JHVEPhoto/iStock Editorial via Getty Images

Liberty Broadband’s Series A (NASDAQ:LBRDA) and Series C (NASDAQ:LBRDK) common shares are essentially call options on Charter Communications (CHTR). The second largest cableco in the US fell by just over 16% yesterday following its 2022 investor day which set out a more expansive capex plan. This will see the now nearly $70 billion cableco invest $10.65 billion next year, higher than initial estimates going into the Tuesday investor day. Liberty owns 49.4 million Charter shares, around a 26% stake, as of the end of its last reported fiscal 2022 third quarter. This means Liberty’s two commons essentially form trackers for Charter but with added exposure to GCI.

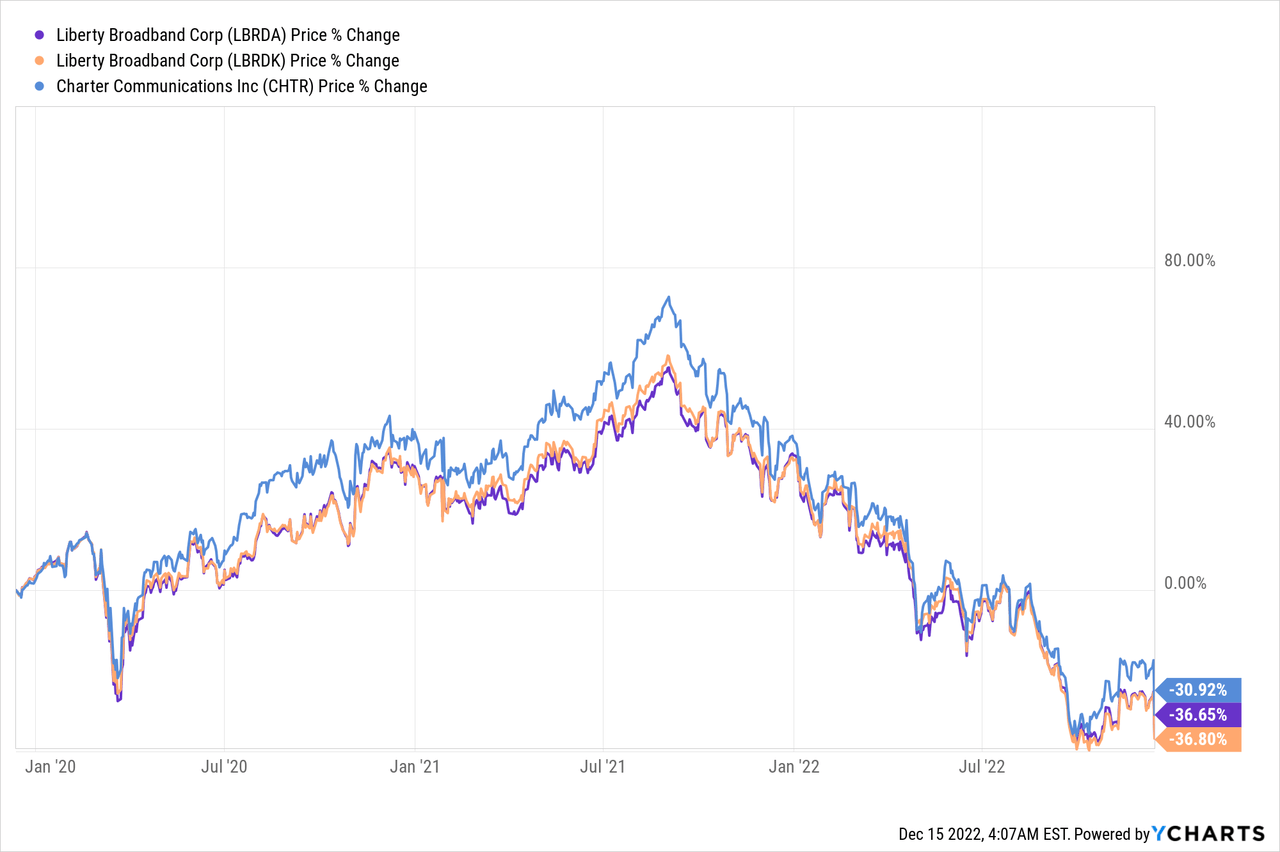

GCI is its wholly-owned subsidiary and the largest communications provider in Alaska. Why would you want to own Liberty over Charter? At face value, the company trades at a discount to its stake in Charter with the 49.4 million Charter shares currently valued at $16.22 billion following the pullback yesterday. This is versus a market cap of $11.4 billion for Englewood, Colorado-based Liberty. However, it will also mean exposure to GIC, which has driven underperformance over the last three years with Charter down around 31% versus a fall of just under 37% for Liberty’s common shares. GCI was started in Anchorage in 1979 with three employees and has over four decades grown to 1,800 employees deploying 10,000 miles of long haul, middle mile, and last mile infrastructure across Alaska to provide a full range of wireless, data, video, voice, and managed services to residential customers, businesses, and public bodies across hundreds of communities in Alaska.

The Charter Investor Day

The big controversy from the investor day was Charter’s plan to ramp up line extensions to more rural areas. This will see line extension capex increase to $4 billion in 2023, up from what’s typically a yearly line extension capex of $1.5 billion. The objective is to capture more of the rural market to support future subscriber growth.

Whilst Charter is targeting a 15% to 19% return profile on its rural buildout, it will take a few years for this to feed through to free cash flow. Hence, against what’s likely to be a recession next year, higher per passing rural construction costs, and a nearly $100 billion dollar net debt, the market got spooked. The worst-case scenario is that free cash flow drops more markedly next year.

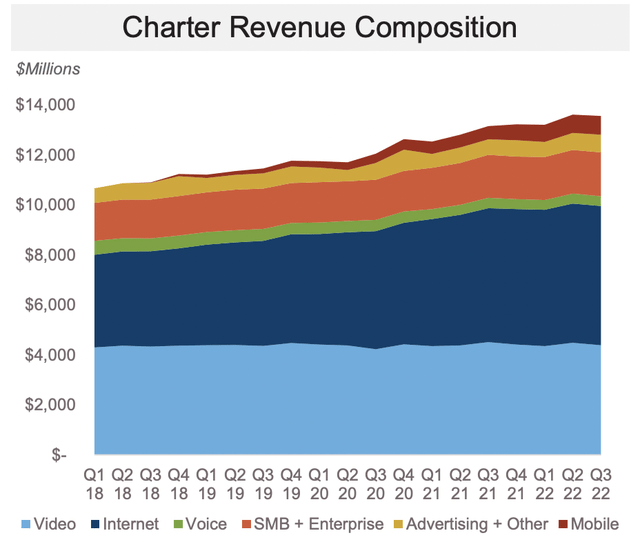

However, Charter is still performing well. The company’s revenue growth trajectory keeps moving up, with revenue for its last reported fiscal 2022 third quarter coming in at $13.55 billion. This was a year-over-year increase of 3.1% but a small miss of $70 million on analyst estimates. Charter’s internet service added 75,000 new residential and business customers. Mobile line net customers during the third quarter set a new record at 396,000. The growing mobile business represents a core source of future growth and will form an increasingly greater part of revenue in the years ahead. Indeed, the future possibilities look healthy with Charter only having captured 28% of the combined household spend on mobile connectivity in its footprint so far.

However, profitability continues to lag behind its year-ago comps. Whilst adjusted EBITDA during the last reported quarter increased to $5.4 billion, a year-over-year growth of 2.4%, free cash flow decreased by 39.1% over its year-ago comp. This decline was driven by the 2022 rural buildout capex. Hence, it’s easy to see why the market reacted the way it did, FCF is already under pressure as we enter what could be a brutal macroeconomic environment next year.

GCI Is Printing Cash With Share Buybacks In Tow

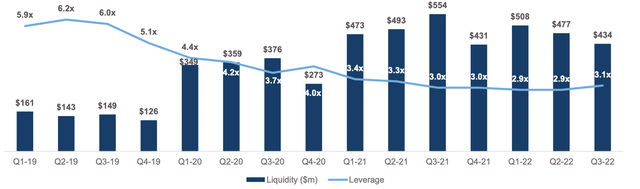

Liberty’s capital allocation program is very shareholder friendly. The company actively disposes of parts of its ownership stake in Charter and uses the proceeds to buy back its own shares. This most recently saw Liberty repurchase 5.5 million shares for total proceeds of $550 million. Liberty has year-to-date received $2.8 billion from Charter share sales of which it has spent around $2.7 billion to purchase 22 million LBRDA and LBRDK common shares.

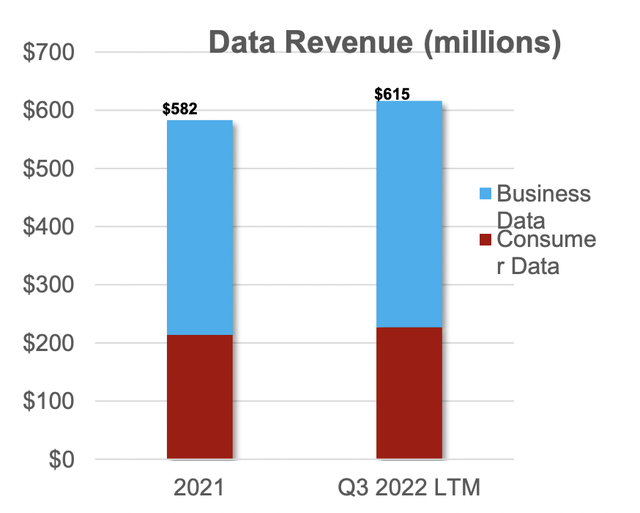

GIC is somewhat stagnant in terms of growth. The company’s last reported quarter saw revenue growth by just $2 million to increase trailing 12-month data revenue to $615 million. This was up 5.67% from the year-ago comp to drive adjusted operating income before depreciation and amortization that grew by $1 million.

With GCI having paid $110 million in dividends to Liberty in 2022, the company represents a cash-generative source of funds for Liberty to continue its capital allocation program. This will see a further $2.15 billion of Liberty share buybacks. Critically, an investment in Liberty is an investment in Charter plus GIC. The poor performance of Liberty’s commons so far compared to Charter perhaps conveys what the market thinks of the setup. It would be far easier and more straightforward to buy Charter directly without the added risk of GIC whose year-to-date adjusted OIBDA as at the end of its third quarter declined by just under 2%. That said, Charter’s large debt burden of $96.8 billion places it above my risk tolerance.

Be the first to comment