ipopba/iStock via Getty Images

Right now, I’d encourage investors to think with a growth mindset and be open to taking on a little bit of risk. In the mere space of a few months, the market’s attitude went from a “gung-ho” drive that went all-in on expensive tech stocks, to one that is now gingerly avoiding any growth stock that doesn’t have cold, hard earnings to show on the bottom line.

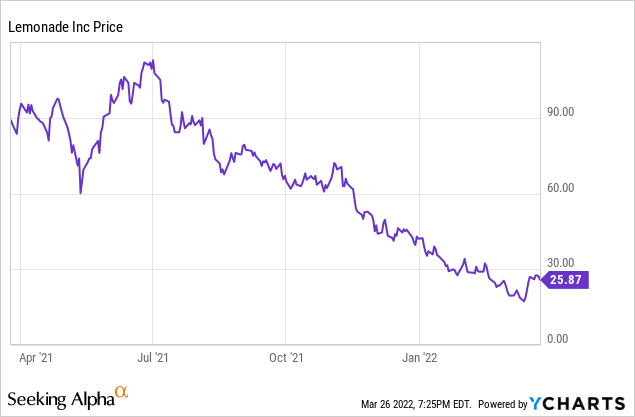

Slowly, however, risk appetite appears to be recovering – and investors have a fantastic opportunity to buy into some former high-flyers at a fraction of their former worth. Lemonade (NYSE:LMND), in particular, is one major decliner worth watching. This stock is down more than 40% year to date, and nearly 80% relative to all-time highs:

Lemonade is building an all-in-one insurance platform that is much more durable than where it started

Now, do note that I have not always been positive on Lemonade. For the majority of its early days as a public company, I expressed skepticism over A) the company’s scale and ability to reach profitability, and B) its outrageous valuation.

Since then, however, valuation has only crumbled while the company’s fundamentals are starting to show through. While it’s true that Lemonade has not yet fixed its massive losses, I like the diversification that the company is bringing to the table. In particular, I think Lemonade’s acquisition of Metromile, which is now serving as the building block for the insurance offering branded “Lemonade Car”, brings Lemonade into a new and huge market.

Speaking on the benefits of diversification on the Q4 earnings call, CEO Daniel Schreiber noted as follows:

As we enter 2022, we find ourselves in an enviable position, having launched pet, life and car in the past 18 months. We believe we have achieved a critical mass in both our technology and our product portfolio. Of course, we have ambitious plans for new products and new technologies for years to come. But for the first time, both pillars are now sufficiently complete to be built upon. This enables us to shift resources from making technology and products to harnessing our technology and products in new ways. That means leveraging our technology to lower our expense ratio through automation and our loss ratio through machine learning while growing our CAC to LTV ratio through cross-selling and bundling.

None of this is entirely new. We’ve been investing in graduation and automation and precision for years, but we are on the cusp of a changing degree that we expect will amount to a change in kind. When we were in monoline business, cross-selling and bundling, perhaps the biggest LTV unlocks were not really available to us and our technology investments were largely consumed by building products. The balance will now shift and we expect that over the coming quarters and years, this shift will take our business to new levels of efficiency, growth and profitability. One upshot is that we project that 2022 will be a year of peak losses with our EBITDA improving in each subsequent year […]

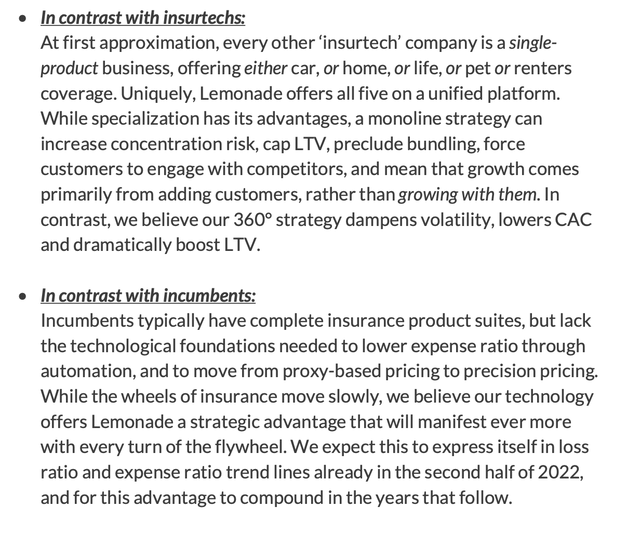

Take our fellow insurtechs on the one hand. At first approximation, every other insurtech company is a single-product business, offering either car or home or life or pet or rented insurance, whereas Lemonade uniquely offers all 5 on a unified platform. While specialization has its advantages, a monoline strategy increases concentration risk, caps LTV, precludes bundling, forcing customers to engage competitors and generally, it means that growth comes exclusively from adding customers rather than from growing them.”

In other words, other insur-tech companies (including Metromile, which Lemonade swallowed up) failed precisely because they were spending gobs of marketing dollars to induce customers to produce only one insurance contract. Lemonade, however, now has five different products to sell: pet, life, car, home, and renters – with all but the latter two being natural cross-sell opportunities. By gaining more of a customer’s wallet share, as well as diversifying the underlying risk in the portfolio across different categories, Lemonade can now build a scalable and eventually hopefully profitable insurance model.

I’ll repeat something that I’ve said before in defense of Lemonade: insurance is all about scale, and in investing in new categories, Lemonade can aim to build a new insurance conglomerate that rivals the legacy giants like AIG (AIG) and Progressive Insurance (PGR), with the lower-cost online sales model ultimately driving higher margins and better customer inflows (especially because the way people are buying insurance is shifting: with Lemonade holding the key millennial demographic, more of the insurance industry’s market share will spill over to insurtech incumbents like Lemonade).

Here’s Lemonade’s own statement, from its recent Q4 shareholder letter, on how the company has a competitive advantage against fellow insur-tech players as well as against legacy insurers:

Lemonade vs. competitors (Lemonade Q4 shareholder letter)

Valuation: Lemonade is trading next to free

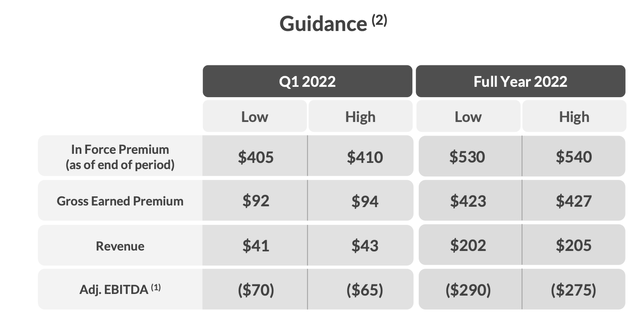

Investors’ undue pessimism on Lemonade has dropped the stock’s valuation to levels that can almost be considered free. At current share prices near $23, Lemonade trades at a market cap of just $1.60 billion. However, after we net off the $1.07 billion of cash on the company’s most recent balance sheet, Lemonade’s resulting enterprise value is just $523 million.

We should note here that we congratulate Lemonade’s prescience in raising additional capital at the start of 2021 at a whopping $165/share, raising just north of $500 million for the company’s coffers. This amount of cash covers roughly two years of adjusted EBITDA losses (and per the company’s prior statement, 2022 should be the “valley” year with the worst adjusted EBITDA, before the “insurance flywheel” strategy begins to produce leverage in 2023). Had Lemonade waited until 2022 to raise this capital, its diminished share price would have yielded only ~$100 million for the balance sheet, which would leave Lemonade struggling now.

Lemonade is currently guiding to end FY22 with $530-$540 million in in-force premium (IFP). Recall that Lemonade paid a ~2x multiple of IFP For Metromile. Right now, Lemonade’s enterprise value is trading just shy of <1x its FY22 IFP guidance.

Lemonade FY22 guidance (Lemonade Q4 shareholder letter)

Growth metrics still robust

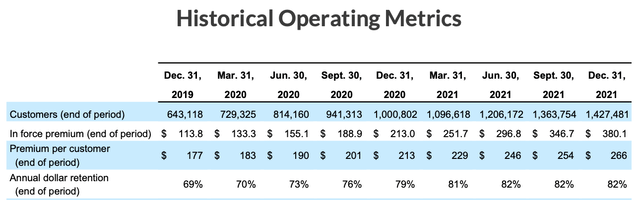

We note as well that Lemonade continues to pump out tremendous growth, driven by the cross sell between its products. Some of the key metrics are shown in the table below:

Lemonade key customer metrics (Lemonade Q4 shareholder letter)

Lemonade grew its total customer base by 43% y/y in Q4 to hit 1.43 million total customers. Its in-force premium, meanwhile, grew 78% y/y to $380.1 million (next year’s $530-$540 million IFP forecast represents 39-42% y/y growth).

Perhaps the most notable metric to quote: Lemonade is becoming more successful at holding onto its customers. The company’s dollar-based retention rate climbed to 82% in Q4, up 3 points from the prior year and a significant improvement from the ~70s in 2019/early 2020. More products in the Lemonade ecosystem are having a positive impact across all metrics.

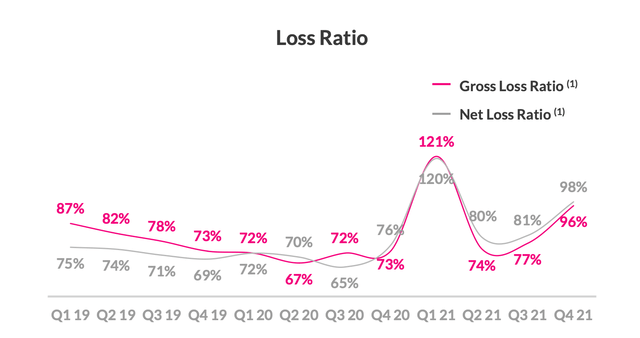

Now, do note that Lemonade’s loss ratios still remain elevated, with gross loss ratios at 96% in the quarter (meaning that each policy written is just about breakeven).

Lemonade loss ratios (Lemonade Q4 shareholder letter)

However, there is a nuance behind this number: gross loss ratios in Q4 were impacted by historical losses that didn’t carry sufficient reserves. Accident loss ratios in Q4, however, were no higher than they were in Q3.

Shai Winiger, the company’s co-CEO, expressed confidence that Lemonade can turn loss ratios around during his prepared remarks on the Q4 earnings call:

Nevertheless, we’ve seen a few quarters with elevated loss ratios. The underlying cause is the welcome and intentional shift in our business mix with U.S.-based renters comprising less than half of the book today compared to about 2/3 a year ago. The lines of business that have captured that share, home and pet, demonstrate higher loss ratios than our more mature, stable renters book.

We have projects across all of our newer product lines to underwriting profitability and these are yielding steady improvements in loss ratios for both pet and home. These improvements have been outpaced by these products’ growth, meaning that our aggregate loss ratio has climbed even as our product-specific loss ratios improved. In time, the one should catch up with the other, so we expect loss ratios of all Lemonade products to be below 75% in due course. In the short term, though, our newer products will likely be above this target even if they trend downwards. This is a natural and temporary cost of scaling new businesses.”

Key takeaways

In my view, there’s a lot of undue pessimism directed at Lemonade at the moment, which creates a well-timed opening for investors willing to bear a little risk and near-term volatility to buy into a future insurance giant. Insurtech is still a relatively nascent space, yet few companies other than Lemonade have the name-recognition and ambitious designs on becoming a multi-product insurer. Stay long here and buy the dip.

Be the first to comment