Robert Way/iStock Editorial via Getty Images

Introduction

Lenovo Group Limited (OTCPK:LNVGY, OTCPK:LNVGF) is one of the Chinese stocks that has fallen sharply, like all other Chinese stocks. Some know Lenovo from the PC market, but now Lenovo has further distinguished itself in Infrastructure Solutions and Solutions & Services. The Solutions & Services business group is quite profitable as the operating margin is 23%. As this business group grows, Lenovo Group’s operating margins will improve.

Still, there are some risks, the overall PC market looks bleak this year. And because Lenovo generates 83% of sales from the PC market, this is a major headwind for Lenovo.

However, I give this stock a buy recommendation. Investors can enjoy a 5.9% dividend, there is clear growth in the ISG and SSG business groups, and the equity valuation is the most attractive compared to competitors.

Quarterly Results Were Strong

Quarterly results for 1Q22/23 were mixed. Consolidated sales were virtually flat, but net income grew 11% year over year.

Lenovo Group is divided into three business groups:

- Intelligent Devices Group (IDG) (83% of total revenue, as of 2021)

- Infrastructure Solutions Group (ISG) (10% of total revenue)

- Solutions & Services Group (SSG) (7% of total revenue)

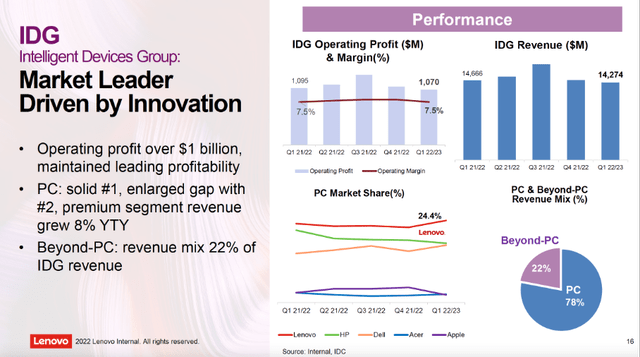

In the most recent quarter, the Intelligent Devices Group saw sales decline by 3%. A large part of the turnover is made up of PC sales and this is a volatile market. Therefore, Lenovo has innovated into a new segment called “Beyond PC,” which includes wearable technology and holographic displays, augmented reality, and more. In the Beyond-PC segment is the Mobile Business Group, a fast-growing business group that saw revenues grow 21% year-over-year to $2.2 billion.

IDG (1Q22 Investor Presentation)

The Infrastructure Solutions Group receives revenues from data center, edge computing and hybrid cloud segments. Revenue from this segment grew 14% year-over-year to $2.1 billion in the quarter.

Solutions & Services Group helps clients improve their efficiency and business agility. Customers use services, subscriptions, and pay-as-you-go models. SSG’s revenue grew 23% year over year to $1.5 billion in the quarter.

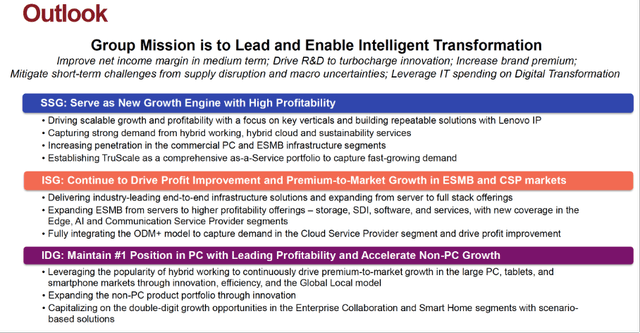

Positive Long-Term Outlook

Outlook (1Q22 Investor Presentation)

Lenovo has the largest market share in PC sales at 24.4%. Despite hybrid work, growth in the Chinese PC market declined sharply. PC shipments are expected to fall by 13% by 2022. This is partly due to weaker demand due to the economic downturn, inflation, and the strong increase in PC sales in 2020. Market Research expects the industrial PC market to grow at a CAGR of 5.5% in the long term from 2022 to 2030.

Their recent quarterly overview shows that the business groups SSG and ISG are growing strongly. These business groups make up an increasing share of the consolidated revenue. Their IDG business group generates 83% of the consolidated revenue but the operating margin is quite low (7.5%). The operating margin of the SSG business group is in fact much higher (22.6%). Because this business group is growing strongly, the operating margin of Lenovo Group will increase. However, ISG’s operating margin is 0.5% lower, but this business group has been profitable for the first time since the x86 business acquisition.

Valuation Metrics Are Favorable

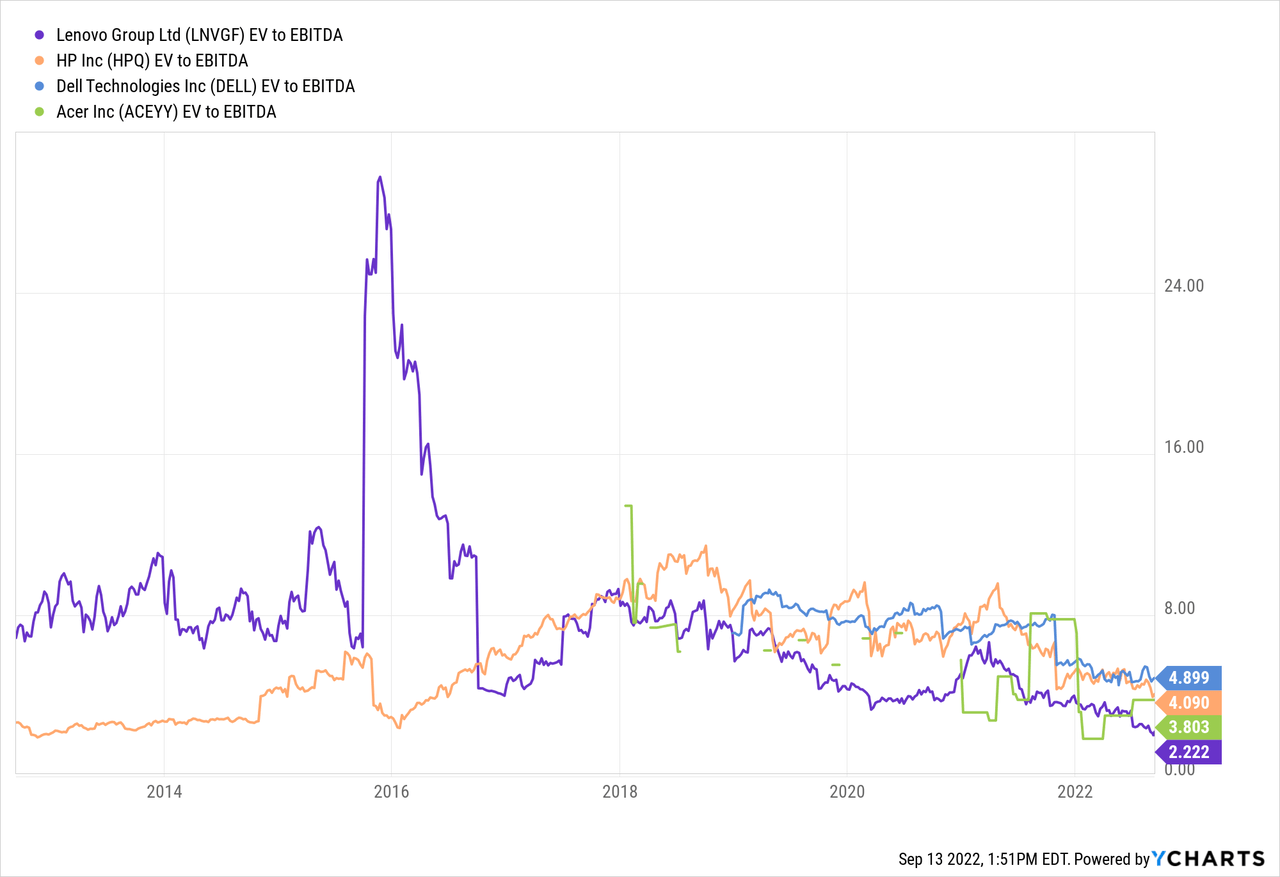

Lenovo has the largest market share in the PC market with 24%. This is followed by HP (HPQ) and Dell (DELL), which have approximately the same market share. Acer (OTC:ACEYY) and Apple (AAPL) have a significantly smaller market share. Apple mainly derives its revenue from the sale of iPhones, which is why I don’t include Apple in the comparison of valuation statistics.

HP, Dell, and Acer are compared against their enterprise to EBITDA ratio. This ratio takes the market value + debt – cash and compares it to EBITDA.

This metric shows that Lenovo is the cheapest valued of the four companies in the market. The sharp decline in Chinese stocks in general this year has also plagued Lenovo.

Lenovo is offering a dividend of 0.38HKD and the shares are listed on the Hong Kong Stock Exchange at a price of 6.34HKD. This makes the dividend yield 5.9%.

Risks

Investing in foreign stocks involves some risks. Below I discuss four possible risks from Lenovo.

1) Lenovo is listed on the Hong Kong Stock Exchange, but ADRs are also available. The ADRs have been marketed so that investors can easily take a position in a foreign stock. A disadvantage of an ADR is that the liquidity is much lower than the shares on the original exchange. This can be unpleasant if a large position has to be sold.

2) The Security and Exchange Commission is demanding that Chinese companies listed on the U.S. stock exchange as ADRs be taken off U.S. exchanges if they fail to comply with disclosure regulations. Lenovo is not subject to the SEC disclosure requirement, meaning investors should not fear being delisted. Still, because of the higher liquidity, it is convenient to buy the shares on the Hong Kong stock exchange.

3) The currency risk remains an important issue, the FED has raised interest rates considerably, causing the value of the dollar to rise. A U.S. investor who has bought Chinese stocks will see their value fall due to the currency’s depreciation.

4) The PC market is very volatile and speculators also benefit from this. In 2018, 14% of the outstanding shares went short, nearly booting Lenovo from the Hong Kong stock market. Exchange-traded funds (“ETFs”) that track the Hong Kong stock market sell Lenovo in such a situation, causing the stock to fall even further. Uncertainty surrounding Chinese equities remains high.

Conclusion

Lenovo Group is divided into three business groups, with the Intelligent Devices Group generating the most revenue (83% of total revenue). Lenovo is the market leader in their IDG business group, but revenue declined in the past quarter. On the positive side, looking at the long term, the industrial PC market is expected to grow at a CAGR of 5.5% until 2030.

Lenovo’s other two business groups grew strongly in sales and are increasingly contributing to consolidated sales. The operating margin of their strongly growing Solutions & Services group is higher than that of the IDG group. This is beneficial for Lenovo Group’s operating margin as this business group grows.

Competitors such as HP, Dell and Acer are valued more expensively than Lenovo based on the EV/EBITDA ratio. And because Lenovo offers a 5.9% dividend yield, I see good value in Lenovo.

Both ADRs and regular shares on the Hong Kong Stock Exchange can be purchased. To guarantee liquidity, it is more convenient to buy the shares directly on the Hong Kong stock exchange. However, one must accept the currency risk. The PC market is also very volatile, with big jumps and deep dips in this business cycle.

Lenovo is a value stock. Don’t expect strong growth, but expect stability in their dividend. The stock is a buy.

Be the first to comment