Michael Kovac/Getty Images Entertainment

Lenovo Group Limited (LNVGY, OTCPK:LNVGF) stock has a YTD performance of –29.41%. This PC and server hardware vendor’s stock has recently experienced a mini bull run. Its 1-month price return is +10.13%. Unfortunately, Seeking Alpha Quant still rates LNVGY a hold. The +10.13% run-up is largely thanks to Lenovo’s decent FQ2 2023 numbers. My fearless forecast is that Lenovo can sustain its TTM $71 billion in revenue performance.

You can average down or hold on to your LNVGY. My last buy rating for Lenovo was when it was still trading a little above $20 on September 13, 2021. LNVGY went as high as $30 on October 4, 2021. I hope this thesis will replicate that quick run up to $30. The bounce-higher story would likely gain traction as more investors/traders come to realize Lenovo is more than just a PC company. The global website of Lenovo told me it sells third-party hardware and software products. It is commendable that a $71 billion/year company doesn’t mind being a reseller or affiliate vendor of third-party products.

Why Stay Long?

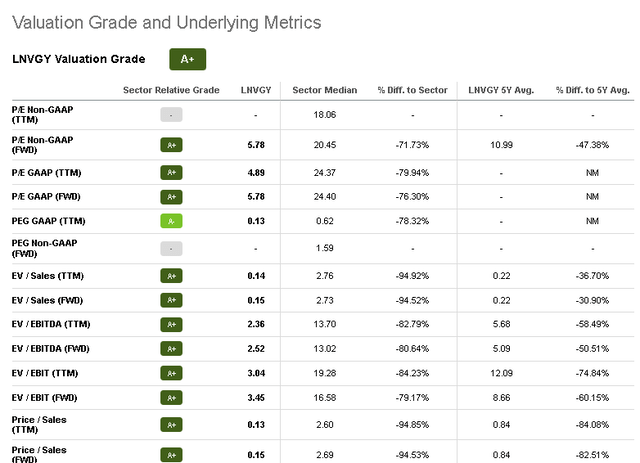

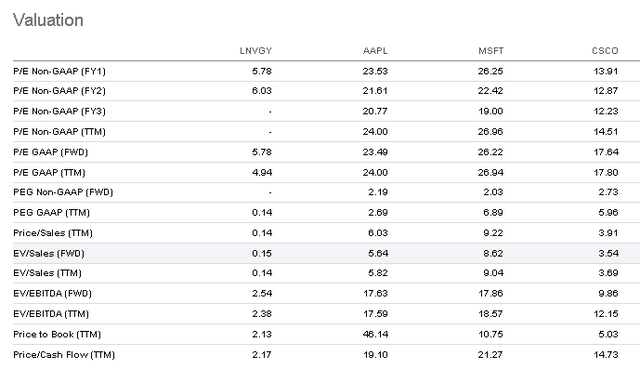

It is worth it to remain long, go long, or even average up on LNVGY. That big 29.51% YTD decline in LNVGY has made it even more affordable. LNVGY is relatively undervalued when compared to its Information Technology peers. Lenovo’s stock is cheap at just 5.78x forward GAAP P/E. This forward valuation is -76.30% below the sector average of 24.40%.

LNVGY’s forward Price/Sales is now only 0.15X. This is 94.53% lower than the sector median forward P/S of 2.69x. The persistent gross undervaluation of Lenovo is unjustified. Lenovo is still the no. 1 PC vendor in the world. This company has been profitable since Q4 2018. Stay long on LNVGY because Seeking Alpha Quant gives it a dividend grade of A+. Lenovo’s TTM dividend yield is 5.90%, higher than its 5-year average dividend yield of 4.91%.

Keep the faith, management recently announced a quarterly dividend of $0.20. LNVGY’S forward dividend yield is 4.99%. I suggest that this dividend performance will persist even though there’s declining sales of personal computers.

Lenovo Is An AI Company

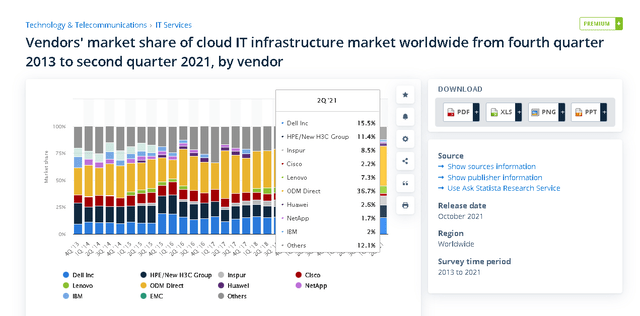

Yes, LNVGY is down big this year. Blame this on the almost-stagnant projected 1.36% CAGR of the $206.7 billion PC industry. The remarkably high 38.1% CAGR of the $93.5 billion Artificial Intelligence market can offset the PC weakness. The comprehensive AI solutions of Lenovo is a little-discussed tailwind. Lenovo is already an AI company by virtue of being a top 5 cloud IT infrastructure vendor.

Premium Access At Statista.com

Investors, traders, and fund managers should take note that the AI, analytics, and high-performance computing services of Lenovo are allowed in the U.S. Lenovo’s investment quality is excellent. Its Artificial Intelligence, other cloud computing services, software, and hardware products can be sold to U.S. customers.

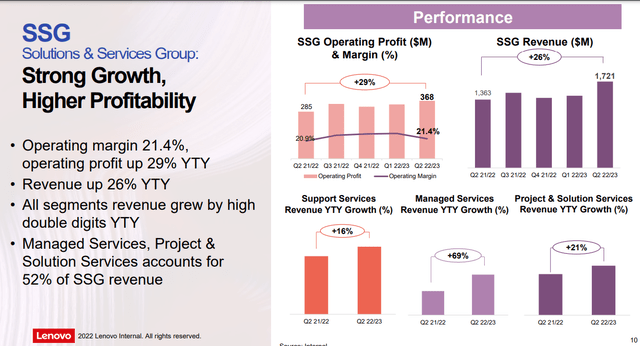

My fearless forecast is that the high 38.1% CAGR of the AI industry is boosting Lenovo’s SSG (Solutions & Services Group). As per the FQ2 2023 presentation, SSG’s revenue grew 26% YoY in FQ2 2023 to $1.721 billion. This is also notably better than FQ1 2023’s $1.456 billion (+23% YoY).

Going forward, the performance of SSG should be the most important metric when evaluating LNVGY. This segment’s operating margin is 21.4%. This is much higher than the Intelligent Devices Group or IDG’s operating margin of 7.4%. IDG covers the PCs, tablets, smartphones, and other products of Lenovo.

Focus More On SSG Numbers

SSG should also be your top metric when judging LNVGY. The cloud computing, AI, analytics, and other enterprise services are usually bundled with Lenovo’s ThinkSystem server computer products. Lenovo’s profitability and dividend history are relatively safe. It has enterprise customers for its hardware, AI, and other cloud computing solutions.

SSG’s high growth performance fortifies Lenovo’s $2.6 billion/quarter ISG (Infrastructure Solutions Group) business segment. Unlike the stagnating PC business, the global datacenter industry (hardware + software) still touts a 21.98% CAGR.

My fearless forecast is that, 4 or 5 years from now, SSG bundling with ISG products could help Lenovo earn $85 billion in annual revenue. The PC business could decline further, but aggressive marketing of its AI + ThinkSystem bundled datacenter products could outpace dips in PC sales.

It is a downside risk of LNVGY that the decline of desktop and laptop computer sales might be faster than SSG and ISG’s growth rates.

This worst-case scenario might not happen. Aside from AI, cloud computing, Lenovo is also an AR/VR company that sells the $1,500 ThinkReality A3 Smart Glasses. Lenovo’s AR and VR ambitions extend to the U.S. K–12 education market.

The AR/VR market is growing at 40.7% CAGR. It should be worth $454.73 billion by 2030. You should go long on LNVGY. The AR/VR business is an evolution of the traditional desktop/laptop computer business. The ThinkReality A3 is just a PC or cloud PC-connected computer that we wear as bulky eyeglasses.

Conclusion

I argue that buying LNVGY stock is a very affordable gambit. Lenovo is engaged in the AI market (38.1% CAGR), global datacenter (21.4%), and AR/VR (40.7% CAGR). The tactic of bundling its SSG and ISG products will deliver growth drivers. They could be enough to offset PC and smartphone weaknesses.

The ability to sell its products in the United States is an excellent reason to stay long or average down on LNVGY. This unique feature should excuse my assertion that this stock deserves a forward P/E of 7.5x. Multiply this by the estimated March 2023 EPS of $2.84. My fearless 1-year PT for LNVGY is $21.3. My 7.5x forward P/E assertion for LNVGY is reasonable when you compare it to Apple’s (AAPL) 23.49x.

Like it or not, I conclude that Lenovo is the more affordable and flexible version of Apple, Cisco (CSCO), and Microsoft (MSFT). LNVGY’s investment quality is very good when you consider that it also sells Lenovo-branded network Ethernet switches.

Be the first to comment