Valerii Evlakhov/iStock via Getty Images

I’ve been driving down to Miami a lot lately. There’s quite a bit of business to be done there, not to mention great friends to see.

This past week, for instance, I met up with a great guy who’s an advisor for high-net-worth individuals. He does very well for himself, but let me tell you – he works hard for that money.

While we talked, he told me about a client of his who had just passed away (leaving names and other specifics out, of course). Apparently, this man was in his 80s and had lived a good life. But his passing was still unexpected.

As a result, his widow was left utterly clueless about his portfolio, what was in it, and how to handle it on her own. My friend’s been spending a lot of time helping her through the situation, including moving her into more dividend-paying stocks.

You just never know what’s going to happen and when.

Another friend, this one in my hometown and much closer to my age, just died. We grew up together, played basketball together, raised our kids together…

I even bought his old house a while back. I know this man. I know he was in perfectly good health by all known assessments.

Yet he passed away on the golf course. I don’t know why.

Again, you just never know what’s going to happen and when.

Your Loved Ones Will Thank You for Properly Preparing

I hate to sound morbid here, but I’m going to give you one more personal example of a now-deceased friend. It was a couple of years ago when the unexpected happened and he died of a heart attack.

Gone. Just like that.

These stories are all on my mind right now, as well they should be. But similar stories should be on your mind too.

Cheesy though it might sound, the old sayings are true: No moment you spend here on earth should ever be taken for granted. There are always opportunities to make the most of your life, even if it’s something that seems trivial.

So go on. Go for it. Read a good book. See a new (or old) sight. Smile at the cashier behind the counter. Make time for family and friends.

And, along the “family” lines, make sure you have a plan in place for your loved ones. Recognize your limitations – including the fact that you can’t and won’t always be around – and create a legal will.

Let those who will outlast you know:

- How your property should be divided

- What your passwords are for your various accounts

- Where you have important papers and valuable stores

- Who your executor should be

- Etc.

Because, yet again – and I really can’t stress this enough – all the how’s, what’s, where’s, and who’s will eventually face a “when.” Nobody’s invincible, including you.

So have a plan to take care of your loved ones. It’s the smart, right, and caring thing to do.

Companies Need a Plan in Place, Too

The same goes for companies. Only instead of looking out for “those who outlast” them, they need to properly prepare for “those who succeed” them.

Chains of command and plans for succession are exceptionally important for businesses – perhaps especially publicly traded ones – for the same bottom-line reason as wills are exceptionally important for individuals.

Are you sick of me saying it? Too bad. Here goes again…

You just never know what’s going to happen and when.

In this case, it’s not even a matter of the CEO potentially dying on the job, although that can certainly happen. It’s much more likely though for them to accept other positions, get ousted by the board and/or activist investors, or decide to retire.

Either way, they’re no longer involved in the company anymore.

Either way, there’s someone else taking over that role – who may or may not be properly prepared.

Now, admittedly, in most cases, there should be someone who’s at least decently prepared. After all, the C-suiters who retire or accept other positions give at least a few months’ notice.

But “decently” and “properly” are too different things when running a national or international corporation. There are so many angles and aspects involved in such businesses…

Which means there are so many ways to mess things up.

In some cases, admittedly, it can’t get much worse. That might very well be the case with Kohl’s (KSS) CEO Michelle Gass announcing her upcoming departure. She’ll be running Levi Strauss (LEVI) instead.

My condolences to Levi?

But even then, it could be much better with an incoming CEO who’s been groomed for the position instead of a long, drawn-out search for someone who will come in and have to figure everything out as-is.

PS: See my latest article on KSS – the value destroyer!

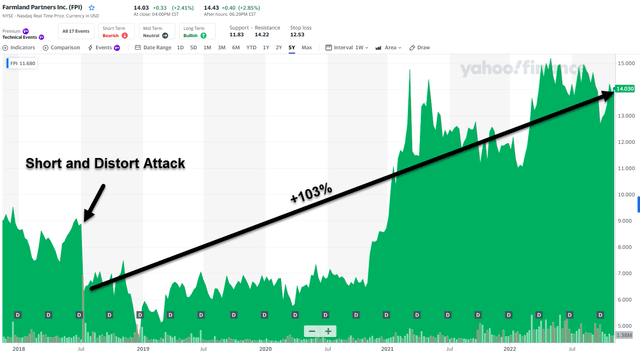

Farmland Partners Inc. (FPI)

In case you missed it, FPI recently said that it had approved a senior executive succession plan under which the company’s President, Luca Fabbri, will become CEO in late February 2023. FPI’s current Chairman and CEO, Paul Pittman, will remain as executive chairman of the company’s Board of Directors and as a full-time employee.

When I heard the news, I picked up the phone to speak with Pittman and congratulated him on both his new role, and also for his pursuit of the short attack that commenced a few years ago on Seeking Alpha. In a recent Ground Up interview (for iREIT on Alpha members), Pittman told me:

“These short and distort attacks are a real problem for investors and truly unethical, illegal, in my point of view. It would’ve killed our company if we had not been a hard asset company and what saved us was that farmland’s value didn’t change, stock markets value changed, but the underlying assets were still the same assets and still worth the same amount of money….

…It just tells you that the short and distort fraud scheme worked. And so, we were able to fight back and I’m happy we did.”

Congratulations Paul!

Tanger Factory Outlet Centers, Inc. (SKT)

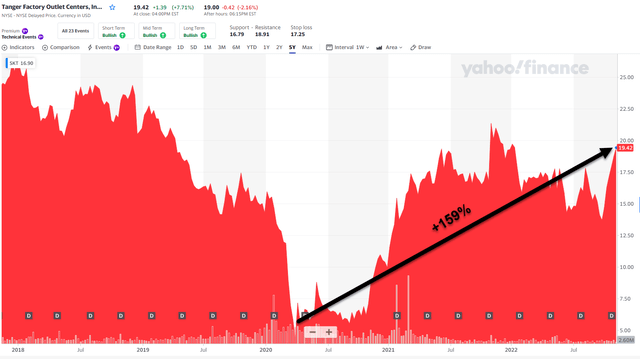

I have known Stephen Tanger, Chairman of SKT, for over a decade, and over the years I have admired him for his shrewd and disciplined investing acumen. You may not know, but Warren Buffett actually invested in SKT over two decades ago.

Around 2017, I began to ask Mr. Tanger about a succession plan for the company, recognizing that he did not have an ideal candidate in place to run Tanger Factory Outlet Centers.

And given the fact that Mr. Tanger shares the same name as his prized REIT (founded by his father, Stanley Tanger) I knew that finding a top candidate for the company would not be easy.

All of that changed – in April 2020 – just as Covid-19 was forcing businesses to close. SKT announced its new CEO, Stephen Yalof, would succeed Mr. Tanger at the beginning of 2021.

However, it was during 2020 that SKT’s stock price began to fall hard, losing more than 50% of its value. As a so-called Dividend Champion – with 25 years of dividend increases – it was difficult for SKT to cut its dividend, but it opted to do so in light of the strain on the fortress balance sheet.

Recognizing the potential for the once SWAN, turned Ugly Duckling, I piled up more shares in late 2020, recognizing that the company was in capable hands, with two Stephens behind the wheel (Tanger and Yalof). See my latest SKT article HERE.

By the way, in October 2022, the company approved a 10.0% increase in the dividend, from $0.80 to $0.88 per share on an annualized basis. Lest we forget, “The safest dividend is the one that’s just been raised.”

It Boils Down to Risk Management

As analysts and investors, it’s our job to manage risk, and succession planning is an important part of the preparation process.

This ensures that there’s no leadership vacuum and that the business (or family) operates after the exit or death of the key person.

There should always be an emergency succession plan in place, as it’s in the best interest of the employees (or family). I know this article may not be as entertaining as others that I write, but I consider the topic extremely important.

In fact, I plan to speak with my lawyer in a few days to make some modifications to my will/estate, to insure that my family is adequately protected.

Perhaps this article inspires you to do the same!

“Life is short. Break the rules. Forgive quickly. Kiss slowly. Love truly. Laugh uncontrollably and never regret anything that makes you smile.” – Mark Twain

Happy SWAN Investing!

Be the first to comment