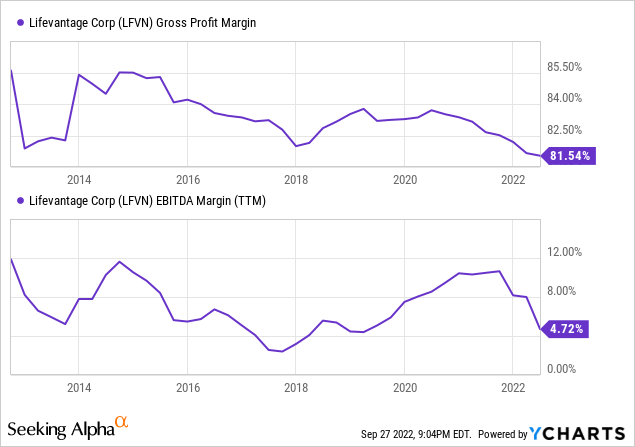

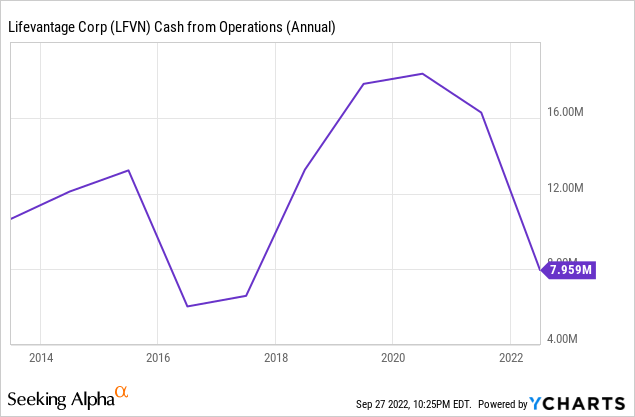

The company has managed to generate steady positive EBITDA margins during the past decade, which has enabled positive cash from operations. Commissions and incentive expense represents almost half of the company’s revenue as it was 48.1% of the total revenue in the last quarter. As of recently, the increased cost of transport and negative foreign exchange rates as well as inflationary pressures are having a direct impact on the company’s margins, which has led the share price to fall by 46% year to date.

Gross profit margins declined by 40 basis points during the fourth quarter of fiscal 2022 due to increased raw material prices and increased manufacturing and transportation costs. Increased inventory obsolescence expenses also contributed to this impact. But despite all these macroeconomic headwinds, the company keeps posting positive cash from operations.

Furthermore, these headwinds are affecting all industries in one way or another as they come from the current global landscape, which is getting more complex as time passes. This suggests that they are actually temporary, and considering that the company has a debt-free balance sheet and high cash on hand, the room for maneuver at this point is still enormous considering that cash from operations remains positive.

A debt-free balance sheet grants some safety until headwinds fade

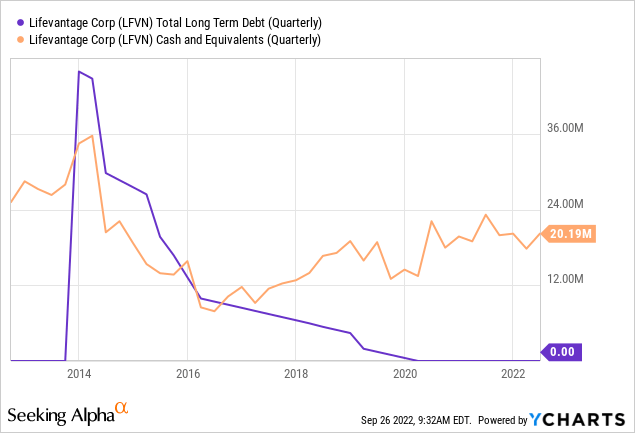

The company’s balance sheet is debt-free since 2020, and cash on hand has increased since 2017 despite relatively aggressive buybacks, and this is possible thanks to the positive cash from operations generated year after year. Looking back, the company took $40 million of long-term debt to fund share repurchases in 2014 and has since then deleveraged the balance sheet completely while accumulating cash.

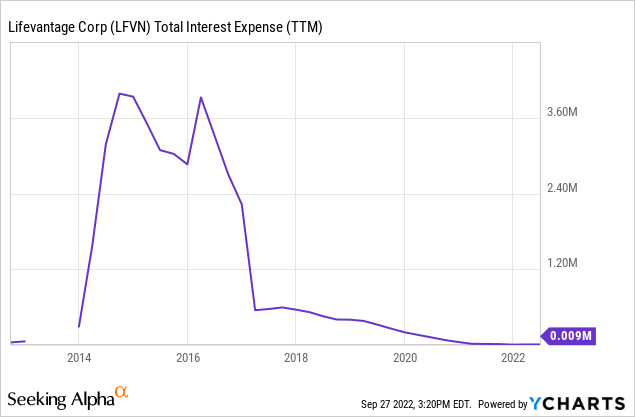

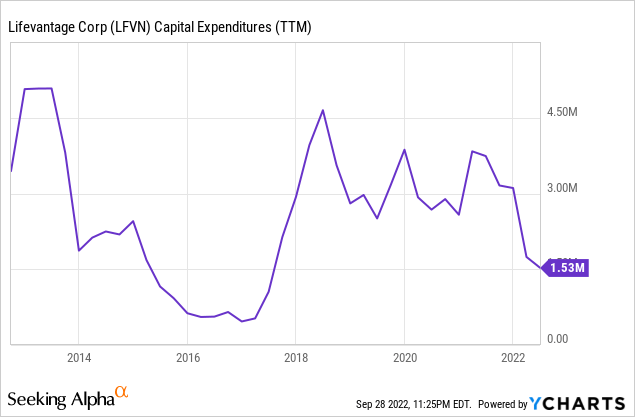

The company currently holds $20.2 million of cash on hand, and its current repurchase authorization stands at $27.1 million, whose successful completion will only be possible if it continues to generate enough cash from operations to cover its capital expenditures of ~$3 million per year and the new dividend that began in early 2022. But luckily, the company now has virtually no interest expenses to meet at the end of each quarter as it used to.

This means that the company can use all its resources and cash from operations to cover the dividend and buybacks and fund capital expenditures. Next, I am going to explain the main reason why the room for maneuver is enormous for the company as the current cash on hand is enough to cover the dividend and the capital expenditures for approximately 5 years, although it should continue to generate positive cash from operations as the management is determined to spend vast amounts of cash to fund buybacks.

The dividend is safe and buybacks are generous

After a period of explosive growth characterized by an enormous share dilution to finance growth, the company has entered a new stage characterized by dividend payments and strong share repurchases. The company took ~$40 million of long-term debt and spent $46.2 million in share repurchases in 2014 but kept decreasing the number of shares outstanding to date. In November 2017, it announced a $5 million share repurchase program, although the number of shares outstanding declined by just 0.25% by October 2020. Still, the number of shares outstanding started to decline very fast in the 2021-2022 period as the company spent $13.3 million in fiscal 2021 and $9.1 million in fiscal 2022. This period coincides with the moment in which the company finished paying all the debt contracted in 2014.

In May 2022, the company announced its first dividend of $0.03 per share, and the quarterly dividend remained intact in August 2022. At the current share price, the dividend yield stands at 3.3%, which is very generous considering the very low cash payout ratio. Next, I expose a table in which I have calculated, over the last few years, what percentage of the cash generated from operations has been allocated to the payment of interest on the debt and the dividend. In this way, we can see how the decrease in interest expenses thanks to the deleveraging of the balance sheet has given way to the new dividend in 2022.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Cash from operations (in millions) | $12.11 | $13.22 | $5.99 | $6.60 | $13.26 | $17.79 | $18.33 | $16.27 | $7.96 |

| Dividends paid (in millions) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0.38 |

| Interest expense | $3.18 | $3.09 | $3.32 |

$0.57 |

$0.46 | $0.32 | $0.12 | $0.02 | $0.01 |

| Cash Payout ratio | 39.92% | 23.35% | 55.48% | 8.64% | 3.44% | 1.82% | 0.65% | 0.1% | 4.87% |

As we can see, the cash payout ratio has been reduced to 0% from 2014 to 2021 as the company fully paid its debt pile, and has increased to 4.87% in 2022 due to the new dividend. Still, it is very important to note that only one quarterly dividend was paid in fiscal 2022 as first the quarterly dividend was paid during the fourth quarter of 2022. If we extrapolate the quarterly dividend to the rest of the quarters, we can conclude that if a dividend payout of $0.03 per share is maintained, the annual expense will be $1.5 million in fiscal 2023. This means that the cash payout ratio will be at ~20% should the cash from operations remain at the same level as 2022.

It is true that the current inflationary pressures and negative foreign exchange rates could deteriorate the company’s operations further in the short and medium term, but once they start to fade, at least partially, cash from operations should surpass the $10 million barrier again with relative ease given the company’s historical capacity to convert sales into cash, which would lead to a cash payout ratio of less than 15%. Furthermore, capital expenditure of ~$3 million for a typical year is well below the usual cash from operations of over $10 million and leaves a lot of room for leftovers to cover the dividend.

As we can see in the graph above, the management reduced capital expenditures by more than half to $1.53 million in 2022, and they were extensively covered after the payment of $0.38 million for the dividend. Considering the company was able to generate $7.96 million of cash from operations in 2022 despite being a year marked by a very complex global landscape, an annual dividend payment of ~$1.5 million and capital expenditures of ~$3.5 million per year should be easily covered in the coming years.

Risks worth mentioning

First of all, I would like to mention that one of the most significant risks that I perceive is related to the use that management wants to make of cash reserves. Certainly, cash on hand has increased successfully in recent years and this proves the company’s ability to keep profitable, but if the current share repurchase authorization is actually executed completely, there might not be enough cash left over to fund operational expansions. Revenue has been stagnant for a decade and this trend could continue if the management doesn’t take advantage of the current cash pile to make a significant acquisition.

Another risk related to revenue is the fact that the company constantly needs to find independent distributors and the continuity of its business depends directly on it. If the current model of rewarding individual distributors fails to retain them, this would have a direct impact on the company’s sales, since its business directly depends on the effort made by these distributors.

Also, and no less important, we have witnessed a period characterized by tighter margins, and the trend could continue to sharpen if current inflationary pressures persist. The current EBITDA margin, although sufficient to generate cash from operations in a relatively stable way, does not leave much more margin if the current headwinds worsen a little more. For this reason, the company could have profitability issues in the short and medium term if inflationary pressures squeeze the company’s operations even more.

Conclusion

It is obvious that the current situation of LifeVantage is not too ideal, although its business viability in the medium and long term is not as compromised as the current drop in the share price would make one think. The company continues to generate positive cash from operations and the 3.3% dividend is safe due to a low cash payout ratio and in large part thanks to the huge cash reserves the company has on hand. The company’s fiscal 2022 was a very difficult period for the world economy and the company suffered a serious (yet most likely temporary) deterioration in profit margins and revenues due to inflationary pressures and negative foreign exchange rates, and still managed to generate enough cash to cover the dividend and CAPEX loosely.

The biggest problem that I believe is the basic reason for operational stagnation and subsequent share price decline is that there does not seem to be a roadmap to grow the company’s operations via acquisitions. Rather, the management seems determined to use the company as a cash cow by making aggressive buybacks and paying a portion of the cash generated in the form of dividends, thus allocating the rest for product development, a strategy that has only served to keep sales stable in the last decade.

But even so, we must not forget that the current high cash on hand and the debt-free status of the balance sheet leave the company in a very favorable position to continue maintaining stable sales by continuously updating its product portfolio and returning large amounts of cash to shareholders, which is why I consider that the current pessimism does not correspond to the real situation of the company and represents a great opportunity for patient investors with a certain appetite for risk in exchange for large upside potential. After all, revenue growth hasn’t been a true need for the company as sales keep stable, and the current cash position leaves the company in a good position to expand operations if the current products start to see serious declining demand issues, something that hasn’t happened yet.

Be the first to comment